| April 11, 2020 |

SUPPLEMENT

|

No. 12

|

Notes on the Energy Sector

Inter-Imperialist and Inter-Cartel

Contention Over Control of the Energy Sector

• Contention

over Russian Pipelines to Europe

• U.S.

Imperialism

Strives for Global Hegemony

• Control over the

Canadian Energy Sector

• Questions

on

People's Minds Regarding an Economy and Sector

They Do Not Control

• The

Necessity for Change in the Energy Sector

• U.S.

Hydraulic Fracturing Disrupts Global Oil and Gas

Markets

For Your Information

• The

LNG Canada Project

• Some

Examples of Cancelled

Pipelines and

Energy Projects in Canada

Inter-Imperialist and Inter-Cartel

Contention over Control of the Energy Sector

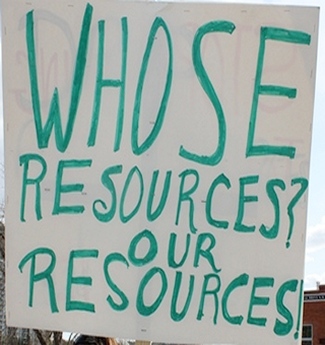

The overriding issue for Canadians concerning

the energy sector is "Who Controls and Who

Decides?" To assert rational scientific planning

and social responsibility over the production and

distribution of carbon and other energy resources,

the people must wrest control of the sector away

from the global cartels.

Contention among the imperialists in the energy

sector has become increasingly severe especially

since the fracking boom in oil and natural gas

production in the United States. The coup in

Ukraine and the subsequent anti-Russian positions

of the coup government form the backdrop for

attacks against Russian oil and gas exports to

Europe. The U.S. with its now oversupply of

natural gas compared with its internal demand, and

with a similar situation developing with oil but

less desire to export it, has launched a concerted

campaign to displace Russian energy in Europe with

natural gas exported from the U.S. as LNG.

U.S. Energy Oligarchs Strive for Global

Hegemony

With increased production from hydraulic

fracturing, the U.S. energy cartels are now

positioned to export some oil and lots of natural

gas as LNG with Europe as a main target.

Consequent to the rapid increase in domestic

supply, the United States has had a massive shift

in LNG terminal planning and construction starting

in 2010-2011. Many brand-new LNG import-designed

terminals are planning, or have begun, to add

liquefaction facilities and intend to operate

instead as export terminals.

In 2019, many regasification plants have been

converted to liquefaction trains (facilities) i.e.

Sabine pass and others. Seven liquefaction plants

in the U.S. have been built or are under

construction. On November 21, 2019, U.S.

regulators approved permits for three new

liquefied natural gas export terminals in the Rio

Grande Valley in Texas. The Federal Energy

Regulatory Commission approved permits for Rio

Grande LNG, Annova LNG and Texas LNG at the Port

of Brownsville.

Standing in the way of increased U.S. exports of

LNG to Europe is the availability of much cheaper

Russian gas arriving through pipelines. The amount

of Russian gas available to Europe is poised to

greatly increase with the completion of two new

pipelines: Nord Stream 2 and Turkstream.

The U.S. is violently opposed to both pipelines.

It put in place punishing sanctions against all

participants in Russia's Nord Stream 2 expansion

bringing it to a halt. Nord Stream 2 will triple

its current capacity. It includes the world's

longest undersea pipeline linking Russia to

Germany via the Baltic Sea so as to avoid going

through the Ukraine. The U.S. has also imposed

sanctions against any company participating in

Turkstream, a gas pipeline running from Russia to

Turkey, where it can be transferred to existing

pipelines into central Europe. Both projects are

near completion but stalled because of U.S.

opposition and sanctions.

The inter-imperialist and inter-cartel contention

over energy resources and markets arises from the

control of the economy and politics by the

financial oligarchy. This control blocks the

people from asserting their control on the energy

sector and taking it in a new pro-social direction

to humanize the social and natural environment and

avoid war.

Note

Of note especially for Canadians is that the

Dutch-British energy cartel Royal Dutch Shell is a

major investor in Nord Stream 2. The Shell energy

cartel is also the lead investor in LNG Canada,

which is building a gas pipeline across northern

BC to Kitimat on the coast. A liquefaction plant

is being constructed in Kitimat to convert the gas

to LNG for export to Asia.

The rapid development of energy demand in China

and south Korea in recent decades and the

continuing high demand in Japan has become a

source of competition for existing and emerging

energy producers. Russia with new pipelines into

China has established itself as a large supplier

of oil and gas in competition with Saudi Arabia

and other west Asian and African producers and

emerging LNG exporters in the United States.

The obstacle for Russian energy commodities to

reach greater markets in south Korea and Japan is

the U.S. military occupation of both Japan and

south Korea and blockade of the Democratic

People's Republic of Korea.

Russia and many oligarchs in Japan and south

Korea would like to see both oil and gas pipelines

come down through China or Russia directly into

the DPRK and continue through south Korea and

eventually underwater to Honshu in Japan. They

also want rail lines in the Korean Peninsula to

connect with Chinese routes to the west via the

New Silk Road, the Belt and Road Initiative and

with a possible tunnel to Japan.

With U.S. energy production now greater than U.S.

demand, the issue for a faction of the U.S.

imperialists has become one of opening up energy

markets in Asia and raising or at least

stabilizing the price of oil and gas. When the

U.S. was a large importer of oil and gas it sought

to gain control of foreign energy suppliers and

keep the prices low. The U.S. was the main

opposition to OPEC and any attempt to restrict the

supply of oil and gas in the international market

to stabilize prices at least at their prices of

production.

For the U.S. a conundrum has developed from its

fracking bonanza. The sudden quantity of oil and

gas has meant downward pressure on prices. To deal

with the problem, U.S. imperialism has unleashed

new attacks on other producers to suppress oil and

gas production and seize their markets.

In an unprecedented

frenzy the U.S. has unleashed sanctions and

boycotts against oil and gas producers and

invasion and war. Until recently before the U.S.

hydraulic fracturing allowed the U.S. to become

mostly self-sufficient in oil, Venezuela was a

major supplier to the U.S. Through sanctions and

sabotage, the U.S. imperialists have destroyed

much of Venezuela's oil production and markets.

Iran's oil production and economy are effectively

stymied by U.S. sanctions while invasion and war

have destroyed considerable energy production in

Libya and Syria. The U.S. imperialists have

pressured European companies and governments to

oppose Russian oil and gas projects through

sanctions such as those against the construction

of the Nord Stream 2 and Turkstream pipelines. In an unprecedented

frenzy the U.S. has unleashed sanctions and

boycotts against oil and gas producers and

invasion and war. Until recently before the U.S.

hydraulic fracturing allowed the U.S. to become

mostly self-sufficient in oil, Venezuela was a

major supplier to the U.S. Through sanctions and

sabotage, the U.S. imperialists have destroyed

much of Venezuela's oil production and markets.

Iran's oil production and economy are effectively

stymied by U.S. sanctions while invasion and war

have destroyed considerable energy production in

Libya and Syria. The U.S. imperialists have

pressured European companies and governments to

oppose Russian oil and gas projects through

sanctions such as those against the construction

of the Nord Stream 2 and Turkstream pipelines.

In contrast, Japan, both south and north Korea and China are

keen on having increased oil and gas production,

lower prices and a wider number of suppliers.

Japan and the Korean Peninsula do not have

substantial proven oil and gas reserves and China

is only beginning to explore and develop its

energy resources, and is currently producing 3.9

million bbl per day, somewhat less than Canadian

production of 4.6 million bbl per day but well

below the 15 million bbl per day the U.S.

produces.

Many in the ruling elite in Japan would welcome a

resolution of the isolation of the DPRK because in

their view that would open the possibility of

Russian gas and oil being piped down to Japan

through the Korean Peninsula and then underwater

to Honshu, Japan. As well, they want to see rail

lines and highways up the entire Korean Peninsula

to China and Russia and beyond along the New Silk

Road. Even within the U.S. financial oligarchy,

opposition to the Russian energy and other sectors

is not unanimous as some sections are connected to

and profit from that sector and more broadly from

the Russian economy while others welcome lower

energy prices.

The situation in

east Asia and Europe and throughout the world is

perilous. In Europe the U.S. strives to retain its

dominance through sanctions and military threats.

In east Asia, the U.S. is repositioning its

military to directly confront China and the DPRK,

and any forces in Japan and south Korea that may

desire to break free from its domination. In west

Asia and north and sub-Saharan Africa, the U.S.

and other imperialists are waging open warfare

against the peoples that want to gain control of

their economies and countries. The situation in

east Asia and Europe and throughout the world is

perilous. In Europe the U.S. strives to retain its

dominance through sanctions and military threats.

In east Asia, the U.S. is repositioning its

military to directly confront China and the DPRK,

and any forces in Japan and south Korea that may

desire to break free from its domination. In west

Asia and north and sub-Saharan Africa, the U.S.

and other imperialists are waging open warfare

against the peoples that want to gain control of

their economies and countries.

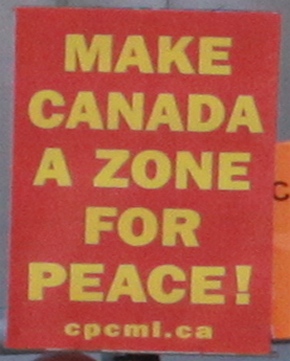

Canadians have the social responsibility to make Canada

a factor for peace. This requires Canada leaving NATO and NORAD and

breaking all military alliances and agreements with the U.S.

imperialists. On the economic front, Canadians must gain control over

the strategic energy sector not only as an economic measure

beneficial to Canadians and the social and natural environment but in

order to remove Canada's energy sector from global imperialist

contention and to make it a factor for peace not war.”

The Canadian energy sector is completely

under the control of the global financial

oligarchy, which colludes and contends for the

strategic resource both for profit and to power

their economies and militaries.

Canadians do not

control the energy sector and have no say over its

direction and development. The development or not

of the sector is a direct result of the decisions

of the cartels in control and their collusion and

contention. Canadians do not

control the energy sector and have no say over its

direction and development. The development or not

of the sector is a direct result of the decisions

of the cartels in control and their collusion and

contention.

Oil, natural gas and LNG are exported and

imported through business deals between and among

cartels. They are not state to state trading

relations that the people control, as they do not

control either the private cartels or the state.

The price received or paid for the energy

commodity is a private affair of the cartels and

states involved and the scores of parasites and

speculators that abound within the imperialist

system.

The market price for natural gas is now well

below its price of production, as is the projected

market price that LNG Canada would receive in Asia

at this time. The price of natural gas has fallen

below $2 per MMBTU (one million British Thermal

Units), while LNG has gone down below $4 per MMBTU

on world markets. This is below what is considered

profitable from fracking extraction and LNG

liquefaction. Some find it remarkable that LNG

Canada would proceed with a project when oil,

natural gas and LNG market prices are below their

prices of production. But this may be the point or

at least part of the attraction aside from the

need for the strategic energy resources to power

industries and militaries.

One of the investor/owners of LNG Canada is

Mitsubishi, which controls the LNG import market

in Japan and is also a major user/consumer of LNG

throughout its vast financial/industrial/trading

empire. The cartel wants to sustain its control

over the LNG market and to seize/steal natural gas

from other countries at the lowest price possible.

This forms part of its program to maintain control

over the market in Japan and maintain a constant

supply of energy for the Japanese economy

including its own industries and military. As far

as supporting or opposing other energy projects

around the world it analyzes the situation and

takes a position that favours its private

interests. This is exactly what all cartels do.

This is what cartels in the expanding "green"

renewable energy sector do as well. They finance

NGOs and other groups to do their bidding either

promoting or opposing energy projects.

To have a rational planned energy sector requires

the people's control over the direction of the

economy, which necessarily controls the wholesale

sector and export and import of commodities. This

requires activating the human factor/social

consciousness to take control over economic

affairs so as to see and act on the necessity not

to permit the private interests of the

imperialists to prevail. Their aim for maximum

private profit is very narrow and has no regard

for the social and natural consequences. Similar

to other sectors of the economy a new pro-social

aim and direction is necessary.

What should working people think of the

opposition to or support for pipelines in Canada?

Does the opposition or support come from a

principled position of opposing imperialism and

its anti-social aim of maximum profit and refusal

to recognize the rights of Indigenous peoples and

refusal to deal with human-influenced climate

change, pollution and other environmental

problems? Or is the opposition or support

manipulated on behalf of powerful private

interests of this or that imperialist cartel both

colluding and contending within the energy sector?

Why is one pipeline

approved and another cancelled? What is the

difference? Can a principled difference be found

and elaborated? For example, the federal

government cancelled the Northern Gateway oil

pipeline from Alberta to the northern coast of BC

yet is frantically trying to build the Trans

Mountain pipeline to Vancouver despite broad

opposition. What is the great difference? Why one

and not the other? They both are scheduled to

carry the same product. Why not cancel both? Why

not approve both? Why cancel an oil pipeline to

the northern BC coast and then force through the

building of a natural gas pipeline by LNG Canada

on much the same route to the same northern port

city of Kitimat? Why is one pipeline

approved and another cancelled? What is the

difference? Can a principled difference be found

and elaborated? For example, the federal

government cancelled the Northern Gateway oil

pipeline from Alberta to the northern coast of BC

yet is frantically trying to build the Trans

Mountain pipeline to Vancouver despite broad

opposition. What is the great difference? Why one

and not the other? They both are scheduled to

carry the same product. Why not cancel both? Why

not approve both? Why cancel an oil pipeline to

the northern BC coast and then force through the

building of a natural gas pipeline by LNG Canada

on much the same route to the same northern port

city of Kitimat?

The people do not control the energy economy or

any sector for that matter. This collusion and

contention over pipelines is essentially

inter-imperialist and inter-cartel contention over

control of the energy sector. Part of this

contention is to displace traditional oil and gas

(and coal) with renewable energy; part is for

control of the sector; and part is for broader

geopolitical and military reasons to weaken the

influence of contending imperialists in various

regions and globally.

The situation reveals that the imperialists must

not be permitted to manipulate the situation to

the advantage of this or that faction of the

financial oligarchy and lead the people astray,

especially the working class. The organized

working class must identify and defeat any and all

attempts to disinform the working people.

Disinformation is a means to keep the people

unorganized and unable to discuss and uphold a

principled position that favours their interests.

This is a problem that must be taken up for

solution. This struggle forms part of the broader

struggle to gain control over the energy sector.

To restate the thesis: The overriding issue for

Canadians concerning the energy sector is "Who

Controls and Who Decides?" To assert rational

scientific planning and social responsibility over

the production and distribution of carbon and

other energy resources, the people must wrest

control of the sector away from the global

cartels.

The thousands of

orphaned and abandoned drilling sites left behind

without environmental remediation in both Alberta

and BC expose the greed, anarchy and lack of

social responsibility on the part of the energy

companies. The aim for private profit drives them

into risky and irresponsible decisions before,

during and after their operations. When unforeseen

events occur such as a drop in market prices they

fling up their hands in despair and cry, "What can

we do; we have no money to clean up the mess. End

of story." Not "end of story" but end of such a

socially irresponsible control, direction and aim

of the economy. The global cartels currently in

control of the energy sector show with their

irresponsible practice of leaving behind polluted

orphaned and abandoned sites that they are

incapable of addressing the broader environmental

issues arising from their industry. Time for a

change to the new, to humanize the social and

natural environment! The thousands of

orphaned and abandoned drilling sites left behind

without environmental remediation in both Alberta

and BC expose the greed, anarchy and lack of

social responsibility on the part of the energy

companies. The aim for private profit drives them

into risky and irresponsible decisions before,

during and after their operations. When unforeseen

events occur such as a drop in market prices they

fling up their hands in despair and cry, "What can

we do; we have no money to clean up the mess. End

of story." Not "end of story" but end of such a

socially irresponsible control, direction and aim

of the economy. The global cartels currently in

control of the energy sector show with their

irresponsible practice of leaving behind polluted

orphaned and abandoned sites that they are

incapable of addressing the broader environmental

issues arising from their industry. Time for a

change to the new, to humanize the social and

natural environment!

Protest against the dangers of the use of Fracking

have taken place across the U.S. This one in

Maryland in 2017. (Food & Water Watch)

The global oil market price began a steady

decline when U.S. oil production rapidly increased

due to the extensive use of hydraulic fracturing

circa 2011. From 2007 to 2016, annual U.S. oil

production increased 75 percent and beyond to 15

million bbl per day for 2019, while natural gas

production increased 39 percent, due to the

advancements in horizontal drilling and fracking

technology. This caused major oil exporters to the

U.S., in particular Saudi Arabia, to seek other

markets, which led to increasing global

competition for those markets and a price war. It

appears in the present situation that Russia and

Saudi Arabia are seeking an agreement to reduce

global oil supply but the U.S. or at least its

major energy cartels do not want to comply.

In return for any cut of Russian oil production,

Russia probably also wants the U.S. to drop its

opposition to Russia's Nord Stream II and

Turkstream pipelines to Europe and possibly have

U.S. troops leave Syria and return the U.S.

occupied oilfields to the Syrian government.

Deliberately reducing the price of a commodity by

flooding markets with a certain commodity to drive

a competitor out of business is a longstanding

tactic for imperialist cartels. The price of

production of fracked oil is higher than

conventional drilling. The current global market

price below $30 a barrel is driving U.S.

unconventional oil production (hydraulic

fracturing) into crisis. This is what both Russia

and Saudi Arabia want in the short term but Saudi

Arabia cannot appear publicly to support such a

cause because of its dependent status vis-à-vis

U.S. imperialism.

Saudi Arabia is in the toughest bind because of

the Yemen war, the temporary loss of tourism and

pilgrimages to Mecca and its anti-Iran posture. It

has succeeded in finding other oil markets in east

Asia to partly offset the loss of the U.S. energy

market from the growth of U.S. domestic supply but

still the world is awash in oil in particular now

with the COVID-19 crisis. Once the pandemic is

defeated and the demand for energy increases and

with less U.S. supply, with the bankruptcy crisis

having destroyed many small and medium sized U.S.

producers of unconventional oil, the oil price

will rise. At least that is the hope of Russia and

Saudi Arabia and possibly even the big U.S. energy

cartels such as ExxonMobil and Chevron.

For

Your Information

The engineering and overall supervision of the

construction of the LNG Canada project has been

awarded to a joint venture of two large

engineering companies, JGC of Japan and Fluor

Corporation of the U.S.

The first phase of

the project is to include a $6.2-billion Coastal

GasLink Pipeline through northern BC, built and

operated by TransCanada. Coastal GasLink is

projected to be a 670-kilometre gas pipeline with

an initial capacity of about 2.1 billion cubic

feet per day (Bcf/day) with the potential for

expansion of up to approximately 5 Bcf/day.

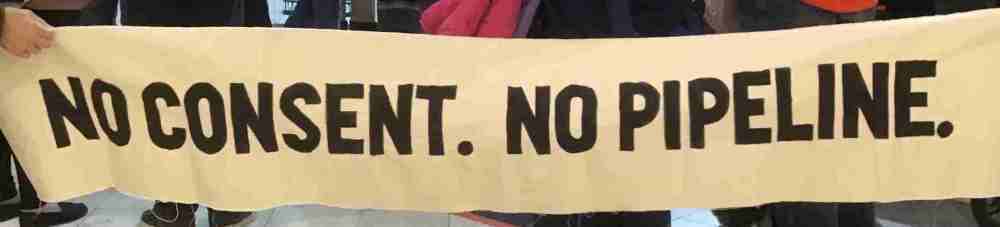

Permits have been issued by the BC government for

the project to proceed in spite of the fact that

the hereditary chiefs of the Wet'suwet'en people,

whose lands the pipeline is to traverse, have not

given their consent and are determined to continue

fighting to stop construction of any pipelines on

their unceded territory. The first phase of

the project is to include a $6.2-billion Coastal

GasLink Pipeline through northern BC, built and

operated by TransCanada. Coastal GasLink is

projected to be a 670-kilometre gas pipeline with

an initial capacity of about 2.1 billion cubic

feet per day (Bcf/day) with the potential for

expansion of up to approximately 5 Bcf/day.

Permits have been issued by the BC government for

the project to proceed in spite of the fact that

the hereditary chiefs of the Wet'suwet'en people,

whose lands the pipeline is to traverse, have not

given their consent and are determined to continue

fighting to stop construction of any pipelines on

their unceded territory.

The pipeline project is backed by a 25-year

transportation service agreement between

TransCanada Corporation and the LNG Canada

partners.

The second phase is the construction of an

$18-billion gas liquefaction and storage plant in

the port of Kitimat, BC, with two liquefaction

trains where the natural gas will be cooled to

reach its liquid state, and then stored to await

transfer to LNG ships for transport to Asian

markets.

A new terminal for LNG carrier ships will be

built at the port of Kitimat, BC connected to the

LNG Canada liquefaction and storage plant.

LNG carrier ships will sail up and down the

Douglas Channel, to and from the port of Kitimat,

to load LNG and sail fully loaded to overseas

destinations, mainly in Asia. Such ships may be

owned and operated by some of the LNG Canada

partners, or by their LNG purchasing clients or

they may be time-chartered from specialized

independent ship owners and operators of such

specialized ships.

Two partners, Royal Dutch Shell and Mitsubishi

have stated that the project will initially export

LNG from two processing units, or trains,

totalling 14 million tonnes per annum (mtpa) of

natural gas, and that, ultimately, the project may

add two more trains for another 14 mtpa.

The global LNG

industry, as natural gas in liquefied form, is

being used more and more extensively and directly

to fuel power plants, petrochemical and other

industrial plants and for natural gas distribution

through pipelines to homes and offices, as well as

to fuel various transport modes such as ocean

shipping. The global LNG

industry, as natural gas in liquefied form, is

being used more and more extensively and directly

to fuel power plants, petrochemical and other

industrial plants and for natural gas distribution

through pipelines to homes and offices, as well as

to fuel various transport modes such as ocean

shipping.

When completed, LNG Canada will likely be the

first Canadian terminal to export LNG overseas,

whereas several LNG liquefaction and export

terminals are already operating on the Gulf and

Atlantic coasts of the United States, with others

being planned, including on the U.S. west coast.

Within 10 days of the announcement of the LNG

Canada investment decision in October 2018, two

Japanese gas utilities, Toho Gas and Tokyo Gas,

signed heads of agreement for LNG purchasing

contracts over 15 and 13 years, respectively, with

a subsidiary of one of the LNG Canada partners and

shareholders, the Mitsubishi Group.

LNG Canada is the recipient of tax incentives.

The BC government offered the project a break on

the BC carbon tax, as well as the provincial sales

tax. The total subsidies for the project are

valued at $5.35 billion. The subsidies extend

beyond the natural gas plant itself, to new

transmission lines that are being built by BC

Hydro to service the gas fields where the gas will

be extracted through hydraulic fracturing. These

transmission lines have a cost of $296 million.

The LNG project is slated to be a major recipient

of electricity from the new Site C dam and

hydroelectric project, which will cost more than

$10.7 billion to build and is experiencing cost

overruns. The liquefaction process requires

tremendous energy consumption usually from natural

gas but, if electricity is available from Site C

or independent run of river producers at a lower

cost, it will be used.

Notes

LNG Canada:

The LNG Canada Website says the company will

export Canadian natural gas to Asian markets, and

in the process, put Canada on the global map of

LNG exporting countries and create a world-class

liquefied natural gas (LNG) industry in British

Columbia and Canada.

Joint Venture

Participants:

Royal Dutch Shell Plc. (40 per

cent, lead partner), of the UK and Holland;

PETRONAS (25 per cent), of Malaysia; PetroChina

Co. Ltd. (15 per cent), of China; Mitsubishi Corp.

(15 per cent), of Japan; and Korea Gas Corporation

(5 per cent) of Korea.

Shell: a global leader in LNG

since 1964, helping to pioneer the LNG sector.

Shell operates about 20 per cent of the world's

LNG vessels and has LNG supply projects either in

operation or under construction in ten countries.

PETRONAS: a fully integrated

energy company with extensive experience in LNG.

Through its wholly owned upstream energy company

Progress Energy and its partners, PETRONAS is one

of the largest natural gas reserves owner in

Canada — with the majority of these reserves in

the North Montney natural gas formation in

northeast British Columbia. The price of natural

gas has fallen to

$1.68 per MMBTU, well below the reported price of

production, through fracking in the Montney.

The ownership by PETRONAS of gas reserves in BC

with plans to greatly expand production when

Coastal GasLink begins transporting gas to Kitimat

brings to mind the situation in Alberta where

producers of oil sell it upstream in the U.S. to

themselves at a cheap price for refining and

eventual sale at higher prices. In this situation,

the cartels that control production and

distribution can drive smaller producers out of

business through low prices, declare poverty in

Alberta, abscond without paying corporate taxes or

royalty fees, and instead demand pay-the-rich

schemes including free infrastructure and other

subsidies.

PetroChina Company Limited (PetroChina):

China's largest oil and gas producer and supplier.

PetroChina has launched three LNG import

facilities in China and is increasingly an

investor in global unconventional gas production

(fracking) and LNG export facilities. (PetroChina

was also a big

supporter/investor/committed-buyer-of oil of the

now cancelled Northern Gateway oil pipeline, which

planned to cross BC from Alberta to Kitimat along

a similar route to that of the Coastal GasLink

pipeline.)

Mitsubishi Corporation: Japan's

largest trading cartel with more than 50 per cent

share of LNG imported into Japan. Mitsubishi has

been investing in LNG since 1969 and has an

interest in 11 LNG export projects globally.

Mitsubishi is also a member of the Mitsubishi

keiretsu (Group). The Mitsubishi Group employs

350,000 people and has many business segments or

subsidiaries including finance, banking, energy,

machinery, chemicals, beer and food.

Mitsubishi is one of the original zaibatsu

following the overthrow of the Edo feudal era of

petty production in 1868. The zaibatsu were large

financial houses and trading and manufacturing

companies controlled by powerful business and

merchant families. They immediately made the

transition to become dominant monopolies, as

merged industrial and financial companies after

the overthrow of the Edo feudal government and

international trade and overseas investment of

social wealth became commonplace. The original

seven zaibatsu were Mitsui, Mitsubishi, Sumitomo,

Yasuda, Furukawa, Asano and Kawasaki.

Korea Gas Corporation (KOGAS):

the world's largest LNG importing company and

south Korea's principal LNG provider. KOGAS

operates four LNG import terminals and a

nationwide pipeline network in South Korea, and

another terminal in Mexico.

The following are some examples of cancelled

pipeline and energy projects in Canada, that

illustrate the incoherence and contention in this

sector. In the oil sands alone, there are many in-situ

projects at various stages -- completed but not

brought into production, under construction, on

hold or cancelled.

Energy East Project Cancelled October 5, 2017

The Energy East pipeline owned by TransCanada was

a proposed oil pipeline in Canada. It would have

delivered diluted bitumen from Western Canada to

Eastern Canada, from receipt points in Alberta and

Saskatchewan to refineries and port terminals in

New Brunswick and possibly Quebec. It also would

have served to ship U.S. oil extracted by

hydraulic fracturing from the Bakken Formation

(now transported by rail).

The entire length would have been 4,600

kilometres, with approximately 70 per cent (3,000

kilometres) being existing pipeline that would

have been converted from carrying liquefied

natural gas to carrying diluted bitumen. The

pipeline route would have run from Alberta to New

Brunswick, crossing through Saskatchewan,

Manitoba, Ontario, and Quebec. The project would

have had a capacity of 1.1 million barrels

(~200,000 tonnes) of crude oil per day. Irving Oil

had announced plans to build a new $300-million

terminal at its Canaport facility in Saint John to

export the oil delivered from the pipeline. The

Quebec government was a particularly vociferous

opponent.

Northern Gateway Project Cancelled 2016

Gitxsan protest against LNG approvals in northern

BC in 2014.

Company: Enbridge (creation of Imperial Oil --

1949)

The Northern Gateway project was first proposed

in 2002. It would have exported diluted bitumen

from Kitimat, BC, to Asian markets, which would

arrive via a pipeline from Alberta. Ship travel

from Kitimat to Asia is two days shorter than from

Vancouver. Enbridge signed a cooperation agreement

with PetroChina in 2005 to ensure the utilization

of pipeline capacity. PetroChina is now a major

investor/participant in LNG Canada.

In 2006, Enbridge delayed the project in favour

of accelerating new lines to the United States. Up

until its outright cancellation by Canada's

federal government in 2016, the project faced

multiple court challenges amid a lengthy

regulatory process, combining to delay its

advancement multiple times. In July of 2016 the

Federal Court of Appeal overturned the previous

approval of Northern Gateway, citing a lack of

meaningful consultations with many Indigenous

communities.

Mackenzie Gas Project Cancelled 2017

Inception: 2000. Companies: ConocoPhillips,

ExxonMobil, Aboriginal Pipeline Group.

Also known as the Mackenzie Valley

Pipeline/Mackenzie River Pipeline, this 1,200 km

project in northern Alberta was initially started

in the mid 1970s but was later scrapped after an

official government inquiry recommended a 10-year

moratorium on pipeline development.

The project was resurrected in 2004 with a new

proposal to transport natural gas to the Beaufort

Sea and abroad with supply coming from pipelines

in northern Alberta. In late 2010 the project was

approved by the National Energy Board only to have

its deadline of 2015 for the start of construction

pass without any construction beginning.

Eagle Spirit Pipeline

The Eagle Spirit Pipeline is a

$16-billion First Nations owned Canadian

pipeline proposed by Indigenous businessman

Calvin Helin, which would ship oil from Northern

Alberta to Prince Rupert, BC following a route

well north of that of Coastal GasLink. The group

filed a request last year with the National

Energy Board for guidance regarding its project

description requirements, an early step in the

regulatory process.

Teck Resources Proposal for Open-Pit Petroleum

Mine

Abandoned 2020

Petitions are delivered to Environment

Minister's office in North Vancouver, January

2020, opposing approval of Tech mines project.

In February 2020, Teck abandoned plans for

Frontier Mine -- a $20 billion open-pit petroleum

mine proposal -- 25 km south of Wood Buffalo

National Park and north of Fort McMurray in

northeast Alberta. In announcing the decision the

CEO hinted that the company was having trouble

finding investors for the project. He wrote in

part, "Global capital markets are changing rapidly

and investors and customers are increasingly

looking for jurisdictions to have a framework in

place that reconciles resource development and

climate change, in order to produce the cleanest

possible products. This does not yet exist here

today and, unfortunately, the growing debate

around this issue has placed Frontier and our

company squarely at the nexus of much broader

issues that need to be resolved. In that context,

it is now evident that there is no constructive

path forward for the project. Questions about the

societal implications of energy development,

climate change and Indigenous rights are

critically important ones for Canada, its

provinces and Indigenous governments to work

through."

(To access articles

individually click on the black headline.)

PDF

PREVIOUS ISSUES

| HOME

Website: www.cpcml.ca

Email: editor@cpcml.ca

|