|

SUPPLEMENT

No. 33September 5,

2020

Discussion

on the Direction

of the Economy

• The

Green

Face of BlackRock

- Peter Ewart -

For Your Information • New

Self-Serving Definition of

"Fundamental Corporate Commitment"

• The Neo-Liberal Definition of a

"Stakeholder"

Discussion

on the Direction of the Economy

- Peter Ewart -

"The Great Reset"  At a time when

youth, workers and people all over the globe

have deep concerns about climate change, the environment, and the

political and economic system itself, influential factions of the

global financial oligarchy are calling for a "Great Reset" of the

financial system in the wake of the COVID-19 pandemic; or to put

it another way a "better" or "repurposed" capitalism, one which

can supposedly ensure its preservation. Such calls for a

"systemic change" and a return to "stakeholder capitalism,"

especially in regards to climate change, are coming from various

organizations of the North American and European oligarchies

including the World Economic Forum,[1][2]

U.S.

Business Roundtable,[3]

Climate Action 100+,[4]

and

other oligarchic bodies. At a time when

youth, workers and people all over the globe

have deep concerns about climate change, the environment, and the

political and economic system itself, influential factions of the

global financial oligarchy are calling for a "Great Reset" of the

financial system in the wake of the COVID-19 pandemic; or to put

it another way a "better" or "repurposed" capitalism, one which

can supposedly ensure its preservation. Such calls for a

"systemic change" and a return to "stakeholder capitalism,"

especially in regards to climate change, are coming from various

organizations of the North American and European oligarchies

including the World Economic Forum,[1][2]

U.S.

Business Roundtable,[3]

Climate Action 100+,[4]

and

other oligarchic bodies.

A key promoter of this

thrust has been BlackRock and its CEO

Larry Fink. BlackRock is the world's largest asset manager and

super-cartel with substantial shares in most of the top 300

corporations in North America and Europe, and a co-owner of over

17,000 corporations and banks worldwide. Most recently it has

been appointed by the U.S. government and Federal Reserve to hand

out hundreds of billions of public dollars to chosen financial

institutions and corporations -- many in which BlackRock has

investments -- in what has been described as the largest transfer

of wealth in history. The company is also a key advisor to the

Bank of Canada in its corporate bailout program. BlackRock

Letters to CEOs and Clients

Every year, Fink and BlackRock send out letters to CEOs of

BlackRock associated companies and financial institutions, as

well as other clients. In his 2018 letter to CEOs, Fink commented

that "society is demanding that companies ...serve a social

purpose" and that without such a purpose "no company... can

achieve its full potential." He further argued that how well a

company manages ESG (Environmental, Social & Corporate

Governance) issues "demonstrates the leadership and good

governance that is so essential to sustainable growth."[5]

This was followed up more recently with another letter to CEOs

in January of 2020 titled "A fundamental reshaping of

finance,"[6]

and which to

some represents a fundamental shift of the company's focus on

environmental matters to a more "green" approach. According to

one analyst, this letter "sent shockwaves through corner offices"

of corporations across America, given that BlackRock can exert

substantial pressure through its sheer size and influence by

pulling funding from companies and financial institutions that

aren't toeing the line in regards to the environment,[7] as

well as using other pressure

tactics at its disposal. Of course, it will be BlackRock, the

super-cartel and global enforcer, that ultimately decides the

criteria by which such determinations will be made. Not

surprisingly, some factions of the financial oligarchy,

especially in the energy sector, are not happy about this

development. BlackRock -- "Climate Risk Is

Investment Risk"

In this letter,

Fink notes that climate change has become "a

defining factor" in the long-term prospects of companies, that

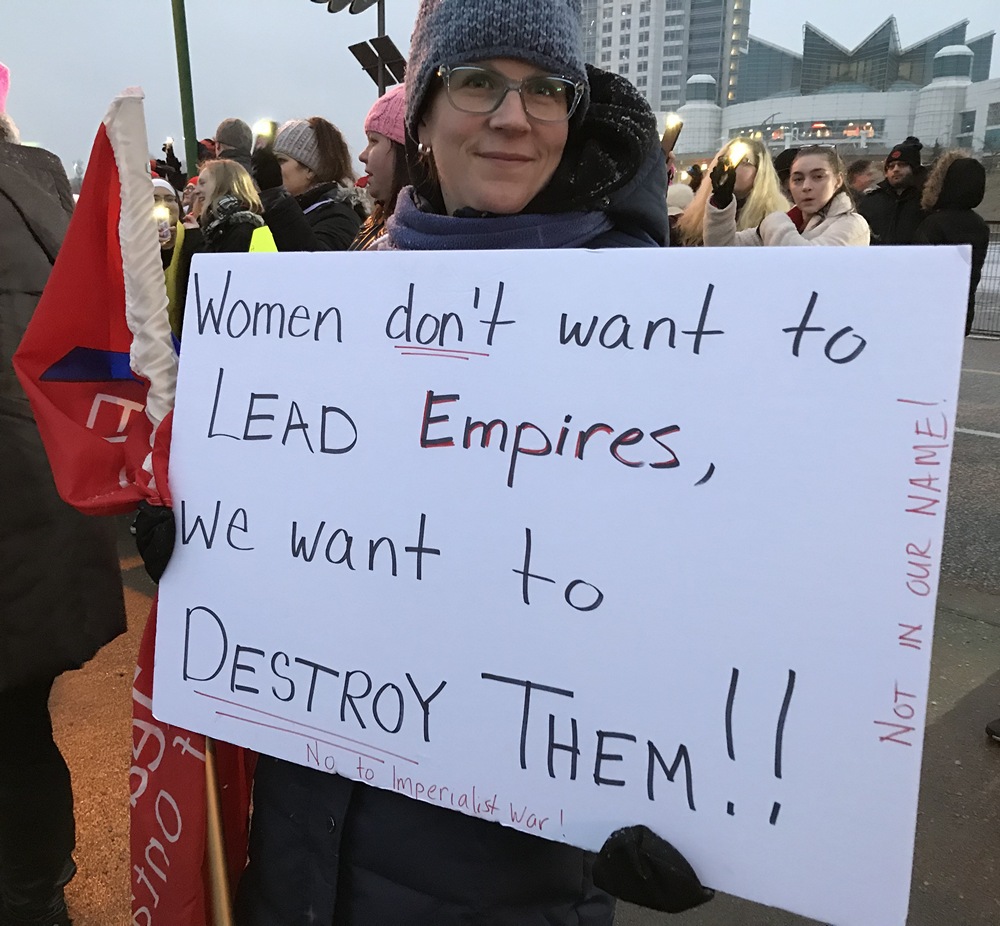

"awareness is rapidly changing," that millions of people have

taken "to the streets" and that the "evidence on climate risk is

compelling investors to reassess core assumptions about modern

finance." He gives examples as to how climate risk will "impact"

the physical world and the global financial system. "Will

cities," he asks, "be able to afford their infrastructure needs

as climate risk reshapes the market for municipal bonds? What

will happen to the 30-year mortgage -- a key building block of

finance -- if lenders can't estimate the impact of climate risk

over such a long timeline, and if there is no viable market for

flood or fire insurance in impacted areas?" In this letter,

Fink notes that climate change has become "a

defining factor" in the long-term prospects of companies, that

"awareness is rapidly changing," that millions of people have

taken "to the streets" and that the "evidence on climate risk is

compelling investors to reassess core assumptions about modern

finance." He gives examples as to how climate risk will "impact"

the physical world and the global financial system. "Will

cities," he asks, "be able to afford their infrastructure needs

as climate risk reshapes the market for municipal bonds? What

will happen to the 30-year mortgage -- a key building block of

finance -- if lenders can't estimate the impact of climate risk

over such a long timeline, and if there is no viable market for

flood or fire insurance in impacted areas?"

According

to Fink, such questions "are driving a profound

reassessment of risk and asset values" and will result in "a

significant reallocation of capital." In that regard, BlackRock's

responsibility is "to help clients navigate this transition." His

conclusion is that "sustainability and climate-integrated

portfolios can provide better risk-adjusted returns to investors"

and that "sustainable investing is the strongest foundation for

client portfolios going forward." In other words, "climate risk

is investment risk" and a "green" and "sustainable" focus will

result in better financial outcomes for investors. Thus the logic

of his argument is caught up entirely in the framework of making

a profit for BlackRock and its clients. However, Fink does not

explain what will happen to this "green" focus if realizing a

profit is no longer possible. Nor does he explain that it is the

same relentless pursuit of maximum profit in the past by the

oligarchy, and which is inherent in the financial system, that

has created today's environmental problems in the first place.

Fink himself has been a big advocate of deregulation which many

believe has allowed financial institutions to run wild over the

years and corporations to pollute indiscriminately. BlackRock

and Stakeholders

In any case, to achieve long-term profits, Fink argues that a

company must consider "the needs of a broad range of

stakeholders." He gives a number of negative examples including

"a pharmaceutical company that hikes prices ruthlessly, a mining

company that shortchanges safety, a bank that fails to respect

its clients -- these companies may maximize returns in the short

term." But, he argues, "as we have seen again and again, actions

that damage society will catch up with a company and destroy

shareholder value." He goes on to say that, "by contrast, a

strong sense of purpose and a commitment to stakeholders helps a

company connect more deeply to its customers and adjust to the

changing demands of society" and that "ultimately, purpose is the

engine of long-term profitability." In a third

letter issued to clients in 2020,[8]

this time from BlackRock's Global

Executive Committee, the claim is repeated that

"sustainability-integrated portfolios can provide better

risk-adjusted returns to investors," and that includes "striving

for more stable and higher long-term returns." In a recent

report, BlackRock defines sustainable investing as "combining

traditional investing with environmental, social and

governance-related (ESG) insights to improve long-term outcomes

for our clients."[9]

It

further claims that during this year's economic downturn

ESG-titled portfolios outperformed their non-sustainable

counterparts and this promises to be a growing trend, i.e. it is

"a long transition just getting started." This "dynamic" is

expected to accelerate, Larry Fink says, "as the next generation

takes the helm of government and business."[10]

BlackRock and "Sustainability"

To move the process forward, BlackRock claims to make

"sustainability" its standard building block in client investment

portfolios, whether through its passive investment programs (such

as index funds) or its active investment programs, which include

mutual funds and which feature portfolio managers. In that

regard, BlackRock currently offers more than 150 sustainable

funds and investment instruments for its clients.[11]

The firm also claims that it will reduce ESG risk in its

active investment strategies, such as cutting back or ending

investments in thermal coal producers, while at the same time

expanding investments that "support the transition to a

low-carbon economy." As part of its stewardship, BlackRock aims

to hold client companies to account through proxy voting and

other pressure tactics regarding how well they are disclosing and

managing sustainability-related risks and how transparent they

are in their stewardship practices. So far this year, according

to news reports, BlackRock has taken material actions against

management at 53 companies (mostly energy related) over climate

concerns. These actions included "siding with shareholders on

their proposals, voting against board members and raising

governance concerns." In addition, BlackRock has put another 244

companies on notice for making "insufficient progress integrating

climate risk into their business models or

disclosures."[12]

According to the second 2020 letter, Fink says that BlackRock,

working with other index providers, plans to expand and improve

sustainable index investment instruments, adding to those that

the company already has in place. At the same time, the

corporation believes that many clients will continue to prefer

"traditional" investment strategies. It also recognizes that

"while the low-carbon transition is well underway, the

technological and economic realities mean that the transition

will take decades" and that "global economic development,

particularly in emerging markets, will continue to rely on

hydrocarbons for a number of years." As a result, the portfolios

it manages "will continue to hold exposures to the hydrocarbon

economy as the transition advances." BlackRock --

"Having its Cake and Eating It Too"

And so it is that BlackRock aims to have it both ways, to have

its cake and eat it too. It wants to appear to be addressing the

demands of youth and other sections of the people for climate

change solutions, but to do so in ways that are profitable for

BlackRock and its clients -- in spite of the fact these will end

up perpetuating the problem. The company pulls this off by

appearing to take action against some polluters, such as thermal

coal, as well as providing sustainable funds for "green

investments" for environmentally conscious investors. But, while

doing so, it pledges to continue to provide investment vehicles

and support for many years to come for chosen polluters in the

oil & gas sector. Thus it will amass profit from both the

"green"

side and the "polluter" side of the equation. And

the same configuration holds true in other ESG areas like

war production. BlackRock will now be providing investment

"baseline screens" which will allow investors to put money in

BlackRock managed funds which screen out companies that

manufacture controversial weaponry like landmines, cluster bombs

and depleted uranium.[13]

All the while, with other "less clean" funds and investments, it

will be continuing to support major weapons manufacturers like

Boeing, Lockheed Martin, and Northrop Grumman. As one critic put

it: "Funding war and the nuclear arms race, or promoting social

responsibility? It's not possible to do both at the same

time."[14]

BlackRock's Terrible Record

Indeed, there is a savage irony in BlackRock presenting itself

as a "green" or "progressive" force on the world stage. For many

critics, the super-cartel has a terrible record in regards to

climate change, as well as on environmental and other social

issues in general. For decades, BlackRock has been a top global

investor in major polluting industries and war production

companies, and has operated as a huge cartel with other asset

managers and financial institutions. In that regard, it has one

of the worst corporate voting records on climate issues. Between

2015 and 2019, BlackRock opposed more than 80 per cent of climate

change-related motions at fossil fuel companies in which it has a

stake.[15]

As a result,

some environmental groups have labelled BlackRock as the "biggest

driver of climate destruction on the planet" and its sustainable

initiatives as nothing more than "green wash."[16]

"A License to Operate"On

June 23 and

24, BlackRock convened its first Global Summit focused on

sustainability which attracted 3,000 "investment professionals"

from 60 countries. At that Summit, Larry Fink was interviewed and

revealed some of the rationale behind BlackRock's recent adoption

of its "green face." In the course of the interview, he expressed

the worries and concerns of the global oligarchs about the

stability of the financial system and their need to head off any

threats to it. For example, Fink stated that "in this period of

time where globalization is being questioned and we are seeing

more nationalism in every country, for multinational companies

more than ever before, we are going to have to prove that we

deserve a license to operate in every country we are working in

and ... prove [to] every society that we are doing the best we

can."[17]

BlackRock and P3s

In the above interview, Fink indicated that global oligarchs

like BlackRock will be prioritizing "public-private partnerships"

(P3s), as the path forward in addressing climate change and other

ESG issues. Instead of government using public funds to finance

the infrastructure that is needed to address climate change, Fink

argues that private corporations like BlackRock and others should

finance and manage such projects using the large pools of private

funding available. He phrased this to sound as if the financial

oligarchs will be carrying out this investment to "help"

government and, by extension, society itself. He claims that this

"help" will free up government to invest in other ESG projects,

such as anti-racism campaigns, solar energy installations, etc.

According to him, P3s should be at the top of every government's

agenda, whether federal, provincial or municipal. However, he did

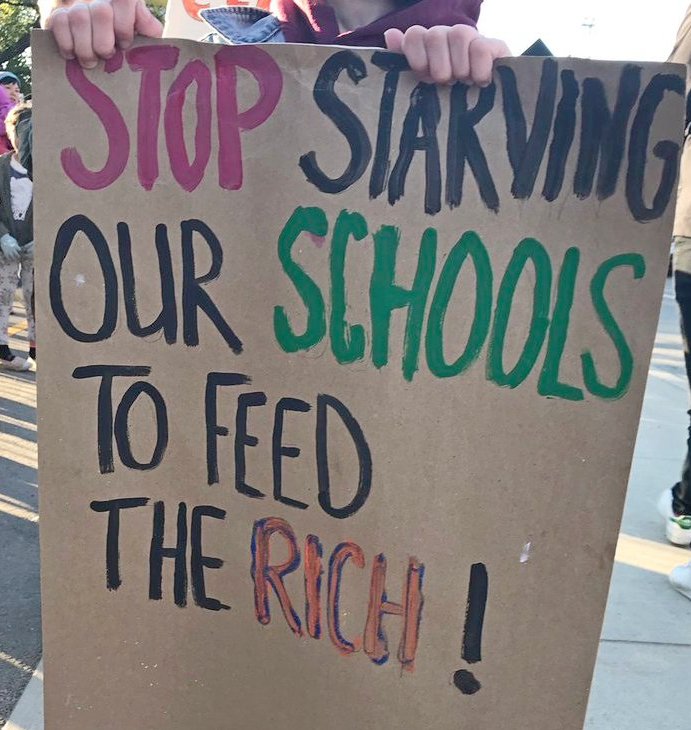

not explain that P3s are "pay the rich" schemes that result in

the privatization of public infrastructure and higher costs of

construction, as well as increased taxes, tolls and user fees

imposed on the population. P3s are one of the main means by which

the global oligarchs are swallowing up and taking over the

operations of the state in many countries. In that regard, the

"progressive" oligarch Fink is known for pushing for the

privatization of the entire social security system in the US.

A Thing Cannot Escape its Essence

What is left unsaid in Fink's remarks is that BlackRock and

the globalized oligarchs do not want youth, workers and other

sections of the people to have their own agenda on climate change

and other social and political issues, but rather to give up

their agenda and line up behind the program of the global

oligarchs who trumpet a "reset" and "stakeholder" capitalism.

What has been the main cause of global environmental and other

problems has now magically become the solution. But

a thing cannot escape its essence, no matter how much

"resetting" or "greenwashing" is attempted, and no matter whether

it is BlackRock or the financial system itself. For

further information on BlackRock see

TML Weekly June 13, 2020.

Notes 1.

"Why

we need the 'Davos Manifesto' for a better kind of

capitalism," Klaus Schwab.

2. "The

Great Reset: A unique twin

summit to begin 2021." 3. Business Roundtable, "Statement

on

the purpose of a corporation," June 14, 2020.

4. Climate Action

100+, Global

investors

driving business transition. 5. "BlackRock's

2018 CEO letter: A new

'sense of purpose' for corporate America?" Lexology, January

24,

2018. 6.

"A

fundamental reshaping

of finance," Larry Fink, BlackRock, January 2020.

7. "BlackRock

C.E.O. Larry Fink: Climate crisis will reshape finance," Andrew Ross

Sorkin, New

York

Times, January 14, 2020. 8. BlackRock's Global Executive

Committee, "Sustainability

as BlackRock's new standard for

investing," January 2020. 9. BlackRock, "Sustainable

investing:

resilience amid uncertainty," 2020. 10. "BlackRock

C.E.O. Larry Fink: Climate crisis will reshape finance," Andrew Ross

Sorkin, New

York Times, January 14, 2020. 11. BlackRock, "BlackRock

hosts Global

Summit focused on sustainability," July 8, 2020.

12. "BlackRock

voted

against management at 53 companies over climate concerns,"

Declan Harty, S&P

Global, July 14, 2020. 13. BlackRock, "BlackRock's

baseline

screens in Europe, Middle East and Africa."

14. "BlackRock:

Funding war, preaching social responsibility," William

Hartung, Medium.com, May

11, 2018. 15.

"Activists

respond

to BlackRock's climate change investment strategy: 'There are

questions left unanswered," Emma Newburger, CNBC,

January 16, 2020. 16.

Wikipedia, "BlackRock,"

accessed May 26, 2020. 17.

"A

conversation

with Larry Fink: A fundamental reshaping of finance,"

Francine Lacqua, from the

BlackRock Global Summit 2020, Bloomberg TV.

For Your Information

In August of 2019, the U.S. Business Roundtable, made up of

nearly 200 of the country's largest corporations and banks,

issued a new "Statement on the purpose of a

corporation."[1]

For a

number of decades, the Business Roundtable has endorsed

principles of shareholder primacy -- that corporations exist

principally to serve shareholders. In this, they were following

the dictum of the economist Milton Friedman that "the one and

only social responsibility of business ... is to increase

profits." However, the Business Roundtable appears

to have changed its

tune. In the Preamble to the new statement, it now claims that

the language of the old one regarding responsibility "does not

accurately describe the ways in which we and our fellow CEOs

endeavor every day to create value for all our stakeholders,

whose long-term interests are inseparable." It goes on to say

that "While each of our individual companies serves its own

corporate purpose, we share a fundamental commitment to all of

our stakeholders," i.e. not just shareholders. In

the statement, the CEOs, who represent many of the biggest

corporations in the U.S. such as BlackRock, Vanguard, Apple,

American Express, Lockheed Martin, Goldman Sachs, Walmart,

Bechtel, Boeing, and Exxon, and others, now pledge commitment to

a range of "stakeholders" by "delivering value to our customers

... investing in employees [which] starts with compensating them

fairly and providing important benefits ... dealing fairly and

ethically with our suppliers ... supporting the communities in

which we work ... protect[ing] the environment by embracing

sustainable practices across our businesses." And, at the very

end of the list, is "generating long-term value for

shareholders." Indeed, there have been various

phases over the last 100+ years as

to how the oligarchs have described their purpose, depending on the

arrangements necessary at the time to advance their interests

and

the "spin" that goes along with it. For these CEO proponents of

American pragmatic theory, there is no objective reality. Truth is what

"works" in their interest and, to them, reality is only a construct.

Thus the financial oligarchy can conjure up new "realities" about the

aims and purpose of their enterprises. But once one of these realities

stops producing the results they desire, another must be

substituted in order to continue to advance their interest. Thus the

Business Roundtable CEOs can claim with all certainty one year that

their rapacious monopolies serve only shareholders and now say they

serve "stakeholders" including workers, suppliers,

communities and

so on. For these CEO proponents of American

pragmatic theory, there

is no objective reality. Truth is what "works" in their interest

and, to them, reality is only a construct. Thus the financial

oligarchy can conjure up new "realities" about the aims and

purpose of their enterprises. But once one of these realities

stops working or is discredited another must be substituted in

order to continue to advance their interest. Thus the Business

Roundtable CEOs can claim with all certainty one year that their

rapacious monopolies serve only shareholders. Yet the next year,

the leopard spots magically change, and the monopolies claim to

"create value" for a range of stakeholders which includes

workers, suppliers, communities and so on. Besides

obscuring that it is the working people acting on

nature who create all new value, what this pragmatic thinking and

demagogy covers up is that the current financial oligarchy has

had two fundamental aims since the rise of the monopoly

capitalist system and imperialism at the beginning of the 20th

century. These are: 1) striving for maximum profits by

whatever means necessary; 2) preserving, maintaining and

expanding their exploitive system, both nationally and

internationally. Why are these CEOs resetting their

avowed purpose now? When

Milton Friedman's dictum of shareholder primacy was adopted back

in the 1980s and '90s, this was actually a time when the

financial oligarchy had launched a renewed offensive against the

workers and people of the U.S., Canada and the world using

neo-liberal dogmas, like the claim of shareholder primacy, as

justification to slash wages and pensions, privatize public

institutions, cut social programs, and other anti-social

behavior. "Greed is good," was a Friedman-like mantra of that

time and pursuit of private interest was presented as the highest

virtue. Today, in 2020, the financial oligarchy is

also on a renewed

offensive, but the conditions are different than the 1980s. In

order to achieve maximum profits and preserve the system, it must

further loot the huge reservoir of social wealth created by

working people in the U.S. and abroad. This looting has been

going on in direct and indirect ways since the rise of monopoly

capitalism many decades ago. But in the wake of the 2008

financial crisis and now the COVID-19 debacle, it has been ramped

up to an unprecedented degree. Herein lies the

dilemma for the Business Roundtable CEOs.

How can they justify following the Friedman dictum of being only

responsible to their wealthy shareholders, yet going, year after

year, with outstretched palms to demand literally trillions of

dollars from the public purse? No, the CEOs must now proclaim that they

have found a new "social responsibility" to all the "stakeholders" in

society; and thus, in turn, the implication is

that society must be prepared to permanently backstop the big

banks and corporations with trillions of public funds, through

bailouts, public-private partnerships, privatizations, subsidies,

tax cuts and other means. The Roundtable's

statement lies within the recent thrust of

the Davos World Economic Forum to push for "stakeholder

capitalism" and a "better kind of capitalism." The billionaires

of Davos want all of civil society to fall in line behind their

agenda, as do the CEOs of the Roundtable. Above all, they do not

want an alternative agenda to develop that is put forward by an

empowered working class and people. Despite all their talk

about "social responsibility," the oligarchs continue unabated to

exploit the very "stakeholders" they claim to be serving. The

leopard has not and cannot change its spots. Note

1. "Statement

on

the purpose of a corporation," Business Roundtable, June 14,

2020.

The definition of a "stakeholder" is recycled from

the days of Tony Blair when he spread the "Third Way" thesis of a

"stakeholder society" to hook the people onto the illusion that

somehow they have a say on the decisions which affect their

lives. Reproduced

below is an extract of an article published by

Workers' Forum in 1997 titled "What is a

Stakeholder?" [...] According to this

vulgar materialism, society is not

composed of classes but of "stakeholders." The motive force for

development is not the class struggle but the seeking of a

"balance" between these disparate "stakeholders." At the level of

an enterprise or a sector such as education or health care, all

human beings are presented as stakeholders. Class differences

vanish before the commonness of being a "stakeholder."  The problem, of

course, is that only the bourgeoisie can have

a stake in capitalism but it cleverly wants to convince the

working class and people that they also have a stake in

capitalism. In fact, the only stake the working class has in

capitalism is to overthrow it and build socialism. It matters

little to the working class that there are those who do have a

stake in capitalism: stockholders, management, certain consumers

and customers, suppliers, governments, big business and the

enterprises of big labour. A worker knows instinctively that all

of the above have a stake in the capitalist system that they wish

to defend. They all merge and form the "unity of stakeholders"

according to the logic being advanced by the ideologues of the

bourgeoisie at this time. The problem, of

course, is that only the bourgeoisie can have

a stake in capitalism but it cleverly wants to convince the

working class and people that they also have a stake in

capitalism. In fact, the only stake the working class has in

capitalism is to overthrow it and build socialism. It matters

little to the working class that there are those who do have a

stake in capitalism: stockholders, management, certain consumers

and customers, suppliers, governments, big business and the

enterprises of big labour. A worker knows instinctively that all

of the above have a stake in the capitalist system that they wish

to defend. They all merge and form the "unity of stakeholders"

according to the logic being advanced by the ideologues of the

bourgeoisie at this time.

A worker also knows

instinctively that these "stakeholders"

work together with the aim of creating "values" in an enterprise

from which they profit, while on a grander scale they work

together to restructure the entire society to fit their schemes

of being competitive in the global market. Workers

are supposed to forget all this, even though they

realize it instinctively. Against all logic, they are supposed to

declare themselves as "stakeholders" in the capitalist system. The

capitalist system, which develops through the violent destruction

of the productive forces and has created an ever-increasing

standing army of unemployed and an exploding number of poor, is

now supposedly going to help a worker because that worker has

become a "stakeholder" in capitalism! They are supposed to

abandon class struggle and deny class antagonisms; they are to

believe that everything will be looked after when a "balance" is

struck between various "stakeholders."  The bourgeoisie

applies the same logic to the attempt to get

teachers, parents and others to declare themselves "stakeholders"

as concerns education; or doctors, nurses and hospital personnel

as concerns the health care system, and so on. As stakeholders,

parents are supposed to support the deficit-reduction targets and

"pitch in" to make all the changes work smoothly -- all for the

sake of the future of their children and society. The aim of the

bourgeoisie and its governments to completely destroy the system

of public education or public health is supposed to be accepted

by the people under the hoax that they too are "stakeholders." If

they do not do "their bit" to achieve the "balance" between the

various "stakeholders," then they are branded as troublemakers,

or those who "do not want a bright future for society." Every

attempt is made to isolate them. The bourgeoisie

applies the same logic to the attempt to get

teachers, parents and others to declare themselves "stakeholders"

as concerns education; or doctors, nurses and hospital personnel

as concerns the health care system, and so on. As stakeholders,

parents are supposed to support the deficit-reduction targets and

"pitch in" to make all the changes work smoothly -- all for the

sake of the future of their children and society. The aim of the

bourgeoisie and its governments to completely destroy the system

of public education or public health is supposed to be accepted

by the people under the hoax that they too are "stakeholders." If

they do not do "their bit" to achieve the "balance" between the

various "stakeholders," then they are branded as troublemakers,

or those who "do not want a bright future for society." Every

attempt is made to isolate them.

The intent of this

thesis is to make sure that there is an

alliance at the base of society of workers and capitalists alike

in whose interest it will be to defend the capitalist system and

go to bat for the bourgeoisie in its campaign to restructure

everything so as to make Canada "the greatest country in the

world in which to live". This is a euphemism for making the

Canadian bourgeoisie competitive on global markets so that it can

realize maximum capitalist profit. Instead of

contributing to setting a new direction for the

economy, the working class is supposed to keep busy defending

the

very system that is the root of its exploitation and oppression.

Instead of developing antagonism against private property and the

exploitation of persons by persons, the workers are supposed to develop

antagonism against those who wage the class struggle against the

capitalist system and to open society's path to progress.

(To

access articles individually click on

the black headline.)

PDF

PREVIOUS

ISSUES | HOME

Website: www.cpcml.ca

Email: editor@cpcml.ca

|