|

November 30, 2017

Fight for Security in Retirement!

Withdraw Bill C-27!

No to Attacks on Defined

Benefit Pensions!

PDF

Fight

for

Security

in

Retirement!

• Withdraw Bill C-27! No to Attacks on Defined

Benefit

Pensions!

• Congratulations to CEZinc Steelworkers!

• Quebec Aluminum Workers Overwhelmingly

Reject Two-Tier Pension Plan

- Interview, Clément Masse, President, United Steelworkers Local

9700

• Canadians Demand a New

Direction to

Guarantee Defined Pensions

for All - K.C.

Adams

Fight for Security in Retirement!

Withdraw Bill C-27!

No to Attacks on Defined Benefit Pensions!

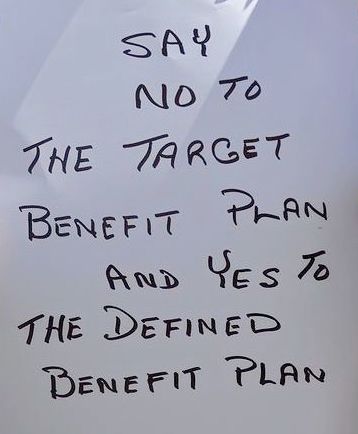

Retired and active postal workers from the Toronto and

Scaborough

Locals of the Canadian Union of Postal Workers (CUPW), workers from

other unions and their allies held a rally and picket in Toronto on

November 28 to denounce the Liberal government's attacks on

workers and retirees and to demand that Bill C-27 be scrapped.

Bill C-27, if passed, will remove the issue of pensions

from postal

workers' upcoming negotiations. Workers will have no say in the kind of

pensions they have, as the police powers of Bill C-27 will replace

negotiations with state dictate. The government through Bill C-27

will direct Canada Post to unilaterally replace the defined benefit

plan with a target benefit plan.[1]

The action took place outside the annual meeting of the

Institute of Corporate Directors at which Liberal Finance Minister Bill

Morneau was the keynote speaker. Bill C-27 would reap windfall profits

for Morneau Shepell -- the

pension

consultancy company owned by the Morneau family. Protesters denounced

this as a blatant conflict of interest and "highway robbery."

Jean-Claude Parrot,

President of the National

Organization of

Retired Postal Workers (NORPW), and a former National President of

CUPW, pointed out that postal workers have historically fought to

defend their rights and those of all workers to live and work with

dignity. He stated that the Harper government had planned to convert

postal

workers' defined benefit pension plan to a defined contribution plan

but postal workers mobilized to prevent this. He pointed out that

during the 2015 federal election the Trudeau Liberals

promised

not to touch government workers' pension plans, but one year after

coming to power they tabled Bill C-27. Parrot stressed that postal

workers'

fight for defined benefit pensions is one with the fight of all workers

for a secure retirement and called for continued unity of workers from

all sectors. Jean-Claude Parrot,

President of the National

Organization of

Retired Postal Workers (NORPW), and a former National President of

CUPW, pointed out that postal workers have historically fought to

defend their rights and those of all workers to live and work with

dignity. He stated that the Harper government had planned to convert

postal

workers' defined benefit pension plan to a defined contribution plan

but postal workers mobilized to prevent this. He pointed out that

during the 2015 federal election the Trudeau Liberals

promised

not to touch government workers' pension plans, but one year after

coming to power they tabled Bill C-27. Parrot stressed that postal

workers'

fight for defined benefit pensions is one with the fight of all workers

for a secure retirement and called for continued unity of workers from

all sectors.

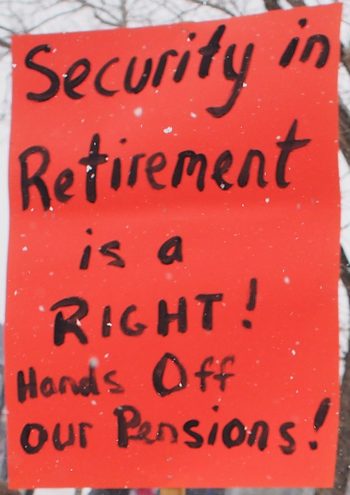

Peter Whitaker, speaking for NORPW, stated that retired

and active

postal workers are not alone in defending workers' pensions. He cited

the courageous battle waged by the steelworkers in Hamilton whose

pensions and benefits were misappropriated by U.S. Steel using the Companies' Creditors Arrangement Act

(CCAA). He stated that the Public Service Alliance of Canada and other

unions are also demanding "Hands Off Our Pensions!" Whitaker noted that

the Trudeau Liberals appointed Morneau as Finance Minister knowing that

he and his company had long agitated for governments to pass

legislation to convert defined benefit pensions to target benefit

pensions which allow companies like Morneau Shepell to make a killing.

He called on everyone to join in the fight to defeat the

Liberals' anti-worker Bill C-27.

Other speakers also denounced Bill C-27 and called for

the

resignation of Morneau and Trudeau, and the repeal of this anti-pension

bill. They pledged to take collective action to unseat the Liberals in

the next federal election in 2019.

The action received wide support from passers-by, many

of whom stopped to find out more about the action and

to offer their support.

Note

1. For further information on Bill

C-27 see Workers'

Forum, September 18, 2017.

Congratulations to CEZinc Steelworkers!

Meeting of steelworkers from CEZinc refinery in

Salaberry-de-Valleyfield, November 25, 2017

Workers' Forum joins with all workers and their

allies in

extending our heartiest congratulations to CEZinc steelworkers in

defending their rights! Members of United Steelworkers/Syndicat des

Métallos Local 6486 at the CEZinc refinery in

Salaberry-de-Valleyfield,

with the active assistance of many community and other

allies, have successfully defended their pension plan for current and

future workers.

On strike for nine and a half months, the 371

CEZinc steelworkers

have maintained their just and honourable position to defend their

pension plan from the attacks of those who own and control the

refinery, the Noranda Income Fund and global monopoly Glencore. The

steelworkers' position in defence of the right of current and future

workers to a just claim on the value they produce and to retire in

dignity won the active support of the working class and others across

Quebec, Canada and internationally. Their strike began on

February 12,

and continued until the ratification vote to accept the new contract on

November 25, which contains no concessions regarding

the pension plan.

Quebec Aluminum Workers Overwhelmingly

Reject Two-Tier Pension Plan

- Interview, Clément Masse,

President, United Steelworkers Local 9700 -

Workers at ABI plant in Bécancour following vote to reject

company offer,

November 22, 2017.

On November 22,

the day their collective agreement came to an end, the 1,030

workers at the ABI aluminum plant in Bécancour overwhelmingly

rejected the company's offer to introduce a two-tier pension plan and

create two-tier working conditions by dismantling existing contractual

arrangements with respect to job transfers

and mobility. The workers decided not to go on strike at this time and

the employer has not locked them out. There are talks going on right

now in the presence of a mediator. Posted below is an interview with

Clément Masse, President of USW Local 9700 representing the

ABI workers.

***

Workers' Forum: How many workers

are there at the ABI smelter, and what do they produce?

Clément Masse: At the ABI

plant, we produce primary aluminum in the form of ingots, billets and

plates. The plant has a production of about 450,000 tonnes per

year. It is owned in partnership by Alcoa (75 per cent) and Rio Tinto

(25 per cent). We are 1,030 unionized workers and management has

about 100 people.

The union members are divided into three units, all of which are part

of USW Local 9700. These are: the production unit, which

comprises about 950 workers, the office and technical unit, and

the lab technicians' unit which comprise about 50 and 21

people respectively.

The ABI plant has a big impact in the region

economically. The plant is located on the south shore of the St.

Lawrence River in Bécancour, but it has an impact throughout the

region, even on the North Shore because 75 per cent of ABI

employees live on the North Shore. There is no big city on the

Bécancour side while the nearest town is

Trois-Rivières on the North Shore. People often will prefer to

live on the North Shore because of the services for children and the

schools. The plant provides work for several small businesses and

contractors. It must also be said that about 1,000 workers with an

average wage of $42 to $43 per hour have an impact on the

region.

If there was to be a work stoppage here, the economy of the region

would certainly feel it.

WF: You mentioned in a statement

that negotiations are at an impasse on the issue of the pension fund

and the job mobility issues in the plant. Can you tell us more about

that?

CM: We went into early negotiations

starting in January. We had done a lot of work. We had discussions with

the employer but the negotiations stalled on the pension plan. The

employer wants to establish a two-tier plan and put that proposal on

the table. We said "no way." The early negotiations ended there in the

spring.

We started official negotiations in September -- in the

official negotiating period of 90 days before the end of the collective

agreement on November 22, one minute before midnight. We are now

without a contract. In September, we immediately asked the employer

what their stand was on the issue of the pension plan. Their position

was and still is to establish a new pension plan for new hires. This

put a big gap between the positions of the two parties. On top of that,

the employer has a lot of demands regarding job transfers and mobility

issues.

There are many people who are retiring in the plant.

The plant opened in 1986 and almost all of us were hired at the

same time between 1986 and 1990. That's when the hiring boom

at ABI happened. Now we are at a point where everyone is retiring.

Since 2012, our last contract, there have been almost 400

hires to replace those who retired, and there will be almost 400

more in the next four to five years. Virtually the entire plant is

going to

be filled with new people within 10 years.

The employer's demand is to maintain the current regime

for those who are currently employed, and to introduce a member-funded

pension plan (MFPP) scheme for new hires. We are opposed to having two

pension plans for our workers.

Our current plan is a defined benefit plan. The other

is an MFPP, and in the employer's offer there are no details about the

terms of the plan. All the employer says is that they would contribute

to the plan and the rest would be built as we go, for example, what

would be the workers' contribution, what would be the retirement age,

and so on.

What we do know, however, is that with the MFPP plan, the worker

assumes the risk. In our defined benefit plan, if there is not enough

money in the plan, it is the employer who has to make up the

difference. In the MFPP it

is the workers who have to do so and bear the risk. The only obligation

of the employer is to pay their contribution,

which

is

fixed. This is how an MFPP is defined by law.

The employer also has a lot of demands on job transfers

and mobility issues. We do not want to go there because they want to

attack our working conditions. In the proposal they made to us and

which was rejected massively by our members, there is no respect for

seniority. They want to be able to hire people directly to fill

vacancies.

They

want to freeze people for four years in the specific jobs they are

doing, with workers not being able to apply for and get other positions

in the plant when there are vacancies.

So we are stuck on the issues of the pension plan and

job transfers.

WF: How does the union argue

against these two demands from ABI owners?

CM: As a matter of principle, we do

not agree that there should be two regimes for workers. In our view,

everyone belongs to the same regime and we are moving forward together.

We have always fought against two-tier conditions. The same thing

applies to working conditions. We have provisions whereby when there is

a vacancy the employer is obliged to post the position internally. If

the position is not filled it has to go into hiring and the person who

is hired is part of the union and works on the same terms as everyone

else. Someone who is hired and does the same job as another worker

makes the same wage. We have been fighting all the time so that working

people have the same conditions. In 2004 when we went on strike, it was

for that too.

We have explained to our members the danger of having

two pension plans in our agreement. It would divide us. What would we

do if in four years, the 400 new people have a different pension

fund? In the membership meetings, there would be conflicts between the

workers. It is between workers that disputes are going to take

place. The 400 new hires will say that we abandoned them when

we signed a new contract.

WF: The workers overwhelmingly

rejected ABI's offer on these two issues.

CM: The workers rejected the

employer's offer and gave a 97 per cent strike mandate and the

participation rate was 90 per cent. The room was packed. There

were a lot of young people, a lot of new workers. The largest unit,

the production unit, which includes about 950 workers,

voted 98 per cent against the offer

and for the strike mandate.

There has never been a membership meeting with so many

people in the life of the union at ABI. I've been working here

for 30 years and I've never seen anything like it.

Canadians Demand a New Direction to Guarantee Defined

Pensions for All

- K.C. Adams -

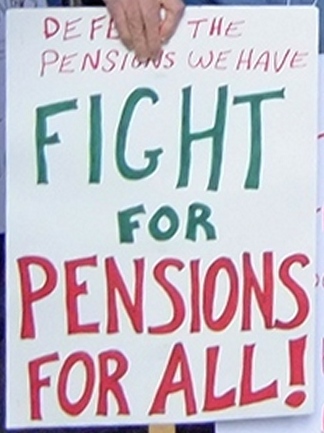

Join the working class in organized

actions to defend the pensions

we have

and fight for defined pensions for all!

Canadian pensions are under attack. The ruling

imperialist elite have launched a broad campaign to reduce the amount

of the new value workers produce that goes towards pensions. The

transfer of social wealth

from workers' pensions and benefits to private coffers of the rich in

the last 30 years is unprecedented, reversing the pension

guarantees the working class won in battles following World War II.

The working class is

resisting the assault on the pensions it now has and fighting for the

right of all to a guaranteed retirement at a Canadian standard.

Campaigns are underway to expose and denounce the attack on pensions

and the parasitism and corruption of contracting out pension

administration and investment of workers' savings to third

parties with close connections to the ruling imperialist elite. The working class is

resisting the assault on the pensions it now has and fighting for the

right of all to a guaranteed retirement at a Canadian standard.

Campaigns are underway to expose and denounce the attack on pensions

and the parasitism and corruption of contracting out pension

administration and investment of workers' savings to third

parties with close connections to the ruling imperialist elite.

Organizations have come together to denounce and stop

the Trudeau/Morneau Liberal Bill C-27 that undermines public sector

defined benefit pensions and replaces them with savings funds with no

guaranteed pension benefits. Canadians are further incensed at the

blatant hypocrisy and corruption of Liberal Finance Minister Bill

Morneau

leading the assault on federal public sector and Crown corporation

pensions, such as at Canada Post. The company owned by the Morneau

family, Morneau Shepell, will directly profit from user fees to

administer the

so-called pension savings funds that will replace the defined benefit

pensions. Active and retired members of the Canadian Union of Postal

Workers,

the National Organization of Retired Postal Workers, and others in the

Public Service Alliance of Canada and their allies across the country

are determined to stop Liberal Bill C-27 and defeat this attack on

federally-administered defined benefit pensions.

Other organizations of the working class have united to

demand immediate changes in bankruptcy legislation, specifically the Companies' Creditors

Arrangement Act (CCAA) for large companies. The

present arrangement allows a form of legalized theft of what belongs to

workers by right in pension benefits and other promised

post-employment benefits.

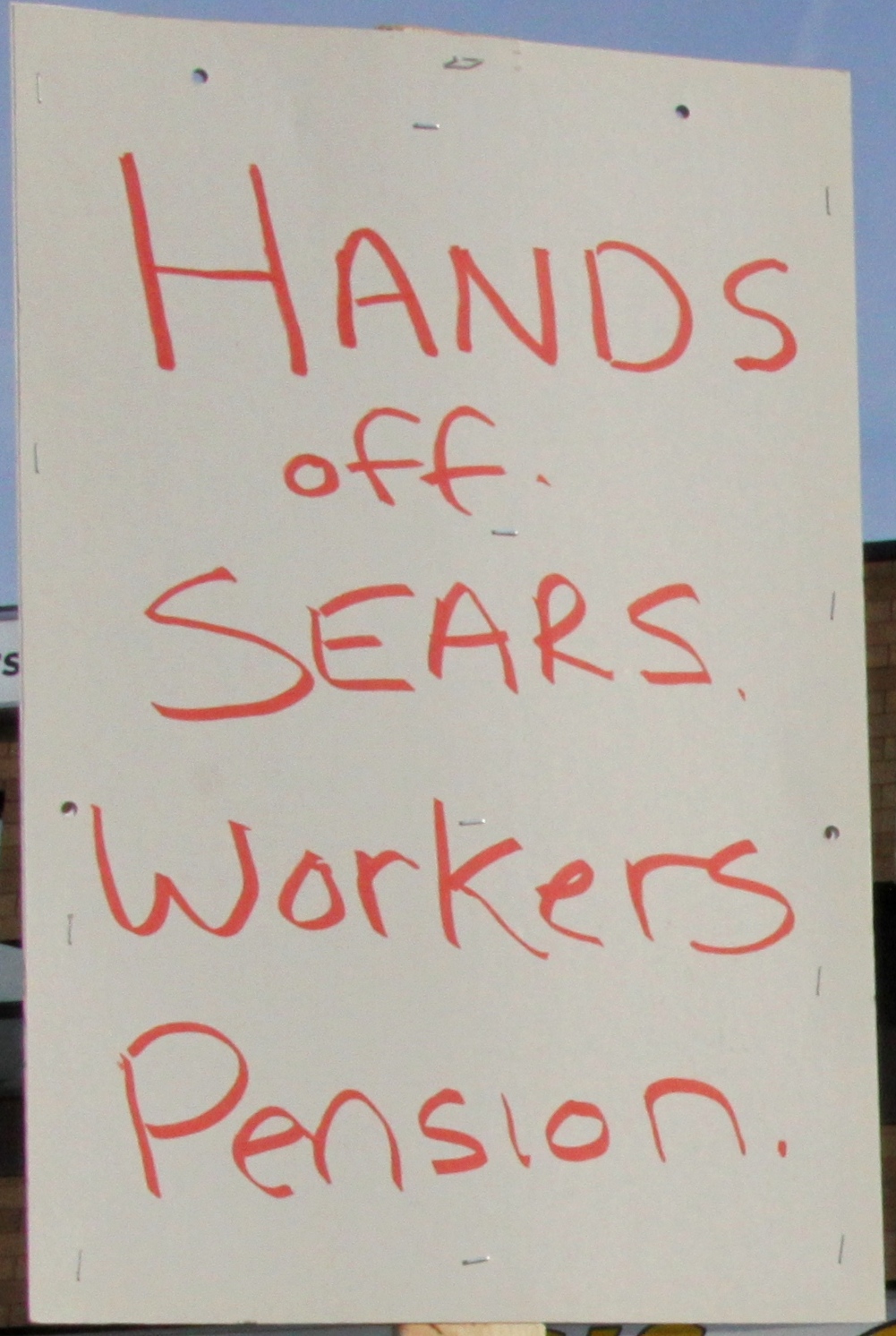

A recently released study

from the Canadian Centre for Policy Alternatives (CCPA) shows that

companies, such as the recently bankrupt Sears, can deliberately

degrade their defined benefit pension funds, transfer that money to

directors and shareholders instead, and then declare CCAA bankruptcy

and legally evade responsibility to make the

pension funds whole and capable of meeting the promised defined

benefits. A current NDP Member of Parliament and former Stelco

steelworker

from Hamilton, Scott Duvall, with the support and encouragement of the

working class has introduced a private member's bill to stop this

criminal practice of large companies, while the Trudeau Liberal

majority government and Conservative opposition do not support the bill. A recently released study

from the Canadian Centre for Policy Alternatives (CCPA) shows that

companies, such as the recently bankrupt Sears, can deliberately

degrade their defined benefit pension funds, transfer that money to

directors and shareholders instead, and then declare CCAA bankruptcy

and legally evade responsibility to make the

pension funds whole and capable of meeting the promised defined

benefits. A current NDP Member of Parliament and former Stelco

steelworker

from Hamilton, Scott Duvall, with the support and encouragement of the

working class has introduced a private member's bill to stop this

criminal practice of large companies, while the Trudeau Liberal

majority government and Conservative opposition do not support the bill.

CCPA Study: The Lion's Share -- Pension Deficits

and Shareholder Payments Among Canada's Largest Companies

Along with the Trudeau Liberal attack on

public sector pensions, the CCPA study reveals a trend has become

entrenched amongst large companies to eliminate defined benefit

pensions for new employees. Defined benefit (DB) pensions were designed

to guarantee pension benefits at a certain level. Their introduction

was a step towards

guaranteeing the right of all to a Canadian standard of living in

retirement. Before defined pension benefits came into being along with

the still inadequate Canada and Quebec Pension Plan, Canadian workers

had to rely on savings during retirement, which is a recipe for

poverty. The elimination of DB pensions and other post-employment

benefits

is a backward step to reliance on savings resulting in greater

impoverishment of seniors.

The CCPA study shows a steady decline in DB pensions,

which are being replaced with various forms of savings plans without

any guarantee of benefits in retirement. This trend is accompanied with

the companies involved no longer administering pensions as a

responsibility but rather contracting out the service to companies such

as Morneau

Shepell that charge a user fee, which comes directly from the pension

savings.

The CCPA investigation found that the employees of

only 39 of Canada's 60 largest companies traded on the stock

exchanges still have DB pensions. Those companies controlled $174

billion in DB pension assets in 2016. The combined private sector

pension assets in all of Canada's registered pension plans including

DB plans and all retirement savings plans such as company defined

contribution plans and RRSPs amounted to $537.39 billion

in 2016.

The DB funds can fall into a deficit if not replenished

with current revenue. DB plans promise a certain pension benefit and

must have enough money currently coming directly from the company's

accounts (balance sheet) or from the fund itself to cover all expected

pension benefits. If the company declares CCAA bankruptcy as in the

case of

Nortel, Sears and others, or the DB plan is taken off the balance sheet

through CCAA such as at Stelco, or wound up for whatever reason, then

the existing assets in the DB fund must be enough to maintain the

promised pension benefits until all members of the plan pass away.

Having enough money in the pension fund is never the case since a

company planning bankruptcy or to take the DB pension plan off the

balance sheet or wind it up wants to use an existing pension fund

deficit as one of the excuses for doing so and use available revenue

for other purposes. The companies usually stop putting enough revenue

in the fund well before the collapse. The revenue instead goes into the

pockets of those who own and control the company.

The CCPA study found that the DB pension funds of

the 39 largest companies held an aggregate deficit of $10.8

billion in 2016 up from a $6.6 billion shortfall

in 2015. Instead of putting cash in the pension funds in 2016

to make them whole or at least stop the deficit from becoming worse,

those

companies collectively decided to use available revenue their workers

produced to pay executives and directors their huge claims and to give

shareholders $46.9 billion.

Over the past six years those 39 DB pension funds

have consistently been in deficit yet those in control paid shareholder

dividends at an increasing combined amount from $31.9 billion

in 2011 to $46.9 billion in 2016. Those 39

companies directed four times the amount of revenue towards

shareholders

than the amount needed to fully fund their DB pension plans. The study

shows that 25 of those DB plans could have been fully funded with

less than one year's worth of payouts to shareholders. The shortfall

in 18 of those DB plans could be fully funded now with

just 13 per cent of what was paid to shareholders over the entire

six years.

The study reveals what it

calls a "curious" situation in that the DB pension plans in the worst

shape with less than 80 per cent of the necessary funds to

maintain benefits in the event of a fund windup could be fully funded

with only 6 per cent of the shareholder payments since 2012. The study reveals what it

calls a "curious" situation in that the DB pension plans in the worst

shape with less than 80 per cent of the necessary funds to

maintain benefits in the event of a fund windup could be fully funded

with only 6 per cent of the shareholder payments since 2012.

The CCPA study writes, "[Federal and provincial DB plan

regulations] purposely ignored what employers were doing with corporate

earnings, as long as the required minimum required solvency payments

were being met. In other words, broader corporate decisions about

retained earnings are treated as a 'black box' for the purposes of

pension regulation. In certain instances, this could create a 'moral

hazard' in which firms had an incentive to direct cash flow to

shareholders and directors, leaving as little as possible in a plan

they could shed through eventual restructuring and insolvency."

(The "required payments" are routinely softened

such as with Ontario's "too big to fail" legislation allowing the

largest companies to delay their DB solvency payments. At Stelco, rules

were put in place upon the exit from CCAA in 2006 restricting

share dividend payments while the DB plan was in deficit but U.S.

Steel insisted this regulation be lifted, which the ruling elite

quickly agreed to do. -- WF Ed. note.)

Poisonous Deceit and Theft of Workers' Pensions

and Benefits

at Sears Canada Inc.

The CCPA study exposes the particular case of Sears

Canada, which shows the U.S. ownership taking value out of Canada while

letting the DB pension fund and the company itself badly deteriorate.

The CCPA study writes, "Canadian subsidiaries being

raided by American parents is an all-too-familiar story with Canadian

pensioners (not to mention suppliers and the courts) left to pick up

the pieces in bankruptcy. The recent news that Sears Canada will

shutter all remaining stores as a result of its insolvency leaves its

DB pension plan

with a $267 million funding shortfall on a wind-up basis.

"Since 2010, Sears Canada paid back $1.5

billion to shareholders in dividends and share buybacks. In other

words, Sears Canada paid back five-and-a-half times more to its

shareholders than it would have cost to entirely erase the deficit in

its DB pension plan.

"As Sears proceeds to liquidate its entire Canadian

operations, it will be Canadian retirees who are left to deal with that

decision."

Destruction of DB Pensions Means a Large Transfer

of Actual and Potential Value from the Working Class to the Not-Working

Class, Those Who Own and Control the Socialized Economy

The CCPA investigation found that over the

past 30 years, the number of workers enrolled in DB plans has

declined from nearly 50 per cent of the workforce to one quarter

with many of the remaining workers with DB plans concentrated in the

public sector. Three million workers in the public sector are members

of DB

pension plans with another one million workers in the private sector.

Less than one in 10 workers in the private sector now has a DB

plan. The next target of the ruling imperialist elite not surprisingly

is the public sector. The federal Trudeau/Morneau Liberal government

has unleashed a direct attack on public sector and Crown corporation

DB plans with its Bill C-27, which workers are determined to stop.

Almost all new pension plans today in the private

sector are of the defined contribution (DC) savings plan variety where

the pension benefit payments upon retirement are uncertain to say the

least and can soon run out altogether. Many companies that still have

DB plans are restricting entry of new employees into them. Many workers

with

pension savings plans, when they fall into difficulties beyond their

control such as unemployment, injuries or serious illness, often cash

in their DC or other savings plans to make ends meet in the present

leaving themselves without any pension income beyond the wholly

inadequate Canada Pension Plan and Guaranteed Income Supplement.

The CCPA study writes, "The trend away from DB pensions

towards DC schemes is part of a wider redirection of corporate earnings

away from workers and towards shareholders. This process reflects a

change in corporate thinking over the past several decades that seeks

to better align executives' decision-making with shareholder interests,

at

the expense of other corporate constituencies like labour."

The attacks on DB pensions are a feature of the ongoing

class struggle between the working class and the not-working class,

those who own and control the basic sectors of the socialized economy

and state, over the aim and direction of the economy and how to use the

value workers produce. The CCPA study clearly shows that the problems

surrounding defined benefit pensions are not a result of lack of money

but one of aim and which social class has control over the economy and

state and the power to direct the value workers produce to serve its

aim.

For the working class, the struggle to defend and

broaden its claims on the value it produces forms part of its immediate

or tactical aim in the class struggle with the not-working class. The

long-term or strategic aim of the working class is to seize control of

the entire value it produces for distribution to meet and guarantee the

well-being and

security of all from birth to passing away, to ensure the uninterrupted

extended reproduction of the economy through harmonizing the existing

socialized means of production with socialized relations of production,

and to provide the necessary value for the general interests of society

to open a path forward to the complete emancipation of the

working class and elimination of social classes.

The defence of the pensions workers have, and the fight

for defined pensions for all, form part of the tactical class struggle

to raise the standard of living of all with improved wages, benefits,

pensions and working conditions for all workers, to stop paying the

rich and for increased investments in social programs.

How to wage this class struggle successfully is a

matter of learning warfare through warfare, through organizing the

practical politics of the working class and mobilizing workers to

engage in actions with analysis in defence of their rights and claims

on the actual and potential value they produce. An important feature of

the tactical aim of the

working class to defend its rights in the here and now is to organize

and strengthen its independent institutions, politics and voice. Join

the independent institutions and organized class struggle of the

working class for its tactical and strategic aims!

Workers' Forum is a voice for the working class

to advance its tactical and strategic aims. Read, discuss, write for

and distribute Workers' Forum.

(To read CCPA's complete report on pensions click here.)

PREVIOUS

ISSUES | HOME

Website: www.cpcml.ca

Email: office@cpcml.ca

|