|

September 18, 2017

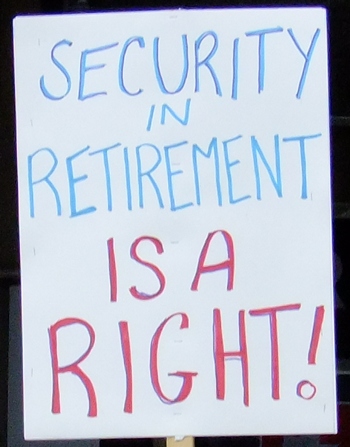

Fight for Security in Retirement!

Defined Benefit Pensions for All!

Canada's Pension Regime

Needs a New Direction to

Guarantee the Rights of All

PDF

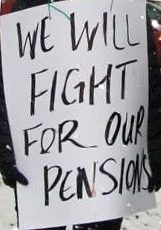

Demonstrate

to

Protect

Your

Pensions

|

|

Fight

for

Security

in

Retirement!

• Defined Benefit Pensions for All! Canada's

Pension Regime

Needs a New Direction to Guarantee the Rights of All -

K.C. Adams

• Take Action to Stop Anti-Pension Bill C-27!

- Louis Lang

• Finance Minister's Conflict of Interest with

His Target Benefit Plan

- Ottawa Committee for Pension Security

• Bill C-27 -- An Attack on Workers' Pensions

- Ottawa Committee

for Pension Security

Fight for Security in Retirement!

Defined Benefit Pensions for All!

Canada's Pension

Regime Needs a New Direction to Guarantee the Rights of All

- K.C. Adams -

Those who employ workers either privately or through

the state

machine are not acting responsibly with regards to ensuring equilibrium

in the social relation between the working

class and employers. Workers must have peace of mind that their needs,

well-being and standard of living will be sustained throughout their

lives from birth to passing away under all

circumstances.

The actions of the ruling

elite are leading the working class to

believe that those in control of the means of production and the state

do

not want equilibrium in the social relation. The use

of the state police powers of the Companies'

Creditors

Arrangement

Act

(CCAA) and changes in legislation to attack the

defined pensions of

workers, including federal and other public

sector workers, and the refusal of the government to strengthen the

Canada and Quebec Pension Plans to guarantee defined pension benefits

for all are stark evidence of the refusal to

uphold rights and ensure equilibrium in the social relation. The actions of the ruling

elite are leading the working class to

believe that those in control of the means of production and the state

do

not want equilibrium in the social relation. The use

of the state police powers of the Companies'

Creditors

Arrangement

Act

(CCAA) and changes in legislation to attack the

defined pensions of

workers, including federal and other public

sector workers, and the refusal of the government to strengthen the

Canada and Quebec Pension Plans to guarantee defined pension benefits

for all are stark evidence of the refusal to

uphold rights and ensure equilibrium in the social relation.

Defined pension benefits that guarantee a cultured

standard of

living until passing away are a necessary component of modern life. The

attacks of the ruling elite on defined benefit

pensions and their refusal to extend them to all is a major factor

causing disequilibrium in society. Workers want equilibrium in the

social relation with employers but the other pole in the

dialectic needs to come to their senses and recognize the rights of the

working class as inviolable, including importantly defined benefit

pensions for all.

If the ruling elite refuse equilibrium in the social

relation based

on the recognition of the rights of all, including the right to defined

benefit pensions for all, they prove themselves unfit

to rule. Within a condition of disequilibrium and refusal of the ruling

elite to extend defined benefit pensions to all and even attack those

that exist, a new direction is required that deprives

the ruling elite of their power to deprive the people of their rights,

a new direction that opens a path forward to modern relations of

production within a nation-building project that vests

sovereignty in the people and guarantees their rights without exception.

Take Action to Stop Anti-Pension Bill C-27!

- Louis Lang -

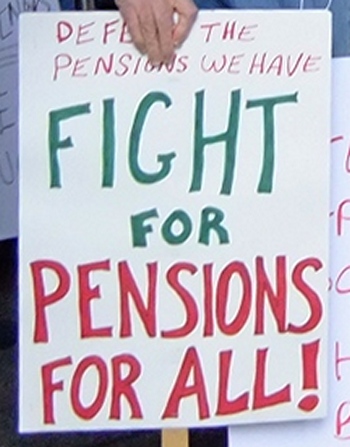

Protest in Ottawa against Bill C-27, May 5, 2017.

The Ottawa Committee for Pension Security has issued a

call for Canadians to demonstrate against Bill C-27, the Liberal

government's anti-pension legislation. The demonstration in Ottawa will

be held on September 18, at the office of Finance Minister Bill

Morneau, while another will take place the same day at his Toronto

constituency office. The Committee's call to demonstrate continues the

determined struggle of public sector workers and their allies to defend

the pensions they have and demand Canadian standard defined benefit

pensions for all.

The demonstrations at

Minister Morneau's offices on September 18

coincide with the reconvening of the House of Commons. The people

demand the withdrawal of the Liberal

anti-pension bill. The Liberal plan to eliminate public sector defined

benefit pensions will result in the loss of secured pension

benefits. The proposed target-benefit pensions (TB plans) will

increase the amount workers are forced to put into pension savings,

directly lowering their disposable wages. TB plans, which are similar

to the defined contribution plans currently the rage

amongst private corporations, lessen the amount those corporations put

into their workers' pension plans thereby raising their profits, a

factor widening the gap in social wealth between the

working class and the imperialist empire-builders.

The Ottawa Committee for Pension Security also

highlights the clear

conflict of interest concerning Finance Minister Morneau. It points to

the high level of private profits that will

flow from the proposed TB plans to pension consulting and management

firms such as his family-owned Morneau Shepell Company. Those companies

are hired to implement the TB plans as workers' pension plans and gain

from the destruction of defined benefit pensions.

Bill C-27, An Act to

amend the Pension Benefits Standards Act,

1985, was introduced in the House of Commons by Minister Morneau

on

October 19, 2016. The bill creates a

"framework for the establishment, administration and supervision of

target-benefit plans" for federally regulated workers in the private

sector, as well as Crown Corporations. Currently,

there are over 300 defined benefit plans in the federal sector

covering 489,000 workers with $100 billion in assets. Bill C-27, An Act to

amend the Pension Benefits Standards Act,

1985, was introduced in the House of Commons by Minister Morneau

on

October 19, 2016. The bill creates a

"framework for the establishment, administration and supervision of

target-benefit plans" for federally regulated workers in the private

sector, as well as Crown Corporations. Currently,

there are over 300 defined benefit plans in the federal sector

covering 489,000 workers with $100 billion in assets.

Bill C-27 would allow employers, such as Canada Post,

to undermine

the existing defined benefit plans and replace them with TB plans. This

would reduce the money employers

contribute to their employees' pension plans and eliminate their

obligation to maintain and provide a guaranteed level of benefits to

retirees. With TB plans, employers' legal requirement to fund, maintain

and guarantee pension plan benefits is

removed.

The bill has been stalled at first reading in the House

of Commons. Since this spring retirees and unions in the public and

private sector

have actively organized to stop the government's

attacks. Still, the government has ignored the demands of workers, has

refused to withdraw the bill, and is waiting for an opportunity to move

it into second reading and push it through

Parliament. Organized workers are just as determined to stop this

attack on their right to a secure retirement. Join with them in their

resistance to these attacks on the right of Canadians to a

secure retirement! Attend the demonstrations September 18!

Conflict of Interest Complaint

The Ottawa Committee for Pension Security has announced

it intends

to lay a conflict of interest complaint with the Office of the Conflict

of Interest and Ethics Commissioner against

Finance Minister Morneau. The Committee will submit evidence to the

Commissioner, Mary Dawson, obtained through the Access to Information

Act showing, "Mr. Morneau still indirectly

owns 2,066,489 common shares in Morneau Shepell worth about $32 million

through a numbered company in Alberta. Morneau also holds another

42,186 common shares worth $474,000

in AGF Management Limited, an investment firm."

The Ottawa Committee for Pension Security finds

ridiculous Morneau's

suggestion that his

change from sole ownership of his Ontario and Alberta numbered

companies to joint ownership with his spouse

as the President and Director, somehow relieves him of any conflict of

interest. The Commissioner will be asked to rule on the matter.

Also, in 2012, Morneau Shepell acquired the Canadian

pension and

benefits administration practice of Mercer Canada, the actuarial firm

used by Canada Post. This Crown Corporation

has the largest federal defined benefit pension plan with 55,000 active

members and

37,000 retirees. Morneau's Bill C-27 is a direct attack on the postal

workers' defined benefit pension plan and their security in

retirement.

Liberal Bill C-27 Directly Targets Postal Workers

A key unresolved issue

during the last round of negotiations

between the Canadian Union of Postal Workers and Canada Post was the

demand of the corporation for the elimination of

the defined benefit plan to be replaced by a defined contribution plan

similar to

the Liberal's TB plan. Under instructions from the Trudeau cabinet, a

short 18-month contract was approved without

any changes to the defined benefit pension plan. Awaiting the Liberals'

legislative

changes, Canada Post abandoned their demands to eliminate the defined

benefit plan

for the time being in the face of the

sustained resistance of postal workers. A key unresolved issue

during the last round of negotiations

between the Canadian Union of Postal Workers and Canada Post was the

demand of the corporation for the elimination of

the defined benefit plan to be replaced by a defined contribution plan

similar to

the Liberal's TB plan. Under instructions from the Trudeau cabinet, a

short 18-month contract was approved without

any changes to the defined benefit pension plan. Awaiting the Liberals'

legislative

changes, Canada Post abandoned their demands to eliminate the defined

benefit plan

for the time being in the face of the

sustained resistance of postal workers.

Postal workers know that their pension plan is not safe

as the

police powers of the state are being mobilized to attack their defined

benefit

pension plan through Bill C-27. Negotiations for a new

collective agreement are to begin in November or soon thereafter. If

the Liberal government uses their majority to force Parliament to adopt

Bill C-27, the issue of pensions will be removed

from the negotiations. Workers will have no say in the kind of pensions

they have or need, as the police powers of Bill C-27 will replace

negotiations with a state dictate. The government

through Bill C-27 will direct Canada Post to unilaterally replace the

defined benefit plan with a TB plan. Morneau Shepell and other similar

parasites

will make windfall profits managing the

implementation of the TB plan. Canada Post will reduce the value it

contributes towards postal workers' retirement, and postal workers will

lose their defined pension benefits that will be

replaced with uncertain "targeted" benefits.

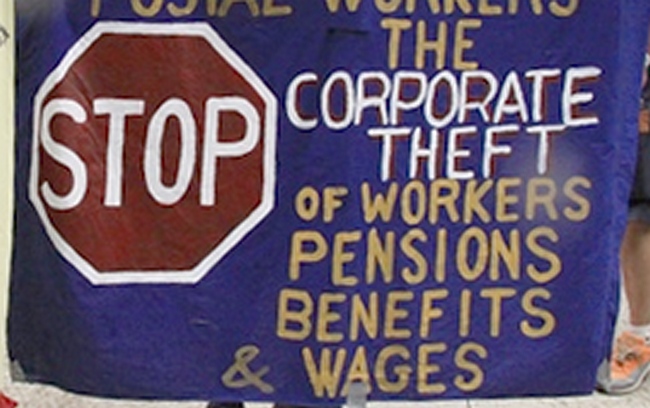

The working class cannot and will not allow these

attacks against

their pension security to pass. Workers are determined to stop this

assault on their rights by private corporate interests

and their flunky representatives in government and state-organized

enterprises. The theft of what belongs to workers by right must be

stopped! It is up to workers themselves to organize and

resist this attack on their rights!

The struggle to defend the defined benefit pensions

that workers

have now and extend Canadian standard defined pension benefits to

all is an important contribution to reversing the

retrogressive conditions the imperialist empire-builders are imposing

on workers and the entire society.

Defeat Anti-Pension Bill C-27!

Hands Off Our Pensions!

Defend the Defined Benefit Pensions We Have!

Fight for

Defined Benefit Pensions for All!

Governments Must Guarantee the Right of All to a Secure Defined

Benefit Pension

and Retirement at a Canadian Standard!

Finance Minister's Conflict of Interest with

His Target Benefit Plan

- Ottawa Committee for Pension Security -

The July 12 response from the Director of the

Access to

Information Privacy Division of the Department of Finance was as

follows: "In accordance with section 10(1)(a) of

the [Access to Information Act],

I

must

inform

you

that,

after

a thorough search, no records

exist in the department of Finance Canada concerning this request."

The request to the Commissioner, under section 25(2)

and

section

27(8)(1) of the Access to

Information Act was "has there been a public

declaration and divestment either by sale

taken place or that a trust exists by Finance Minister Bill Morneau for

the following:

"Insider trading reports at the last filing September

15th 2015

that Mr Morneau still indirectly owned 2,066,480 common shares in

Morneau Shepell worth about $32 million, through a

numbered company in Alberta. Morneau also held another 42,186 common

shares in AGF Management Limited, an investment firm, worth about

$474,000".

Public Registry on Morneau's Conflict of Interest

The following information was obtained from the public

registry of

The Office of the Information Commissioner from the Last Annual Review

completed on June 21, 2017 on Bill

Morneau Member of Parliament Toronto Centre:

"Morneau received income

from Morneau Shepell and from

AGF

Management as well as dividend and interest income from investments in

the last 12 months. Morneau reported he

will only receive dividend and interest income from investments for the

next 12 months. "Morneau received income

from Morneau Shepell and from

AGF

Management as well as dividend and interest income from investments in

the last 12 months. Morneau reported he

will only receive dividend and interest income from investments for the

next 12 months.

"Morneau reported joint ownership with 2070689 Ontario

Limited of

1193536 Alberta Limited, an investment holding company located in

Calgary, Alberta.

"Under the public declaration of agreed compliance

measures (section

29) in order to prevent a conflict of interest situation from arising

and to avoid the perception, Morneau reported

in 2016/02/14 the following: Assets promissory note from the Morneau

McCain family Trust Trusts I am a potential (actual). On the same date

he reported that this public declaration of

assts is no longer applicable "Sole ownership of 2070689 Ontario

Limited, a holding company located in Toronto, Ontario."

"Morneau reported his spouse was now the President and

Director of

the 2070689 Ontario Limited and of 1193536 Alberta Limited. He reported

for the last 12 months and for the next

12 months his spouse's income from 1193536 Alberta Limited as well as

dividend, interest and capital gains income from investments."

Morneau's Agreed Compliance Measures

"In order to prevent a conflict of interest situation

from arising

and to avoid the perception of preferential treatment, the Conflict of

Interest and Ethics Commissioner has determined

that a conflict of Interest screen is necessary to assist with my

obligation to abstain from any participation in any matters or

decisions, other than those of general application, relating to

Morneau Shepell Inc. or its subsidiaries, affiliates and associates.

"Accordingly, a conflict of interest screen has been

established

and will be administered by my Chief of Staff to ensure that I will

abstain from participation in any discussions or

decision-making process and any communication with government officials

in relation to any matter or issue forming part of the subject matter

of the conflict of interest screen."

Bill C-27 Target Benefit Plan Benefits Actuarial Firms!

Finance Minister Bill Morneau's firm Morneau Shepell

wrote in a

submission to the federal government that TB plans entail "excessive

operating costs" (which of course, flow to

firms like Morneau Shepell). These actuarial firms would be big winners

if Defined Benefit pension plans were converted to TB plans, which

require more frequent and complex services

from actuarial and pension consulting firms like Morneau Shepell.

A Further Indirect Conflict of Interest by Finance

Minister Bill Morneau!

In 2012 Morneau Shepell Inc. acquired the Canadian

pension and

benefits administration practice of Mercer Canada. The fact that Mercer

Canada is the actuarial firm used by Canada

Post which has the largest Crown Corporation pension plan (55,000

active members and 37,000 retirees) that would be affected by Bill

Morneau's Bill C-27 is a major problem. Morneau's

2012 acquisition of part of the Mercer Canada pension administration

practice in itself should be a conflict of interest when it comes to

his target benefit plan!

Glen McGregor of Postmedia was the first to

question Morneau's conflict of interest.

McGregor's Postmedia article published on October 28th

2015 stated,

"Morneau's situation recalls Paul Martin's continued ownership of a

multinational shipping company while

serving as Finance Minister." Under the Conflict of Interest Act,

Morneau

would be expected to either sell off his assets or place them in a

blind trust before joining the cabinet -- though the

latter option could raise the same concerns as Martin's arrangement

with CSL, which critics assailed as "a Venetian blind trust."

Morneau Shepell employs two lobbyists with Toronto

StrategyCorp to

lobby the government of Canada related to employee assistance

contracts, disability management, and pensions

for the federal public servants.

McGregor as well reported in February 2014, Morneau

resigned

suddenly as chair of the board of the C.D. Howe Institute after

criticizing the Harper government's economic record at

the Liberals national convention. It may be of interest to hear

Morneau's response now that the C.D.Howe Institute on April 4th 2017 is

calling for the Liberal government to have the

new proposed expanded portion of the CPP be a Target Benefit Plan as

opposed to having it the same as the existing CPP Defined Benefit Plan.

Bill C-27 "Target Benefit Plan"

Trudeau Must Stop the Attack on Defined Benefit Pension Plans and Live

up to His 2015 Pre-Election Promise!

On July 23, 2015, the Member of Parliament for Papineau

wrote, "As we

head into election 2015, I would like to reiterate my position [that]

any

changes to existing Defined Benefit

Pensions (DBPs) should be made on a going-forward basis. DBPs, which

have already been paid for by employees and pensioners, should not

retroactively be changed into TBPs."

Finance Minister Bill Morneau's Bill C-27 Target

Benefit Plan

is tainted with his past involvement with Morneau Shepell. Morneau's

"conflict of interest screens" (as opposed to the

Venetian blind trust of Paul Martin) that Morneau set up to be

administered by his Chief of Staff regarding Morneau Shepell does not

pass the smell test. Morneau's change from sole

ownership of his Toronto company and his Alberta numbered company to

joint

ownership with his spouse as the President and Director of these

numbered

companies is not all that reassuring that it

relieves the conflict of interest. Finance Minister Morneau's Bill C-27

Target Benefit Plan should not be adopted.

Bill C-27 -- An Attack on Workers' Pensions

- Ottawa Committee for Pension Security -

Finance Minister Bill

Morneau's Bill C-27 would allow

employers to

rob workers of the retirement security they have already bought and

paid for! The target benefit plan model

proposed in Bill C-27 would allow the elimination of the guarantee of

defined benefit pensions and cuts to your promised pension. This is

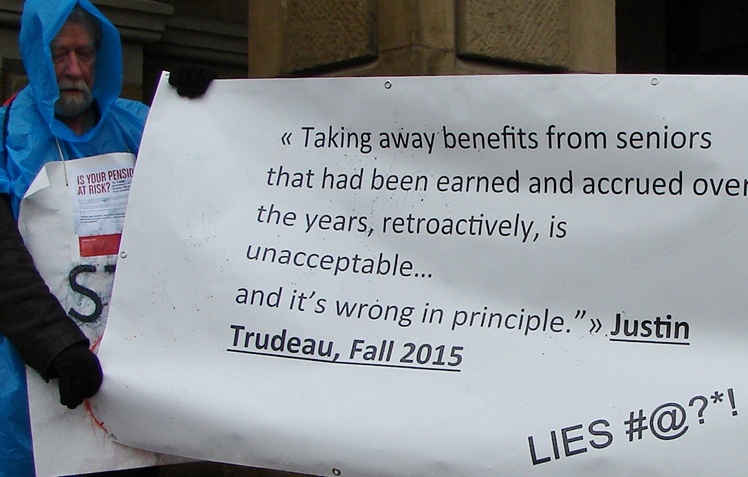

why, during the 2015 federal election campaign,

candidate Justin Trudeau formally condemned the Harper government

proposals to do the same thing: Finance Minister Bill

Morneau's Bill C-27 would allow

employers to

rob workers of the retirement security they have already bought and

paid for! The target benefit plan model

proposed in Bill C-27 would allow the elimination of the guarantee of

defined benefit pensions and cuts to your promised pension. This is

why, during the 2015 federal election campaign,

candidate Justin Trudeau formally condemned the Harper government

proposals to do the same thing:

"Taking away benefits

from seniors that had been earned and

accrued over the years, retroactively, is unacceptable...and it's wrong

in principle." -- Justin Trudeau pre-election

interview, Fall 2015

Meanwhile, the unnecessary additional administrative

oversight the bill would create will translate into a financial

windfall for pension

consulting firms like Morneau Shepell -- Minister

Morneau's family company. This is an obvious and outrageous conflict of

interest and attack on long-established workers' pension rights. Even

the Globe and Mail has

pointed out the

money to be made by the Morneau consultants from the "more complex"

(and less secure) pension design proposed in Bill C-27:

"Investors looking to

capitalize on growing work

force needs

and a changing pension landscape are snapping up shares of human

resources consultant Morneau Shepell

Inc.... Continuing pension reforms across Canada are poised to benefit

the company; as pensions get more complex, more companies are relying

on providers such as Morneau to design,

develop and administer the plans." -- Globe and Mail, June 3, 2014

In fact, some journalists have already asked whether

Morneau's

conflict of interest would force him to "step aside" from cabinet

decisions involving pension regulation:

" Bill Morneau,

touted for Trudeau cabinet

post, moving to nix potential conflicts from his corporate holdings

"... the size

of his company and its business

dealings with

the federal government could force Morneau to step aside from the wide

range of cabinet decisions on issues affecting

Morneau Shepell, such as pension regulation, insurance and taxation."

-- Glen McGregor,

Postmedia News I, October 28, 2015

None of this stopped Morneau from introducing Bill

C-27, a measure

that would not only undercut the security of existing defined benefit

pensions of federal jurisdiction workers but it

does so in a way that will clearly benefit his own family company.

There is still time to stop Bill C-27! Join the Ottawa

Committee

for Pension Security to defend pensions over profits on Monday,

September 18th at noon at 90 Elgin Street, Minister

Morneau's office, the headquarters of Bill C-27. Retirees, union

activists, and rank and file workers will be there to demand the

withdrawal of this Bill, and its replacement with improved

pensions and retirement security for everyone.

Follow us on Facebook for

further updates and clips of our recent actions at the Prime

Minister's Office and our Townhall.

PREVIOUS

ISSUES | HOME

Website: www.cpcml.ca

Email: office@cpcml.ca

|