|

Supplement No. 16May 9, 2020 |

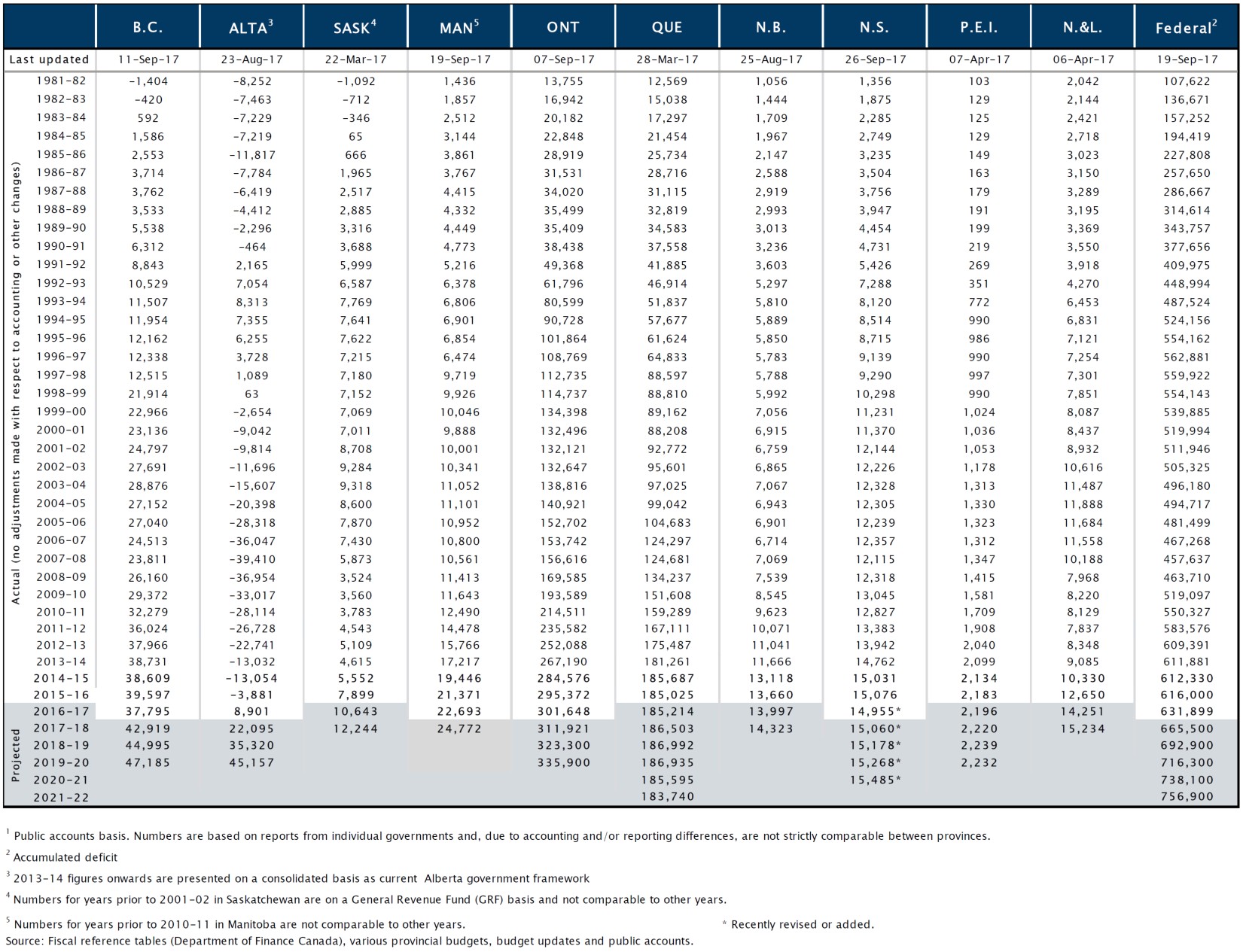

| Province/ Territory |

Net Debt 2007/08 | Net Debt 2019/20 | Change ($ billions) | Change (%) |

| BC | 23.9 | 44.5 | 20.6 | 86.3% |

| AB | (35.0) | 36.6 | 71.7 | 204.5% |

| SK | 5.9 | 12.0 | 6.1 | 104.2% |

| MB | 10.6 | 25.8 | 15.2 | 144.3% |

| ON | 160.0 | 353.7 | 193.7 | 121.0% |

| QC | 124.7 | 172.5 | 47.8 | 38.4% |

| NB | 7.1 | 13.8 | 6.8 | 95.6% |

| NS | 12.1 | 15.3 | 3.2 | 26.1% |

| PEI | 1.3 | 2.2 | 0.9 | 66.6% |

| NL | 10.2 | 14.0 | 3.8 | 36.9% |

| FED | 516.3 | 793.7 | 277.4 | 53.7% |

| FED+ PROV |

837.0 | 1,484.2 | 647.2 | 77.3% |

(Source: Annual Financial Report of the Government of Canada Fiscal Year 2018-2019)

Foreign Ownership of Government Debt

The global financial oligarchy owns the government debt of the countries within the U.S.-led imperialist system of states.

In 1960, four per cent of the Canadian government debt was held by foreign investors.

From 2009-2010 to 2013-2014, the amount of the debt held by foreign investors passed from 15 per cent to 27 per cent with a peak of 30 per cent in 2012-2013.

This compares with percentages of foreign investors from the global financial oligarchy holding debt in most of the G7 countries. In 2013-2014 foreign ownership of government debt was 64 per cent in France, 65 per cent in Germany, 48 per cent in the United States, 33 per cent in Italy, 29 per cent in the United Kingdom, and 8 per cent in Japan.

(Source: Wikipedia)

Statistics Canada on the Role of Government

in Canada's

Economy

The general government sector is an important component of Canada's economy, representing roughly one quarter of economic activity. In 2009 it accounted for $345 billion of final consumption expenditure and $72 billion of gross fixed capital formation expenditure, together comprising 26.6 per cent of gross domestic product. In that same year average employment in educational services, health care, social assistance and public administration was 3,792,968 persons, equivalent to 26.0 per cent of total employment.

(User Guide: Canadian System of Macroeconomic Accounts)

Service Charges Paid on Government Debt

Servicing charges paid on government debt held mostly by private institutional interests of the global financial oligarchy varies with the governments involved and the type of security.

Note: CGG stands for the consolidated Canadian general government (CGG), which combines the federal, provincial-territorial and local governments.

PTLG stands for the consolidated provincial territorial and local governments (PTLG).

In 2018, the CGG paid 7.4 cents in interest charges for every dollar of revenue received, down slightly from 7.5 cents in 2017. Interest expenses accrued on debt liabilities totalled $61.3 billion for the year. (Commonly called debt charges in government accounts.)

Despite an increase of 56.1 per cent in total liabilities since the 2008 financial crisis, the ratio of 7.4 cents per dollar of revenue is significantly down from 10.1 cents per dollar of revenue in 2008 due to historically low interest rates on the outstanding debt to the financial oligarchy.

The federal government paid 7.0 cents in interest for every dollar of revenue received in 2018, compared with 6.5 cents for PTLG. Quebec (9.9 cents), Manitoba (9.6 cents) and New Brunswick (7.1 cents) spent the most on interest per dollar of revenue in 2018.

(Source: Statistics Canada)

Banks of the Global Financial Oligarchy

The working class should not overestimate the importance of the banking system and related institutions, as the financial oligarchy invariably does. Almost all produced goods and services within the imperialist economy must be sold before they can be used. The necessity to circulate all goods and services in the imperialist commodity economy as exchange-value before being used means that currency and electronic services to realize commodities are important. This places a high degree of importance on the financial institutions, which in reality are not productive and require value from the productive sectors to operate. A new direction for the economy where goods and services are produced according to a plan, are used directly as produced and needed and do not have to circulate would eliminate much of the current role of currency and other means to realize goods and services.

Under imperialism the banks and other institutions of the financial oligarchy have extended their role into parasitic activities of the worst kind. These activities mostly deal with the re-division of already-produced value increasingly disconnected from the actual production and circulation of goods and services and should be viewed and denounced as criminal corruption.

The primary role of banks is to act as a repository of the value the working class has produced through work. From this role the banks can serve as a clearinghouse for the circulation and exchange of goods and services in cash, cheques and electronically. As a holder of value, they also have a role as lender of already-produced value to individuals and businesses.

Banks have long strayed from their primary role into speculation and other parasitic activities aided by governments through the proliferation of stock and commodity exchanges. Through an insider arrangement, the owners of the Toronto Stock Exchange some time ago were given the exclusive right to handle the sale of government securities greatly expanding their cartel now called TMX Group.

Banks have been accorded the right to create money by lending in practice far more than they hold in deposits. The creation of money should be a public activity controlled exclusively by government, which should be completely transparent and for which the public authorities in charge are fully accountable. The creation of money through the private banks of the financial oligarchy is a practice that serves the narrow private interests of the rich and goes against the broad public interests of working people. The ruling elite have even put a target of creating yearly price inflation of at least 2 per cent for goods and services so that the price the working class receives for selling its capacity to work is constantly under downward pressure and workers are forced to play catch-up to maintain their standard of living.

The working class should demand that all special rights accorded banks through legal regulations and charters be rescinded and that governments at all levels sever their relations with the private financial institutions. This includes the severing of any relation with private lenders and institutions with regard to government borrowing. Governments should borrow from themselves when necessary without any connection whatsoever with the private institutions of the financial oligarchy. The repayment of government debt to itself should be based on the working class creating new value from its work within the Canadian economy. Public government borrowing must be completely transparent and justified and for which the public authorities are accountable.

All servicing of outstanding government debt must cease immediately. A public investigation should be conducted as to the legitimacy of the public debt, why and for what purpose governments sold securities to private institutions of the financial oligarchy, and how much has already been repaid in debt charges. The inquiry should decide how much of the principal should be paid. Absolutely no new interest should be paid under any circumstances for existing debt and absolutely no new securities should be sold to the private institutions of the financial oligarchy.

Public service banks should be formed that serve their primary role as repositories of value, clearinghouses for the circulation of goods and services and to lend money to individuals and businesses. The working class and its collectives should withdraw their savings from all private institutions of the financial oligarchy and deal only with public banks or those financial institutions that the working class may organize itself.

Banks should be viewed as providing a public service to the economy and people over which the people must exercise control and demand accountability. The working class provides banks with value as money through their individual savings and checking accounts and in other collective ways such as pension funds. The demand that banks operate in an open and aboveboard manner free of corrupt practices can be accomplished if workers themselves exercise control over their savings and financial institutions and public banks are created and forced to be transparent and accountable for their actions.

Discussion should begin on how to mobilize the savings and pensions of the working class to serve the interests of working people and society and not the narrow private interests of the financial oligarchy. Discussion and actions on the front of banking forms part of the movement for a new pro-social direction for the economy outside and in opposition to the control of the financial oligarchy.

For Your Information

How the Bank of Canada Creates Money for the Federal Government: Operational and Legal Aspects

Note that for the purpose of this publication, "money" means bank deposits. For the complete document click here.

This paper explores the operational and legal aspects of how, by buying newly issued federal government bonds and treasury bills, the Bank of Canada creates money for the federal government. Information about how private commercial banks create money is also provided.

In its 2011 Budget, the Government of Canada announced its intention to borrow $35 billion over the next three years in order to increase its deposits with financial institutions and the Bank of Canada by about $25 billion and to increase liquid foreign exchange reserves by US$10 billion. The intention was to ensure sufficient liquid assets to cover at least one month of the federal government's net projected cash flows, including interest payments and debt refinancing needs.

In response, the Bank of Canada announced its intention to increase from 15% to 20% its minimum purchases of federal government bonds. The Bank of Canada's purchase of federal government bonds is a means by which the Bank creates money for the Government of Canada.

The Bank of Canada helps the Government of Canada to borrow money by holding auctions throughout the year at which new federal securities (bonds and treasury bills) are sold to government securities distributors, such as banks, brokers and investment dealers.

(Typically, private interests purchase 80% of the newly issued bonds and treasury bills) while the Bank of Canada itself purchases 20% of newly issued bonds and a sufficient amount of treasury bills to meet the Bank's needs at the time of each auction. These (Bank) purchases are made on a non-competitive basis, meaning that the Bank of Canada does not compete with the distributors at auctions. Rather, it is allotted a specific amount of securities to buy at each auction.

The Bank of Canada's purchase of government securities at auction means that the Bank records the value of the securities as a new asset on its balance sheet. The Bank simultaneously records the proceeds of (the government's) sale of the securities as a deposit in the Government of Canada's account at the Bank, (which becomes) a liability on the Bank's balance sheet.

No paper evidence of a bond, treasury bill or cash is

exchanged between the Government of Canada and the Bank of Canada

in these transactions. Rather, the transactions consist entirely

of digital accounting entries.

Since the Bank of Canada is a Crown corporation wholly

owned by the federal government, the Bank's purchase of newly

issued securities from the federal government can be considered

an internal transaction. [This contrasts with the U.S. Federal

Reserve, which acts as the Central Bank but is owned by a cartel

of big private banks. TML Ed.]

By recording new and equal amounts on the asset and liability sides of its balance sheet, the Bank of Canada creates money through a few keystrokes. The federal government can spend the newly created bank deposits in the Canadian economy if it wishes.

The Bank of Canada's creation of money for the federal government is achieved through de facto loans from the Bank to the government.

The Bank of Canada Act gives the Bank the power to "buy and sell securities issued or guaranteed by Canada or any province" as well as the power to "accept deposits from the Government of Canada and pay interest on those deposits."

Those two provisions empower the Bank to create money through the direct purchase of Government of Canada securities at debt auctions.

Private Commercial Banks Also Create Money

Private commercial banks also create money when they purchase newly issued government securities as primary dealers at auctions. (They do so) by making digital accounting entries on their own balance sheets. The asset side is augmented to reflect the purchase of new securities, and the liability side is augmented to reflect a new deposit in the federal government's account with the (private) bank.

(Also) every time (private) banks extend a new loan, such as a home mortgage or a business loan (they create money). Whenever a bank makes a loan (to a business or individual), it simultaneously creates a matching deposit in the borrower's bank account, thereby creating new money. Most of the money in the economy is, in fact, created within the private banking system.

A key similarity between money creation in the private banking system and money creation by the Bank of Canada is that both are realized through loans to the Government of Canada and, in the case of private banks, loans to the general public.

One difference between the two types of money creation is that there is no external limit to the total amount of money that the Bank of Canada may create for the federal government. The amount of money that a private commercial bank is permitted to create depends on the amount of the bank's equity relative to its assets, which is set by the banking regulator in guidelines.

Another difference is that the creditworthiness of the borrower is the key factor in the decision by a private commercial bank to provide a loan to a private entity, while this is not a factor in the Bank of Canada's decision to lend money to the government.

Both private commercial banks and the Bank of Canada create money by extending loans to the Government of Canada and, in the case of private commercial banks, (also by) lending to the general public.

The Bank of Canada's money creation for the Government of Canada is an internal government process. This means that external factors, such as financial markets dysfunction, cannot cause the federal government to run out of money.

Note: In managing its balance sheet, the Bank of Canada acquires Government of Canada securities to offset its liabilities, which consist mainly of bank notes in circulation and deposits. The Bank typically acquires a fixed percentage of the amount of nominal bonds being auctioned, with the amount of treasury bills purchased reflecting the Bank of Canada s balance sheet needs at the time of each auction. Generally, the Bank of Canada s holdings of financial assets are driven by its role in issuing bank notes. The issuance of bank notes creates a liability for the Bank, the largest on its balance sheet. Government of Canada deposits typically represent the second largest liability for the Bank.

(Source: Library of Parliament, 2015 (excerpts))

Government of Canada Securities

The federal government and those of Quebec and the provinces and territories use financial instruments to borrow money from the global financial oligarchy. Institutional investors of the global financial oligarchy purchase the available government securities. Retail or individual purchase of government savings bonds was discontinued in 2017. Even prior to eliminating savings retail bonds, they only represented less than one per cent of the purchased securities.

Technical Guide (Government of Canada Securities)

Excerpts from here

Fixed-Coupon Marketable Bonds

Effective October 1995 Government of Canada marketable bonds are issued in global certificate form only whereby a global certificate for the full amount of the bonds is issued in fully registered form in the name of CDS & Co., a nominee of the Canadian Depository for Securities Limited (CDS), (a division of a private cartel called TMX Group - Ed). The bonds must be purchased, transferred or sold, directly or indirectly, through a participant of the Debt Clearing Service, which is operated by CDS, and only in integral multiples of $1,000 (face value) . All Canadian-dollar marketable bonds are non-callable and pay a fixed rate of interest semi-annually.

Note: CDS Clearing and Depository Services Inc. (CDS) is a subsidiary of the Canadian Depository for Securities Limited, a for-profit corporation owned by the TMX Group. CDS owns and operates CDSX, implemented in 2003, which clears and settles eligible exchange-traded and over-the-counter equity, debt and money market transactions. CDS's depository service provides facilities to deposit and withdraw depository-eligible securities, manage related ledger positions, and use these positions for various business functions.

TMX Group claims assets of over $10 trillion. Found at https://www.tmx.com/tmx-group/tmx-group-companies

Domestic Nominal Bonds

(the "Bonds") are securities issued by the Government of Canada

pursuant to Part IV of the Canadian Financial Administration

Act ....

The Bonds constitute direct,

unsecured, and unconditional obligations of Her Majesty in right

of Canada ("Canada"). Payments of principal of and interest on

the Bonds are direct charges on, and payable out of the

Consolidated Revenue Fund of Canada. The Bonds rank pari passu in

all respects amongst themselves and with all other securities

issued by Canada and presently outstanding.

Interest

The Bonds shall accrue interest from the issuance date ("Issue") to the date immediately prior to the maturity date ("Maturity"), as specified in the Specific Terms, inclusively ....

Canada will redeem the Bonds

at par on Maturity. The Bonds are not redeemable prior to

Maturity.

Registration

The Bonds are registered only in the name of CDS & Co., as nominee of CDS Clearing and Depository Services Inc. ("CDS"), and are held by CDS in its record entry securities clearing and depository system. The Bonds are not represented by physical certificates but only by book entries in the records maintained by CDS. Interests in the Bonds held by participants in the CDS system (each, a CDS Participant ) are represented through book entries in accounts established and maintained by CDS for each such CDS Participant, in accordance with the practices, rules, and agreements of CDS. CDS Participants may in turn maintain on behalf of other persons accounts in which such persons interests in the Bonds may be recorded.

Canada may treat CDS &

Co. as the absolute owner of the Bonds for the purpose of

receiving payment and for all other purposes. No beneficial owner

of Bonds (each, a "Bondowner") will be shown on the records

maintained by CDS other than a Bondowner who is a CDS

Participant. The Bonds must be purchased, transferred, or sold

directly or indirectly by or through a CDS Participant and all

rights of Bondowners must be exercised through such CDS

Participant.

Treasury Bills

Effective November 1995 all new issues of Treasury bills are issued in global certificate form only whereby a global certificate for the full amount of the Treasury bill is issued in fully registered form in the name of CDS & Co., a nominee of the CDS. Treasury bills must be purchased, transferred or sold, directly or indirectly, through a participant of the Debt Clearing Service, which is operated by CDS, and only in integral multiples of $1,000 (face value) ....

The Government of Canada also periodically issues cash management bills (CMBs). CMBs are Treasury bills with maturities of less than three months (they can be as short as one day) used as a source of short-term financing for the Government. CMB auctions can take place on any business day, typically for next-day delivery, but on some occasions for same-day delivery.

Treasury bills are priced at a discount. The return to the investor is the difference between the purchase price and the par value.

Government of Canada Real Return Bonds

Government of Canada real return bonds (RRBs) pay semi-annual interest based upon a real interest rate. Unlike standard fixed-coupon marketable bonds, interest payments on RRBs are adjusted for changes in the consumer price index (CPI). The CPI, for the purposes of RRBs, is the all-items CPI for Canada, not seasonally adjusted, published monthly by Statistics Canada ....

At maturity bondholders will receive, in addition to a coupon interest payment, a final payment equal to the sum of the principal amount and the inflation compensation accrued from the original issue date, i.e. final payment = principal + ((principal x reference CPI on Maturity / reference CPI on Issue) - principal).

These bonds must be purchased, transferred or sold, directly or indirectly, through a participant of the Debt Clearing Service and only in integral multiples of $1,000 (face value).

Canada Bills are

promissory notes denominated in US dollars and issued only in

book-entry form. They mature not more than 270 days from their

date of issue, and are discount obligations with a minimum order

size of US$1,000,000 and a minimum denomination of US$1,000.

Delivery and payment for Canada Bills occur in same-day funds

through JPMorgan Chase Bank New York.

Primary distribution of Canada Bills occurs through four dealers: CIBC Wood Gundy Inc., Credit Suisse First Boston Corporation, Goldman, Sachs & Co. and RBC Dominion Securities Inc. Rates on Canada Bills are posted daily for terms of one to six months. Canada Bills are issued for foreign exchange reserve funding purposes only.

Canada Notes

Canada Notes are promissory notes usually denominated in US dollars and available in book-entry form. They are issued in denominations of US$1,000 and integral multiples thereof. At present the aggregate principal amount outstanding issued under the program is limited to US$10.0 billion. Notes can be issued for terms of nine months or longer, and can be issued at a fixed or a floating rate.

The interest rate or interest rate formula, issue price, stated maturity, redemption or repayment provisions, and any other terms are established by the Government of Canada at the time of issuance of the notes and will be indicated in the Pricing Supplement. Delivery and payment for Canada Notes occur through the Citibank, N.A.

The Government may also sell notes to other dealers or directly to investors. Canada Notes are issued for foreign exchange reserve funding purposes only.

Cross-Currency Swaps

A cross-currency swap agreement is a contract in which one party borrows one currency from another party and simultaneously lends the same value, at current spot rates, of a second currency to that party. Cross-currency swaps of domestic obligations are a cost-effective alternative to foreign-currency-denominated bond issues as a means of meeting the Government's targets for longer-term foreign currency funding.

Official Government Information on the

Economic and Fiscal

Situation

Finance Canada Publications

- Budgets

- Financial Statistics:

information about the Bank of Canada rate, exchange rates, money

market yields, GoC bond yields, etc.

- Weekly Financial

Statistics: updated

weekly.

The following

links are to sites of organizations or other entities that are

not subject to the Official Languages Act. The material

found there is therefore in the language(s) used by the sites in

question.

Primary Distributors

- BMO Nesbitt Burns: Economic Research

- Canadian

Imperial Bank of Commerce: CIBC Economics and Strategy

-

Deutsche Bank: Research

- Merrill Lynch: Research

- Prudential: Dr. Ed

Yardeni's Economics Network

-

RBC Dominion Securities: Global Markets

- Royal Bank:

Economics

-

Scotiabank: Expert Research and Analysis

- TD Bank: TD Economics

Comment

How the Imperialists Misuse the Word "Capital"

The imperialists have debased the word "capital." Their aim is to make the parasitism and decay of the imperialist economy appear as normal and capable of producing new value without the working class. The impression is given that the imperialists can create new value or social wealth out of nothing without setting in motion the working class in productive work.

The fleecing of others of the already-produced value they possess or the re-division of already-produced value is presented as making money or creating new value. This glamorizes the parasitism of the stock market, other Ponzi schemes, gambling activities and the forcing up (or down) of the market prices of already-produced value such as oil or even land to suit narrow private interests.

The aim of the debasement of the language is to eliminate the

working class in the collective and individual consciousness as

the necessary human factor in the production of new value within

a relation with already-produced value and those who control

it.

The aim of the debasement of the language is to eliminate the

working class in the collective and individual consciousness as

the necessary human factor in the production of new value within

a relation with already-produced value and those who control

it.

The working class faces the issue of who controls the already-produced value with which it can produce new value. Under the imperialist system, the working class does not control the already-produced value and cannot enter into a relation with the value in a manner that suits working people and their families with an aim to meet their needs and that of society. At present, the working class enters into a social relation with an alien class or not-working class (financial oligarchy or imperialist class) that controls the already-produced value. This social relation is called capital.

The social relation capital is in crisis and needs to be replaced. The economic base of the social relation continually falls into crisis. Look at Alberta. For years, the imperialists in control of the already-produced value have said that the road to prosperity is for workers to produce more and more oil for shipment to the U.S. and beyond and this would secure their future. The result does not match the hype. Alberta is in crisis and workers face 25 per cent unemployment, businesses face bankruptcy and the people face the wrecking of social programs and public services. The imperialists in control refuse to admit that the direction and aim of the Alberta economy have to change.

The energy oligarchs cannot even control the market price of the precious natural resources the workers produce and are giving them away for a song to the U.S. imperialists. The response of those in control cannot be considered serious but only self-serving in the extreme. Firstly because they refuse to admit the imperialist system has failed and is in one crisis after another. They deny that the sellout of resources and their refusal to build a dynamic diverse pro-social Alberta economy are wrong and must be changed. What a joke to suggest the way out of the crisis is more of the same and endless handouts to the self-same energy oligarchs through buyouts of their failed projects such as the Keystone XL and Trans Mountain pipelines, and public payments to clean up the mess they have left behind such as orphaned wells.

The economic meaning of capital describes an unequal social

relation between those who control already produced value and the

working class, and that relation is in crisis and needs to be

overcome with a new relationship of working people directly with

already produced value.

Those who currently control already produced value are supposed to buy the capacity to work of the working class and put workers to work producing the new value the people and society need for their existence. The social relation in action can produce new value when workers are engaged in productive work but the working class has no control over how the new value is used and the relationship is in crisis and need of replacement. The aim of those in control for maximum profit is in contradiction with a modern socialized economy that needs cooperation and planning and an aim that favours the working people and social and natural environment not the narrow private interests of the few in control.

Already produced value, such as a factory, machine, oil or its representation in money, cannot produce new value on its own outside a social relation with the working class. For the working class to open a path to its emancipation it must seize control of the already produced value and enter into a new social relation with it without the interference and control of the not-working class (financial oligarchy or imperialist class).

Use of the Term "Capital"

The suggestion is not to use the term "capital" unless it specifically and clearly refers to the social relation between those who control already-produced value, the not-working class (financial oligarchy or imperialist class) and the working class, which sells its capacity to work to the not-working class in control of the already-produced value. Otherwise, as in most cases, the terms value, wealth, money, social wealth, means of production should be used.

Note

The term stock market "capitalization" is meant to give the impression that money or "capital" invested in the stock market can produce new value when the stock price goes up outside of a direct social relation with the working class or even any direct relation with any means of production. Conversely, the impression is given that value is lost when the stock price, its market price or "capitalization," goes down.

Even the term human capital is bandied about without any thought as to what it means other than perhaps potential value of some sort under the control of the not-working class (financial oligarchy or imperialist class).

This misuse of the word capital debases thinking on pensions as well. The social value within pension and many mutual funds represent the savings of workers of value they have already produced. Instead of that social wealth being put to work in a social relation with workers to produce new value within the home economy, it is mostly invested in the stock market or sent abroad. When the stock price goes up, everyone congratulates the managers of the fund as somehow creating new value. But this hides the truth that the stock price going up does not mean that workers have produced new value corresponding to the higher stock price and the company owns that much more already produced value and the shares represent that new value.

When shares are purchased on the stock market, the money goes to the seller of the shares; it does not go to the company listed as being behind the stock. The only time the purchase of stock goes to the company directly for investment is through an initial public offering or when the company issues more stock.

When a company buys back stock and delists the amount of stock it purchases, the company in effect disinvests value or drains value from the company, sending it to the sellers of the shares thus reducing or weakening the amount of already-produced value at the company's disposal to enter into a social relation with the working class, possibly to produce new value.

(To access articles individually click on the black headline.)

Website: www.cpcml.ca Email: editor@cpcml.ca