|

May 18, 2017

Injured Workers Demand Canadian

Standard Compensation

"We Are Working on a Provincial Campaign

to Reform the Compensation System to Fulfill Its Mandate"

- Karl Crevar, Ontario Representative,

Canadian Injured Workers' Alliance -

PDF

All Out

for Ontario Injured Workers' Day June 1!

Justice

Bike

Ride

Rights for

All!

Thursday, May 25 -- Thursday, June 1

Starts in Ottawa and visits Cornwall, Brockville, Kingston,

Belleville, Cobourg, Oshawa, arriving in Toronto for Queen's Park Rally

For itinerary see

here

Vigil

Sleepless in

Queen's Park

Wednesday, May 31 -- 7:00 pm

Queen's Park, Toronto

Facebook

Rally & March

Workers'

Compensation Is a Right!

Thursday, June 1 -- 11:30 am - 1:00 pm

Queen's Park, Toronto

Facebook

Panel

Discussion

Fighting Back Against Toxic and Unsafe

Work

Thursday, June 1 -- 2:00 pm

OCAD Auditorium, 100 McCaul St. Room 190, Toronto

Facebook

Organized

by

Ontario

Network

of

Injured

Workers

Groups

|

|

Injured

Workers

Demand

Canadian

Standard

Compensation

• "We Are Working on a Provincial Campaign to

Reform the Compensation

System to Fulfill Its Mandate" - Karl Crevar, Ontario

Representative,

Canadian Injured Workers' Alliance

• "We Want to Restore Balance at WorkSafe New

Brunswick" - Patrick Colford, President, New Brunswick

Federation of Labour

Canadians'

Need

for

Their

Own

Steel

Industry

• New Class-Action Lawsuits Against U.S. Steel

• U.S. Steel Faces Historic Necessity for

Change - K.C. Adams

Consequences of Trade

War in Forestry Industry

• Resolute Forest Products Lays Off Workers

• Softwood Lumber Prices Rise Sharply in Canada

Injured Workers Demand Canadian Standard

Compensation

"We Are Working on a Provincial Campaign to

Reform the

Compensation System

to Fulfill Its Mandate"

- Karl Crevar, Ontario Representative,

Canadian Injured Workers' Alliance -

Workers' Forum:

What

are

the

main

issues

facing

injured

workers

at

this

time? Workers' Forum:

What

are

the

main

issues

facing

injured

workers

at

this

time?

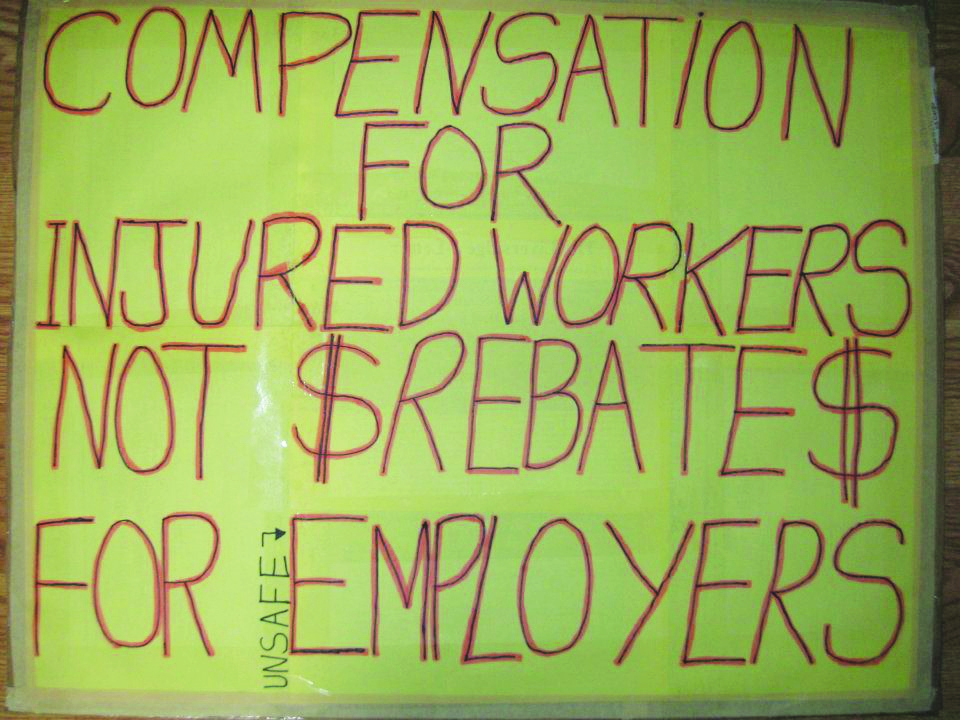

Karl Crevar: What we find in

our work is that there are common problems going on right across Canada

such as the treatment of pre-existing conditions. Some of the

legislation is also very similar. Even on the health and safety issues,

the numbers of workplace fatalities are similar and they are on the

rise.

We have a court case that is going on in regard to

Non-Economic Loss (NEL) awards. We went to court to see if workers can

proceed and the Supreme Court said yes, we can proceed. There are a

number of people whose NEL has been reduced because of existing

legislation on pre-existing conditions. A NEL award happens when you

have a permanent impairment. They were introduced to replace full

lifetime pensions back in 1990. Before that, if you had a permanent

impairment you could be awarded a lifetime pension. Now, if you have a

permanent impairment, you are only going to be assessed up to age

sixty-five. Pre-existing conditions considered in adjudicating claims

are being used widely all over the country to reduce injured workers'

benefits.

Then there is the issue of the workers' doctors. A

number of doctors came out publicly two years ago because their

decisions were being overturned by Ontario's Workplace Safety and

Insurance Board (WSIB). A number of complaints have been filed with the

Ontario

Ombudsman. Professional medical opinions are being overturned by

workers' compensation

boards across the country, which are using medical consultants to

override the opinion of the workers' physicians.

The Ontario Network of Injured Workers' Groups, of

which I am a member of the Board of Directors, also obtained intervenor

status in the Supreme Court of Canada in a case out of Quebec regarding

the human right of an injured worker to an accommodation with suitable

duties when the worker exercises their right to return to work. We

were part of that case because we are concerned that a Supreme Court

decision could have an impact not only in Quebec or Ontario but right

across Canada.

Generally what is happening

is a push for financial stability of the system. Compensation boards

are trying to get rid of their unfunded liabilities, particularly in

Ontario where for the last seven years there has been a strict focus on

unfunded liability. The government and the WSIB have developed policies

to more strongly enforce the issue of pre-existing conditions in order

to reduce NEL awards. What it has

actually done is increase the number of cases that are going to the

Workplace Safety and Insurance Appeals Tribunal. People are rejecting

the decisions of the Board and there are approximately four to five

thousand claims sitting or waiting to be adjudicated just in Ontario.

Workers have to wait anywhere from two to five years and I suspect that

the same thing is happening across Canada. The Ontario government and

the Board are addressing the issue of unfunded liability, but who is

paying for it? It is the injured workers. It is not true that the

system has to be 100 per cent funded in order to pay the cost of

the future claims if the Board and the government were willing to raise

the assessment rates, which they are not doing. In spite of the

increase

of cases that are being denied and going to the tribunal and the cuts

we have been seeing in the NEL because of pre-existing conditions, the

Board in Ontario reduced assessment rates for the

year 2017. Generally what is happening

is a push for financial stability of the system. Compensation boards

are trying to get rid of their unfunded liabilities, particularly in

Ontario where for the last seven years there has been a strict focus on

unfunded liability. The government and the WSIB have developed policies

to more strongly enforce the issue of pre-existing conditions in order

to reduce NEL awards. What it has

actually done is increase the number of cases that are going to the

Workplace Safety and Insurance Appeals Tribunal. People are rejecting

the decisions of the Board and there are approximately four to five

thousand claims sitting or waiting to be adjudicated just in Ontario.

Workers have to wait anywhere from two to five years and I suspect that

the same thing is happening across Canada. The Ontario government and

the Board are addressing the issue of unfunded liability, but who is

paying for it? It is the injured workers. It is not true that the

system has to be 100 per cent funded in order to pay the cost of

the future claims if the Board and the government were willing to raise

the assessment rates, which they are not doing. In spite of the

increase

of cases that are being denied and going to the tribunal and the cuts

we have been seeing in the NEL because of pre-existing conditions, the

Board in Ontario reduced assessment rates for the

year 2017.

As more and more workers' claims are being denied they

are forced to go to other social services such as social assistance.

Governments are downloading costs onto communities, onto the taxpayers,

which is not the way the workers' compensation legislation originally

was. The employers were to pay the assessments to fund the program, not

the taxpayers or the injured workers. We are raising this in the

communities, particularly with our Bike Ride that is going on from May

25 to June 1. We are opposing the downloading of the costs of the

compensation system from the employers onto the communities and the

taxpayers.

Another big issue of concern is the fact that there is

a trend, especially in the U.S., for employers to be able to opt out of

the compensation system. This has already happened in a few states in

the U.S. and this means that the employers are managing their

compensation, their injuries. This is self-regulation and it is an

alarming trend that we

are witnessing.

In Ontario, we are also working on a provincial

campaign, with our labour and community partners, to reform the

compensation system so that it fulfills its mandate as was set by the Workplace Safety and Insurance

Act. This is going to be a real challenge not only to the Board

but to

the next government.

Ontario elections are coming in 2018 and we want

this reform of the compensation system to be part of the platform of

the parties that are going to run to form the government. Poverty of

injured workers has gone up, family breakups have gone up, all these

things are on the rise. We are going to make these issues election

issues.

"We Want to Restore Balance at

WorkSafe New Brunswick"

- Patrick Colford, President, New

Brunswick Federation of Labour -

Workers' Forum: The government of New

Brunswick announced at the beginning of May that it will establish a

task force to examine WorkSafe, the workers' compensation in New

Brunswick. What is the stand of the Federation of Labour on this move

by the government?

Patrick Colford: Certainly, if

this is the direction that the government wants to go with the task

force, the New Brunswick Federation of Labour, the largest labour body

in the province, should be at the table. We are also asking for the

public to

talk to their MLAs about WorkSafe. We want the public to ask questions.

We

have been calling for a while for assessment rates to be increased,

because the WorkSafe Board told us that by 2017 the fund may be in

a deficit position. Over the last six years the average rate has

declined from $2.08 per $100 of payroll in 2010

to $1.11 in 2016.

We are a little bit worried

with that because last time that it was in a deficit position, in the

early 1990s, workers gave up a lot of benefits and a lot of

clawbacks were introduced. That is when New Brunswick introduced the

three-day waiting period, when we went from 90 per cent wage

recovery back to 80 per cent, as

well as a whole host of clawbacks. It was presented at the time that we

were going to do this until the system got back to being funded

at 110 per cent as that is where the comfort zone is. We have seen

the system funded as high as 130 per cent and actually in the last

two years, since 2015-2016, when the system was in that

surplus range, rebates were given back to the employers. In the last

three years employers have received rebates of up to $51 million

and workers' benefits have not increased. There has been some increase

of the assessment rates for 2017 and the employers' side is crying

foul, saying they can't afford assessment rates to go up

otherwise benefits will have to shut down. This is the same rhetoric we

hear all the time. We even have some of the biggest employers'

representatives saying that WorkSafe should be run by a private

insurance firm. We are a little bit worried

with that because last time that it was in a deficit position, in the

early 1990s, workers gave up a lot of benefits and a lot of

clawbacks were introduced. That is when New Brunswick introduced the

three-day waiting period, when we went from 90 per cent wage

recovery back to 80 per cent, as

well as a whole host of clawbacks. It was presented at the time that we

were going to do this until the system got back to being funded

at 110 per cent as that is where the comfort zone is. We have seen

the system funded as high as 130 per cent and actually in the last

two years, since 2015-2016, when the system was in that

surplus range, rebates were given back to the employers. In the last

three years employers have received rebates of up to $51 million

and workers' benefits have not increased. There has been some increase

of the assessment rates for 2017 and the employers' side is crying

foul, saying they can't afford assessment rates to go up

otherwise benefits will have to shut down. This is the same rhetoric we

hear all the time. We even have some of the biggest employers'

representatives saying that WorkSafe should be run by a private

insurance firm.

We hope this task force won't result in more cuts to

the benefits of injured workers. Our main concern is restoring the

balance at WorkSafe New Brunswick, getting rid of that three-day

waiting period. In the province of New Brunswick if you get hurt at

work and need to file a claim you have three days without pay before

you file your

claim. That is three days of lost wages. The other aspect is the wage

recovery. A lot of my members have a hard time living on 100 per

cent of their wages so to be penalized for being injured at work does

not make sense. Injuries are not being reported because workers say

that they will work with their injuries because they cannot afford

that three-day waiting period and the lost wages. People are working

injured and suffering even greater harm because their injuries do not

have time to heal.

The New Brunswick Federation of Labour is holding its

Biennial Convention May 28-May 31 and we are going to be

launching our WorkSafe campaign at the convention.

Canadians' Need for Their Own Steel

Industry

New Class-Action Lawsuits Against U.S. Steel

Numerous class-action lawsuits were launched against

U.S. Steel at the beginning of May, accusing the company of misleading

shareholders and buyers of USS stocks. According to press releases,

lawsuits have been filed on behalf of U.S. Steel investors by Robbins

Arroyo LLP, Lundin Law PC, Khang and Khang LLP, Kessler Topaz Meltzer

and Check, LLP, Rosen Law Firm, Johnson and Weaver LLP, Goldberg Law PC

and others.

Excerpts from two of the legal firms' press releases

explain the nature of the complaint. In a news release on May 9,

Robbins Arroyo LLP said:

"Shareholder rights law firm Robbins Arroyo LLP

announces that a class action complaint was filed against United States

Steel Corporation (NYSE: X) in the U.S. District Court for the Western

District of Pennsylvania. The complaint is brought on behalf of all

purchasers of U.S. Steel securities between November 1, 2016

and

April 25, 2017, for alleged violations of the Securities

Exchange Act of 1934 by U.S. Steel's officers and

directors. U.S.

Steel produces and sells flat-rolled and tubular steel products

primarily in North America and Europe.

"According to the complaint, in 2013, U.S. Steel

launched a process called the 'Carnegie Way,' which was a business

strategy designed to create stockholder value. In the

company's 2016 Form 10-K filed with the U.S. Securities and

Exchange Commission on February 28, 2017, U.S. Steel stated

that '[t]he

Carnegie Way has already driven a shift in the Company that has enabled

us to withstand the prolonged downturn in steel prices while

positioning us for success in a market recovery.' However, on

April 25, 2017, U.S. Steel reported a net loss of $180

million, or negative $1.03 per diluted share, and a negative

operating

cash flow of $135 million. The company further revealed a

reduced 2017 outlook that widely missed analyst expectations,

including a 35 per cent reduction to its 2017 adjusted

earnings

guidance before interest, tax, depreciation, and amortization. During a

conference call on April 26, 2017, U.S. Steel's Chief

Executive Officer, Mario Longhi, stated that the company would 'be

taking more downtime at our facilities, which will limit our steel

production volumes.' On this news, U.S. Steel's stock fell 26 per

cent to close at $22.78 per share on April 26, 2017...."

On May 9, Lundin Law PC announced a suit concerning the

same period. It stated:

"According to the Complaint, during the Class Period,

U.S. Steel issued materially false and/or misleading statements and/or

failed to disclose: that while the Company was implementing its

Carnegie Way program, it was focused on cutting costs and was not

making investments necessary to position U.S. Steel so that it could

respond to

improved market conditions; that the Company's failure to invest in

improving capital assets during the industry downturn, in order to

report apparent financial improvements, meant that U.S. Steel had

higher production costs than its competitors, even in the face of

improved pricing, which would negatively impact its financial results;

and that

U.S. Steel was forestalling expensive capital equipment upgrades in

order to boost its short-term financial results at the expense of

long-term financial performance, leaving U.S. Steel in need of

accelerated, costly equipment upgrades that would leave the Company

years away from generating improved financial performance. When this

news was

released, U.S. Steel's stock price declined materially, which harmed

investors according to the Complaint."

U.S. Steel Faces Historic Necessity for Change

- K.C. Adams -

Ruling oligarchy blocks resolution of

economic problems and

continues

on failed path

U.S. Steel considers the amount it does not spend on

renewing its productive force as savings. The quantified savings

year upon year since 2014 is $2.5 billion. It reports that

the company "has realized from CEO Mario Longhi's Carnegie Way

efficiency and cost-cutting initiative $575 million

in 2014; $815 million in 2015; $745 million

in 2016; and $310 million so far this year."

The result, in the words of USS, is "enormously more

efficient operations." This factor coupled with rising steel market

prices should result in "enormously" improved financial results. Why

then, did U.S. Steel report a $180 million first-quarter loss and

slash its 2017 profit outlook in half? Simply put, the Carnegie

Way and other

forms of refusal to renew productive capacity such as closing perfectly

good mills are examples of the ruling oligarchy's unwillingness to face

the historic necessity for a new direction in the economy.

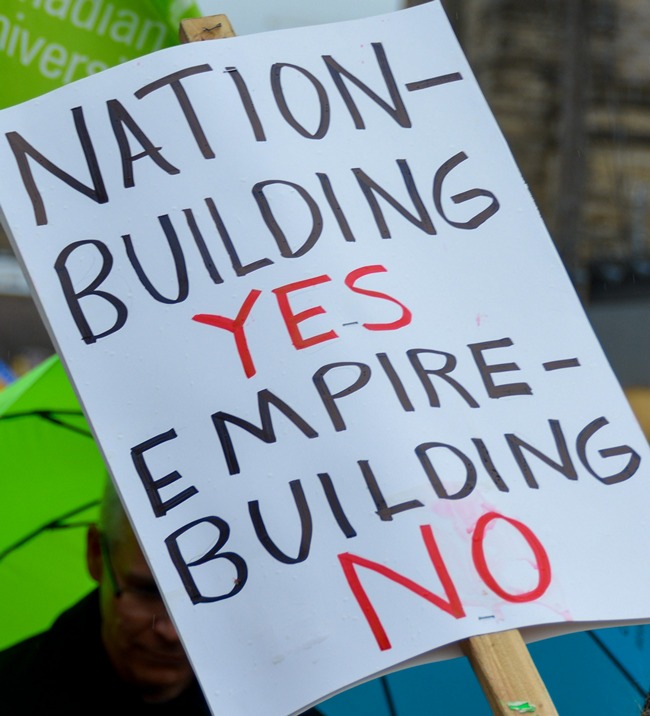

The present relations of production whereby the actual

producers are not in control of the socialized forces of production

doom the economy to failure. Private control of socialized production

cannot take advantage of or control the production and distribution of

the enormous social product. The aim of private ownership to compete

globally

for profit and empire-building with other privately owned parts of the

economy is in contradiction with the objective conditions of modern

socialized production.

Socialized production demands broad cooperation of all

parts and sectors of the economy in a nation-building project to

guarantee the well-being of the people and general interests of society

that opens a path towards the emancipation of the working class. The

modern working class is the only social force with the aim and outlook

to manage

the socialized means of industrial mass production for the benefit of

all, in harmony with all its interrelated parts without crises. The

working class as the actual producers has the aim and duty to

distribute the social product within a nation-building project that

guarantees extended reproduction of the economy and the well-being,

security and rights

of all.

U.S. Steel and Its Years of Failure

U.S. Steel executives and private institutional

ownership of its stock equity and debt refuse to recognize and accept

the law of a falling rate of profit in industrial mass production

caused by the ever-increasing amount of social wealth required in

modern productive forces. To counter the law, the ruling financial

oligarchy engages in reckless

parasitic adventures

including predatory and inter-imperialist wars with competitors and

lashes out at the

working class and productive forces in destructive anger.

USS has made equity profit in only one year

-- $102 million in 2014 -- since 2008. Why then have all

the "cost savings" from closing and abandoning facilities in Canada and

elsewhere, refusing to invest in renewing production, and forcing

concessions from steelworkers and salaried employees not resulted in

profits?

Where is the much-ballyhooed $2.5 billion in cost savings from the

Carnegie Way? This puzzle confounds financial analysts and

representatives of the institutional owners of the company's stock

equity and debt who are impatient for positive answers and results and

do not appreciate continuing losses. The experts, journalists and

university

pundits are all schooled in seeing only what the ruling imperialist

class wants them to see. They are not good at engaging in acts of

finding out what the root problems really are in the socialized economy.

Len Boselovic of the Pittsburgh

Post-Gazette

writes, "The miserable performance makes U.S.

Steel's constant contention that the company can compete with anybody

if only Washington would crack down on predatory, subsidized imports

look pretty ridiculous." He quotes Axiom Capital analyst Gordon Johnson

saying, "They (USS)

can't compete with anybody on a level playing field. They have the

highest costs in the industry." Len Boselovic of the Pittsburgh

Post-Gazette

writes, "The miserable performance makes U.S.

Steel's constant contention that the company can compete with anybody

if only Washington would crack down on predatory, subsidized imports

look pretty ridiculous." He quotes Axiom Capital analyst Gordon Johnson

saying, "They (USS)

can't compete with anybody on a level playing field. They have the

highest costs in the industry."

Boselovic writes, "In announcing the

company's $440 million loss last year, Mr. Longhi emphasized that

'Carnegie Way transformation efforts' have improved the company's cost

structure. 'These substantive changes and improvements have increased

our earnings power'."

Really, Mr. Longhi, why then is USS facing another huge

quarterly loss and projected losses for years to come?

New York economic analyst Charles Bradford was not

convinced and looking for the promised improved earnings in U.S.

Steel's first-quarter numbers asked rhetorically during the company's

quarterly conference call, "Where is it?"

"Oh, it's there," replied a U.S. Steel spokesperson.

"The company completed nearly 450 Carnegie Way projects in the

first quarter and has over 3,500 more in the pipeline."

Boselovic writes, "Such pronouncements make skeptics

think the critical elements of the Carnegie Way are smoke and

mirrors.... [Axiom Capital analyst Johnson] believes the problem is

that for years, U.S. Steel has spent less on capital expenditures to

modernize its mills than it has reported in depreciation and

amortization expenses -- an accounting measure that expenses the cost

of the company's steelmaking equipment over its useful life and

measures how much book value the equipment loses each year.

"When depreciation and amortization exceed capital

expenditures, it is a strong indication that a company is not investing

enough to keep its plant and equipment up to date. 'This is a company

that has under maintained its facilities for 80 years,' Mr.

Bradford said."

Mr. Bradford could investigate who has claimed the

added-value steelworkers have produced over the years. Added-value has

been available for reinvestment in the productive forces if the owners

of debt and others would reduce their claims and graciously accept a

fall in the rate of profit. But that is not in their class nature.

Owners of stock equity have routinely claimed twenty

cents per share annually for years, around $34.8 million, on

greatly fluctuating stock ownership equity of $3.5 billion.

Executives have doled out this amount even while announcing continuous

quarterly losses per share.

The lion's share of the annual claim on added-value

goes to owners of debt, which amounts to about $230 million

on $3.4 billion of debt ownership. Other claimants on added-value

include executive managers and governments.

The totality and pressure

for claims on added-value go beyond what is available and often dips

into transferred-value that should be used to replace depreciated

machinery or pay for material inputs. Ironically, the subjective

feature of the imperialist controlled economy with private ownership's

insistence on an ever-greater return on its

investment of social wealth despite the objective law of a falling rate

of profit puts pressure on executive managers not to reinvest in

production from added-value but instead use additional borrowing, which

exacerbates the problem and leads to greater crises. The totality and pressure

for claims on added-value go beyond what is available and often dips

into transferred-value that should be used to replace depreciated

machinery or pay for material inputs. Ironically, the subjective

feature of the imperialist controlled economy with private ownership's

insistence on an ever-greater return on its

investment of social wealth despite the objective law of a falling rate

of profit puts pressure on executive managers not to reinvest in

production from added-value but instead use additional borrowing, which

exacerbates the problem and leads to greater crises.

In large industrial companies requiring huge

investments of social wealth in the means of production, the oligarchs

prefer debt ownership for its regular claims, and stock equity

ownership for a chance to manipulate the fluctuating stock price to

their advantage and fleece other buyers of stock. Many industrial

companies pay no stock dividend

at all but must service the debt ownership with interest profit or go

into bankruptcy protection.

Len Boselovic continues, "[Johnson] has been listening

to the company's pronouncement about being able to compete on a level

playing field for decades and isn't buying it. 'This is the same

garbage story we heard in the '70s when [former chair of USS] David

Roderick claimed they could compete with anybody,' he said.... If Mr.

Longhi

had paid more attention to his mills instead of government handouts,

'Maybe things would have been a little different,' Mr. Johnson said."

Forbes, a major news agency of the financial

oligarchy, tried to explain the situation in an item entitled,

"Underperforming

Amid Favorable Business Conditions: The Curious Case Of U.S. Steel."

The explanation looks only at the obvious surface features and fails to

probe deeply into why such problems continually plague not

only particular companies but entire sectors and the socialized economy

captured within the private control of the oligarchs.

The Forbes article states, "U.S. Steel dismayed

investors with an underwhelming Q1 earnings release last week. The

company reported an unexpectedly steep decline in shipments for its

U.S. Flat-Rolled steelmaking operations, which account for

around 70 per cent of the company's revenue, translating into a

significant decline

in EPS (Earnings Per Share). The poor Q1 2017 earnings resulted in

a sharp decline in the company's stock price over the course of the

past week.... The company attributed the decline in shipments for the

Flat-Rolled division to planned production outages as it embarks upon

its asset revitalization program, which is aimed at improving the

efficiency, reliability, and product quality in addition to lowering

production costs. However, in doing so, the company is foregoing higher

production levels during a favorable time period characterized by

rising steel prices and demand for the commodity in key markets.

"The improved business conditions are reflected in the

recent recovery in steel prices, with U.S. Steel reporting an 18

per cent year-over-year increase in realized prices for the Flat-Rolled

division in Q1.... In Q3 2016, the division's shipments were

negatively impacted to the tune of 125,000 tons, or around 5

per cent

of the company's Q3 shipments, as a result of unplanned production

outages. The division's shipments fell further 6 per cent

sequentially in Q4, as a result of planned production outages. The

company lowered production levels in Q4 as it undertook its asset

revitalization process, partly aimed at addressing operational problems

leading to

unplanned production outages. However, problems for the company's

Flat-Rolled steelmaking operations continued into 2017, with the

accidental release of waste water from the company's Midwest plant in

Portage, Indiana, which temporarily halted operations at the plant.

Moreover, the company reported a 4 per cent year-over-year

decline in shipments for its Flat-Rolled division in Q1 2017, with

the decline in shipments attributed to planned production outages under

the asset revitalization program.

"The recent disruptions at

the Flat-Rolled steel division's facilities have raised concerns over

U.S. Steel's ability to increase production levels to profit from the

improved business conditions for steel in the U.S. The asset

revitalization program will lower the Flat-Rolled division's shipments

by around 1 million tons in 2017." "The recent disruptions at

the Flat-Rolled steel division's facilities have raised concerns over

U.S. Steel's ability to increase production levels to profit from the

improved business conditions for steel in the U.S. The asset

revitalization program will lower the Flat-Rolled division's shipments

by around 1 million tons in 2017."

The Forbes

article fails to mention the demands for concessions from workers, the

numerous recent shutdowns, closures and sale of USS productive

facilities including Stelco in Canada, a mill in Serbia, facilities in

Gary, Indiana; Fairfield, Alabama; Lorain, Ohio; Lone Star, Texas;

Granite City, Illinois; and a rumoured sale of its mill in Slovakia.

All these

anti-social attacks

and refusal to deal with the root problems in the economy have resulted

in a tremendous toll on active and retired workers and their

communities that depend on the value workers reproduce at those

facilities. The failure to act to resolve the problems and

contradictions in the economy exposes the oligarchs as unfit to rule.

The working class must

organize to deprive the ruling imperialist elite of their power to

block the opening of a new direction with socialized relations of

production in conformity with the objective conditions replete with a

new aim. The ruling financial oligarchy puts its narrow private

interests ahead of the broad interests of the working people and

general interests of

society. The social responsibility falls on the shoulders of the

working class to build the new.

Consequences of Trade War in Forestry

Industry

Resolute Forest Products Lays Off Workers

Protest by forestry workers in Ottawa, June 2, 2009, demanding

government take action to defend forestry workers and their communities.

Resolute Forest Products began cutting shifts at seven

sawmills in

Quebec this week and delaying the start of its forest operations. One

thousand two hundred and eighty two workers

will lose their jobs for an indefinite period. Forestry workers and

their small communities are suffering the consequences of an

orchestrated crisis in a sector dominated by huge companies

such as Resolute.

The Quebec forestry industry accounts for 60,000 direct

jobs and

many more indirect ones. In addition to contributing lumber for Quebec

and Canada, the social product is highly

regarded as an export. Ninety per cent of Quebec's softwood lumber

exports go to the United States. Workers in the sector contribute

enormous value to Quebec and Canada. They deserve

respect and peace of mind about their security and future.

La Tuque mayor Normand Beaudoin says Resolute has laid

off 100 mill

workers in his community located about 200 kilometres south of the

Lac-Saint-Jean region. He said any

extended downtime would be difficult not only for the working families

directly affected but the entire town.

Outside Quebec, a small cedar mill in New Brunswick

recently closed

affecting six workers reflecting the growing crisis across Canada and

hardship imposed on workers. Danny

Stillwell, owner of Hainesville Sawmill Ltd., northwest of Fredericton,

said the mill will have to cease operations until the nonsense is over

and he can again sell lumber in the U.S. with

some certainty without having to pay thousands of dollars in duties

before any money is received from the buyer. Mr. Stillwell said his

mill is the major employer in the small town so the

closure "is a very big deal." Lumber from the small Hainesville Sawmill

faces a U.S. duty of 19.88 per cent having been lumped in with all

small sawmills throughout Canada. They also

have to pay the duty immediately and retroactively on all the lumber

they exported to the U.S. back to January 31.

Lumber from New

Brunswick's J.D. Irving, which has mills

throughout the province and in the U.S., faces a much lower tariff of

3.02 per cent. For the lower tariff, the

self-serving company "voluntarily" argued before the U.S. International

Trade Commission that the timber it mills comes from privately-owned

forest land unlike many mills across Canada,

which pay ground rent or stumpage fees to the state to log Crown-owned

forests. Along with other forestry giants in North America seeking to

raise prices, J.D. Irving implied that certain

competitors, especially in the West, have an "unfair advantage," as

almost all forest land is Crown-owned. The oligarchs at J.D. Irving

will also benefit directly from this crisis with higher

lumber retail prices both in Canada and the U.S. and possible expansion

by taking over the market and even operations of small mills such as

Hainesville Sawmill Ltd. Lumber from New

Brunswick's J.D. Irving, which has mills

throughout the province and in the U.S., faces a much lower tariff of

3.02 per cent. For the lower tariff, the

self-serving company "voluntarily" argued before the U.S. International

Trade Commission that the timber it mills comes from privately-owned

forest land unlike many mills across Canada,

which pay ground rent or stumpage fees to the state to log Crown-owned

forests. Along with other forestry giants in North America seeking to

raise prices, J.D. Irving implied that certain

competitors, especially in the West, have an "unfair advantage," as

almost all forest land is Crown-owned. The oligarchs at J.D. Irving

will also benefit directly from this crisis with higher

lumber retail prices both in Canada and the U.S. and possible expansion

by taking over the market and even operations of small mills such as

Hainesville Sawmill Ltd.

It should be noted that New Brunswick Liberal

Premier Brian

Gallant, a representative of the financial oligarchy in a province

dominated by the Irving Empire, has been quick to

argue against any state aid for small forestry companies and workers

during the current lumber crisis. He contends that the U.S. government

would use that as "further evidence of unfair

subsidies." Gallant has appointed David Wilkins to manage the dispute

on behalf of J.D. Irving's operation and others. Wilkins is the former

U.S. ambassador to Canada during the reign of

President George W. Bush.

Fears exist that this fifth softwood drama concocted by

the

financial oligarchy, which dominates and controls Fortress North

America, could be as punishing as the last one from 2004

to 2006. During that period, Canadian forestry workers lost 20,000 jobs

and 400 sawmills closed. The softwood sector had not even recovered

from that blow when it was hit again with the

collapse of the U.S. housing market in 2008. Once the worst of the

damage of that crisis was thought to be over, the forestry oligarchs

are now using the current upswing in U.S.

construction and increased lumber demand to go after higher prices by

orchestrating another softwood dispute.

The financial oligarchy and the oligopolies it controls

in the

forestry sector throughout Fortress North America are engaged in

constant battles to defend their private interests and

expand their empires, which continually disrupts the sector leading to

economic crises. While falsely presented as a national dispute between

Canada and the U.S. over terms of trade, the

recurring softwood lumber drama in effect has become a regular occasion

to raise retail lumber prices, weaken the forestry workers' organized

defence of their rights, and to consolidate

ownership and control of the sector in the hands of the few.

Calls are becoming louder to put an end to these

recurring crises

that disrupt the lives of so many working people in both Canada and the

United States and seriously harm the

economies of both countries. To bring stability and security to

forestry workers and their communities and to those sectors reliant

upon lumber supply and consistent pricing, a new direction

for the economy free from the self-serving control of the oligopolies

has become the order of the day.

Softwood Lumber Prices Rise Sharply in Canada

Workers' Forum

received a letter and photos from an Ontario construction contractor

showing the sharp rise of softwood lumber prices in Canada. The letter

and comment from Workers' Forum is below.

***

"This size lumber (in photo

-- 2"x4"x8') was $2.59 over the winter. Now, Home Depot

and/or

the suppliers always price gouge come spring

and summer but I have never seen it this high. I am thinking it is

connected to the current scam trade "dispute" and the corresponding

hysteria, which tries to justify price fixing. Weyerhaeuser [the

company at the centre of the recent disputes -- WF note] is the

other supplier at Home Depot. I find it goes back and forth with

Resolute.

Probably whoever gives the better deal for Home Depot at any given

time." "This size lumber (in photo

-- 2"x4"x8') was $2.59 over the winter. Now, Home Depot

and/or

the suppliers always price gouge come spring

and summer but I have never seen it this high. I am thinking it is

connected to the current scam trade "dispute" and the corresponding

hysteria, which tries to justify price fixing. Weyerhaeuser [the

company at the centre of the recent disputes -- WF note] is the

other supplier at Home Depot. I find it goes back and forth with

Resolute.

Probably whoever gives the better deal for Home Depot at any given

time."

Workers' Forum Comment

A 46 per cent price increase for lumber! The U.S.

tariff does not apply to lumber sold in Canada but obviously, that does

not stop the gouging. The big companies must have colluded to apply the

higher U.S. price throughout Fortress North America. The contractor is

correct in denouncing it as a scam.

Resolute's specific softwood lumber tariff

is 12.82 per cent, which is lower than the average of 19.88

per cent most companies are assessed. This means it will pocket any

difference from the tariff and the new higher market prices. Also, it

is one of the four companies that do not have to pay the duty at the

border but only after

selling the lumber and submitting the paperwork.

Weyerhaeuser's assessed tariff is the

average 19.88 per cent but Weyerhaeuser does not have to ship much

lumber to its customers in the U.S., as it is the largest softwood

lumber producer within the United States. Unless of course the specific

wood product is only found in Canada. Weyerhaeuser and other companies

with mills in the

U.S. will greatly benefit from the tariff and higher prices, as they

will pocket the duty as a higher market price.

All the larger lumber companies will benefit from the

higher prices in Canada and from expansion as they seize control of the

small mills that cannot weather the loss of some of their U.S. market,

which has been the case each time the U.S. government has imposed a

higher tariff. In addition, many smaller companies will suffer from

having

to pay the duty upfront and wait for it to be returned with higher

prices when and if the product is sold.

Many construction companies will suffer a loss of

business in both Canada and the U.S., if they cannot find customers

willing to pay a higher price matching the higher price of production

for their construction social product. There could also be some

switching of construction material away from wood.

U.S. furniture manufactures have launched a petition

for exemption from the softwood lumber tariff, as the type of lumber

needed for much of their production is only found in the colder

Canadian climate and they cannot sell furniture with the higher price

of production forced upon them with the tariff.

Resolute may not profit as much as the other big

companies in the Canadian forestry sector because at this point it does

not have any U.S. lumber mills. In addition, Resolute's Canadian mills

are in Quebec and Ontario where the ground rent for forest use is

higher than in BC. The big lumber companies in BC with mills in the U.S

can supply

most of their U.S. lumber customers from their U.S. mills, especially

as demand may drop off somewhat with these kinds of large price

increases. They can also ship BC raw logs to their own U.S. mills and

then cut them into lumber circumventing the tariff. Raw softwood logs

are not subject to the duty.

Resolute and other producers in Canada are also

threatened with the countervailing duty (accused of selling social

product in the U.S. below the price of production) to be applied later

this year on top of the tariff. The extra duty will then put even more

upward pressure on lumber prices through North America.

The 46 per cent jump in the price of lumber at

Home Depot in Canada shows how susceptible the economy is to

manipulation by the financial oligarchy and how destructive this

manipulation can be for the economies of both the U.S. and Canada. The

time has come to remove the power of the oligopolies from the economy

and march

forward in a new pro-social direction under the control of the actual

producers, the working class, and their allies.

PREVIOUS

ISSUES | HOME

Website: www.cpcml.ca

Email: office@cpcml.ca

|