|

SUPPLEMENT

No. 36September 26, 2020

The Banking Sector of the Economy

An Important Sector Over Which the Working People Must Exercise Control

- Workers' Centre of CPC(M-L) -

For Your Information

• U.S.

Institute

for Public Banking Demands

Banking Become a Public Utility

• The

New International Financial Institution for U.S.

Expansion

- Ansonith Albano -

• How

Was the World Bank Formed? A Brief History

• U.S.

Federal

Reserve System

- K.C. Adams -

The Banking Sector of the Economy

- Workers' Centre of CPC(M-L) -

Why should banking be considered a private

matter to enrich those in control and concentrate

money and power in fewer hands? This is an

important question.

A key issue is the

role of the state at all levels. Should the state

and its many institutions serve the people or a

tiny minority of rich oligarchs? With food

insecurity now a serious issue facing one in eight

people; unemployment, poverty and homelessness

constant threats; governments incapable of

mobilizing the people and science to bring the

pandemic under control; and racial and other forms

of inequality and injustice plaguing the society,

people are questioning the reactionary role of the state and its authority within the conditions

that have developed. A key issue is the

role of the state at all levels. Should the state

and its many institutions serve the people or a

tiny minority of rich oligarchs? With food

insecurity now a serious issue facing one in eight

people; unemployment, poverty and homelessness

constant threats; governments incapable of

mobilizing the people and science to bring the

pandemic under control; and racial and other forms

of inequality and injustice plaguing the society,

people are questioning the reactionary role of the state and its authority within the conditions

that have developed.

Does the state at all levels, as the most

important and powerful institution, not have a

social responsibility to ensure the well-being of

all? Would that not include the broad functioning

of the economy in a manner that serves the public

interest and not simply a select wealthy

privileged few?

The imperialist system in both the U.S. and

Canada gives state-sanctioned private banks the

social responsibility of creating new money and

moving it into the economy as credit. This broad

social responsibility to increase the money supply

and supply credit to meet the needs of the economy

and people comes into contradiction with the

narrow aim of private banks to make maximum profit

for their private owners.

This contradiction between a private aim and

social responsibility exists throughout the

imperialist economy. This unresolved contradiction

is a leading reason for the recurring economic

crises and the inability of the imperialist

economy to mobilize the tremendous productive

power of modern industrial mass production to meet

the needs of the people and guarantee their rights

and well-being.

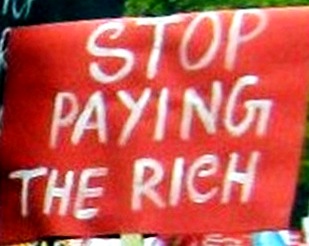

State-Sanctioned Banking to Pay the

Rich

In assessing the role of the state

within the banking sector and the important role

of providing credit and creating new money the

reality is clear: the state has awarded

positions of power to private enterprises and

individuals that use their state-sanctioned

privilege for private gain. Those in control of

the banking sector act with impunity to serve

their narrow private interests and are not held

to account for their actions. They refuse to

uphold social responsibility as a matter of

course, as they consider banking a private

matter to enrich those in control and

concentrate money and power in fewer hands.

The working people

take an opposing view and demand change. Banking

and the provision of credit and creation of the

money supply are a public matter and entail broad

social responsibility. Banking in a modern economy

is a necessary public infrastructure or utility

required for the proper functioning of the economy

in the production and distribution of the goods

and services the working class produces to meet

the needs of the people. The working people

take an opposing view and demand change. Banking

and the provision of credit and creation of the

money supply are a public matter and entail broad

social responsibility. Banking in a modern economy

is a necessary public infrastructure or utility

required for the proper functioning of the economy

in the production and distribution of the goods

and services the working class produces to meet

the needs of the people.

The banking sector controls the creation of a

national money supply at an appropriate level to

serve the extended reproduction of the economy in

conformity with the growth and development of the

productive forces and the actual and potential

amount of social product. Further, banks are meant

to provide a safe place for people and businesses

to keep their savings and for the use of those

savings for nation-building to serve the local and

national economy. These tasks cannot and should

not be considered private responsibilities with

the aim of enriching a privileged few.

Banking is a necessary infrastructure that

carries important social responsibilities for the

well-being of all and society. How to uphold

social responsibility on all fronts and in new

forms necessary to fulfil their roles are

important issues to be discussed for all the

different sectors of the economy and politics.

The old forms and aim that arose with the origin

of the country, constitution and economy are

obsolete. New political, economic, social and

constitutional forms, institutions and authority

are necessary that are in conformity with a modern

economy and country of industrial mass production

where the productive forces are completely

socialized and workers who sell their capacity to

work and produce the social product constitute the

vast majority of the people.

Within the modern world and conditions that have

developed, working people demand their rights, as

they must. They demand an authority in conformity

with the modern conditions; they require control

over the political and economic power so as to

deal effectively with those affairs that affect

their lives and in ways that favour the people.

Banking is an important sector over which the

working people must exercise control.

The people are determined to bring into being new

forms that conform to the socialized nature of the

basic economy, how they acquire their living, and

how they relate to one another and to nature.

Modern forms must serve the broad public interest,

uphold social responsibility, and have an aim to

guarantee the rights and well-being of the people.

The banking and credit system is a sector that

needs immediate and radical reform. The old form

of state-sanctioned private banks holding the

savings of the people and businesses, providing

credit throughout the economy, and creating the

money supply, has degenerated into parasitism and

decay. Private banking has become a form of paying

the rich, which plays a negative destructive role

in the economy and the lives of the people. The banking and credit system is a sector that

needs immediate and radical reform. The old form

of state-sanctioned private banks holding the

savings of the people and businesses, providing

credit throughout the economy, and creating the

money supply, has degenerated into parasitism and

decay. Private banking has become a form of paying

the rich, which plays a negative destructive role

in the economy and the lives of the people.

Private banking and

its aim of maximum profit for the few have become

factors contributing to recurring economic crises

and the further concentration of wealth and power

in fewer hands. Private control of banking is part

of the overall pay-the-rich economy. The ruling

oligarchy uses its control of banking to block and

deprive the people of the power and control they

need to deal with the issues that affect their

lives and to take action to solve the mounting

economic, social and natural problems facing the

country and the world.

State-sanctioned private banking reflects the

contradiction between the conditions that have

changed and an authority that has not. The

resolution of this contradiction requires the

renewal of the democracy with equality for all

members of the polity at the core, the development

of friendly peaceful relations with all humanity,

and the humanization of the social and natural

environment. Fighting consciously on all fronts

for a new pro-social direction for the economy and

country brings to the fore the human factor and

democratic personality necessary to resolve the

contradiction.

The Banking and Credit System Must Become a

Public Utility in the Service of the People and

Under Their Control

The contradiction in the economy between the

state-sanctioned private aim for maximum profit

and the need for social responsibility to serve

the people and society is starkly evident in the

banking system. People are discussing and coming

to the realization that the banking system must be

torn from the clutches of the imperialist

oligarchs. How to deprive the rich of their power

over banking and to organize to make this reform

of the economy permanent are major concerns of the

movement for the New. Bringing into being a public

banking system that upholds its social

responsibilities to the economy, people and

society is an important part of the overall

struggle to build the New in opposition to

imperialism.

For

Your Information

Activists in the United States are discussing

and taking action on the issue of the regressive

destructive role of the state-sanctioned private

banks. Organizations such as the Public Banking Institute are demanding a new pro-social

direction for the economy and, in this instance, the

banking sector. They are speaking of the necessity

for banking to be recognized as a public utility

with a modern aim to serve the public interest and

uphold social responsibility in all its affairs.

No one can deny that the people of the United

States are facing enormous challenges to move

their country in a new direction. The unending

aggressive wars abroad, social despair at home

amid economic collapse and increasing poverty and

a failure of governments at all levels to mobilize

the people to control the pandemic pose difficult

questions for all on how to organize effectively

to move society forward in a new pro-social

direction. No one can deny that the people of the United

States are facing enormous challenges to move

their country in a new direction. The unending

aggressive wars abroad, social despair at home

amid economic collapse and increasing poverty and

a failure of governments at all levels to mobilize

the people to control the pandemic pose difficult

questions for all on how to organize effectively

to move society forward in a new pro-social

direction.

According to its website, the Public Banking

Institute in the U.S. "was formed in January 2011

and is a national educational non-profit

organization working to achieve the implementation

of Public Banking at all levels of the American

economy and government: local, regional, state,

and national. [...] Our current private banking system

has presided over the greatest concentration of

wealth in human history, while the vast majority

of America and the world has endured stagnant

wages, declining wealth, and recurring

recessions."

The founder of the Public Banking Institute, Ellen

Brown, writes, "Shock waves from one Wall Street

scandal after another have completely

disillusioned us with our banking system; yet we

cannot do without banks. Nearly all money today is

simply bank credit. Economies run on it, and it is

created when banks make loans. The main flaw in

the current model is that private profiteers have

acquired control of the credit spigots. They can

cut off the flow, direct it to their cronies, and

manipulate it for personal gain at the expense of

the producing economy. The benefits of bank credit

can be maintained while eliminating these flaws,

through a system of banks operated as public

utilities, serving the public interest and

returning their profits to the public."

Brown writes, "The advantages of public over

private banking are not rocket science. A

government that owns its own bank can keep the

interest and reinvest it locally, resulting in

potential public savings of 35 per cent to 40

per cent. Costs can be reduced across the board;

taxes can be cut or services increased; and market

stability can be created for governments,

borrowers and consumers. Banking and credit become

public utilities, sustaining the economy rather

than mining it for private gain."

Under discussion is the concept that banking

should be considered a public utility to be owned

and managed by a public institution with the

mandate and social responsibility to serve the

public interest, with branches throughout the

country and an authority accountable to the

people. Money creation should be a public function

with the social responsibility falling to the

public banks. Enterprises and individuals with

excess money could lend out the amounts they have

but not create new money as the state-sanctioned

U.S. commercial banks and Canadian chartered banks

now do.

With the creation of public banks, working people

and their allies in the middle strata and small

and medium-sized businesses would be encouraged to

keep their money and savings in public banks and

not funnel them into the hands of private

financial enterprises. Workers in particular

should demand and direct their pension and mutual

funds be held within public banks that have the

mandate and aim to serve the public interest,

economy and society. The creation of public banks

is a front in the movement to stop paying the rich

and to increase investments in social programs,

public services and public enterprise.

- Ansonith Albano -

In the framework of the institutional

transformations that the United States is

advancing to regain global hegemony, in January

2020 it launched the so-called International

Development Finance Corporation (DFC), as the new

agency that will control the necessary financing

for its repositioning in the world.

The intention to modernize the international

development financing scheme is contained in the

new National Security Strategy (NSS), promulgated

at the end of 2017, and where it states that the

United States must arm itself with new tools to

face the growing influence of China and other

powers on the international scene.

The NSS recognizes that the United States has

been losing the battle for that global

pre-eminence, and provides orientation to the

formation of the new financing scheme,

understanding that this action will be essential

to update its geopolitical position. The

questioning that the document makes of the

situation of U.S. hegemony is linked to its

inability to offer fair and attractive trade

relations, in contrast to what China has been

achieving, especially in Latin America and the

Caribbean. "Today, the United States must compete

for positive relationships around the world. China

and Russia direct their investments in the world

to expand their influence and gain competitive

advantages against the United States," reiterates

the NSS.

China and its promotion of a multi-polar world

is defined in the NSS as the greatest threat to

the objectives of the United States. And from this

criterion, the NSS states that this country must

use a new methodology for international financing,

prioritizing the promotion of private capital over

areas that contribute to the great objectives of

imperial foreign policy.

The new U.S. national security doctrine proposes

that the new DFC should openly confront the China

Belt and Road initiative,[1] and at the same

time, favour the expansion of U.S. private

capital, to foster new alliances and strengthen

existing ones: "The United States can play a

catalytic role in promoting economic growth, led

by the private sector," the document clarifies.

The legal initiative that creates the DFC,

approved by consensus by Republicans and

Democrats, merges the former Overseas Private

Investment Corporation (OPIC), and the Development

Credit Authority (DCA), belonging to USAID, in a

supra development aid agency, the largest and most

important created in that country.

To materialize this geopolitical operation, the

DFC will manage some U.S.$60 billion, doubling the

financial capacity of its predecessor OPIC. The

new corporation will also assume the management of

the credit portfolios of OPIC and DCA; that is, it

starts its work, managing just under U.S.$30 billion, distributed in a variety of projects around

the world.

The legislation provided the DFC with innovative

financial tools, which guarantee it greater

flexibility in its new role, and prioritizing its

line of action, in the investment in energy and

infrastructure projects, contained in the

following regional initiatives arranged by the

United States for its geopolitical repositioning:

Connect Africa, 2X Women's Initiative, Feed the

Future, América Crece [America Grows],

Indo-Pacific Strategy, U.S.-India Development

Foundation and, European Energy Security and

Diversification.

From this perspective, in December 2019 the

United States government launched the "America

Grows" initiative as the response of Donald

Trump's government to the significant progress

made by China and Russia on the continent.

In recent years, Latin American and Caribbean

countries have deepened their economic relations

with China, establishing more and more agreements

and trade flows with the Asian nation. According

to a 2018 World Economic Forum report, China

displaced the United States as the main trading

partner of Argentina, Brazil, Chile, Peru and

Uruguay, and has invested more than $110 billion

in government projects across the region. The

report highlights the peculiarity that Chinese

banks refrain from imposing political conditions

on the governments receiving loans.

In this scenario, which envisions a transition of

the political, economic, and cultural order in

Latin America and the Caribbean, the United States

raises the America Grows initiative, as an updated

implementation of the old Monroe Doctrine.

Among other things,

with the implementation of the America Grows

initiative, the United States seeks to change the

energy matrix of the Caribbean region, in order to

redirect its growing surpluses of liquefied

natural gas (LNG) there. The International Energy

Agency (IEA) noted in a report dated November

2017, that in 2025, the United States will become

the world's largest exporter of LNG, from the

extraction of shale gas on its territory. A

substantial core of the projects, contained in the America Grows initiative, reflects the intention

of the United States to move its gas surpluses to

the Caribbean region. Among other things,

with the implementation of the America Grows

initiative, the United States seeks to change the

energy matrix of the Caribbean region, in order to

redirect its growing surpluses of liquefied

natural gas (LNG) there. The International Energy

Agency (IEA) noted in a report dated November

2017, that in 2025, the United States will become

the world's largest exporter of LNG, from the

extraction of shale gas on its territory. A

substantial core of the projects, contained in the America Grows initiative, reflects the intention

of the United States to move its gas surpluses to

the Caribbean region.

On July 21, 2020, the United States and Honduras

signed a memorandum of understanding, in which the

Central American country formalizes its

incorporation into the America Grows initiative,

with the promise of investment of U.S.$1 billion,

in private projects, during the next three years,

prioritizing the energy issue: "Our focus will be

on projects to strengthen the country's

infrastructure, advance digital connectivity,

strengthen the health sector, expand financial

services, and help lay the foundations for a more

prosperous future," declared the Executive

Director of the DFC Adam Boehler during the

signing of the document, which was attended virtually by the Honduran President Juan

Orlando Hernández.

The document, negotiated between the United

States and Honduras, adopts reference points from

the agreements already signed with Panama, Chile,

Argentina, Jamaica, Colombia, Brazil, Peru, and El

Salvador, and establishes the legal framework of

reference for future financial actions of the DFC

in Latin America and the Caribbean.

Unlike the type of financing that China provides

to Latin American and Caribbean countries, where

national projects are prioritized, and the

capacities of governments are strengthened to

generate higher levels of well-being for the

population, the action of the DFC would reinforce

economic dependence and the expansion of U.S.

private capital, commodifying the phenomenon of

development assistance.

The configuration of the DFC as the new financial

body of U.S. foreign policy has generated

enthusiasm in anti-Chinese conservative groups. On

August 14, 2020, Senators Marco Rubio (Republican)

and Bob Menéndez (Democrat), characterized by

their extremist positions against sovereign

governments in Latin America and the Caribbean,

presented the bill entitled Advancing

Competitiveness, Transparency and Security in the

Americas Act (ACTSA). According to the initiative

presented, the bipartisan proposal would seek, on

the one hand, to strengthen the economic

competitiveness of the United States, and on the

other, to criminalize China's political and

commercial presence in the region. "China's goal

is to use economic power to displace the U.S. I

am proud to join Senator Menéndez in presenting

this project, which seeks to strengthen our

economic capacity, to counter the growing evil

influence of Beijing in Latin America and the

Caribbean," Senator Rubio pointed out on his

social networks. The ACTSA project involves the

new DFC, and will propose, for the approval of

Congress, that 35 per cent of the financial budget

of said agency be dedicated to the region during

the next 10 years.

The DFC's agenda, since the formal start of its

operations on January 2 of this year, has been

affected by the institutional rearrangement, the

capture of human capital that will make the work

of this body effective, and, of course, the

consequences of the COVID-19 pandemic.

However, its Executive Director Adam Boehler, a

young businessman linked to the provision of

health services who graduated in 2000 in economics

from the University of Pennsylvania, has wasted no

time and has established work meetings with

different characters and officials of Latin

America and the Caribbean, carrying the promise of

the Trump administration to generate large

investments for the projects that may be presented

to this institution.

Before the end of 2019, he visited the Colombian

President, Iván Duque, in Cartagena, where he

confirmed that his agency will promote efforts

that guarantee the financing of the largest number

of projects, especially in energy and

infrastructure. He also held meetings with the

same discursive criteria, with President Nayib

Bukele from El Salvador, Juan Orlando Hernández

from Honduras, Alejandro Giammattei from

Guatemala, and Mexican Foreign Minister

Marcelo Ebrard with whom he signed a letter of

intent to finance a gas pipeline, which will be

built by the company Rassini SAB de CV in the

southern states of the country, for U.S.$632 million.

As the new agenda of the DFC is proposed, based

on the guidelines set forth in the U.S. National

Security Strategy, it could contribute to the

deepening of political instability in the region,

and even more explosive scenarios, with the

intensification of economic inequality, inequity

in the distribution of resources, and political

dependence.

Ansonith Albano is a professor in the Faculty

of Political Sciences, National Autonomous

University of Nicaragua.

TML Note

1. The Belt and Road Initiative is a global

infrastructure development strategy adopted by the

Chinese government in 2013 to invest in nearly 70

countries and international organizations. Its

stated aim is to strengthen China's connectivity

with the world. It combines new and old projects,

covers an expansive geographic scope, and includes

efforts to strengthen hard infrastructure, soft

infrastructure, and cultural ties. Originally

called One Belt, One Road it is a Chinese economic

and strategic agenda by which the two ends of

Eurasia, as well as Africa and Oceania, are being

more closely tied along two routes -- one overland

and one maritime.

Signing of the agreement founding the World Bank,

December 27, 1945.

The following is an excerpt from an article by

Gustavo Castro Soto, Chiapas al Dia

Bulletin, May 8, 2002, No. 289.

Together with the International Monetary Fund

(IMF), the World Bank (WB) was formed in 1945 with

the participation of 38 countries -- it now has

181 member countries. The WB was formed with the

principal goal of boosting the economies of the

European countries that participated in World War

II and that ended up destroyed and impoverished.

Among these countries were France, Germany, Japan,

Italy, the United Kingdom and others. France was

the first country to receive a loan for the

equivalent of $250,000,000 at the time. Later,

loans were given to Chile, Japan and Germany, among

many other countries. Bit by bit the WB Group was

formed, composed of diverse types of banks for

diverse types of loans. Since its foundation, the

WB has had profits each year from the payment of

interest, speculation on the stock exchange and

for the fees that the governments must pay to be members and thus have a right to

request loans from the bank. For example, in 1970

the WB lent out $2 billion and two years

later in 1972 it lent out $3 billion and then $10 billion in 1979.

The debt of the poorest countries or those in the

process of developing reached such height that the

WB began to lend these governments money to pay

the interest on their original debts to the WB. In

1980, the owners of the WB took advantage of these

debts to grant Turkey a loan of $200,000,000

under the severe conditions of the so called

Structural Adjustment Program (SAP), the function

of which will be explained later. For the year

1990, Mexico received the largest loan ever

granted for a total amount of $1,260,000,000 in

order to pay its external debt. In 1992,

Switzerland, the Russian Federation and twelve

republics of the former Soviet Union became part

of the WB.

The protests and pressure against the WB, its Structural Adjustment Programs and it debt policies were such that, in 1994

the Public Information Centre was opened so that

citizens could obtain information about the

projects that the WB was carrying out in different

nations. In 1997, Uganda was the first country to

which the Heavily Indebted Poor Countries (HIPC)

Initiative was applied. Part of Uganda's debt with

the WB would be pardoned in exchange for the

application of the very extreme policies of

structural adjustment. However, this pardon will

take place years after these changes have been in

effect.

What Institutions Make Up the WB Group?

The WB Group is made up of five institutions:

1) The International Bank for Reconstruction and

Development (IBRD): This was the first WB

institution created in 1946. It grants loans to

countries with average incomes and to the poorest

nations which are able to pay their debts and low

interest rates but at the cost of other conditions

which impoverish nations. For this reason, their

external debts are now unsustainable. The majority

of its funds come from international capital

markets (speculation on the stock exchange). The

number of votes held by its members is according

to the member's economic contribution and its

offices are in the country that contributes the

most money. That is to say that the U.S. both

hosts and operates this institution. The loans and

low interest should be repaid within 15 to 20

years. All of the countries have been obliged to

pay on time. If a country wants to be a member of

the IBRD, it must pay into the IMF which also

controls the economies of the nations. The IBRD

consists of 181 member countries. Mexico became

part of the IBRD in 1945 and it is from this bank

that it receives its loans.

2) The International Development Association

(IDA): Formed in 1960, the IDA gives loans to the

poorest nations -- those that do not have resources

and hence, only pay a commission (less than 1 per

cent) for administrative costs. The loan should be

paid back over a 35-40-year time period with the

first payment being made after 10 years. Not one

country has delayed its debt. The money comes

mainly from the U.S., France, Japan, the United

Kingdom and Germany, and other developing

countries such as Argentina, Brazil, Hungary,

Botswana, Korea, Turkey and Russia.

There are almost 40 countries that contribute to

this fund and they recover their contributions

every three years. In the past few years, the

IDA's funds have represented 25 per cent of the

total resources of the WB. If a country wishes to

join the IDA, it must be a member of the IBRD and

it must pay its fee. The IDA presently has 160

member countries. Mexico joined the IDA in 1961

though it does not actually fit the bill of an

impoverished country since, according to the WB,

Mexico has the 13th largest economy in the world.

Only a very few countries are categorized as being

very poor. Such is the case for Haiti, Bolivia,

Honduras and El Salvador.

3) The International Finance Corporation (IFC):

The IFC was created in 1956 to lend money to

companies with the goal of promoting foreign

investment after World War II. If a country wants

to join the IFC, it must be a member of the IBRD,

and to join the IBRD, it must be a member of the

IMF. The IFC has loaned funds to about two

thousand companies in 129 countries. In 1999

alone, the IFC lent $5,280,000,000 to companies.

The IFC has a membership of 174 countries.

4) The Multilateral Investment Guarantee Agency

(MIGA): MIGA was created in 1988 and it provides

security for company investments in the event that

wars, civil unrest or terrorism arise or if a

government does not comply with the rules of the

market or if it expropriates goods that affect

investment. This is another way in which the poor

governments benefit companies in that these

governments must repay MIGA the money that was

given out to the insured companies for losses. For

this reason, not all countries want to accept that

there are political conflicts within their

borders. MIGA offers insurance to countries for no

more than $225,000,000 at a rate of $50,000,000

of insurance per company project. Until now, MIGA

has provided insurance to no more than 300

companies in 52 countries and not one has had to

collect its insurance. Given that both MIGA and

the IFC offer loans to companies, they do not give

out much public information and society does not

have the power to influence the projects that it

supports nor to evaluate their impacts. MIGA has

151 countries as members.

5) The International Centre for Settlement of

Investment Disputes (ICSID): The ICSID was created

in 1966 to resolve the differences and conflicts

that arise between foreign investors and the

national governments where the investment is

taking place. It has 131 member countries.

Although this allows companies to secure their

investments (i.e., they can procure compensation

from the government via insurance), Indigenous

peoples, campesinos and the general population

have no insurance against the damage caused by WB

projects.

Who Is the Owner of the WB?

Although one might suppose that all of

the member countries are the "owners" of the WB,

the five most important shareholder countries

are the real owners. Among these shareholders

are: the United States (which contributes 16.98

per cent of the WB funds), followed by Japan

(6.24%), Germany (4.82%), France

(4.62%) and the United Kingdom (4.62$). These five nations, along with Canada and

Italy make up the G7. Obviously, the one that

contributes the most, has the greatest influence

over the decisions that are made.

What Is the Structure of the WB?

The Board of Governors meets once a year

(September or October) and is made up of the

government representatives from the 181 member

countries. At this meeting, nothing is decided. It

is an information meeting only. Later, the 181

countries divide into 24 Executive Directors

according to their economic contribution to the

WB. The United States, Germany, France, Japan and

the United Kingdom each have their own post and

they have the greatest weight in the making of

decisions. The remaining 176 countries make up the

rest of the 19 groups in such as way that the sum

of their economic contributions equals one vote.

In these latter groups, countries take turns

representing their group. Mexico shares its

Executive Director post with eight other countries

-- El Salvador, Costa Rica, Guatemala, Nicaragua,

Panama, Honduras, Venezuela and Spain. Some of

these countries will also share in the Plan

Puebla-Panama.

The Executive Directorate names the president of

the WB. This position is always filled by the

country that contributes the most economically to

the WB and is renewed every five years. Hence, the

United States always occupies this position. The

current WB president is James Wolfensohn. There

are also six regional vice-presidents: East Asia

and the Pacific, South Asia, Europe and Central

Asia, Middle East and North Africa, Africa

Sub-Saharan and, Latin America and the Caribbean.

As well, there are four sector vice-presidents.

The WB employs around 6,000 people around the

world.

Where Are the Offices of the WB?

In addition to the main offices in

Washington, DC, USA, there are 67 offices

in total throughout the world and 25 per cent of

them are in Latin America. In Latin America

there are 17 offices in 15 countries: Mexico,

Jamaica, Haiti, Guatemala, Honduras, Venezuela,

Nicaragua, Costa Rica, Colombia, Ecuador, Peru,

Bolivia, Paraguay, and Argentina and there are three

offices in Brazil.

Where Does the WB Get Its Money?

The main source of money is from the personal

taxes and other public funds that governments

collect and then use to pay their WB fee. This

makes them WB members and hence, they are able to

solicit WB loans. As well, the WB makes a lot of

money from stock exchange speculation -- money that

does not generate employment and that is not

taxable. Finally, the foreign debts that have been

created in many countries are so great that the WB

makes easy money from the interest paid by these

indebted governments.

How Does the WB Lend Money?

The WB is the largest financial institution in

the world and each year it loans out around $30

billion to its client governments and companies.

The WB states that it wants "to fight poverty with

passion..." and it promises loans with low

interest rates. Nonetheless the number of people

who now live in poverty, with less than two

dollars a day to live on, is at three billion and

growing. How is it then that the WB states that it

has combatted poverty for the past 50 years of the

WB's existence? The key to understanding this is

in the other conditions that the WB imposes on

those who ask for a loan under the Structural

Adjustment Program. As with all banks, the

WB is a bank intent on doing good financial

business, as they themselves acknowledge. It is

not a humanitarian bank nor a charity and much

less a bank to distribute the wealth of the world.

The SAPs that the WB imposes as a condition on

those governments that are granted money, consist

of adjusting the economic and political structure

of the nations with the goal of adapting the

country to the free market and to liberal

macroeconomic policies, thus, facilitating the

investment of transnational capital from the most

powerful companies in the world. If, with one hand

they "lend" money to the poorest nations via the

IDA, with the other hand they demand that severe

measures be taken to benefit their economies,

their companies and to secure their investments

with the MIGA.

The severe measures of the WB's SAPs are made in

close coordination with the IMF, with the goal of

increased economic liberalization and reform.

Thus, loans are made with the conditions that

governments carry out the following:

1) Privatize the companies, institutions and

other areas controlled by the government (in

Mexico -- CONASUPO, telephones, highways, mines,

ports, airports, gas, petroleum, natural

resources, water, electrical energy, education,

health care, research centres, etc). This leaves

investors with a monopoly on basic services, in

addition to generating unemployment and leaving

the state without resources.

2) Eliminate subsidies and liberate price

controls (on corn, social programs for the poorest

sectors, etc.). The companies argue that subsidies

for only some are unfair, that it is not

equitable, etc. However this would cause more

poverty, migration, an increase in the price of

basic products, etc.

3) Eliminate or reduce social costs (health care,

education, services, etc). Companies argue that

private investment will be responsible for the

distribution of these services to people. For its

part, the WB wants to be certain that the

government will have money to pay its debt.

4) Adjust laws and rules to eliminate obstacles

for transnational companies (labour laws,

investment laws, etc).

5) Strengthen the judicial systems to give

security to investments, combat corruption, etc.

6) Assure property rights with the goal being

that companies have legal security regarding land

ownership.

7) Free the market by eliminating duties on

imports and all mechanisms (administrative, legal

and economic) that impede exportation and

importation of goods.

8) Devalue the national currency.

In the event that a government is complying with

the SAP, the WB pays, bit by bit, the rest of the

loan. The WB also lends to areas that will benefit

foreign investment -- these are called sector

adjustment loans. In this way the WB loans money

to a country to improve the highway infrastructure

necessary for businesses; to improve railways and

other companies that it might later demand be

privatized; to endow an industrial park with the

infrastructure necessary for investment; to do

feasibility studies for investors; to allow a

government to modify its laws in such a way as to

benefit the free market and/or to execute

privatizations; to pay the same WB and/or other

loaning institutions the money that it owes; to

modify property laws with the goal that the

government is guaranteed more taxes for paying the

debt; etc.

The WB has loaned money to those countries that

have had to pay compensation to the workers and

employees that were dismissed from their jobs when

state companies were closed or privatized.

Nonetheless, when the government has to pay back

this loan, the cost for the compensated unemployed

is the trimming of other subsidies and services as

part of the Structural Adjustment with which the

government is obliged to comply.

Each year, the WB promises more loans for the

Structural Adjustment of countries (more than 65

per cent of its funds in recent years) and for the

payment of interest and capital that is owed to

them by these same clients. Less money goes

towards development projects, specific investments

and aid to the poorest nations. To these, the

poorest nations, the WB offers to pardon their

debts years after they have put into place the

severe measures of Structural Adjustment. In this

way, the IDA takes the lead in promising loans for

business development in Latin America. Society, of

course, is not able to check out such projects, to

examine their impacts and success because such

loans are for private initiatives. We recall that

at the first Summit of the Americas carried out in

1994 to form the Free Trade Area of the Americas

(FTAA), the governments of the continent mandated

that the IDA be in charge of returning more and

more funds to the WB as regards financing of

businesses and governments.

Who Pays the Consequences?

To avoid having its policies exacerbate misery,

the WB grants loans to cushion poverty's blow. The

"Advisory Group for Aid to the Poorest lends

support to financial institutions that grant

loans, generally between $50-$100, and usually

for women, to assist them in starting up small

businesses such as the production of clothing,

artesania and milk." This demonstrates an

intention to keep the labour of the poorest at a

subsistence level but it does not make them

competitive in the international market. The

interests behind the WB will never permit that

their assistance leads to their own death:

competition.

During the 1980s, the policies of the WB created

alarming conditions of poverty. In its 1990 Report

on World Development, the WB proposed to reduce

the number of poor in the world to 300 million by

the year 2000; but it didn't take long for them to

realize that it would be the opposite. In 1994 the

WB confirmed that the measures of economic

stabilization and adjustment had not overcome

illiteracy, malnutrition and growing misery; and,

now there were 219 million more poor people in the

world.

The WB recently confirmed that of the 4.7 billion

people living in the 100 client countries of the

WB: 3 billion people live on less than two dollars

a day; ... 130 million children do not attend

primary school (80 per cent of these children are

girls); 1.3 billion lack drinking water. Moreover,

it stated that, "...the increase in poverty can

produce adverse effects in the wealthier nations,

decreasing their markets and investment

opportunities ...."

Given the social complaints against the

sharpening impoverishment of women in the world,

in 1994 the WB published its first document about

gender policy. For this to happen many years had

to pass and millions of women and children had to

lose their lives to poverty. In 1995, the WB

carried out an evaluation of its projects and it

concluded that, "about one-third of the projects

(33%) financed by the WB, once completed,

had been categorized as "unsatisfactory" by the

Operations Evaluation Department. And the failure

rate (33%), had stayed at this level for

five years." It added that, "the global results

after 20 years of this monitoring and evaluation

initiative have been disappointing ... and have

been characterized by a lack of completion." Among

other lamentable things is the fact that this

poverty that the WB has provoked is subsidized by

the same taxes taken from the increasingly poor.

In other words, the poor provide the money to make

them even poorer.

In general we can say that there are three

positions regarding the WB:

1) Those that consider the WB to be contributing

effectively to development and to the fight

against poverty in the world and who believe that

the WB's projects are effective. This position is

one that even the officials of the WB don't dare

defend.

2) Those that consider that, although the WB is

the body structurally responsible for poverty, it

is possible to influence and even pressure the WB

on its policies at a high level and, from below to

monitor and evaluate their projects, demanding the

incorporation of better policies and citizen

participation.

3) Those that consider that, even though it is

necessary to influence the policies of the WB, in

the end it will continue to put forward the

neo-liberal model and generate more structural

poverty. For this reason, the WB should disappear

and resign itself to other world mechanisms in a

new economic model that balances justice with a

real distribution of wealth.

And you, what do you think?

Chiapas al Dia Bulletin was a publication of the

Centre for Economic and Political Investigations of Community

Action of Chiapas (CIEPAC). CIEPAC was a member of the

Movement for Democracy and Life (MDV) of Chiapas, the Mexican

Network of Action Against Free Trade (RMALC).

- K.C. Adams -

Originally published in TML Daily, July 3,

2002.

The U.S. Federal Reserve System (Fed) was

established as a federal government agency in 1913

by an act of Congress. The Fed consists of a Board

of Governors (BoG) in Washington and twelve

Reserve Banks situated throughout the country. The

BoG overseas all the operations of the Fed

including the twelve Reserve Banks. The most

important bank with the greatest responsibilities

is the Federal Reserve Bank of New York. The Board

of Governors consists of seven members appointed

by the President of the United States and

confirmed by the U.S. Senate. The full term of a

Board member is fourteen years; the Chairman and

the Vice Chairman of the Board are also appointed

by the President, confirmed by the Senate and must

be members of the Board. A Washington staff

numbering about 1,700 supports the Board of

Governors.

Shareholders privately own the twelve Reserve

Banks. The shares are owned by banks that are

members of the federal reserve system. Member

banks must subscribe to stock in their regional

Federal Reserve Bank in an amount at least equal

to 3 per cent of their capital and surplus. The

holding of this stock is a legal obligation that

goes along with membership, and the stock may not

be sold or pledged as collateral for loans. Member

banks receive a 6 per cent dividend annually on

their stock, as specified by law, and vote for the

Class A and Class B directors of the Reserve Bank

in their district. The BoG appoints Class C

directors. The stock is not available for purchase

by individuals.

The presidents and directors of the Reserve Banks

are powerful members of the Fed, holding key

positions on committees that decide U.S. fiscal

and monetary policy. They also participate in

selecting nominees to the BoG. Studies that chart

the history of Reserve Bank directorships and

members of the BoG since 1913 reveal a "who's who"

of the U.S. (and European) financial and

industrial elite. (See charts below) The most

powerful families of the financial oligarchy were

responsible for the original design of the Fed and

at its inception manoeuvred to own a controlling

interest of stock in the Reserve Banks.

The Fed is a powerful arm of the U.S. capitalist

state controlled directly by the richest families.

It is only marginally accountable to elected

representatives. The Fed is somewhat unusual as a

U.S. state institution as it makes no attempt to

hide its control by the monopoly capitalist class.

Most state institutions try to create an illusion

of being above classes, operating in the interests

of all the people regardless of social class --

not the Fed. The most powerful U.S. capitalists

have never allowed any interference with the

workings of the Fed. Most proceedings of the BoG

and the Reserve Banks are secret even from

Congress and the Executive Branch. Only a small

sector of its financial accounts are subject to

audit by the General Accounting Office (GAO) and

its decisions cannot be overturned by the

President, the Senate or House of Representatives.

The Chairman of the BoG routinely reports to a

Senate Oversight Committee and publishes reports

on the activities and decisions of the Fed but

that is about the extent of elected political

contact. The Congress usually receives the

Chairman of the BoG as a paramount leader with

such influence that no individual or group dare

criticise him. The Fed is extremely profitably in

its own right returning 95 per cent of its

earnings after expenses to the U.S. Treasury. Only

five per cent of earnings is needed to pay the

established annual six per cent dividend to

shareholders of the Reserve Banks.

Activities of the Federal Reserve System

The Fed conducts U.S. monetary policy,

distributes currency within the U.S. and abroad,

operates a payments system, supervises the banking

industry, has international responsibilities and

serves as central banker for the U.S. Treasury.

The Fed's activities fall into four general

areas:

1) Conducting the nation's monetary and economic

policy by influencing the money and credit

conditions in the economy; 2) Supervising and

regulating banking institutions; 3) Maintaining the

stability of the financial system and containing

systemic risk (collapse) that may arise in

financial markets and monopolies; and 4) Providing certain

financial services to the U.S. government, to the

public, to financial institutions, and to foreign

official institutions, including playing a major

role in operating the nation's payments system.

Monetary Policy

The Federal Reserve System conducts monetary

policy using three major tools:

1) Open market operations-the buying and selling of

U.S. government (mainly Treasury) securities in

the open market to influence the level of reserves

in the depository system; 2) Reserve

requirements-deciding the amount of funds

commercial banks and other depository institutions

must hold in reserve against deposits; 3) Discount

rate-the interest rate charged commercial banks

and other depository institutions when they borrow

reserves from a regional Federal Reserve Bank.

These activities all influence and control the

amount of money circulating within the U.S.

economy and abroad, the amount of hard currency

and coins needed at home and abroad, the level of

borrowing, the foreign exchange rate and the

credit rate. Monetary policy also affects economic

activity generally, prices of most commodities,

the real income of the working class, the

purchasing power of consumers and the level of

capital flowing from within the U.S. and abroad

into the stock markets, bonds or other interest

bearing securities.

Federal Open Market Committee

The Federal Open Market Committee (FOMC) consists

of twelve members: the seven members of the Board

of Governors of the Federal Reserve System; the

president of the Federal Reserve Bank of New York;

and, for the remaining four memberships, which

carry a one-year term, a rotating selection of the

presidents of the eleven other Reserve Banks. The

FOMC holds eight regularly scheduled meetings per

year to direct the conduct of open market

operations by the Federal Reserve Bank of New

York. The FOMC is charged under law with

overseeing open market operations, the principal

tool of national monetary policy. These operations

influence the amount of reserves available to

depository institutions, the amount of money in

the economy and interest rates. The FOMC sets

ranges for the growth of the monetary aggregates

and directs operations undertaken by the Fed in

foreign exchange markets. Decisions in the FOMC

directly influence money market conditions and the

growth or contraction of money and credit. The

actions of the Fed affect the volume of money and

credit and their price-interest rates, thus

influencing the level of prices generally in the

economy.

Controlling "Systemic" Disruptions

The Fed is charged by the ruling class with

containing wide-scale "systemic" (complete)

disruptions, such as those that can occur during a

plunge in stock prices, recession at home or

abroad or the serious difficulties of a monopoly

such as the Long-term Capital Management in 1998,

a hedge fund with great influence in the Fed.

Monopolies are a combination of banking and

industrial capital and through their financial arm

have direct access to the resources of the Fed. If

a threatening disturbance develops, the Fed can

sometimes cushion its effects on the monopoly or

monopolies involved, the financial markets and the

economy by providing liquidity through its

monetary policy tools, mainly capital to cover

debts of a troubled monopoly or monopolies.

Covering shortfalls of capital by a monopoly

within a federal reserve bank are highly guarded

secrets and extremely difficult to confirm. Even

borrowing by financial institutions at the Fed

discount window is secret. In order to contain

rumours, no accounting of Fed monetary actions is

allowed by any other state agency including the

powerful General Accounting Office. The Fed argues

that secrecy is important, as the stock price of a

monopoly would fall if emergency borrowing were

confirmed, or worse, a panic removal of deposits

from financial institutions may occur as happened

in Argentina. The ability to provide almost

unlimited emergency capital to financial

institutions has made the Fed one of the most

powerful and influential agencies in the United

States. Control of the Fed and its most important

decisions by certain wealthy families has

guaranteed their leading position within the U.S.

ruling class. A monopoly's relations, good or bad,

with the BoG, especially its chairman and the

president of the Reserve Bank of New York, may

determine its survival or demise during a crisis.

This may explain the dearth of criticism of the

Fed by official political circles or academics

even though the Fed is grossly undemocratic by

modern standards and unaccountable to the people

in any way, shape or form.

The Reserves Market

The Fed's policies influence the demand for or

supply of reserves at banks and other depository

institutions. The demand for reserves has two

components: required reserves and excess reserves.

Congress expanded the Fed's role in the payment

system with the enactment of the Monetary Control

Act of 1980 (MCA). The MCA subjected all

depository institutions, not just member banks, to

reserve requirements and also gave all depository

institutions access to the Federal Reserve's

payment services. All depository

institutions-commercial banks, saving banks,

savings and loan associations, and credit

unions-must retain a percentage of certain types

of deposits to be held as reserves (subject to

reserve requirements set by the Fed) in specified

assets, either as cash in their vaults or as

non-interest-bearing balances at the Federal

Reserve. At the end of 1993, 4,148 member banks,

6,042 non-member banks, 495 branches and agencies

of foreign banks, 61 Edge Act and agreement

corporations, and 3,238 thrift institutions were

subject to reserve requirements. Since the early

1990s, reserve requirements have been applied only

to transaction deposits (basically,

interest-bearing and non- interest-bearing

checking accounts). Required reserves are a

fraction of such deposits; the fraction-the

required reserve ratio-is set by the BoG.

The BoG has tremendous power to impose reserve

requirements on transaction deposits and on

non-personal time deposits solely for the purpose

of implementing monetary policy. The MCA also

empowers the BoG under extraordinary circumstances

to establish a supplemental reserve requirement of

up to 4 percentage points on transaction accounts

if such an action is deemed essential for the

conduct of monetary policy.

Changes in Required Reserve Ratios

Increasing the ratios reduces the volume of

deposits that can be supported by a given level of

reserves and, in the absence of other actions,

reduces the money stock and raises the cost of

credit. Decreasing the ratios leaves depositories

initially with excess reserves, which can induce

an expansion of bank credit and deposit levels and

a decline in interest rates; it also lowers the

costs of bank funding by reducing the amount of

non-interest- bearing assets that must be held in

reserve.

Total required reserves expand or contract with

the level of transaction deposits and with the

required reserve ratio set by the Board.

Depository institutions hold required reserves in

one of two forms: vault cash (cash on hand at the

bank) or, more important for monetary policy,

required reserve balances in accounts with the

Reserve Bank for their Federal Reserve District.

Depositories use their accounts at Federal Reserve

Banks not only to satisfy their reserve

requirements but also to clear many financial

transactions. Given the volume and

unpredictability of transactions that clear

through their accounts every day, depositories

need to maintain a cushion of funds to protect

themselves against debits that could leave their

accounts overdrawn at the end of the day and

subject to penalty. Depositories that find their

required reserve balances insufficient to provide

such protection may open supplemental accounts for

required clearing balances. Some depository

institutions choose to hold reserves even beyond

those needed to meet their reserve and clearing

requirements. These additional balances, which

provide extra protection against overdrafts and

deficiencies in required reserves, are called

excess reserves; they are the second component of

the demand for reserves.

Supply of Reserves

The Federal Reserve supplies reserves to

the banking system in two ways:

1) Lending through the Federal Reserve discount

window Buying government securities (open market

operations).

2) Reserves obtained through the first channel are

called borrowed reserves. The Fed supplies these

directly to depository institutions that are

eligible to borrow through the discount window.

Access to such credit by banks and thrift

institutions is established by rules set by the

BoG, and loans are made at a rate of interest-the

discount rate-set by the Reserve Banks and

approved by the BoG.

Basic Discount Rate

The basic discount rate that each Federal Reserve

Bank charges on its loans is established by the

Bank's board of directors, subject to review and

determination by the BoG. In the past the U.S.

banking system was fragmented and state-based. The

Fed has fought this feature on behalf of the

largest financial institutions. Gradually, smaller

local banks have been eliminated as big banks and

the Fed gained power and influence. Regional

credit markets are almost a thing of the past as a

national credit market has been created with a

national discount rate. Today, the Federal Reserve

maintains a uniform structure of discount rates

across all districts of the Reserve Banks.

Discount Window

Institutions eligible to borrow at the Fed's

discount window include domestic commercial banks,

U.S. branches and agencies of foreign banks,

savings banks, savings and loan associations, and

credit unions. Many depository institutions meet

the eligibility criteria -- about 11,000 banks

(including U.S. branches and agencies of foreign

banks) and 16,000 thrift institutions (including

credit unions) at the end of 1993. Any institution

holding deposits subject to reserve requirements

(such as transaction accounts and non-personal

time deposits) whether it is a Fed member or not

have access to the discount window.

All discount window credit must be secured to the

satisfaction of the Federal Reserve Bank that is

providing the credit. Satisfactory collateral

generally includes U.S. Treasury and federal

agency securities and, if of acceptable quality,

mortgage notes covering one to four -- family

residences; state and local government securities;

and business, consumer, and other customer notes.

Types of Credit

The three basic types of discount window credit

are adjustment credit, seasonal credit, and

extended credit.

Adjustment credit helps depository institutions

meet short-term liquidity needs. For example, an

institution experiencing an unexpectedly large

withdrawal of deposits may request adjustment

credit overnight or for a few days until it finds

other sources of funding. Seasonal credit assists

institutions in managing liquidity needs that

arise from regular, seasonal swings in loans and

deposits, such as those at agricultural banks

associated with the spring planting season or

during the Christmas gift buying season when

people traditionally drain their accounts.

Extended credit may be provided to depositories

experiencing somewhat longer-term liquidity needs

that result from exceptional circumstances. The

Fed sometimes provides credit to troubled

depositories to facilitate an orderly closure of

the institution and stop "contagion" to other

companies or allow a takeover.

Buying Government Securities (Open Market

Operations)

The other source of reserve supply is

non-borrowed reserves. The Fed exercises a certain

control over this supply through open market

operations-the purchase or sale of securities by

the Domestic Trading Desk at the Federal Reserve

Bank of New York. When the Fed buys securities in

the open market, it creates reserves to pay for

them, and the supply of non-borrowed reserves

increases. Conversely, when it sells securities,

it absorbs reserves in exchange for the

securities, and the supply of non-borrowed

reserves falls. In other words, the Federal

Reserve adjusts the supply of non-borrowed

reserves by purchasing or selling securities in

the open market, and the purchases are effectively

paid for by additions to or subtractions from a

depository institution's reserve balance at the

Federal Reserve. A Federal Reserve securities

transaction changes the volume of reserves in the

depository system: A purchase adds to non-borrowed reserves, and a sale reduces them.

When the Federal Reserve buys securities from any

seller, it pays, in effect, by issuing a check on

itself. When the seller deposits the check in its

bank account, the bank presents the check to the

Federal Reserve for payment. The Fed, in turn,

honours the check by increasing the reserve

account of the seller's bank at the Federal

Reserve Bank. The reserves of the seller's bank

rise with no offsetting decline in reserves

elsewhere; consequently, the total volume of

reserves increases (the amount of money in the

economy). Just the opposite occurs when the Fed

sells securities: The payment reduces the reserve

account of the buyer's bank at the Federal Reserve

Bank with no offsetting increase in the reserve

account of any other bank, and the total reserves

of the banking system decline (less money in the

economy). This characteristic-the

dollar-for-dollar change in the reserves of the

depository system with a purchase or sale of

securities by the Fed makes open market operations

the most common tool of monetary policy

(controlling the money supply).

The only financial instrument that is suitable

for open market operations is U.S. government

securities. The Fed carries out the greatest part

of its open market operations in that market. The

U.S. government securities market, in which

overall trading averages more than $100 billion a

day, is the broadest and most active of U.S.

financial markets. Transactions are handled over

the counter (that is, not on an organized stock

exchange), with the great bulk of orders placed

with specialized dealers (both bank and non-bank).

Although most dealer firms are in New York City, a

network of telephone and wire services links

dealers and customers regardless of their location

to form a worldwide market.

Most Fed purchases and sales of securities to

adjust conditions in the reserves markets are not

undertaken as a result of a general policy

decision. Rather they are made to offset other

influences on reserves. Certain factors beyond the

immediate control of the Fed stimulate purchasing

of securities such as the amount of currency in

circulation and the size of Treasury balances at

Federal Reserve Banks. The amount of currency in

circulation rises late in the year because

individuals tend to hold more currency during the

holiday shopping season. This rise in currency in

circulation drains reserves from the depository

system because, when a depositor withdraws

currency from a bank, the bank turns to the

Federal Reserve to replenish its depleted vault

cash and pays for the shipment of currency by

drawing down its reserve account. In contrast, a

decline in currency in circulation provides added

reserves.

Effects on Other Rates

The Fed's monetary policy works through the

market for reserves and involves the federal funds

rate. A change in the reserves market will trigger

a chain of events that affect other short- term

interest rates, foreign exchange rates, long-term

interest rates, the amount of money and credit in

the economy, even levels of employment, output,

and prices. For example, if the Federal Reserve

reduces the supply of reserves, the resulting

increase in the federal funds rate tends to spread

quickly to other short- term market interest

rates, such as those on Treasury bills and

commercial paper. Because interest rates paid on

many deposits in the money stock adjust only

slowly, holding balances in money (in a form

counted in the money stock) becomes less

attractive. As investors pursue higher yields

available in the market (for example, on Treasury

bills), the money stock declines. Moreover, as

bank reserves and deposits shrink, the amount of

money available for general lending may also

decline.

Bank Supervision

The Federal Reserve also plays a major

role in the supervision and regulation of the

U.S. banking system. The Fed's supervisory

responsibilities extend to all national banks,

which by law are automatically members of the

Reserve System, the roughly 1,000 state banks

that are members of the Federal Reserve System,

all bank holding companies, the foreign

activities of member banks, the U.S. activities

of foreign banks, and Edge Act and agreement

corporations (institutions that engage in a

foreign banking business). One member of the BoG

serves as the Fed's representative to the

Federal Financial Institutions Examination

Council (FFIEC), which is responsible for

coordinating, at the federal level, examinations

of depository institutions and related policies.

International Responsibilities

The Fed Chairman has formal responsibilities in

the international arena. He is the alternate U.S.

member of the Board of Governors of the

International Monetary Fund, a member of the board

of the Bank for International Settlements (BIS),

and a member, along with the heads of other

relevant U.S. agencies and departments, of the

National Advisory Council on International

Monetary and Financial Policies. Fed staff

represent U.S. and Fed interests at meetings at

the BIS in Basle and at the Organisation for

Economic Co-operation and Development in Paris.

The Chairman is also a member of U.S. delegations

to key international meetings, such as those of

the finance ministers and central bank governors

of the seven largest industrial countries-the

Group of Seven, or G7.

Federal Reserve Banks

A network of twelve Federal Reserve Banks and

their twenty-five Branches operates a nationwide

payments system, distributes the nation's currency

and coin, supervises and regulates member banks

and bank holding companies, and serves as banker

for the U.S. Treasury. All U.S. currency carries

the letter and number designation of the Reserve

Bank that first puts it into circulation. Each

Reserve Bank acts as a central depository for the

banks in its own District. The income of the

Federal Reserve System is derived primarily from

the interest on U.S. government securities that it

has acquired through open market operations. Other

major sources of income are the interest on

foreign currency investments held by the System;

interest on loans to depository institutions (the

rate on which is the so-called discount rate); and

fees received for services provided to depository

institutions, such as check clearing, funds

transfers, and automated clearinghouse operations.

The twelve Federal Reserve Banks are privately

owned through stocks by member banks. Stockholders

and the BoG choose the leadership of the Reserve

Banks. Theoretically the Reserve Banks have

unlimited access to U.S. securities for use in

emergencies. They are accountable to the BoG and

in a more limited way to a Congressional Oversight

Committee.

Member Banks of the Fed System

U.S. banks can be divided into three

types according to which governmental body

charters them and whether or not they are

members of the Federal Reserve System. Those

chartered by the federal government (through the

Office of the Comptroller of the Currency in the

Department of the Treasury) are national banks;

by law, they are members of the Federal Reserve

System. Banks chartered by the states are

divided into those that are members of the

Federal Reserve System (state member banks) and

those that are not (state non-member banks).

State banks are not required to join the Federal

Reserve System, but they may elect to become

members if they meet the standards set by the

BoG. At the end of 1993, 4,338 banks were

members of the Federal Reserve System -- 3,360

national banks and 978 state banks -- out of 11,212

commercial banks nationwide.

Payment System

The U.S. payments system is the largest in the

world. Each year billions of transactions, valued

in the trillions of dollars, are conducted between

payers (purchasers of goods, services, or

financial assets) and payees (sellers of goods,

services, or financial assets). The Fed is an

active intermediary in clearing and settling

interbank payments. The Fed Banks play this role

because they maintain reserve or clearing accounts

for the majority of depository institutions. They

can settle payment transactions by debiting the

accounts of the depository institutions making

payments and by crediting the accounts of

depository institutions receiving payments. The

Reserve Banks, as the mandated central bank, are

immune from liquidity problems (not having

sufficient funds to complete payment transactions)

and credit problems. Payments received in accounts

maintained at the Federal Reserve are free of

liquidity and default risk. For depository

institutions, the Fed Banks maintain reserve and

clearing accounts and provide various payment

services including collecting checks,

electronically transferring funds, and

distributing and receiving currency and coin. For

the federal government, they act as fiscal agents,

maintaining the U.S. Treasury Department's

transaction account, paying Treasury checks,

processing electronic payments, and issuing,

transferring and redeeming U.S. government

securities. The Fed Banks also perform numerous

specialized services for the federal government

and its agencies, such as redeeming food coupons

and monitoring special accounts -- Treasury tax and

loan accounts -- in which tax receipts are held until

the Treasury needs funds to make payments.

Providing Guarantees to the Largest Banks

The Fed's direct and ongoing participation in the

operation of the payments system lessens the risks

for individual banks. For example, the Fed's final

and irrevocable Fedwire funds transfer service

reduces the risk that failure of one institution