Alberta Government's $7.5 Billion Energy

Pay-the-Rich Scheme |

|

|

The number of U.S. workers projected to be directly employed during the two years of pipeline construction is estimated as low as 2,000 to as many as 5,000 workers with others benefiting from indirect employment. The Alberta government estimates 1,400 workers for the Canadian portion, while TC Energy has doubled that number. The Alberta government estimate is consistent with the number of temporary jobs to build other pipelines, and it seems TC Energy has inflated the numbers by adding together the number of workers needed in each year. Permanent jobs upon completion for the entire length are projected to be from 35 to 50.

TC Energy Corporation is a North American energy cartel based in Calgary. The company develops and operates energy infrastructure throughout the continent with its core businesses being Natural Gas Pipelines, Liquids Pipelines and Energy. The Natural Gas Pipeline network includes 92,600 kilometres of gas pipeline transporting more than 25 per cent of North American demand.[2] The Liquids Pipelines division owns 4,900 kilometres of oil pipeline transporting 590,000 barrels of crude oil per day, about 20 per cent of Western Canadian exports. The Energy division owns or has interests in 11 power generation facilities with combined capacity of 6,600 megawatts (MW), including nuclear and natural gas fired power plants.

The global financial oligarchy owns TC Energy through shares traded on the imperialist stock markets. Four hundred and eighty-eight institutional investors own 62 per cent of the stock. The largest owner is the Royal Bank of Canada with over 8 per cent. Other big Canadian banks own a further 9 per cent while global investors The Vanguard Group Inc. own 3.16 per cent, Deutsche Bank 2.71 per cent followed by many of the big names of the financial oligarchy.

Notes

1. U.S. Judge Brian Morris ruled in a Billings, Montana court on April 15 that the U.S. Army Corps of Engineers failed to adequately consider effects of the Keystone XL pipeline and its construction on endangered species as it traverses rivers and streams. The ruling cancels a key 2017 nationwide Clean Water Act permit for the XL project throwing its continuation into greater uncertainty.

It is becoming clear that this ruling involves the raging civil war in the U.S. The venom against former U.S. President Obama and those in the ruling elite calling for investment in renewable energy, rather than carbon fuels, in the pages of the mouthpiece of the Alberta energy oligarchs, called Oil Sands Magazine, is one example. Furthermore, President Trump's first Secretary of State was Rex Tillerson, Chairman and Chief Executive Officer of ExxonMobil, which has vast investments in Russia.

2. LNG Canada partners Royal Dutch Shell, Korea Gas Corporation, Mitsubishi Corporation, PetroChina Company and PETRONAS have contracted TC Energy to build, own and operate the much disputed Coastal GasLink Pipeline Project in northern BC.

U.S. Imperialism Uses Alberta Oil to

Force Regime Change in Venezuela

Make Canada a factor for peace!

The U.S. Gulf Coast (USGC) refineries are

designed for heavy oil. They also blend heavy

crude with the very light oil from the now

oversupplied hydraulically fracked oil extracted

from shale deposits. The heavy oil is also a base

for certain oil products that lighter oil cannot

deliver.

Heavy oil from Venezuela long supplied the USGC

refineries with plentiful cheap supply controlled

by global energy cartels such as ExxonMobil. The

Venezuelan government prior to Hugo Chavez coming

to power in 1999 did little to collect royalties

or any form of taxes and rent from the U.S. for

taking its oil or to enforce environmental or

workplace regulations.

The value from oil extraction and sale to the U.S.

heavy oil refineries on the U.S. Gulf Coast was

not poured back into Venezuela to diversify the

economy into manufacturing or to invest in social

programs and public services. The vast new value

created in the oil industry mostly left the

country. A change in that anti-national

anti-social direction of the Venezuelan economy

occurred when Hugo Chavez came to national

political power as President in 1999 and continues

to this day under President Maduro.

In reaction to the 1999 change in direction in

Venezuelan political and economic affairs, the

U.S. imperialists began an unrelenting campaign of

sabotage and terror against the Venezuelan economy

and people including sanctions, assassinations,

kidnappings, direct attempts for regime change and

threats of invasion to restore a government and

economic direction under the dictate of the U.S.

imperialists and their energy cartels.

Alberta Heavy Oil as a Pawn in the U.S. War Against Venezuela Making Canada a Factor for War

The U.S. imperialists seek to crush through

sanctions and other means the economy of

independent Venezuela and in this way impose

regime change. An aspect of the U.S. war economy

for regime change in Venezuela directly involves

Alberta and its heavy oil. The U.S. ruling elite

began to supplant Venezuelan heavy oil in the USGC

soon after Hugo Chavez came to power in 1999. This

involved developing means of transporting Alberta

oil to the USGC along with vastly increasing the

capacity of Alberta s heavy oil production.

Alberta oil has gradually replaced Venezuelan oil

in the USGC especially during the last ten years.

U.S. imports of Canadian heavy crude have more

than doubled in the past decade with much of the

growth going to the USGC rising from 100,000

bbl/day in 2014 to over 650,000 bbl/day by the

middle of 2018. The year 2014 is important as it

marks the completion of an Enbridge-built 1,607 km

pipeline from Hardisty, Alberta to Superior,

Wisconsin. Called Line 67 (Alberta Clipper), the

pipeline began to transport 450,000 barrels per

day, which has since been expanded to 800,000 bpd.

The Alberta oil gathered in Superior is available

for reshipment through Enbridge or other pipelines

and by rail and trucks south to the USGC.

The Keystone network of pipelines began sending

Alberta oil to the U.S. in 2013. The first two

phases are capable of delivering 590,000 barrels

per day to the U.S. Midwest refineries. Keystone

Phase III completed in 2016 can deliver up to

700,000 barrels per day to the Texas refineries.

The proposed Phase IV is called the Keystone XL.

The U.S. imperialists want increased shipments of

Alberta crude and have directed its Alberta flunky

Premier Kenney to use public funds to finance the

construction of the stalled TC Energy Keystone XL.

If completed, the XL is designed to transport

830,000 bbl/day of crude oil from Alberta to the

refineries of the U.S. Gulf Coast.

In addition to oil transported to the USGC through

pipelines, Statistics Canada reports Canadian

crude exports to the U.S. by rail jumped from

300,000 bbl/day at the end of 2018 to 400,000

bbl/day in 2019

Click image to enlarge

Click images to enlarge[1]

U.S. Uses Alberta Oil in its Campaign of Regime

Change

Against Venezuela

The U.S. Gulf Coast (USGC) is one of the world's

largest refining hubs, containing some of the

world's most complex high-conversion refineries.

That makes the region the most important buyer of

heavy sour crude produced globally. The U.S.

imperialists use USGC, called PADD 3, to set the

price for most oil blends including Alberta heavy

oil.

The USGC region historically relied on heavy oil

imports from Venezuela, Mexico and Colombia but

with the campaign of sanctions and regime change

against Venezuela and dwindling supplies of heavy

oil from Mexico, the U.S. imperialists sought to

bring in more heavy oil from Alberta and more

recently export the U.S. surplus of domestically

produced light crude, which has increased

dramatically with the widespread use of hydraulic

fracturing. This dual dynamic of increased heavy

oil production in Alberta and light oil in the

U.S. was a key factor in the dramatic fall in oil

prices and subsequent energy crisis that is

playing out today.

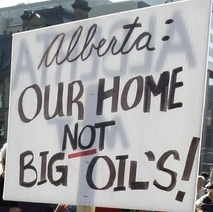

Reject U.S. Imperialist Control

of Alberta Oil!

Time for a New Direction for the Economy!

Make Canada a Factor for Peace!

Note

1. Comparing Alberta oil production in year 2002

with 2018 (Source: Alberta

Energy Regulator)

2002

In 2002, conventional oil production of light,

medium and heavy crude accounted for just over 43

per cent of Alberta s total crude production. Oil

sands (bitumen, upgraded crude), pentanes and

condensates made up the balance.

Alberta s conventional oil production of 660,400

barrels per day represented an 8 per cent drop

from 2001 levels. Total crude and equivalent

production of 1.53 million barrels per day in 2002

represented about 65 per cent of Canada s total

output.

Exports to the US were 1.02 million barrels per

day.

Oil sands production of bitumen and synthetic

crude increased in 2002-03 for the fourth

consecutive year, rising from 645,000 barrels a

day to a record high of over 740,000 barrels a

day, according to the Energy and Utilities Board.

Production of raw bitumen (before mined bitumen is

upgraded to synthetic crude) reached a record high

of over 800,000 barrels per day. Oils sands

production in 2002 was also greater than

conventional oil production for the first time.

2018

Crude Bitumen Production Crude bitumen

production increased by about 7.5 per cent from

2.83 million barrels per day in 2017 to 3.05

million barrels per day in 2018, and therefore

continued a rising trend that has been underway

since 2008. This was the first time that the

annual crude bitumen production in Alberta

exceeded three million barrels per day. Total

crude bitumen production is comprised of mined

production and in-situ production.

The share of crude bitumen production as a

percentage of global consumption also increased in

2018, to 3.1 per cent from 2.9 per cent in 2017.

Production of crude oil and equivalent (condensate

and pentanes plus) increased by about 13 per cent,

from about 715,800 barrels per day in 2017 to

about 808,300 barrels per day in 2018.

Conventional production increased by almost 10 per

cent from 2017 to 2018, from about 446,100 barrels

per day to about 489,600 barrels per day.

Oil Production 2017/2018

Total bitumen production in barrels per day

2.83 million bbl/d (2017)

3.05 million bbl/d (2018)

Conventional Crude Oil Production

0.45 million bbl/d (2017)

0.49 million bbl/d (2018)

Total Crude and Equivalent

Production (conventional, marketable bitumen and

SCO, pentanes plus and condensates)

3.40 million bbl/d (2017)

3.72 million bbl/d (2018)

Removals from Alberta

3.25 million bbl/d (2017)

3.53 million bbl/d (2018)

For Your Information

Magazine Speaks for Alberta Energy Oligarchs

The online Oil Sands Magazine is a mouthpiece of the Alberta energy oligarchs who are integrated with a faction of the U.S. financial oligarchy. The magazine is not shy in describing and promoting the private interests of the energy oligarchy as evidenced in the following excerpts from the article "Why Venezuela is Alberta's biggest competitor."

"Venezuela was once the largest supplier of heavy oil to the US. [Venezuela] took steps to liberalize its petroleum sector in the 1990s, allowing private investment into its oil and gas industry. [ExxonMobil, Total, Shell, Chevron and BP invested heavily in the Venezuelan oil sands producing heavy oil - TML Ed Note.] U.S. Gulf Coast refineries retooled their operations to accommodate this heavy sour feedstock, taking advantage of its discounted price. Imports to the U.S. [from Venezuela] peaked at 1.8 million barrels per day in 1997.

"But in 1999, Hugo Chavez convinced the people of Venezuela they were being robbed by the greedy oil companies, dramatically raised taxes and royalties on new and existing projects. The government cannibalized its energy sector, diverting oil and gas revenues into social programs. Chavez began exporting more oil to Asia in an effort to diversify away from U.S. customers. Exports to the U.S. declined abruptly in 2002 . U.S. refiners who relied on this lucrative heavy oil stream went into panic mode, as their main supplier was dwindling fast."

[The magazine fails to mention that the Venezuelan oil sector during this period suffered unrelenting attacks of sabotage and a growing refusal of U.S. and European energy companies to reinvest the value they expropriated from Venezuelan oil production back into the means of production. -- TML Ed. Note]

"Alberta can thank Venezuela in part for the strong growth in oil sands production seen over the past years. Chavez's erratic behaviour sent many oil majors north to the safe haven of Canada. Although capital and operating costs are much higher in Canada, lower royalty rates, oil-friendly government regimes and excellent proximity to U.S. refineries made Canadian heavy a highly desirable replacement for the heavy sour Venezuelan crude the U.S. so desperately needed.

"Oil majors like Shell and Exxon have long had a stake in Alberta's oil sands, dating back to the 1950s. Exxon, through its ownership of Imperial Oil, bet big on the oil sands, launching the behemoth Kearl Oil Sands Mine. French oil major Total bought its way into Alberta's oil sands through the purchase of Deer Creek in 2005, Synenco in 2008 and UTS in 2010. ConocoPhillips, who already owned 9 per cent of Syncrude, divested its mining assets in 2010 and moved its eggs into the thermal in-situ basket through a partnership with Cenovus. BP also joined the thermal in-situ parade, partnering up with Husky and Devon Energy in 2012.[1]

"Not only do these projects produce the right kind of heavy oil, they also add significant long-life reserves to the company's balance sheets. Money flowed steadily into Canada. Heavy oil production, primarily exported to the U.S., rose proportionately as new facilities came online. Life was good in the oil patch.

[The magazine presents only a half-truth. Money flowed into Alberta but also flowed out in the form of expropriated profit. The lower royalty rates and oil-friendly government regimes in Alberta have meant that very little of the new value oil workers have produced has stayed in Alberta to develop a diversified economy and for use as investments in social programs. The magazine denounces the Venezuelan governments of Chavez and Maduro for raising taxes and royalties on new and existing projects and diverting oil and gas revenues into social programs, which it calls, "reckless social spending." -- TML Ed. Note]

"The election of a left-wing U.S. president in 2008 sent billions of taxpayers dollars flowing into renewables. The country's largest investment funds scrambled for a piece of the action, pushing the climate change agenda to ensure money would keep flowing their way."

[Note that the magazine throws darts at pay-the-rich schemes for renewable projects, which have made billionaires out of left-wing politicians such as former Clinton Vice-President Al Gore but the same magazine constantly demands pay-the-rich schemes for carbon energy oligarchs such as themselves from oil-friendly government regimes. Two are Premier Kenney's $7.5-billion state handout for the Keystone XL project and Prime Minister Trudeau's $4.5-billion purchase of the Trans Mountain pipeline to Vancouver with more to come from secret talks underway between the federal and provincial governments. -- TML Ed.]

"The U.S.-funded anti-fossil fuels campaign set its sights squarely on the oil sands and blocked all exits for Alberta's heavy oil. Canadian politicians joined the bandwagon.... Heavy oil production soon outpaced pipeline capacity, forcing crude onto expensive railcars, straining the profitability of Alberta's oil sands operations...

"Many people believe Venezuela's government is far too unstable to attract foreign investment. To be fair, Venezuela's problems began long before the collapse in oil prices. Chavez's successor, President Maduro, is a leftist enforcer of his predecessor's outdated policies. Reckless social spending has rendered their currency worthless, resulting in a 700 per cent inflation rate....

"The quasi-democratic government has found

unlikely allies in the governments of China and

India, who are desperate for energy security. The

country has received serious cash injections from

China, estimated at $56 billion over the past nine

years, taking oil payments in lieu of cash."

Note

1. Since this article was published in 2016, there has been a flight of capital from the oil sands. Shell has sold all of its in-situ and undeveloped oil sands interests and reduced its share in the Athabasca Oil Sands Project (AOSP) from 60 per cent to 10 per cent. Total has sold off some assets and continues to express interest in getting out of the oil sands completely, which Oil Sands Magazine says are reported to be among the least economically-viable assets in its portfolio. Norway's Statoil has exited the oil sands completely. Both Imperial Oil and ConocoPhillips consider significant "proven reserves" they hold may not be economical to produce. Houston-based Marathon Oil has sold all its oil sands operations.

(To access articles individually click on the black headline.)

Website: www.cpcml.ca Email: editor@cpcml.ca

Alberta Premier

Jason Kenney announced on March 30 that the

government would give the private energy cartel TC

Energy $1.5 billion to kick-start construction of

the disputed Keystone XL pipeline from Hardisty,

Alberta to Steele City, Nebraska.

Alberta Premier

Jason Kenney announced on March 30 that the

government would give the private energy cartel TC

Energy $1.5 billion to kick-start construction of

the disputed Keystone XL pipeline from Hardisty,

Alberta to Steele City, Nebraska.