|

May 5, 2016 Ownership of U.S. Steel Is U.S. Steel Conspiring to  Ownership

of

U.S.

Steel Ownership of U.S. Steel Is U.S. Steel Conspiring to Pull Another Fast One?U.S. Steel recently unveiled a new corporate structure for its tubular operations. Ownership of the U.S. Steel Seamless Tubular Operations has been transferred to a new holding company, a wholly owned subsidiary of U.S. Steel called U.S. Steel Tubular Products Holdings, LLC. The news was met with scepticism not just in Canada, where people have seen this story before, but also at the centre of U.S. Steel control. The Pittsburgh Post-Gazette, usually an avid USS cheerleader, carried an item entitled "Revamp at U.S. Steel raises eyebrows," from which extracts are available below. In Canada, USS revamped its ownership of the former Stelco before putting it into bankruptcy protection in September, 2014. In the most self-serving manner, USS declared to incredulous observers that it had magically transformed its equity ownership in Stelco into debt owed to itself.

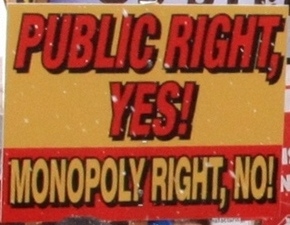

Denial of a Socialized Economy Is at the Heart of the Recurring Crises They are past masters at blaming steelworkers and foreign competitors for the problems in the steel sector and the U.S. economy generally. They refuse to face the broad problems in the sector directly with genuine reforms serving the public interest. For example, they scoff at any suggestion to introduce regulations and control over prices and supply through a public authority in the wholesale sector, complaining that this would infringe on their monopoly right to control everything. Indeed, solutions to the problems faced in the economy would restrict monopoly right and transfer control away from the domination of private monopoly interests into the domain of the public interest and the actual producers. The executives and directors reject any proposals that would serve the public good and interest. They prefer to scream at other countries, fire workers, attack people's rights, destroy productive capacity and engage in corporate manipulation to shift the burden of losses onto others as much as possible without sorting out any basic problems. The problems return with a vengeance because they emerge from the root socialized nature of industrial mass production and cannot be solved with solutions serving narrow private interests. Solutions of a broad social character serving the public interest are necessary but those in control refuse even to discuss proposals the actual producers have long put forward. The situation has reached a point where the only path forward for the working class is to deprive the ruling imperialist elite of their control over the basic sectors of the economy so that the working people can implement a pro-social agenda of their own making.

Wrecking the Productive Forces and Attacking

|

|

U.S. Steel (USS) continued to argue in court on April 29 against opening the Investment Canada Act (ICA) Settlement Agreement. The secret agreement ended the federal government's lawsuit against USS for violating the terms of the original ICA deal upon its purchase of the Stelco steel company. USS says opening the agreement to public scrutiny violates its monopoly privilege.

The issue presents itself

as one of private monopoly interests in opposition to the public

interest. USS does not want any challenge to its monopoly right from

the general public right

of Canadians, much less from the particular steelworkers and

communities directly affected by its anti-social actions. The U.S.

monopoly does not want any serious scrutiny of the Stelco

saga from the first time it entered bankruptcy protection under the Companies'

Creditors

Arrangement

Act (CCAA) back in 2004 to the

present. A proper public accounting

would expose U.S. Steel's financial manipulation, attacks on workers'

rights and Canadian economy, and other anti-social actions serving its

monopoly right and narrow private interests.

The exposure would also be a general indictment against the current

system and public authorities, who have allowed these attacks to

continue with impunity.

Since Stelco's first sojourn in CCAA in 2004, the public authorities in Canada and Ontario have done nothing to defend the public interest. They have bent over backwards to accommodate those in control of Stelco and U.S. Steel, who have acted with impunity to serve their narrow private interests against the broad public interest and the workers, retirees and communities directly involved. The public authorities have given concession after concession to monopoly right including waving Ontario law governing pensions and allowing USS to renege on its commitments under the ICA. The Ontario government even gave the Stelco conspirators a $150 million loan, which USS now refuses to pay back.

Throughout this long ordeal, leaders of the steelworkers have presented solutions to solve problems in the public interest, not only at Stelco but generally in the Canadian steel sector and economy, which for years has been under a neo-liberal siege from monopoly right. Algoma (Essar) Steel in Sault Ste. Marie is presently under CCAA for the third time. The public authorities and their institutions have simply ignored and dismissed the steelworkers' solutions. No serious discussion or argument over their proposals has occurred in official circles, the mass media, universities or any public authority, and that is a big problem facing the people. Monopoly right and its narrow private interests dominate public discussion, the public authorities and public space.

No public organizational

form exists that can hold and sustain a discussion on how to solve

problems in the economy such as those facing the steel sector. No

consistent discussion is

allowed in the courts, in the Ontario Legislature, Parliament, the

universities or mass media. Monopoly right and its private interests

dominate all public spaces where discussion should take

place to solve problems, create public opinion and find a way forward.

No public organizational

form exists that can hold and sustain a discussion on how to solve

problems in the economy such as those facing the steel sector. No

consistent discussion is

allowed in the courts, in the Ontario Legislature, Parliament, the

universities or mass media. Monopoly right and its private interests

dominate all public spaces where discussion should take

place to solve problems, create public opinion and find a way forward.

Only where the steelworkers themselves have organized discussion on the problems the steel sector and economy face does it occur, such as at Local 1005's Thursday meetings, the demonstrations, rallies and mass meetings steelworkers have organized, and in the publications of the Workers' Opposition, as well as Information Update and The Marxist-Leninist Daily and Weekly. This is the reality the working class movement faces. It has to build its own institutions where public right confronts the class privilege of monopoly right and fights for the recognition and realization of the public interest and the building of a stable modern self-reliant economy.

A self-reliant economy serving the public interest begins from a region and country where the people can build their own public authorities exercising sovereign jurisdiction over their affairs, with their own government of laws, which an empowered people control. An economy that has its own internal diverse strength to guarantee the rights and well-being of all engages in international trade based on mutual benefit to complement the internal economy not weaken it.

Through resolute resistance to monopoly privilege and attacks on workers' rights, and with the conscious nurturing of its own institutions, the working class can form a powerful public opinion and popular movement to solve problems and move the country forward to a modern democratic Canada.

Control and Ownership of Monopolies

Time for a new direction

Many Canadians are

perplexed how U.S. Steel (USS) could simply disavow ownership of its

wholly-owned Canadian subsidiary and have its assertion accepted in a

court of law.

By abandoning ownership of the former Stelco, it appears USS had a plan

to turn the actual ownership into a debt prior to applying for

bankruptcy protection under the Companies'

Creditors

Arrangement

Act (CCAA). In that way, if the court accepts, the fraudulent

CCAA process means USS stands to gain around $2.2 billion, if and when

the former Stelco assets are sold. This windfall

would come its way without any encumbrance of environmental cleanup or

responsibility for the pension plans and post-retirement benefits and

would mostly eliminate the former Stelco as

a competing steel producing company.

The CCAA fraud leads many to wonder about ownership in today's economy so dominated by monopolies. If USS can so easily disavow its equity ownership in Stelco as part of a larger plan to seize the assets under bankruptcy protection, what is the essence of ownership of these big companies? It certainly is not similar to a small group or family owning an economic unit and depending on that unit and its productive assets for their living.

The question is not merely scholastic, as it pertains to control of our basic industries and the aim we set as a people for the economy. Who has legal control over the monopolies, especially those owned widely through stocks? If ownership can so easily be repudiated for self-serving reasons such as USS has done with Stelco, perhaps the time has come for the people to centre their concern in the economy on control and not formal ownership of the industrial giants, which are crucial to the functioning of the overall economy and well-being of the people.

Perhaps ownership should be

downgraded in importance

and left merely as one factor in the running of a monopoly. Control

could be exercised in the public interest through a public

authority with ownership receiving an average rate of profit but no

direct control over the operations and its overall aim. Other crucial

factors with regard to the monopoly could then be

addressed, especially its accounting and the claim of governments on

the value workers produce, and in the larger scheme of things, control

of wholesale prices and imports and exports, and

to develop a positive stable relation between supply and demand within

the national economy.

Perhaps ownership should be

downgraded in importance

and left merely as one factor in the running of a monopoly. Control

could be exercised in the public interest through a public

authority with ownership receiving an average rate of profit but no

direct control over the operations and its overall aim. Other crucial

factors with regard to the monopoly could then be

addressed, especially its accounting and the claim of governments on

the value workers produce, and in the larger scheme of things, control

of wholesale prices and imports and exports, and

to develop a positive stable relation between supply and demand within

the national economy.

The separation of control from ownership is not so farfetched given the fact that most big companies are run by professional executives who are not direct owners other than through the shares given to them as bribes to toe the capital-centred line and narrow aim of the owners. Most ownership of monopolies is widely held. If the company's equity is traded on the stock market the ownership is further spread out through the companies or institutions that own the stock. In turn, those institutions are owned by other companies forming the overall financial oligarchy that dominates the economy and country. The key issue with control is to transform the aim from one of serving narrow private interests and empire-building, to one of serving the public interest for the greater good of a stable diverse economy for nation-building to guarantee the rights of all.

Ownership of U.S. Steel

Ownership of USS exists both through ownership of equity stocks and ownership of debt. The same owners can and do own both equity and debt as is the case with USS. Both ownership groups, which overlap, exercise influence in choosing directors and executives of a company to ensure "their people" are appointed to positions of control.

In the case of USS, equity and debt ownership in money value is about equal depending on the share price of USS stock. Moneylenders own about $2.5 billion of USS debt. Stock equity at present totals about $2.7 billion but has in recent times dropped below the total for debt.

The overlap between equity and debt ownership arises from the fact that most of today's equity and debt ownership of the monopolies is institutional and broadly held amongst the financial oligarchy. The institutions are generally a type of financial enterprise or investment fund that controls or manages the social wealth of both wealthy individuals and not-so-wealthy individuals through the banking, pension and savings system. The total social wealth is controlled by what could be called generically as Social Wealth Controlling Funds (SWCFs). These SWCFs, which are banks, insurance companies, hedge and mutual funds, pension plans etc, invest the money they control throughout the imperialist system of states in a manner that strengthens their private interests and empire-building. This gives these SWCFs enormous control and influence over the operations of most companies either through equity or debt ownership and further over the entire economy and politics wherever they operate.

In the case of USS, 329 institutional investors own over 77 per cent of the equity shares. Almost all the institutions are SWCFs that invest in equity, lend money and engage in every parasitic practice yet devised by the financial oligarchy. Many have been heavily involved in corrupt schemes resulting in criminal convictions or at least have agreed to government penalties for obvious wrongdoings. The shares, and debt, they own in USS and other companies are constantly being sold and bought anew by themselves and others. A volatile stock price presents an opportunity for a big score.

The same monopolies, such as JPMorgan Chase that owns 16 per cent of all outstanding USS shares, UBS, Morgan Stanley, Deutsch Bank etc, which buy and sell USS stock, and debt, also constantly release investor information to either boost its stock price or depress it. Two rivals with apparently different agendas for buying and selling USS stock, JPMorgan Chase and UBS, recently issued totally contrasting assessments of the stock within two days of each other.

One thing is certain, volatility in a stock price is their bread and butter as that means investors are either buying or selling and the SWCFs make money either directly or through user fees as brokers. All this has nothing to do with building a stable economy that serves nation-building, and that is the big problem as we have experienced with U.S. Steel's control of Stelco.

Control over the basic

industries in the economy has to

be removed from the hands of the financial oligarchy and its

empire-building. Public control would introduce a new direction

and aim away from the narrow aim of private interests and the damage it

causes and its unwillingness and inability to solve problems. The old

direction can be readily seen with the recent

history of the former Stelco and indeed U.S. Steel in the United

States, which involves the wrecking of the industry not its building

through solving fundamental problems of

nation-building.

Control over the basic

industries in the economy has to

be removed from the hands of the financial oligarchy and its

empire-building. Public control would introduce a new direction

and aim away from the narrow aim of private interests and the damage it

causes and its unwillingness and inability to solve problems. The old

direction can be readily seen with the recent

history of the former Stelco and indeed U.S. Steel in the United

States, which involves the wrecking of the industry not its building

through solving fundamental problems of

nation-building.

A new direction has to be found and one idea is to have public authorities put in charge of the basic industries and charged with the social responsibility of solving problems in the public interest to ensure particular monopolies serve the overall economy and play their important role such as to produce steel in the case of Stelco to meet Canada's apparent demand. Ownership, both debt and equity, could receive its claim on the value workers produce according to a national average rate of return but would be removed from any direct control over the facility.

A new aim of serving the public interest and strengthening the economy for nation-building would guide the public authority in control. The people, especially the workers directly involved in a monopoly, would be charged with ensuring the new aim is faithfully followed.

Social Wealth Controlling Funds that Own Shares in U.S. Steel

Below is a list of the main institutional owners of U.S. Steel stock equity, the Social Wealth Controlling Funds (SWCFs), followed by the number of shares owned.

Total Shares Outstanding: 146,284,894.00

Valued at $18.49 per share on April 26: $2,704,807,690.06

Shares owned by the 329 SWCFs: 113,943,643 (77.82 per cent) valued at $2,106,817,959.07

A majority of the institutional shares (23,416,059) is

owned by JPMorgan Chase, a traditional owner of U.S. Steel. Of course,

JPMorgan is also a large moneylender as are most of the

institutional owners. All the owners in the list are SWCFs. Most are

both owners of equity and debt. They

call themselves banks, hedge or investment funds

or trusts with the odd pension fund included. They all control huge

amounts of social wealth used to enrich the financial oligarchy,

consolidate class privilege and direct the economy to

serve private interests and global empire-building. The list below

includes only the top 45 SWCFs of the 329 by order of number of

shares as of the end of 2015. The entire list can

be found here.

| Company |

Shares |

| JP Morgan Chase

& Co |

23,416,059 |

| Fairpointe Capital

LLC |

9,777,866 |

| Vanguard Group Inc |

9,518,759 |

| State Street Corp |

5,202,522 |

| Blackrock Fund

Advisors |

4,936,081 |

| Amerigo Asset

Management |

4,386,242 |

| Blackrock

Institutional Trust Company, N.A. |

4,188,640 |

| Morgan Stanley |

4,032,639 |

| Susquehanna

International Group, LLP |

3,376,294 |

| Hodges Capital

Management Inc. |

2,673,689 |

| Capital Research

Global Investors |

2,486,000 |

| Luminus Management

LLC |

2,143,083 |

| Dimensional Fund

Advisors LP |

2,098,047 |

| Bank of New York

Mellon Corp |

1,689,371 |

| AQR Capital

Management LLC |

1,679,479 |

| Norges Bank |

1,513,820 |

| Ameriprise Financial

Inc |

1,382,593 |

| Northern Trust Corp |

1,278,243 |

| Goldman Sachs Group

Inc |

1,259,526 |

| Deutsche Bank AG |

1,198,783 |

| UBS Group AG |

972,539 |

| Credit Suisse AG |

883,963 |

| Geode Capital

Management, LLC |

844,472 |

| Managed Account

Advisors LLC |

776,504 |

| Two Sigma

Investments LLC |

764,933 |

| Allianz Asset

Management AG |

598,366 |

| First Trust Advisors

LP |

572,672 |

| Bank of America Corp

/DE/ |

539,329 |

| Vollero Beach

Capital Partners LLC |

527,066 |

| Blackrock Investment

Management, LLC |

500,526 |

| California Public

Employees Retirement System |

495,600 |

| Price T Rowe

Associates Inc /MD/ |

490,149 |

| Tiaa Cref Investment

Management LLC |

461,646 |

| Principal Financial

Group Inc |

439,335 |

| State of New Jersey

Common Pension Fund D |

425,000 |

| QS Investors, LLC |

401,595 |

| Schwab Charles

Investment Management Inc |

393,704 |

| Creative Planning |

390,192 |

| Wells Fargo &

Company/MN |

384,267 |

| American

International Group Inc |

365,479 |

| Nomura Holdings Inc |

360,593 |

| BBT Capital

Management, LLC |

360,000 |

| Barclays PLC |

351,320 |

| New York State

Common Retirement Fund |

334,000 |

| KCG Holdings, Inc. |

315,134 |

(Source: NASDAQ)

Read The Marxist-Leninist

Daily

Website: www.cpcml.ca

Email: editor@cpcml.ca

Those in control of U.S.

Steel deny the social interrelated nature

of the modern economy, which arises from its roots in industrial mass

production. They think steel production is a

private concern and not a public one, and that private ownership and

control is the most important factor in production. Instead of taking a

broad social approach and viewpoint in assessing

the problems at the company and steel sector, they look only to protect

their ownership and control of social wealth, their narrow private

interests.

Those in control of U.S.

Steel deny the social interrelated nature

of the modern economy, which arises from its roots in industrial mass

production. They think steel production is a

private concern and not a public one, and that private ownership and

control is the most important factor in production. Instead of taking a

broad social approach and viewpoint in assessing

the problems at the company and steel sector, they look only to protect

their ownership and control of social wealth, their narrow private

interests.  "Joseph P. Nicola Jr., a

tax partner at Sisterson & Co. said

forming an LLC 'is a signal they are concerned about legal liabilities.'

"Joseph P. Nicola Jr., a

tax partner at Sisterson & Co. said

forming an LLC 'is a signal they are concerned about legal liabilities.'