September 17, 2021 -

No. 84

Workers

Must Control Economic Policy and Economic Outcomes

Canadian

Workers' Pension Monies Used to Privatize Water in Brazil

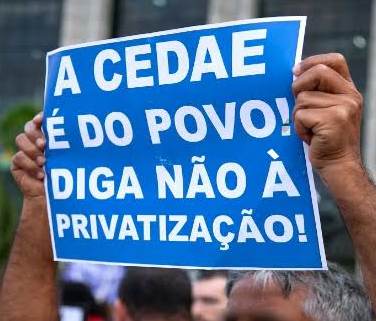

Protest in Brazil, May 3,

2021, against privatization of water and sewage services.

•

Greenwashing Privatization of

Public Utilities •

"Financialization" of Government

Pension Programs

BC

Government's Sell-Off of Public Lands to Powerful Private Interests

• Corruption to

Profit Privileged Buyers

- K.C. Adams

Workers

Must Control Economic Policy and Economic Outcomes

São Paulo,

Brazil, June 11, 2021. São Paulo,

Brazil, June 11, 2021.

One of the matters of ever greater concern

amongst Canadian workers is their lack of control over where their

pension monies are invested. These very large pools of money are put

into the hands of investment companies, financial institutions and

financial oligarchs whose job is to seek the highest return for

themselves

and sometimes but not always the safest bet, irrespective of where the

funds are invested. The workers exercise no control over the fact that

investments are done according to neo-liberal considerations and go

against everything Canadian workers on the whole stand for. The current

term for it is "financialization." It refers to a process whereby

financial markets, financial institutions and financial elites gain

greater influence over economic policy and economic outcomes. The

process transforms the functioning of economic systems at both the

macro and micro levels both at home and abroad in favour of these

narrow

private interests no matter what harm they cause to the social and

natural

environment. Under the guise that business is business, very harmful,

unacceptable nation-wrecking and anti-people investments are made.  Such

is the case with the investment made on April 30 of this year of more

than $900 million of Canadian workers' pension money to privatize water

and sanitation services in Brazil. A large section of Rio de Janeiro's

State Water and Sewage Company (CEDAE) was purchased at auction by a

private company 85 per cent owned by the Canada Pension Plan Investment

Board (CPPIB) and the Alberta Investment Management Corporation (AIMCo). Such

is the case with the investment made on April 30 of this year of more

than $900 million of Canadian workers' pension money to privatize water

and sanitation services in Brazil. A large section of Rio de Janeiro's

State Water and Sewage Company (CEDAE) was purchased at auction by a

private company 85 per cent owned by the Canada Pension Plan Investment

Board (CPPIB) and the Alberta Investment Management Corporation (AIMCo).

CEDAE was the most profitable water system in Brazil, bringing

in

$226 million a year, with part of these revenues used to subsidize

services in areas where costs were higher. AIMCo,

which says it manages the investments for 32 pensions,

endowments and government funds in the Province of Alberta, already

possessed a significant stake in Brazil's third largest private water

and sewage company, Iguá Saneamento, used to acquire part of

the public

utility. However it was a last minute infusion of some $270 million

from CPP Investments, giving it 46.7 per cent ownership of

Iguá, that

was decisive in allowing the company to win the bid for CEDAE.

In preparation for the auction CEDAE was divided into blocks

or

concessions. The most lucrative concessions were scooped up by private

interests, one of these being Iguá. The least profitable

ones remained

in the hands of the state, likely ending its ability to continue using

the profits from some to subsidize others. It will likely also push

rates

up for users already in the grips of a severe economic crisis.

Residents living in areas of Rio already serviced by private companies

are said to pay up to 70 per cent more for water than those serviced by

the public system.  Opposition

by unions and others in Brazil as well as Canada to the privatization

of water and sanitation systems was swift. Brazilian unions said 3,500

public sector workers stood to lose their jobs. The Brazilian National

Urban Workers Union applied for and won an injunction to delay the

auction. State legislators also voted out of concern

for it to be delayed. Both of them were overruled by a government

decree that ordered the auction to go ahead as scheduled. Opposition

by unions and others in Brazil as well as Canada to the privatization

of water and sanitation systems was swift. Brazilian unions said 3,500

public sector workers stood to lose their jobs. The Brazilian National

Urban Workers Union applied for and won an injunction to delay the

auction. State legislators also voted out of concern

for it to be delayed. Both of them were overruled by a government

decree that ordered the auction to go ahead as scheduled.

The

auction took place in the midst of the terrible crisis Brazil was

going through thanks to President Jair Bolsonaro's reckless response

to the pandemic and the grim consequences of this for Brazilians. It

turns out the timing was likely deliberate. Bolsonaro's former

environment minister was secretly recorded urging colleagues at a

cabinet

meeting to take advantage of the pandemic and of people having other

preoccupations to get as many unpopular policies passed as they could,

as quickly as they could. Canadian Union of Public

Employees President Mark Hancock accused

CPP Investments of helping to legitimate Bolsonaro's privatization

agenda, saying "It's outrageous that our public pension plan is using

workers' retirement funds to profit from people's need for clean water

and safe sewage treatment. These are human rights that are

essential for survival. Access to water services is already fragile and

unequal in Brazil. Privatization will make things worse." The

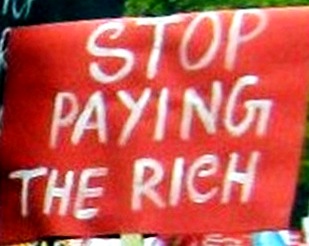

handing over of Canadian workers' retirement funds without their

consent, and over their objection, to pay the rich through schemes

geared to assisting private interests at home and abroad to line their

pockets is unacceptable. It is all the more repugnant when it is

defended in the name of high ideals to detract from the anti-social and

nation-wrecking consequence of the investments. The

facts reveal that workers must control economic policy and

economic outcomes. They must set the direction of the economy and end

the policies which pay the rich and destroy the social and natural

environment.

Protest at Canadian

consulate in Rio de Janeiro, June 2021.

Greenwashing the privatization

of public utilities has become the

fashion when it comes to self-serving and unethical pay-the-rich

schemes by governments and their agencies, including government-run

financial institutions and investment companies. A good example is the

Canada Pension Plan Investment Board's (CPPIB) greenwashing of its

privatization of Rio de Janeiro's public water system, presented as

supporting "sustainable projects and clean tech solutions in Brazil." The

Senior Vice President of Infrastructure & Renewable Resources

of

the Alberta Investment Management Corporation (AIMCo), which

collaborated with the CPPIB in the privatization, said the investment

management company was "excited" with the outcome of the auction and

"for the opportunity to invest further in the business alongside

like-minded partners to increase the service levels in water

distribution and sanitation in the State of Rio de Janeiro." He called

the acquisition, via its holdings in the private water and sewage

company Iguá Saneamento, "an excellent addition to our

infrastructure portfolio that is well-aligned to meeting our clients'

investment objectives." Does anyone believe that

Alberta public

sector workers, presumably the clients being referred to, would have as

an investment objective for their pension fund the privatization of

public services in Brazil or anywhere else? The

Latin America director of the CPPIB, who enthused in a press

release about the "new legal framework" established to facilitate the

auctioning off of Rio's public water system, was similarly excited

about the acquisition which he said would be followed by many more.

According to him, the private sanitation sector with its captive market

offers the prospect of a consistent and stable payback, and is

"perfectly compatible with our expectations, as long-term investors."

He added that Iguá was well positioned to be a powerful

competitor in most or all future auctions as nearly a thousand

Brazilian municipalities were expected to privatize, or seek

concessionaires, in the next few years. Scooping up

public utilities as fast as neo-liberal governments in

Brazil, Canada and elsewhere put them up for sale is but one of many

anti-social projects Canadian workers' pension funds have been used to

finance. Investment managers of the funds do their "fiduciary duty" of

investing workers' money where prospects of amassing maximum

capitalist profit are highest no matter the consequences. Everything

can be justified in the name of high ideals and this must change.

It is high time that working people themselves decide where

their

pension funds should be invested. The direction of the economy should

be set by working people, not financial markets, financial institutions

and financial elites. Pension funds come from the social wealth that

workers produce but do not control. It is this lack of control by the

workers, who are the producers, over what is produced and how it is

produced that is at the heart of the problem. The

social wealth produced by workers must be reinvested in a

socially responsible manner to build a diverse economy at home that has

an internal self-reliant strength and trades with others for mutual

benefit and development. Such an economy must have the aim to guarantee

the rights and well-being of all, and humanize the social and

natural environment.

In the 1990s the international financial oligarchy and their

institutions pushed governments to restructure their pension systems so

the funds could be invested in financial markets where it was said

higher returns could be obtained than was possible by parking the money

in low-risk but more secure instruments like government bonds. Along

with this push to "financialize" pensions came the pressure to convert

pensions from defined benefit plans that guarantee a certain level of

benefits to workers after they retire, to defined contribution plans,

where the level of benefits one receives upon retirement depends on how

well the plan is doing in the financial markets and on returns from

other types of investments at any given time. A

big reason

for these changes, in addition to reducing governments' responsibility

to provide for workers' retirement security, was to put at the disposal

of the financial oligarchy a vast new pool of money to invest in order

to amass even greater private wealth for themselves. In

1997 the Canada Pension Plan Investment Board was created by

federal

legislation to operate at arm's length from the government. The mandate

of the new entity established as a vehicle for the financialization of

the CPP was to exercise its "fiduciary duty" to Canadians by first and

foremost maximizing the return on investments made on their

behalf. The Alberta Investment Management Corporation, established in

2008, operates in a similar way and under a similar mandate.

BC

Government's Sell-Off of Public Lands to Powerful Private Interests

- K.C. Adams -

Below

is Part Two of the series on BC Governments Sell-Off of Public Lands to

Powerful Public Interests. Part One appeared in Workers' Forum

September 15.

The private buyers of BC public property in many cases soon made

outsized profits. The following are examples of this profiteering from

the legalized corruption of the BC government to pay the rich.

Burke Mountain In a 2018 report, the BC

Auditor General Carol Bellringer noted that

the Liberal government sold off 150 hectares of public properties

in Coquitlam's Burke Mountain area for $85 million to a single buyer.

This was $43 million less than the known appraised market value.

In reviewing Bellinger's report, Vaughn Palmer writes in the Vancouver Sun,

"The Liberals must have known they were unloading the 14 parcels for

$43 million less than they were worth. When they signed off on the sale

in February 2014, they had in hand the appraiser's report putting the

value at $128 million. 'The appraisal was timely in

relation to the sale of the land,' says Bellringer. 'The quality of the

appraisal work was appropriate, and the appraised values for the

parcels of land were reasonable.'" Palmer

continues, "Knowing the shortfall, why didn't the Liberals

cancel the sale and do a proper one? I'm guessing it was because the

transaction, like other land sales at the time, was part of a rush-job

effort by the government of then-premier Christy Clark to try to

balance the budget. "The prime beneficiary of the

expensive-for-taxpayers transaction

involving the Burke Mountain lands, acquiring all 14 properties for

two-thirds of the appraised value, was Vancouver-based Wesbild

Holdings. In blowing the whistle on the sale to the legislature in the

spring of 2015, the then NDP Opposition noted that the company's

billionaire founder and chair, Hassan Khosrowshali, was a major donor

to the BC Liberals." George Pearson Centre and

Dogwood Lodge These two public health care

facilities on Cambie Street in Vancouver

comprised 25 acres. A SkyTrain line, which opened in 2009, runs

north-south

under Cambie. Onni developers bought both parcels from the government

in 2015-16 with plans to build thousands of housing units and

commercial spaces. Onni bought Dogwood Lodge in

2015 for $85 million and immediately

subdivided the land into two lots and began seeking city construction

permits. By 2019, the same property, now cleared of buildings, was

appraised at $380 million. Onni bought Pearson

Centre in 2016 for $217 million and subdivided

it into four lots. Officially appraised after its subdivision, the

market value of the four lots increased to $462 million. Without

building anything, Onni turned the $302 million it paid to

the BC government for the public lands of the two health care centres

into a total assessed value of $842 million. This meant a possible

profit of $540 million merely for being privileged recipients of a

state-run pay-the-rich scheme. By building on the lots, the return for

the

Onni oligarchs in control will be even greater. According

to the Elections BC website, the Onni oligarchs gave the

BC Liberal Party $575,000 and the BC NDP $115,000 between 2005 and 2018.

Cottonwood Lands The NDP/Green Party

coalition government sold the Cottonwood Lands

in Maple Ridge, which comprised 11 public properties on 21 hectares (52

acres) for $20 million in September 2017. Developers Polygon and

Morningstar together bought the 11 parcels and subdivided them into 71

lots. The 2019 assessed value of just eight lots of the 71 exceeded the

original $20 million the government received for all 11 parcels.

Polygon also bought Steveston Secondary School in Richmond and

Coronation Park Elementary School in Coquitlam during the sell-off.

The Elections BC website says the Polygon oligarchs gave the

BC

Liberal Party $962,000 and the BC NDP $87,000 between 2005 and 2018.

Moody Centre SkyTrain Station Developer

Ryan Beedie partnered with others to buy four public

properties near the new Moody Centre SkyTrain Station in 2017 and 2018

for a total of $29 million. The BC Liberal government initiated the

sale, which was completed after the BC NDP/Green Party coalition

government took power in 2017. Soon after Beedie took possession

of the four properties the appraised market value ballooned to

$116 million. Elections BC says Beedie donated $668,000 to the BC

Liberal Party between 2005 and 2018. The Aquilini

Investment cartel, well-known for its ownership of the

Vancouver Canucks, during the same 2005-18 period gave $1.5 million to

the BC Liberal Party and $270,000 to the BC NDP. The Aquilini group

partnered with others in 2014 to purchase 40 acres of public property

in Burnaby for $58 million. The property is known as the

Willingdon Lands. Even though designated as "surplus," the government,

after selling the property which houses several mental health and drug

treatment centres, leased it back from the Aquilini group. The rental

fee has not been disclosed. By 2018 the appraised market value of the

property without any additional development has risen from

$58 million to $123 million. The Aquilini cartel has submitted a

"master plan" for development of the Willingdon Lands, which is now

before Burnaby City Council. Lisa Moore, a

principal with the BC auditor general's office told the Vancouver Sun

that her office was aware of all the donations to the Liberals and the

NDP and the involvement of the donors in purchasing public

property. She said the donations did not violate the election rules in

force at the time. The BC government changed the

rules governing donations to BC

political parties in November 2017, banning most donations from

companies and unions. The BC public treasury is now the largest source

of funds for the three cartel parties in the BC Legislature. The

government pays the cartel parties an annual allowance according to the

number of votes received in the election. In the two and a half years

prior to the 2020 BC election, the government paid out approximately

$16.5-million to the three cartel parties that have members in the

legislature. To

be continued — Part Three: "BC

Sold 50 Schools and Educational Land Lots in Six Years and Now Faces a

Shortage of K-12 Space"

(To

access articles individually click on the black headline.)

PDF

PREVIOUS

ISSUES | HOME

Website:

www.cpcml.ca

Email: office@cpcml.ca |