|

Special

Edition

June 29, 2017

Redistribution of Value in the

Stelco/Bedrock Plan of Arrangement

State-Sanctioned Theft of What Belongs to

Workers and Canadians by Right

- K.C. Adams -

PDF

Looking at the numbers behind the

Bedrock plan to seize control of

Stelco

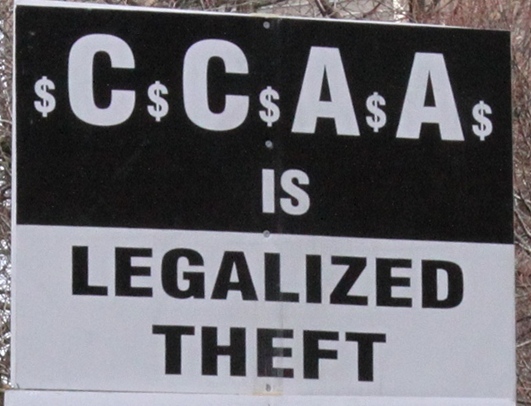

while under the Companies' Creditors Arrangement Act (CCAA)

Discussion is swirling around the

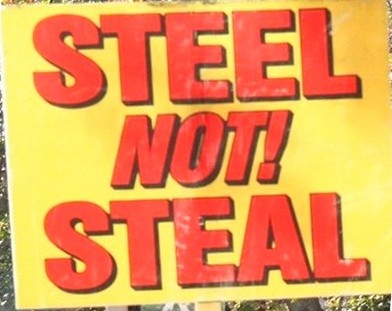

Bedrock/Stelco Plan of Arrangement (PoA). Besides denouncing the theft

of what belongs to workers by right, many are questioning the amount

the Bedrock oligarchs are paying for Stelco's steel production

facilities and ongoing business. The Hamilton Spectator puts

the figure at $500

million. Others suggest the amount is far less taking into account that

Stelco has around $300 million in cash accumulated under Companies Creditors' Arrangement Act

(CCAA)

protection. Using the police powers of the CCAA, Stelco has refused

since September 2014, to make any payments into the pension plans

or pay the legal entitlements of retirees to Other Post

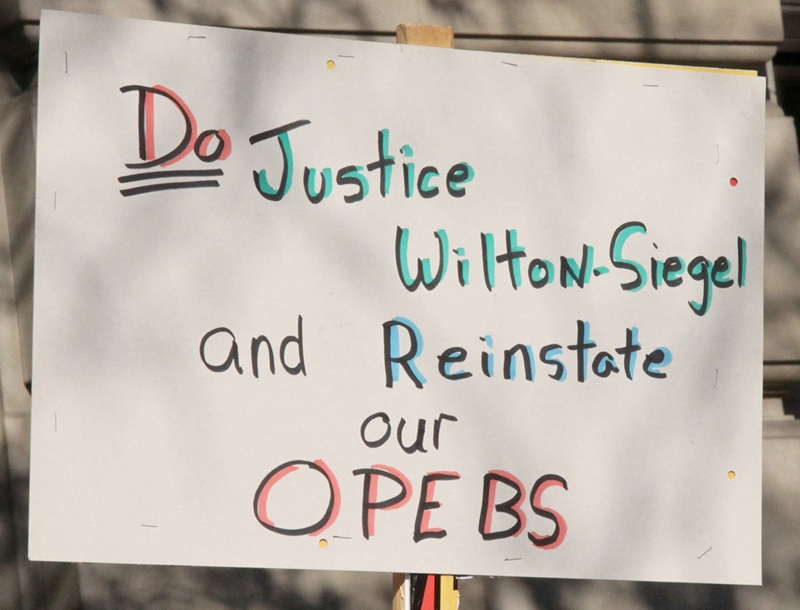

Employment Benefits (OPEBs). These unpaid legitimate claims of retirees

have gone directly into company cash on hand and will become the

property of Bedrock.

Another consideration

reducing the proposed Bedrock payment arises from it not having to pay

immediately most of the commitment for the pension plans and OPEBs.

Much of the payments will come from future new value Stelco

steelworkers produce. This means much of the promised payments will not

come from Bedrock in the U.S. but

from the realized steel value of Stelco production. Some of the future

amounts, which satisfy only a fraction of the legitimate claims of

retirees, are dependent on the amount of realized production. Those

future payments into the plans will soon

cease altogether, as the PoA removes retiree benefits and pension plans

from

the balance sheet cutting off existing and future retirees from any

claim on Stelco produced value. This leaves more realized new value for

the Bedrock oligarchs to seize as added-value and to dangle in front of

prospective buyers who may want to purchase Stelco from Bedrock. Another consideration

reducing the proposed Bedrock payment arises from it not having to pay

immediately most of the commitment for the pension plans and OPEBs.

Much of the payments will come from future new value Stelco

steelworkers produce. This means much of the promised payments will not

come from Bedrock in the U.S. but

from the realized steel value of Stelco production. Some of the future

amounts, which satisfy only a fraction of the legitimate claims of

retirees, are dependent on the amount of realized production. Those

future payments into the plans will soon

cease altogether, as the PoA removes retiree benefits and pension plans

from

the balance sheet cutting off existing and future retirees from any

claim on Stelco produced value. This leaves more realized new value for

the Bedrock oligarchs to seize as added-value and to dangle in front of

prospective buyers who may want to purchase Stelco from Bedrock.

Deal Between Two Sets of U.S. Oligarchs

The PoA is essentially an agreement between two sets of

U.S. oligarchs for transfer of value and ownership of Canadian steel

mills called Stelco. The transfer mediated by the Canadian state

through the CCAA, directly reduces the claims of Canadian workers and

retirees on the new value Stelco workers produce. This means the new

value

the U.S. oligarchs seize from Stelco's ongoing production, the

added-value, is increased. Also, the agreement absolves the U.S.

oligarchs of the responsibility for environmental remediation of the

historical Stelco lands after a one-time payment of $80 million.

The transfer of ownership

from one set of U.S. oligarchs to another with the assistance of the

Canadian state and its CCAA accomplishes what the U.S. Steel oligarchs

wanted to do all along. Through a lawyer, they told the leadership of

Local 1005 USW in 2014 that if steelworkers did not agree to

take the pensions and OPEBs

off the balance sheet voluntarily, then it would be forced upon them

through the CCAA. The transfer of ownership with the state-organized

CCAA will accomplish what the U.S. oligarchs wanted to do all along.

The PoA fix between the USS and Bedrock was hatched last year. The plan

was to transfer ownership to Bedrock with minimum

damage to USS. Pensions and OPEBs would be taken off the balance sheet,

substantial unsecured payments due and debt including the $150

million loan from the Ontario government would be extinguished with the

Bedrock oligarchs paying almost nothing to take control. The transfer of ownership

from one set of U.S. oligarchs to another with the assistance of the

Canadian state and its CCAA accomplishes what the U.S. Steel oligarchs

wanted to do all along. Through a lawyer, they told the leadership of

Local 1005 USW in 2014 that if steelworkers did not agree to

take the pensions and OPEBs

off the balance sheet voluntarily, then it would be forced upon them

through the CCAA. The transfer of ownership with the state-organized

CCAA will accomplish what the U.S. oligarchs wanted to do all along.

The PoA fix between the USS and Bedrock was hatched last year. The plan

was to transfer ownership to Bedrock with minimum

damage to USS. Pensions and OPEBs would be taken off the balance sheet,

substantial unsecured payments due and debt including the $150

million loan from the Ontario government would be extinguished with the

Bedrock oligarchs paying almost nothing to take control.

The PoA states, "On November 1, 2016, USS

announced that it had reached a non-binding agreement with Bedrock

regarding the sale and transition of its ownership of USSC (the 'ITS'

).

The

agreement

incorporated

terms

related to the treatment of USS'

secured and unsecured claims against USSC, and

contemplated the provision of mutual releases among key stakeholders,

including USSC, the continued provision of certain shared services to

USSC during a transition period, and an agreement for a five-year

supply by USS of certain key raw materials to USSC."[1]

Looking at the Numbers in the PoA

Under the proposed PoA, an immediate payment will be

made of $126.4 million to U.S. Steel, the owner of its supposed

bankrupt yet profitable subsidiary. This reduces Stelco's cash on hand

from $300 million to $173.6 million. The CCAA judge agreed to

this strange payment to the equity owners of a bankrupt enterprise

ahead of all other claimants including even an outstanding loan

of $150 million from the Ontario provincial treasury. Putting the

owners of U.S. stock equity first in line has the appearance of a

victim paying an aggressor for having inflicted destruction, pain and

suffering.

No one twisted the arms of executives of U.S. Steel to

buy Stelco in 2007. They jumped at the chance for three reasons:

1) The steel sector was at the top of its cyclical

pattern of boom and bust. The executives at USS appeared to forget that

booms inevitably bust in this crisis-ridden imperialist economy.

2) They wanted to block competitors from gaining control

of Stelco, in particular PAO Severstal from Russia, an consortium that

at the time was interested in making Stelco a major factor in its

direct entry into the North American steel sector.

3) USS wanted to take control of Stelco to block it from

competing with its U.S. mills in supplying steel to the lucrative

automotive sector.

With the economic crisis

in 2008 and the downturn in the steel sector, USS began a campaign

to degrade Stelco and transfer its steel production to USS mills in the

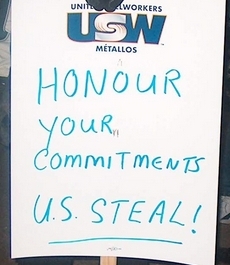

United States. USS broke all its promises of jobs and production levels

agreed to under the Investment Canada Act. It locked out

workers at both Hamilton Works

and Lake Erie Works for extended periods demanding concessions,

cratered the blast furnace at Hamilton Works, and sold off a productive

facility in Hamilton to German imperialists called MANA masquerading as

friendly businesspeople who turned out to be violently anti-worker and

in opposition to Hamilton's economy and standard of

living. With the economic crisis

in 2008 and the downturn in the steel sector, USS began a campaign

to degrade Stelco and transfer its steel production to USS mills in the

United States. USS broke all its promises of jobs and production levels

agreed to under the Investment Canada Act. It locked out

workers at both Hamilton Works

and Lake Erie Works for extended periods demanding concessions,

cratered the blast furnace at Hamilton Works, and sold off a productive

facility in Hamilton to German imperialists called MANA masquerading as

friendly businesspeople who turned out to be violently anti-worker and

in opposition to Hamilton's economy and standard of

living.

USS took away Stelco's best automotive customers,

supplying them from its U.S. mills; it attacked retirees by forcing the

removal of a cost-of-living allowance from their pension benefits,

eliminated the

defined-benefits pension plan for new employees, refused to honour its

public commitment to make the pension plans whole by the end

of 2015, and

now under CCAA refuse to pay the legitimate OPEBs to Stelco retirees,

and have stopped paying their municipal taxes to Hamilton and

Haldimand. U.S. Steel since 2008 has generally played havoc with

the steel communities and Canada's economy.

USS as a "Secured Creditor" to Itself and the

Previous Stelco Bankruptcy

The Bedrock payment to USS of $126.4 million is to

be made despite U.S. Steel having voluntarily put Stelco into CCAA

bankruptcy protection. A payment of this size to owners of equity of a

bankrupt company appears fishy to say the least. Other claimants have

been shuttled to the back of the line behind the claim of the current

owners of Stelco, who are the owners of U.S. Steel stock equity listed

on the stock exchanges.

Equity owners of bankrupt companies generally are

considered below other claimants especially owners of debt. During the

last Stelco CCAA bankruptcy in 2004-06, equity owners of Stelco

shares lost almost all their money in the 2006 CCAA Plan of

Arrangement. Many who lost money were steelworkers, retirees and others

from the Hamilton community who had bought Stelco shares in an effort

to prop up the company. Those in control of the 2006 CCAA process

made Stelco equity stock ownership a target unlike the current

bankruptcy. This reflects the Wild West nature of the CCAA and how the

most powerful oligarchs control the process in their

favour.

In 2006, Brookfield

Asset Management, the Stelco CEO Rodney Mott who was parachuted in from

the U.S. to pave the way for the eventual USS takeover, the CCAA Chief

Restructuring Officer and Monitor and their allies seized control of

the CCAA process. The plotters issued new Stelco shares to replace the

old shares, which

CCAA Judge Farley declared worthless. The plotters sold the new Stelco

shares to themselves at a low price and then after exiting CCAA sold

them a year later to U.S. Steel at a much higher price. It should be

remembered that the hundreds of millions taken as a quick score

in 2007, when U.S. Steel bought the new Stelco shares, went into

the pockets of the oligarchs such as Mott and the Brookfield owners.

The money USS paid was not put into Stelco for its renewal or used to

make whole the pension plans or to assist the steel communities in any

way. In 2006, Brookfield

Asset Management, the Stelco CEO Rodney Mott who was parachuted in from

the U.S. to pave the way for the eventual USS takeover, the CCAA Chief

Restructuring Officer and Monitor and their allies seized control of

the CCAA process. The plotters issued new Stelco shares to replace the

old shares, which

CCAA Judge Farley declared worthless. The plotters sold the new Stelco

shares to themselves at a low price and then after exiting CCAA sold

them a year later to U.S. Steel at a much higher price. It should be

remembered that the hundreds of millions taken as a quick score

in 2007, when U.S. Steel bought the new Stelco shares, went into

the pockets of the oligarchs such as Mott and the Brookfield owners.

The money USS paid was not put into Stelco for its renewal or used to

make whole the pension plans or to assist the steel communities in any

way.

Upon buying those new Stelco shares in 2007, USS

deactivated them and transferred the Stelco equity into its own stock

structure of share ownership in the United States holding what it calls

"shares" in USSC (Stelco) its directly owned subsidiary. The value of

Stelco's fixed assets, the buildings, machinery and other equipment in

Hamilton and Nanticoke plus the circulating assets, mostly material to

make steel such as stockpiled iron ore, the steel inventory and

business as a going concern were added to the global assets of U.S.

Steel.

USS paid around $1.1 billion for the new Stelco

shares and another $900 million in assumed debt. It also assumed

the social obligations that go with ownership of a large enterprise

including in this case the pension plans and OPEBs. No other ownership

of Stelco equity has since been established. Stelco's fixed and

circulating

assets, steel inventory, cash balance and business, technically the

equity minus any liabilities remain the private property of owners of

U.S. Steel stock until the Bedrock PoA takeover is finalized.

U.S. Steel executives declare that their equity

ownership of Stelco exists on paper as "shares," but has ceased to

exist in practice. It says the relationship with its wholly-owned

subsidiary became that of a secured creditor owed $126.4 million

and an unsecured creditor owed countless millions more. How is this

possible or even rational?

Could the owners of shares in a small bankrupt business declare that

certain fixed and other assets of the company should not be considered

as equity but as secured debt held by the owners of stock if that

served their private interests? A creditor in a company is generally

assumed to be an outside lender of money to the enterprise.

At any rate, besides raising the issue that these CCAA

bankruptcies solve no problem and actually block finding a new

direction that works, the comparison of this Stelco CCAA PoA and the

previous one in 2006 raises serious questions. Both PoAs were

given a judicial seal of approval even though no explanation for the

difference between the dispersal of equity ownership in 2006 and today

with this Bedrock PoA payment to the USS equity owners has ever

appeared. The CCAA court has agreed

to accept USS as both a Stelco creditor and equity owner. In effect,

the court declares no ownership is responsible for the

bankruptcy and the USS ownership should not suffer the loss of value of

its shares in Stelco and USS stock or have its U.S. assets cover the

Canadian liabilities.

The CCAA recognizes U.S. Steel's ownership of Stelco on

paper but refuses to make it responsible in practice. This is

convenient for the actual owners because they are in the U.S. and the

CCAA has declared their assets cannot be used to settle the many claims

against Stelco. In fact, the U.S. owners have been accepted as secured

creditors

and awarded $126.4 million.

CCAA Is a Fraud to Serve the Narrow Interests of Those

in Control

The CCAA fraud in 2006

has now been eclipsed by this CCAA fraud in 2017. Obviously, USS

did not want the bankruptcy of Stelco to affect, at least not directly,

its USS equity stock ownership and assets in the United States. In this

situation and with the approval of the CCAA court, USS concocted a

firewall between the

Stelco bankruptcy and its equity stock ownership and U.S. assets. The

CCAA process turned the equity ownership of USS and its Stelco

subsidiary into a creditor/borrower relationship in practice with USS

holding $126.4 million in secured debt and millions more in

unsecured debt and its equity stock ownership and U.S. assets

untouched.

This arrangement is very convenient for a U.S. consortium and confers

on

Canada a status of manipulated colony. The CCAA fraud in 2006

has now been eclipsed by this CCAA fraud in 2017. Obviously, USS

did not want the bankruptcy of Stelco to affect, at least not directly,

its USS equity stock ownership and assets in the United States. In this

situation and with the approval of the CCAA court, USS concocted a

firewall between the

Stelco bankruptcy and its equity stock ownership and U.S. assets. The

CCAA process turned the equity ownership of USS and its Stelco

subsidiary into a creditor/borrower relationship in practice with USS

holding $126.4 million in secured debt and millions more in

unsecured debt and its equity stock ownership and U.S. assets

untouched.

This arrangement is very convenient for a U.S. consortium and confers

on

Canada a status of manipulated colony.

The U.S. ownership greatly damaged Stelco and weakened

its gross income but with the sleight of hand and connivance of the

state-organized CCAA, USS becomes the beneficiary of a payoff and

avoids any direct threat to its equity stock ownership or assets in the

United States. One could say that the U.S. oligarchs as a class are the

beneficiaries of the damage to Stelco and this bankruptcy. The U.S.

oligarchs' redistribution of value amongst themselves and away from the

Canadian working class and economy benefits their narrow interests as

now even greater added-value from future Stelco production will flow

into their U.S. coffers.

Using the Cash on Hand to Purchase Stelco --

General Unsecured Creditor Pool

The PoA says another immediate payment is $15.4

million to the General Unsecured Creditor Pool. This represents 10

per cent of the total $154 million in claims of those in the

Unsecured Pool. The CCAA court has awarded these creditors only 10

cents on the dollar. The Pool consists of suppliers, contractors and

others who are owed money for services, loans or material.

The payment of $15.4 reduces the remaining Stelco

cash on hand of $173.6 million to $158.2 million. In

practice, Bedrock still has not used any of its own money, as it will

gain the cash on hand on June 30, and no money will be paid before

that time. The Unsecured Pool does not include the $150 million

plus interest owed to the Ontario treasury as the PoA simply

extinguishes the debt to the province, as if it never existed. Nor does

it include U.S. Steel's claim of unsecured debt of over a billion

dollars. Without explanation, USS dropped its claim of unsecured debt

in the PoA, yet another example of possible collusion.

Municipal Taxes

A secured municipal tax claim to be paid for back

property taxes, penalties and interest owed to the City of Hamilton

totals $10 million. An unspecified amount, said to be

around $2 million, is owed to other municipalities including

Haldimand.

The estimated $12 million for back taxes to be

paid upon exiting CCAA reduces the cash on hand from $158.2

million to $146.2 million.

Claim of Non-USW Employees

Non-USW secured creditors (non-USW employees) are to

receive $9 million. This reduces the cash on hand from $146.2

million to $137.3 million.

Other Payments Not Detailed

The amounts of several other payments due upon exiting

CCAA are not specified in the PoA.

The PoA states: "The Corporation will pay the DIP

[Debtor in Possession] Lender all amounts required to satisfy all

obligations and liabilities

of the Corporation to the DIP Lender."

The DIP lender is Brookfield Capital Partners Ltd., one

of the principals in control of the last Stelco bout in CCAA

in 2004-06. Brookfield and others in the controlling clique at

that time purchased the new Stelco shares before exiting CCAA and

subsequently sold them to U.S. Steel for a quick fortune in 2007.

The amount of the DIP loan used and to be returned with

interest and an exit fee will be calculated by June 30. Other

payments under the PoA due on June 30 include CCAA Priority

Payment Claims, Construction Lien Claims, and all claims secured by the

CCAA Charges.

Stelco (USSC) cash on hand is $137.3 million after

all known immediate claims are paid except for those payments that have

to be determined in the final days before exiting CCAA. This does not

include the promised money to pay certain claims for pensions, benefits

and environmental remediation.

Pension Plans, OPEBs and Environmental Remediation

The payments due under agreements covering the pension

plans, OPEBs and environmental remediation in the immediate sense are

somewhat offset with loans from the Provincial treasury. The payments

as they come due after Bedrock takes control should be considered as

part of the ongoing operations and claims on the new value Stelco

steelworkers produce. The promised claims for the pension plans, OPEBs

and for environmental remediation will be covered by the value Stelco

workers produce from making steel and having it realized. In this sense

they are similar to claims for wages. Workers reproduce their wages and

benefits when they produce new steel value and the value

is realized. Wages and benefits come out of the new value workers

produce as do benefits, pensions and issues such as environmental

remediation.

Apart from the future promises, Bedrock is due to pay on

June 30, a certain amount to the pension plans, OPEBs and for

environmental remediation of the Stelco lands. These amounts

essentially are claims on new value of a going concern business, which

Stelco still is even while under CCAA. The amount will be reimbursed

with the

production of new value or will come out of what remains of the cash on

hand.

The PoA states: "The Corporation will pay $30

million to the Main Pension Plans in accordance with the Pension

Agreement."

The $30 million to be paid reduces the cash on

hand from $137.3 million (not including certain other claims)

to $107.3 million.

The PoA calls for $33 million to fund the OPEBs in

the first year following exit from the CCAA. However, the $33

million immediate payment is mostly offset with a loan. The PoA states:

"The Province will loan $22 million in aggregate to USSC in

Years 1-2 to fund the Advance OPEB Payment."

If Bedrock takes the entire loan on June 30, the

immediate amount it pays into the OPEBs is $8 million. The amount

Bedrock will pay to meet only a portion of the legitimate claim of

retirees for OPEBs will come from new value Stelco steelworkers produce

both now and in the future. This net payment of $8 million

reduces the cash on hand from $107.3 million to $99.3 million.

Another payment is for environmental remediation of the

polluted Stelco land. With this payment Bedrock is absolved of all

future responsibility for existing pollution caused in building Stelco

and its ongoing production over the past century. The PoA makes this

clear stating:

"Funds for Historical Environmental Issues

"1. At the Plan Implementation Date, a one-time payment

of $61 million (U.S. Dollars) shall be paid to the Province on a

non-refundable basis. For the avoidance of doubt, the receipt by the

Province of $61 million (U.S. Dollars) in cash shall satisfy this

condition."

This net payment of U.S.$61 million (CAD$80 million)

reduces the cash on hand from $99.3 million to $19.3

million.

All promised future payments to the pension plans and

OPEBs will come out of new value Stelco workers produce and cannot be

considered as part of any purchase price. The payments will reduce the

claim of Bedrock owners on the new value they control but the payments

do not come out of their own cash reserves in the United States.

This also holds true when they repay the provincial loans. In a sense,

Bedrock already owns and controls Stelco at least since the bidding

process ended with last November's agreement with U.S. Steel. It became

obvious that those in control of the CCAA favoured Bedrock, especially

U.S. Steel and its handpicked Monitor, Chief Restructuring

Officer and DIP lender. The fact that Stelco under CCAA amassed cash on

hand of $300 million by refusing to pay the claims for OPEBs,

while paying millions to all the CCAA parasites, shows just how

profitable the Stelco steel mills can be when prices are not below the

price of production.

The provincial government has made the Bedrock takeover

of Stelco virtually cashless for the new owners using internal

accumulation of new Stelco value and provincial loans. In return for

paying next to nothing Bedrock receives profitable facilities where

workers are producing and will continue to produce enormous amounts of

new value,

from which Bedrock will claim added-value and do with it as it wishes.

The existing imperialist relations of production dictate this right to

seize the value workers produce and use it according to their narrow

private interests.

Almost all the social responsibilities ownership has

had towards the current and future Stelco retirees have been

extinguished. Bedrock assumes little if any responsibility for

environmental remediation for damage to the land that occurred while

giving rise to the productive facilities it will now seize. The

pensions, OPEBs and environmental

responsibility have been taken off the balance sheet. The

previous $150 million loan from the provincial government is

extinguished and new loans to Bedrock are promised.

The PoA says:

"The Province (i) has agreed to the compromise of the

entirety of its unsecured claims and interest accrued thereon which is

approximately CAD$150.7 million;

"(ii) will provide secured loans to the Land Vehicle,

the OPEB Entities and USSC to fund the closing of the Transaction and

certain funding commitments thereafter; and (iii) will also provide a

release of certain environmental liabilities relating to USSC's land."

After all the immediate known payments are made out of

cash on hand, Bedrock still has $19.3 million in Stelco cash to

pay for those few items to be finalized on or before June 30. At

that time, they will gain access to Stelco workers' continuing

production of new value. The promised future amounts for pensions and

OPEBs

from Bedrock will come from new value Stelco workers produce. Any new

material to be purchased as part of the production process will go into

the produced value of steel as transferred-value and will be returned

to the owners when the social product is realized (sold).

In completing the deal, Bedrock does not put up any of

its own cash but rather organizes a line of credit. If the remaining

cash on hand is not sufficient, the amount will come from this

asset-based facility. If money is used from the asset-based lending, it

could be

returned using new value from Stelco production.

The PoA states:

"Bedrock will make available to USSC a revolving

asset-based lending facility in an amount of at least $125 million

to fund the closing costs of the Transaction and the cost of exiting

the CCAA Proceedings."

The PoA is a complete disgrace and abdication of duty by

all those in positions of official responsibility in the provincial and

federal governments, the Ontario Superior Court and other state

agencies. In sharp contrast, the leadership, members and retirees of

Local 1005 USW at Stelco Hamilton Works and their allies have done

their

best to defend the interests of themselves, the Stelco facilities, the

steel communities and the Canadian economy. Canadians greatly

appreciate their effort but are confronted with the sobering example of

the power of the oligarchs and their state machine on full display. The

oligarchs are in full attack mode.

The working class is charged with the social

responsibility of organizing and mobilizing its members for sustained

actions with analysis to defend their rights and to move the country in

a new direction that deprives the oligarchs of their power to deprive

Canadians of their rights. Just this week, the oligarchs in control of

Sears Canada

announced the company's entry into CCAA with the immediate layoff

of 2,900 workers and a big assault on their pensions and other

claims. These attacks must be stopped!

The Time Is Now to Organize the Workers'

Opposition and

Mobilize

Canadians to Build the New!

It Can Be Done!

Note

1. The PoA states:

"Share Transfer Agreement

"(i) a Share Transfer Agreement providing for the

transfer of USSC shares from USS to Bedrock, (ii) a Debt Discharge

Agreement providing for the release of the USS Unsecured Claims for

nominal consideration, (iii) three Transition Services Agreements

between USSC and USS providing for (x) continuing IT services, (y)

transitional IT

services, and (z) transitional business services, (iii) an Intellectual

Property Agreement, and (iv) an Iron Ore Pellet Supply Agreement."

PREVIOUS

ISSUES | HOME

Website: www.cpcml.ca

Email: office@cpcml.ca

|