No. 46

September 1, 2024

Labour Day 2024

Railworkers' Fight for Safe Working Conditions

• "Join Our Fight And Take This All The Way" Teamsters Say

Stelco Sold for $3.8 Billion to Other U.S. Oligarchs

• Time for a New Aim and Direction for the Economy!

• Canadian Goose Continues Laying Golden Eggs

Labour Day 2024

Only Working People Through Their Actions in Defence of Their

Rights

and the Rights of All

Can Avert the Dangers that Lie Ahead

Prince

George Labour Day 2023

CALENDAR OF EVENTS

Workers,

women, youth and Indigenous Peoples are raising

their voices on this Labour Day 2024 and taking bold actions in defence

of their rights and the rights of all. Workers in all sectors of the

economy are calling out the corruption and immorality of the

pay-the-rich schemes of the ruling

class. They are decrying the crimes that those in positions of

privilege and power are carrying out against humanity; they are

denouncing their corruption, genocide and fratricidal war, which have

become a trademark of those who hold economic and political power.

Workers,

women, youth and Indigenous Peoples are raising

their voices on this Labour Day 2024 and taking bold actions in defence

of their rights and the rights of all. Workers in all sectors of the

economy are calling out the corruption and immorality of the

pay-the-rich schemes of the ruling

class. They are decrying the crimes that those in positions of

privilege and power are carrying out against humanity; they are

denouncing their corruption, genocide and fratricidal war, which have

become a trademark of those who hold economic and political power.

On this occasion, the Workers' Centre of the Communist Party of Canada (Marxist-Leninist) sends its greetings to all working people from coast to coast to coast. The Centre expresses its best wishes for the success of the endeavours of workers in all sectors of the economy to provide the rights of all with a guarantee. These battles are being waged under the difficult conditions of the decades-long anti-social offensive, which justifies all manner of crimes in the name of defending the economy and democracy.

The Workers' Centre calls on workers across the country to exchange views on the challenges they and their sector of the economy face at this time and smash the silence on their working conditions, how their sector of the economy functions, the role it plays and who it serves. Only in this way can Canadians grasp the need to exercise control over the economy themselves and set its direction to serve their needs and contribute to the same abroad.

As more pay-the-rich schemes are put in place in the name of economic recovery and providing happiness to what is called the middle class, the more all sectors of the economy are either being destroyed or put at the disposal of supranational narrow private interests and the U.S. war economy.

To achieve smashing the silence and enabling the working people to find their bearings, the Workers' Centre calls on Party activists and progressive forces to read and write for the Party press, distribute it, send in reports and help finance it. It calls on Party activists and progressive forces to hold workers' forums throughout the rest of the year to discuss the direction of the economy in their sectors, regions and nationally and exchange views with one another to determine how to intervene and keep the initiative in their own hands. When workers from different sectors of the economy fight and defend their claims and rights, those successes need to be widely discussed and celebrated.

Not to contest the nonsense the ruling class spouts is disempowering and a grave mistake. The spokespersons of the monopolies, oligopolies, their business associations, think tanks and governments have full access to means of dissemination and state-sanctioned media. They speak reams about supply chains, national security, protecting the economy, wealth management, foreign interference and the like. They refer to the members of society in business-terms such as by calling members of the polity "clients" or dehumanize them on the basis of categories they criminalize. They spew whatever they think will help them cling to power. Calling them to account shuts their mouths and forces them to sweat to find new excuses. Why, for instance, are workers essential to the economy and the well-being of society not treated with respect? Why are industrial and service workers, miners, fishers, farmers, teachers, health care workers, Indigenous Peoples, migrant workers, refugees, international students, women and children, denied what belongs to them by right of being human? Why are many left in poverty without secure lodging and even food? Why are the natural environment and questions of war and peace left at the whim and aim of the global rich for maximum profit, with even the established international rule of law including judgements against committing genocide, crushed in the rush to increase war production and control spheres of interest?

It is irrational to call on people to uphold an authority that causes workers to be disposable through unemployment and increases in productivity, an authority that harms workers' interests and denies them their rights while calling them essential, an authority that harms the natural and social environment, an authority that blocks every attempt at democratic renewal so as to deny people a say and control over their lives, an authority that pours billions into the U.S. war economy and genocide yet postures as peaceful and desperately clings to power no matter what? Those who commit and support genocide but claim they defend democracy are clearly not fit to rule.

The situation calls on workers to denounce the self-serving slogans about serving the middle class, greening the economy and doling out billions to global companies to expand the economy. Their scams are used to justify paying the rich while denying investment in the most basic social programs to serve the people. When the representatives of narrow private interests say that pay-the-rich schemes are good for the economy, workers know whose pockets are being lined and at whose expense.

Enough with the irrational nonsense! Enough with permitting ruling elites to establish the agenda for society. Working people must discuss and assess the situation by establishing their own vantage point and mapping their own path forward to reach their destination from there.

The political aim of organizing workers' forums is to exchange views on how to move the struggle forward. The aim is not to describe the imposed conditions that have driven down human standards and dignity and then declare in futility that an alternative is needed. The aim is to elaborate the alternative with working people themselves setting the agenda of discussion from the reality of the lives they face and their own actions, reference point and outlook. The aim is to analyze the unfolding events so that the collectives of workers can find their bearings and intervene effectively in a manner which defeats the aim of the ruling class to disempower them and deny their rights and claims.

How to tackle the conditions of disempowerment is on the agenda for the workers to solve. Resistance to disempowerment and all that is unacceptable is served by defending the dignity of labour. Defending the dignity of labour and its rights and claims opens a path to set a direction for the economy to turn things around in favour of working people.

Unemployment, growing poverty, abuse, racist discrimination, environmental crises and the drive of the rich to use the circumstances to set Canada on a war path and benefit their own supranational narrow private interests are not inevitable. A sense of social solidarity based on the class interest of working people imbues Canadian and Quebec workers, women, youth and Indigenous Peoples in Canada. It informs their striving to defeat those with positions of privilege and power and their demand that everyone should fend for themselves, be self-serving, not see the bigger picture and be satisfied with disempowerment and having the ruling elite dictate their lives and work.

How to hold governments to account when they weasel out of taking up social responsibility to keep people safe and pass more and more laws to make doing so legal is in the hands of Canadian workers from coast to coast to coast. They are taking action and it is up to all of us to popularize the actions they are taking and how they contribute to turning things around.

Today, as workers across the country are given a national holiday on Labour Day, fraud is the name of the game for the ruling class whose politicians are already campaigning for election even though no election has yet been called. It involves the falsification of history, both past and present. Fraud is committed by remaining silent about the role of the working class and peoples of the world in making history. But facts are stubborn things and they show that the world as is has no takers. The world as it should be has billions of makers.

On this Labour Day, the Workers' Centre of

CPC(M-L) calls on

all those linked to its work to continue to take measures to smash the

silence of the living and working conditions of the working class and

plight of the people and put an end to the attempts to marginalize,

silence and eliminate the

independent voices and initiatives of working people. Accusations that

when the workers defend their rights they are endangering the economy

demand an answer. What about the actions of the owners which do not

provide their workers with the conditions they require to safely

operate the railways, or

carry out construction projects, or teach our children, heal our sick

or care for the older generation? The working conditions of the workers

are the living conditions of everyone in society. Dogmatic facile

renderings of reality repeated by the media must be confronted by

making the voice of the

workers heard.

On this Labour Day, the Workers' Centre of

CPC(M-L) calls on

all those linked to its work to continue to take measures to smash the

silence of the living and working conditions of the working class and

plight of the people and put an end to the attempts to marginalize,

silence and eliminate the

independent voices and initiatives of working people. Accusations that

when the workers defend their rights they are endangering the economy

demand an answer. What about the actions of the owners which do not

provide their workers with the conditions they require to safely

operate the railways, or

carry out construction projects, or teach our children, heal our sick

or care for the older generation? The working conditions of the workers

are the living conditions of everyone in society. Dogmatic facile

renderings of reality repeated by the media must be confronted by

making the voice of the

workers heard.

People are fighting to uphold their rights and the rights of all. Upholding the rights of all is a social responsibility. Governments at all levels and those in positions of power and privilege must be held to account for not doing so. Workers' forums permit the participants to speak and hear about how the problems are being tackled in different sectors of the economy. They permit the workers to learn from one another and at this time exchange views on what to expect from the Government, the Official Opposition and cartel party system and how to confront them. Canada's integration into the failed U.S. state, which is trying so desperately to reinvent itself must also be opposed. Only the working people through their actions in defence of their rights and the rights of all can avert the dangers that lie ahead.

Together the Canadian and Quebec working class can work it out. Let everyone lend a hand by joining and organizing workers' forums, sharing their experiences and presenting their views. At our own peril we ignore the significance of analyzing unfolding events and establishing our own line of march.

For information or to join the forums, write the Workers' Centre of CPC(M-L): workerscentre@cpcml.ca

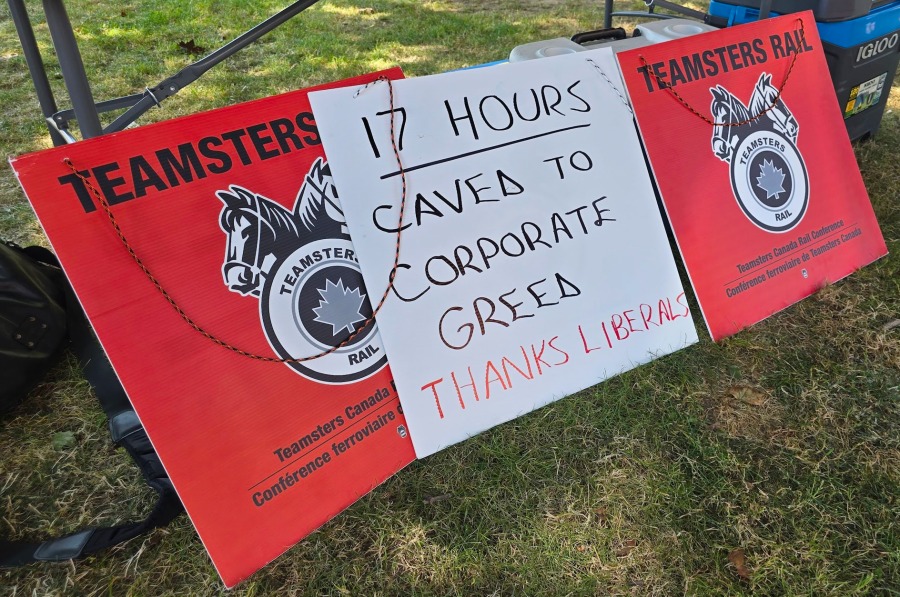

Railworkers' Fight for Safe Working Conditions

"Join Our Fight and Take This All the Way," Teamsters Say

Picket in support of rail

workers at MP Randy Boissonnault's Edmonton office, August 29, 2024

More than $1 billion of goods are moved by rail in Canada every day. It

is such a significant sector of the economy but the railway barons are

only interested in how much money they make, not the well-being of

Canadians or the people in the U.S. either, through whose territory

they also

operate.

More than $1 billion of goods are moved by rail in Canada every day. It

is such a significant sector of the economy but the railway barons are

only interested in how much money they make, not the well-being of

Canadians or the people in the U.S. either, through whose territory

they also

operate.

Canada's two major railways have never had a simultaneous work stoppage before. Contract talks between the rail union and Canadian National (CN) and Canadian Pacific Kansas City (CPKC, formerly Canadian Pacific) usually take place a year apart. But in 2022, after the federal government introduced new rules on fatigue, CN requested a year-long extension to its existing deal rather than negotiate a new one. After a year of the railways not bargaining for a new contract in good faith, the union at both railways engaged in job action at the same time, and in less than 17 hours, the Canada Industrial Relations Board (CIRB) ordered 9,300 rail workers back to work.

When Labour Minister Steve MacKinnon skirted the collective-bargaining process and sent the dispute to final arbitration, he sputtered that the government was "confronted with exceptional circumstances" and that the decision to send the matter to the CIRB was done with everyone's best interests in mind.

MP Randy Boissonnault's Edmonton

office, August 29, 2024

MP Randy Boissonnault's Edmonton

office, August 29, 2024

He remained silent about the refusal of the railway barons to address the major issue that has stalled contract talks for months which is worker safety and the related safety of the public. The union informed that the railway barons were trying to overcome a labour shortage by making employees work longer days, farther from home. CN and CPKC insisted their offers ensure safety despite the ample proof the workers provide that this is not the case.

"This all goes back to an individual named Hunter Harrison who became the executive of CN [in 2003]," pointed out Bruce Curran, associate professor in the faculty of law at the University of Manitoba, when interviewed for the Globe and Mail's podcast series The Decibel. "He implemented something known as precision scheduled railroading -- a lean system of management where railways work with as few crew as possible to drive inefficiencies out of the system. This has led to massive layoffs across the railways, and has led to the workers who remain working longer hours and beyond the point of good decision-making, where fatigue may be an issue."

With regard to the role of fatigue in rail accidents, Curran said: "Since 1990, there have been more than 30 rail disasters in Canada. In virtually all of them, investigations have pointed to fatigue as a major contributing factor. In July 2013, a railway car carrying 72 tankers of volatile shale oil derailed and exploded in Lac-Mégantic. It killed 47 people, spilled a record 6 million litres of oil and incinerated the town centre. Substantial evidence points to fatigue being a major factor. The engineer who was primarily responsible -- because he allegedly improperly applied the brake -- had been awake for more than 17 hours. And that has a severe impact on cognitive functioning and decision-making."

Another factor swept under the rug is the corrupt "revolving door" between industry and government. Former Conservative Member of Parliament John Baird presently sits on the CPKC's board of directors. He joined the Canadian Pacific board in 2015 after resigning from the Harper government in February of that year, prior to the federal election which brought the Liberals to power. He is also currently Chair of CPKC's Corporate Governance, Nominating and Social Responsibility Committee and of its Risk and Sustainability Committee.

Under the Harper government, Baird served as Minister of Foreign Affairs; Minister of the Environment; Minister of Transport, Infrastructure and Communities; and President of the Treasury Board. It was the Harper government, when Baird was Transport Minister from 2008 to 2010, that gave the railway barons the power to write their own rules and carry out their own inspections, thereby limiting Transport Canada's mandate to the simple oversight of the railway companies' operations.[1][2]

Information picket in

Hornepayne, August 29, 2024

Referring to the refusal of the railway barons to negotiate with their union, Teamsters Canada Rail Conference (TCRC) President Paul Boucher said in a press release:

"Throughout this process, CN and CPKC have shown themselves willing to compromise rail safety and tear families apart to earn an extra buck. The railroads don't care about farmers, small businesses, supply chains, or their own employees. Their sole focus is boosting their bottom line, even if it means jeopardizing the entire economy."

"What they have done to the railworkers ... to stop the work stoppages fundamentally takes rights away from the rights to free collective bargaining, and we're protesting against that," Boucher said in an interview.

The TCRC president also said that the union would work with other labour groups as it mounts a legal challenge to the decision that halted work stoppages at the country's two largest railways and imposed arbitration.

A decision obliging over 9,000 Canadian rail workers to stay on the job is a win for the railways and could impact bargaining in other federally regulated sectors like aviation, Boucher pointed out.

"Any federally regulated company, it's a win for them at this point," Boucher said, adding: "This is disastrous for labour, for workers."

The Teamsters are planning on appealing the decision at the Federal Court. Other unions could participate in court and support them, Boucher said. He also informed that he has been in contact with the Airline Pilots Association of Canada (ALPA), the union representing more than 5,400 Air Canada pilots who voted 98 per cent in favour of authorizing job action under the Canada Labour Code on August 22.

"This historical moment is so extremely important that labour needs to get involved, and they will," Boucher declared. "We're going to be calling on all labour across Canada to join our fight and take this all the way," he said.

For his part, ALPA President Tim Perry, said: "The new minister of labour does not trust the Canadian laws governing collective bargaining, nor does the government he represents respect the constitutional rights of workers."

Rail workers picket

outside Liberal cabinet retreat in Halifax, August 27, 2024.

Notes

1. "Brief on rail safety and the transportation of dangerous goods by train in Canada," presented by the Coalition of Citizens and Organizations Committed to Railway Safety in Lac-Mégantic to the hearings of the House of Commons Standing Committee on Transport, Infrastructure and Communities, June 17, 2021.

2. Former Quebec Premier Jean Charest also became a member of CN's Board of Directors in January 2022. He resigned two months later to run unsuccessfully for the leadership of the Conservative Party of Canada.

(With files from The Globe and Mail Canadian Press, Thomson Reuters, Teamsters Canada, CBC News, EnergyNow, CN, CPKC, Parliament of Canada, CTV News)

Stelco Sold for $3.8 Billion to Other U.S. Oligarchs

Time for a New Aim and Direction for the Economy!

Once again Canadians are reduced to spectators as global oligarchs seek to squeeze yet more social wealth for themselves from steelworkers and Canada's precious productive and natural resources. Canadians flinch when they witness these spectacles of having their economy not used to meet the needs of the people but rather reduced to trophies for the rich as they seek ever greater power, wealth and fame. Canadians want such actions of a few using our economy as their playthings to fight over and amass fortunes to stop. They strive for a people's economy in which the people decide the aim and direction and are in control. Only the people's organized opposition can stay the hand of the rich.

Stelco Chief Executive Alan Kestenbaum from Florida announced July 15 the sale of the Hamilton region steelmaking company to the U.S. steel monopoly Cleveland-Cliffs based in Ohio. The sale came as little surprise following Cliffs' defeat, temporarily, at the hands of Nippon Steel in the battle to buy and control U.S. Steel.

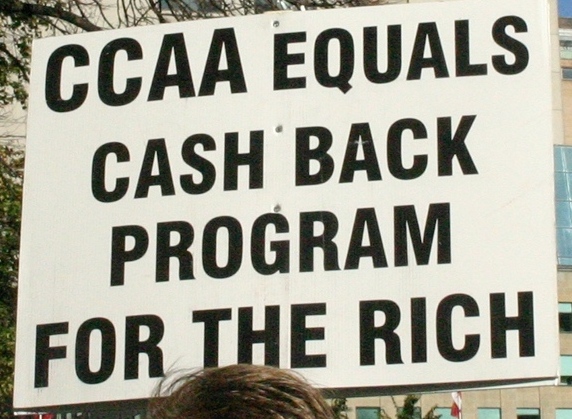

This transfer of ownership of Stelco marks yet another sale

since its fraudulent bankruptcy protection in 2004 under the

Companies' Creditors Arrangement Act (CCAA) and

its

liquidation as a Canadian company. Each change of ownership since

that time has been from the hand of one U.S. cartel to another

with millions of dollars absconded into private hands in the

United States. Many thought the tens of millions the former

Stelco CEO Rodney Mott added to his private fortune would never

be eclipsed when he engineered the sellout of Stelco to U.S.

Steel in 2007 and then scurried back to his mega mansion in the

U.S. with what he looted. But no, the criminal amount that Mott

seized appears paltry compared with what Kestenbaum from Florida

and his gang have engineered from the sale of Stelco to Cliffs.

Criminality in the economy is now entrenched and needs to be

forcefully addressed with accountability and a new aim and

direction under the control of the people.

This transfer of ownership of Stelco marks yet another sale

since its fraudulent bankruptcy protection in 2004 under the

Companies' Creditors Arrangement Act (CCAA) and

its

liquidation as a Canadian company. Each change of ownership since

that time has been from the hand of one U.S. cartel to another

with millions of dollars absconded into private hands in the

United States. Many thought the tens of millions the former

Stelco CEO Rodney Mott added to his private fortune would never

be eclipsed when he engineered the sellout of Stelco to U.S.

Steel in 2007 and then scurried back to his mega mansion in the

U.S. with what he looted. But no, the criminal amount that Mott

seized appears paltry compared with what Kestenbaum from Florida

and his gang have engineered from the sale of Stelco to Cliffs.

Criminality in the economy is now entrenched and needs to be

forcefully addressed with accountability and a new aim and

direction under the control of the people.

Kestenbaum bought Stelco in 2017 from U.S. Steel for a reported $70 million in cash while Stelco was in yet another bout of CCAA bankruptcy protection. As always under CCAA, the most powerful in control loot the company of its assets and refuse to pay millions in accounts receivable to local suppliers and outstanding debt, and in this case in 2017 eliminated an estimated $1.4 billion in pension and benefit obligations to employees. The entire deal appeared rotten and suspicious at the time and now appears scandalous with the sale to Cliffs for $3.8 billion.

The affair is so unscrupulous it looks like some kind of legalized Ponzi scheme. It is a disgraceful theft of Canadian resources, production facilities and social wealth. The fact is that such a thing can occur without repercussions for those involved and holding them to account reveals corruption on an unprecedented scale. It certainly raises the issue of a change in direction and aim for the economy and change in outlook and the social class in control of the country's economic, political and legal affairs.

Kestenbaum personally as his share of the looted amount is reported to be receiving $647 million. The rest will be divided up among his gang and others involved from New York. Prior to the deal and since the seizure from U.S. Steel in 2017, Kestenbaum as CEO has annually awarded himself and his cronies millions in what is euphemistically called executive compensation and bonuses. This money was expropriated from the realized new value Stelco steelworkers produced and from the sale of Stelco lands and certain production facilities.

Who knows what Cliffs will cook up for Stelco now that they are assuming control? It is not out of the question to suspect they will point to the government millions in green pay-the-rich schemes that have been awarded to Algoma Steel in Sault Ste. Marie and ArcelorMittal (Dofasco) in Hamilton to switch to electric arc steelmaking and demand the same.

The seizure of Stelco also cements Cliffs' dominance in North

American flat steel production in particular for vehicle

production and gives them an edge in competition with Nippon

Steel as it attempts to seize control of U.S. Steel while facing

fierce global rivals Cleveland-Cliffs and ArcelorMittal and

certain U.S. officials. Cliffs is demanding U.S. regulators stop

the sale of U.S. Steel to a foreign company from Japan while it

seizes control of whatever it can grasp around the world

including Stelco in Canada. Cliffs calls the Japanese company a

national security risk and damaging to the U.S. national economy

while Canada in its view is already annexed and of no consequence

as a country and independent economy and people. Cliffs, Nippon

Steel and ArcelorMittal's machinations are part of the global

competition of oligopolies which operate as coalitions and

cartels and a big factor in the economic crises and endless wars

the world is facing at this time.

During the entire period since the fraudulent CCAA proceedings began in 2004, Local 1005 of the United Steelworkers has put up a valiant fight to defend the rights and claims of steelworkers on the value they produce. On numerous occasions they have carefully outlined what needs to be done to build the steel industry in Canada and a broader independent and self-reliant economy. Such an economy with a modern aim would serve the people and humanize the social conditions and natural environment with control in the hands of those who produce the goods and services the people and society require, and would defend the economy and country against the attacks, thievery, wars and recurrent economic crises of the U.S. imperialist war economy and its striving for global hegemony.

This is what the recent sale calls for.

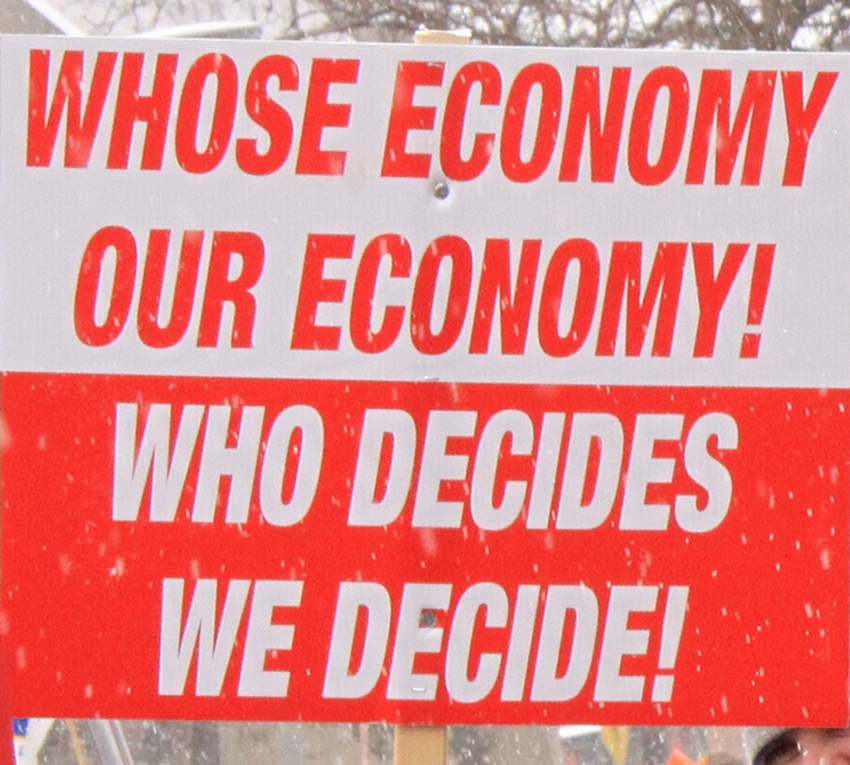

Steel Not Steal! Our Economy! We Decide!

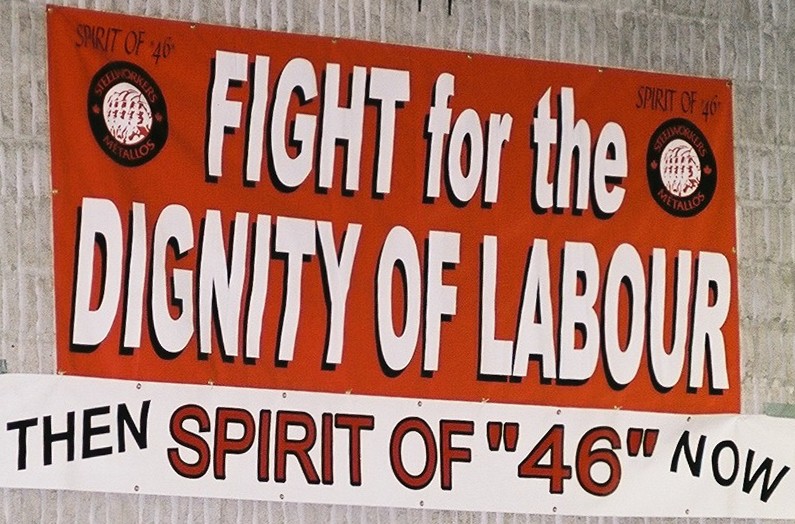

USW Local 1005 celebrates

75 years since its founding at Hamilton Labour Day 2021

USW Local 1005 fights

second round of CCAA fraud, July 27, 2016.

Hamilton Steelworkers' Day

of Action, January 30, 2016, during fight against second round

of CCAA

fraud.

USW Local 1005 at

Hamilton Labour Day 2014.

Celebration

of the 10th anniversary of the beginning of the Thursday meetings, June

13, 2013. The meetings are a venue for the workers to discuss their

concerns and inform themselves about important economic and political

developments and how to intervene.

Day

of Action, January 29, 2011 "The People vs U.S. Steel" during 11-month lockout by U.S. Steel in an attempt to force

concessions from the workers.

May Day 2010 demonstration and

conference on nation-building organized in Hamilton by

May Day 2010 demonstration and

conference on nation-building organized in Hamilton by

USW Local 1005

Hamilton

steelworkers rally in Ottawa, September 26, 2005, as part of their

fight against the fraud of CCAA insolvency protection.

Hamilton

steelworkers rally in Ottawa, September 26, 2005, as part of their

fight against the fraud of CCAA insolvency protection.

USW Local 1005 contingent

in Hamilton Labour Day parade, September 6, 2004, during first round of

fight against CCAA bankruptcy fraud.

Rolf Gerstenberger,

President of USW Local 1005, speaks at Hamilton steelworkers rally,

May

Day 2004.

Hamilton USW Local 1005 steelworkers

march February 27, 2004

Hamilton USW Local 1005 steelworkers

march February 27, 2004

Steelworkers picket Stelco during

historic 1946 strike.

Steelworkers picket Stelco during

historic 1946 strike.

Canadian Goose Continues Laying Golden Eggs

Hamilton May Day 2012

One of the signs, among too many others, that the governments of Canada and Ontario do not give a fig about the Canadian economy is their attitude to the production of steel in Canada.

All four of Canada's integrated steel plants are in Ontario. ArcelorMittal Dofasco in Hamilton is said to be Canada's leading flat steel producer and a hallmark of advanced manufacturing in North America.

Hamilton is to date one of Canada's leading industrial centres. Its iron and steel industry, which began in the mid 19th century, has grown to become Canada's largest, accounting for a major part of the national steel output. Despite the fact that imports of steel to Canada continue to rise, many communities are reliant on the 120,000 direct and indirect jobs production in Hamilton and Lake Erie provide.

In 2019, Canada imported 6.8 million metric tons of steel. The volume of Canada's 2019 steel imports was almost one-fourth that of the United States, the world's largest steel importer.

Flat products accounted for 39 per cent of Canada's steel imports in 2019 -- a total of 2.6 million metric tons. Long products accounted for 33 per cent of imports (2.3 million metric tons), followed by pipe and tube products at 21 per cent (1.4 million metric tons), stainless products at 5 per cent (321 thousand metric tons), and semi-finished products at 3 per cent (189 thousand metric tons).

The United States was the largest source of Canada's steel imports in flat, long, pipe and tube, and stainless products. In flat products, the United States accounted for 63 per cent of Canada's imports (1.7 million metric tons) in 2019.

Since then, perhaps because Canada is now considered to be integrated into U.S. steel production, statistics about imports and exports are not readily forthcoming.[1] Also of significance is that other than what is imported and exported, to whom and from where -- illustrating Canada's integration into the U.S. war economy -- little if anything is said about the role played by the governments of Canada and Ontario when it comes to the disposal of Stelco, a jewel of Canada's steel industry. The fact is that Stelco Canada is not only the producer of large amounts of steel; it is also the producer of Golden Eggs. Recently, it was sold by owner Allan Kestenbaum and his cronies to Cleveland-Cliffs, headquartered in Cleveland, Ohio, for $3.8 billion. This was seven years after Kestenbaum and his private equity partners, known as Bedrock Industries, acquired Stelco out of bankruptcy protection in 2017. Previously in 2015, Stelco had been severed from the other operations of then owner U.S. Steel after seeking protection under the Companies' Creditors Arrangement Act (CCAA) for the second time, the first time also organized so that private financiers and their legal and restructuring retinue could make a big score for themselves at the expense of steelworkers, their community and Canada itself.

The facts associated with the sales and resales of Stelco since 2004 and now with the sale to Cleveland-Cliffs under the most dubious circumstances need to be investigated. What was the role of the governments of Canada and Ontario in paving the way for a handful of U.S. financiers and their retinue to organize such a big score? What role did the government-sanctioned fraud called CCAA play in Canada's integration into the U.S. war economy?

According to TML's calculations Kestenbaum et al. paid $500 million for Stelco, bringing it out of CCAA in 2017. He then spent $114 million for land around Hamilton Works and Lake Erie Works in 2018, and put $30 million into the Hamilton mill in 2019. This amounts to around $644 million in gross payments. In 2022 he sold all of Stelco's lands around the two plants to Slate Asset Management in a $518 million deal. Deduct the $518 million from the gross payment of $644 million leaves a payment for Stelco of $126 million.

Kestenbaum and his ownership group are to receive $3.8 billion from Cliffs in cash and stock from the sale of Stelco. This leaves a credit of around $3.674 billion to be divided up among the Kestenbaum ownership group after just seven years. (Plus whatever they expropriated annually during the seven years of ownership in "compensation." These payments came from the new value steelworkers produced during this period.)

No wonder the Globe and Mail titled its article "The Sale of Stelco Continues Billion Dollar Windfall for Its Owners."

Kestenbaum and his cronies and those who preceded them never intended to develop Stelco into the steel company Canadians need and wish for. Like his predecessors, Kestenbaum has proven in practice that his principle aim is to line his and his cronies' pockets leaving Canadians further trapped within the U.S. military-industrial-civilian complex and war economy with enormous produced social wealth flowing south into the hands of unscrupulous individuals and narrow private interests.

The very least a self-respecting Government of Canada could do is intervene to stop the sale and take control of the Stelco facilities and demand the ill-gotten gains of the Kestenbaum gang be returned to the Hamilton region and be put to use to strengthen steel production and distribution in Canada, assert the rights and just claims of steelworkers and help deal with the glaring social inequalities and other problems in Ontario and Canada.

Also to discuss is why this sale to Cleveland-Cliffs is presented in the mass media and by steel experts and university pundits as the only possibility with no other direction considered. Statements made to the effect that the U.S. buyer promises to be a good employer do not answer the questions which arise surrounding what amounts to robbery in broad daylight of Stelco's golden eggs.

Of interest to Canadians is how Stelco, Dofasco and other steelmakers can become a steel complex to serve Canadians under the control of Canadians especially those who do the work, and to harmonize the company's relations with the people and environment and make a contribution to turning Canada into a zone for peace.

Stelco steelworkers raised important slogans when they refused to cut their throats by capitulating to two rounds of CCAA fraud. Steel, Not Steal! Uphold the Dignity of Labour! Our Security and Our Future Lie in Fighting for the Rights of All! These calls continue to be upheld by Hamilton steelworkers because they remain even more valid today.

Note

1. Statistics for 2024 do not come up when the internet is searched for information. A December 2023 report refers back to 2021: "In 2021, Canada produced almost 13 million metric tons of crude steel, up from 11 million metric tons in 2020." Prior to this, between 2014 and 2018, Canada's crude steel production averaged 12.9 million metric tons. Production in 2019 then went down 5 per cent to 12.8 million metric tons, from 13.4 million metric tons in 2018.

The Global Steel Trade Monitor's Steel Exports Report dates back to May 2020. It says:

"Canada was the world's 18th-largest steel exporter in 2019. In 2019, Canada exported 5.8 million metric tons of steel, a 12 per cent decrease from 6.5 million metric tons in 2018. Canada's exports represented about 1.5 per cent of all steel exported globally in 2019, based on available data. By volume, Canada's 2019 steel exports represented over one-tenth the volume of the world's largest exporter, China. In value terms, steel represented 1.1 per cent of the total goods Canada exported in 2019.

"Canada exports steel to over 130 countries and territories. The United States and Mexico represent the top markets for Canada's exports of steel, receiving more than 350,000 metric tons each. [...]"

Additional Information

Statement of the United Steel Workers Locals

The United Steelworkers issued a statement on July 15 on Stelco's announcement of sale agreement with Cleveland-Cliffs, issued by the presidents of Locals 8782 and 1005 and District 6 Director Marty Warren. They reported that two dozen representatives of steelworkers at Stelco's Hamilton and Lake Erie operations met by video conference with Lourenco Goncalves, Cleveland-Cliffs' President, CEO and Chairman of the Board. The statement says:

"First and foremost, our union believes that any sale of Stelco must be predicated on binding commitments that it will result in tangible, net benefits to our members who are primarily responsible for the company's success, as well as to the communities in which our members and pensioners live and work, and to our province and our country.

"We believe that any purchase of Stelco must come with commitments to honour our members' collective agreements, to protect pensions and benefits, and to make investments that will protect and create jobs and ensure the long-term viability of the company's operations.

"We are committed to engaging in good-faith discussions with Cleveland-Cliffs to ensure these vital objectives are met.

Also on July 15 Stelco CEO Allan Kestenbaum sent a letter to employees outlining some parts of the sales agreement, expectations of increased production and saying that "I also want to point out that Cliffs shares my views with respect to the importance of harmonious relationships with our partner, the United Steelworkers. I am confident that both our represented and salaried colleagues are in great hands with Cliffs" and thanking the workers for their hard work and dedication to Stelco -- "You are one of the main reasons for the success we have achieved together and I am confident that Stelco's future together with Cliffs will be even brighter."

About Alan Kestenbaum, Executive Chairman and Chief Executive

Officer of Stelco Alan Kestenbaum has extensive investing and operating experience in the metals and mining and natural resources sectors as well as a successful track record in turnarounds and restructurings. He currently serves as the Executive Chairman and Chief Executive Officer of Stelco where, according to his profile, "he is responsible for strategic direction and growth initiatives." He was also the Executive Chairman and founder of Globe Specialty Metals and was the former Executive Chairman of Ferroglobe PLC ("Globe") (NASDAQ: GSM). Prior to forming Globe Specialty Metals, Mr. Kestenbaum founded Marco International, a leading international metals trader and investor, and led its expansion in North America and around the globe. Prior to founding Marco International, he was employed by Glencore and then Philipp Brothers. In 2019 he became a minority owner and limited partner of the Atlanta Falcons. Mr. Kestenbaum is also a founder of Bedrock Industries Group LLC, a privately held investment vehicle. He has a B.A. in Economics from Yeshiva University and is involved in numerous educational and communal boards.

Business Newswire Announcement of the Sale

Stelco Holdings Inc. (TSX: STLC) ("Stelco" or the "Company") is pleased to announce that it has entered into a definitive agreement (the "Arrangement Agreement") with Cleveland-Cliffs Inc. (NYSE: CLF) ("Cliffs"), pursuant to which Cliffs has agreed to acquire all of the issued and outstanding common shares of Stelco (the "Transaction") at a price of C$70.00 per share (the "Consideration"), consisting of C$60.00 in cash and 0.454 of a share of Cliffs common stock (equivalent to C$10.00 based on the closing price of Cliffs common stock on July 12, 2024) per Stelco share.

The total enterprise value pursuant to the Transaction is approximately C$3.4 billion. The Consideration represents an 87 per cent premium to Stelco's closing share price of C$37.36 on July 12, 2024, and a 37 per cent premium to Stelco's 52-week high.

Fairfax Financial Holdings, an affiliate of Lindsay Goldberg LLC, Alan Kestenbaum, and each of the other directors and executive officers of Stelco collectively holding approximately 45 per cent of the current outstanding Stelco common shares have entered into support agreements to vote in favour of the Transaction, subject to customary exceptions.

Alan Kestenbaum, Executive Chairman of the Board and CEO of Stelco, stated: "I am proud of what we have accomplished over the past seven years, and the value we have generated. This sale crystallizes a 32 per cent CAGR on a Stelco common share investment since our initial public offering in 2017. Most importantly, we have revitalized Stelco and restored it to its iconic status in Canada. I know that Cliffs will continue to build upon the excellent work and life environment we have created for all of our employees, and continue to be a reliable supplier to our valued customers, while maintaining Stelco's stature and reputation in Canada and maintaining our Canadian national interests. One of the important drivers for this transaction was receiving a meaningful portion of the consideration in Cliffs shares. I have strong belief and optimism in the North American steel market. I believe that Lourenco and his team have created a winning platform and I intend to remain an investor in Cliffs for a long time to come as he and his team continue to build out their platform and business."

Lourenco Goncalves, Chairman of the Board, President and CEO of Cliffs, stated: "I want to first recognize Alan Kestenbaum and the Stelco team for the remarkable turnaround they executed at Stelco, turning what was an underperforming asset under previous ownership into a very cost-efficient and profit-oriented company. In the process, they restored the Canadian national pride associated with Stelco, and we are going to continue that. We did this deal the way it should be done, reaching a respectful agreement between the two parties that keeps national interests at the forefront and recognizes the importance of the workforce. Stelco is a company that respects the Union, treats their employees well, and leans into their cost advantages. With that, they are a perfect fit for Cleveland-Cliffs and our culture. We look forward to proving that our ownership of Stelco will be a net benefit for Canada, the province of Ontario, and the cities of Nanticoke and Hamilton."

Board of

Directors' Recommendation

The Board of

Directors of the Company

unanimously approved the Arrangement Agreement following receipt of the

unanimous recommendation of the Special Committee. The Special

Committee, comprised of independent directors, was appointed by the

Board to, among other matters, review the potential

transaction and potential alternatives and consider the Company's best

interests and the implications to shareholders and other stakeholders.

The Board unanimously recommends that Stelco shareholders vote in

favour of the Transaction.

The Company intends to call and hold a special meeting of shareholders this fall where the Transaction will be considered and voted upon by shareholders of record. Further information regarding the special meeting, including the record and meeting date, is expected to be made available late this summer.

In making its determination to unanimously recommend approval of the Transaction to the Board, the Special Committee, and in the Board's determination to approve the Transaction, the Board, considered the following reasons, among others, for the Transaction:

- Compelling and immediate value and liquidity for shareholders, with large premiums to the current and 52-week high share prices;

- Ability to continue participating in the growth of Stelco, including in synergies created through the Transaction, via ownership of Cliffs common stock;

- Fairness opinions delivered by the advisor to the Special Committee as well as the advisor to the Board;

- Cliffs' strong track record as an excellent operator of integrated steelmaking assets with a special relationship with its unions; and

- Clear path to closing in a timely manner with no financing contingencies and voting support agreements from almost 50 per cent of Stelco's shareholders.

Fairness Opinions

RBC

Capital Markets provided an independent

fairness opinion to the Special Committee and Stelco's Board of

Directors and BMO Capital Markets provided a fairness opinion to

Stelco's Board of Directors, in each case to the effect that, as of the

date thereof, and based upon and subject to the

various matters, limitations and qualifications and assumptions stated

in each such opinion, the Consideration to be received by holders of

Stelco's common shares is fair, from a financial point of view, to such

holders.

Transaction

Summary

The Transaction will be

completed pursuant

to a plan of arrangement under the Canada Business Corporations Act.

The Transaction is subject to approval at the special meeting of Stelco

shareholders by (i) at least two-thirds of the votes cast by Stelco

shareholders; and (ii) a simple majority of

the votes cast by Stelco shareholders (excluding common shares required

to be excluded pursuant to Multilateral Instrument 61-101 -- Protection

of Minority Shareholders in Special Transactions). In

addition to shareholder and court approvals, the Transaction is also

subject to the receipt of

applicable regulatory approvals, including approval under the

Investment Canada Act, the Competition Act (Canada), expiration or

termination of the waiting period under the U.S.

Hart-Scott-Rodino Antitrust Improvements Act, approval of

the listing on the NYSE of the shares of Cliffs common

stock to be issued to Stelco shareholders, and approval under Stelco's

funding agreement with Canada's Strategic Innovation Fund, as well as

satisfaction of certain other closing conditions customary in

transactions of this nature. The Transaction is not subject to a

financing condition or approval

by Cliffs shareholders. Assuming the timely receipt of all required

approvals, the Transaction is expected to close in the fourth quarter

of 2024.

The Arrangement Agreement includes customary non-solicitation provisions, which are subject to customary "fiduciary out" provisions that entitle the Company to terminate the Arrangement Agreement and accept a superior proposal, subject to a customary right to match in favour of Cliffs and payment of a termination fee of C$100 million by the Company to Cliffs. A reverse termination fee of C$131 million would be payable by Cliffs to Stelco if the Transaction is not completed in certain circumstances.

Upon closing of the Transaction, Stelco expects Cliffs to cause the Stelco common shares to cease to be listed on the TSX and to cause the Company to submit an application to cease to be a reporting issuer under applicable Canadian securities laws. Cliffs common stock is traded on the New York Stock Exchange.

Further information regarding the Transaction, the Arrangement Agreement, the voting support agreements and the special meeting of Stelco shareholders, including copies of the fairness opinions, will be included in the management information circular expected to be mailed to shareholders of record in connection with the special meeting. Copies of the proxy materials in respect of the special meeting, as well as a copy of the Arrangement Agreement and the voting support agreements, will also be available on SEDAR+ at www.sedarplus.ca.

Benefits to

Canada and Stelco's

Stakeholders

Stelco understands that

Cliffs is excited

to build on its existing 1,000-employee footprint in Canada with its

Tooling and Stamping and FPT scrap businesses, and that Cliffs is

committed to working with stakeholders to deliver meaningful benefits

to Canada, Ontario, and the communities where

Stelco operates. Cliffs' plan is to grow the business in Canada and

build on the progress Stelco has made in recent years. In connection

with this investment:

- Stelco's headquarters will remain in Hamilton and the name and legacy of Stelco will be preserved in Hamilton, Nanticoke, and Canada;

- Stelco will continue its significant operations in Hamilton and Nanticoke, make capital investments of at least C$60 million over the next three years, and plans to increase steel production over current levels from those facilities;

- Stelco will maintain significant employment levels in Canada and Canadian representation on the management team;

- Recognizing the importance of Stelco's operations to the businesses in the region, Cliffs will ensure existing local supplier arrangements are maintained;

- Cliffs values and will continue Stelco's collaboration with McMaster University and CanmetMATERIALS and will maintain the existing research chairs with McMaster University;

- Cliffs respects Stelco's commitment to charitable and community support and will build on that legacy by increasing the overall charitable support by C$2 million per year, to be directed by Stelco's management team;

- Cliffs will continue Stelco's partnership with the Hamilton Tiger-Cats and Forge FC and will maintain its 40 per cent equity interest and the master lease of Tim Hortons Field. The community engagement program, including the Tiger-Cats High School Mentorship Program, will also be maintained; and

- Cliffs is committed to operating the business and approaching sustainability in a way that supports the United Nations' Sustainable Development Goals (UN SDGs) and will ensure the Canadian operations operate in accordance with the Company's sustainability priorities.

David McCall, International President of the United Steelworkers, stated: "On behalf of our entire membership, I am excited for this transaction and proud to support a deal that is great for the resilience of manufacturing and Union jobs in North America. Cleveland-Cliffs has a proven track record of making sure the Union always has a seat at the table, and this deal was no different. We are delighted to further expand our already great partnership between Cliffs and the USW."

Advisors and

Counsel

BMO Capital Markets is acting

as financial

advisor to Stelco, and McCarthy Tetrault LLP and A&O Shearman

are serving as legal counsel to Stelco. In addition, RBC Capital

Markets is acting as financial advisor and Stikeman Elliott LLP as

legal counsel to the Special Committee of Stelco's Board of

Directors.

Wells Fargo, J.P. Morgan and Moelis & Company LLC are acting as financial advisors to Cliffs. Davis Polk & Wardwell LLP and Blake, Cassels & Graydon LLP are serving as legal counsel to Cliffs. In addition, Wells Fargo Bank, N.A. and J.P. Morgan have provided full underwritten financing commitments and are backstopping Cliffs' existing ABL Facility.

About Stelco

Stelco

is a low cost, integrated and

independent steelmaker with one of the newest and most technologically

advanced integrated steelmaking facilities in North America. Stelco

produces flat-rolled value-added steels, including premium-quality

coated, cold-rolled and hot-rolled steel products, as

well as pig iron and metallurgical coke. With first-rate gauge, crown,

and shape control, as well as uniform through-coil mechanical

properties, our steel products are supplied to customers in the

construction, automotive, energy, appliance, and pipe and tube

industries across Canada and the United

States as well as to a variety of steel service centres, which are

distributors of steel products. At Stelco, we understand the importance

of our business reflecting the communities we serve and are committed

to diversity and inclusion as a core part of our workplace culture, in

part, through active

participation in the BlackNorth Initiative.

About Cleveland-Cliffs

Cleveland-Cliffs is the largest flat-rolled steel producer in North America. Founded in 1847 as a mine operator, Cliffs also is the largest manufacturer of iron ore pellets in North America. The Company is vertically integrated from mined raw materials, direct reduced iron, and ferrous scrap to primary steelmaking and downstream finishing, stamping, tooling, and tubing. Cleveland-Cliffs is the largest supplier of steel to the automotive industry in North America and serves a diverse range of other markets due to its comprehensive offering of flat-rolled steel products. Headquartered in Cleveland, Ohio, Cleveland-Cliffs employs approximately 28,000 people across its operations in the United States and Canada.

Forward-Looking

Information

This release includes

"forward-looking information" and

"forward-looking statements" (collectively, "forward-looking

statements") within the meaning of applicable securities laws.

Forward-looking statements include, but are not limited to, statements

with respect to the rationale of the Board for

entering into the Arrangement Agreement, the terms and conditions of

the Arrangement Agreement, the premium to be received by shareholders,

the attractiveness of the Transaction from a financial point of view,

the complementarity and compatibility of Stelco's business with Cliffs'

existing business,

the expected benefits of the Transaction, the intended success of

Cliffs' initiatives to benefit Canada and support Stelco's

stakeholders, the expected future performance or operations of Stelco

and/or Cliffs following the completion of the Transaction, the

anticipated timing and the various steps

to be completed in connection with the Transaction, including (among

other things) the holding of the special meeting of Stelco shareholders

(including the timing thereof) as well as the satisfaction or waiver of

the conditions to completing the Transaction (such as receipt of

required Stelco

shareholder approvals, court approvals and regulatory approvals), the

anticipated closing of the Transaction (including the timing thereof),

the anticipated delisting of the Company's common shares from the TSX

and the Company ceasing to be a reporting issuer under Canadian

securities laws.

In some cases, but not necessarily in all cases, forward-looking statements can be identified by the use of forward-looking terminology such as "plans," "targets," "expects" or "does not expect," "is expected," "an opportunity exists," "is positioned," "estimates," "intends," "assumes," "anticipates" or "does not anticipate" or "believes," or variations of such words and phrases or state that certain actions, events or results "may," "could," "would," "might," "will" or "will be taken," "occur" or "be achieved." In addition, any statements that refer to expectations, projections or other characterizations of future events or circumstances contain forward-looking statements. Forward-looking statements are not historical facts, nor guarantees or assurances of future performance but instead represent management's current beliefs, expectations, estimates and projections regarding future events and operating performance. Forward-looking statements are necessarily based on a number of opinions, assumptions and estimates that, while considered reasonable by the Company as of the date of this release, are subject to inherent uncertainties, risks and changes in circumstances that may differ materially from those contemplated by the forward-looking statements. Important factors that could cause actual results to differ, possibly materially, from those indicated by the forward-looking statements include, but are not limited to, the possibility that the proposed Transaction will not be completed on the terms and conditions, or on the timing, currently contemplated, or at all, the possibility of the Arrangement Agreement being terminated in certain circumstances, the ability of the Board to consider and approve a Superior Proposal for the Company, and the other risk factors identified under "Risk Factors" in the Company's latest annual information form and management's discussion and analysis for the year ended December 31, 2023 and in the management's discussion and analysis for the period ended March 31, 2024, and in other periodic filings that the Company has made and may make in the future with the securities commissions or similar regulatory authorities in Canada, all of which are available under the Company's SEDAR+ profile at www.sedarplus.ca. These factors are not intended to represent a complete list of the factors that could affect the Company. However, such risk factors should be considered carefully. There can be no assurance that such estimates and assumptions will prove to be correct. You should not place undue reliance on forward-looking statements, which speak only as of the date of this release.

Although the Company has attempted to identify important risk factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other risk factors not currently known to us or that we currently believe are not material that could also cause actual results or future events to differ materially from those expressed in such forward-looking statements. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, you should not place undue reliance on forward-looking statements. The forward-looking statements represent the Company's expectations as of the date of this release (or as the date it is otherwise stated to be made) and are subject to change after such date. However, the Company disclaims any intention and undertakes no obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required under applicable Canadian securities laws. All of the forward-looking statements contained in this release are expressly qualified by the foregoing cautionary statements.

(To access articles individually click on the black headline.)

Website: www.cpcml.ca Email: editor@cpcml.ca