|

June 16, 2016

Court Hearing of U.S. Steel Motion on

Intellectual

Property Rights -- June 13, 2016

Is U.S. Steel Losing Its Grip on USSC and

Becoming Desperate?

PDF

Court

Hearing

of

U.S.

Steel

Motion

on Intellectual Property Rights

• Is U.S. Steel Losing Its Grip on USSC and

Becoming Desperate?

• U.S. Steel Argues the Canadian Economy Does

Not Belong to Canadians

• U.S. Imperialism in the Ontario Superior Court

Court Hearing of U.S. Steel Motion on

Intellectual

Property Rights -- June 13, 2016

Is U.S. Steel Losing Its Grip on USSC

and Becoming Desperate?

U.S. Steel (USS), in yet another attack on the Canadian

steel sector, says it owns the patents and related intellectual

property for producing high-grade steel used at the former Stelco

now under bankruptcy protection and called U.S. Steel Canada. USS

declares none of the Stelco intellectual property presently used to

manufacture high-grade steel can be sold under

CCAA bankruptcy and subsequently used by the new owners.

The USS demand to deprive a restructured Stelco from

using advanced production technique continues its long battle to

eliminate the Canadian mills as a steel competitor. Industrial

mass production of steel cannot take place if the workers engaged in

production are prohibited from using the underlying advanced science

and technology.

The attacks on Stelco and subsequent wrecking of its

productive capacity began almost immediately after the USS takeover in

2007. Putting its wholly-owned subsidiary into

bankruptcy protection of the Companies'

Creditors

Arrangement

Act

(CCAA) in 2014 was a risky attempt to liquidate Stelco without losing

the money it paid to purchase the company's

equity. Through control of the CCAA process, USS planned to have its

equity investment declared a debt to itself and jump to the front of

the queue to seize the assets of a liquidated

Stelco. To create a fiction of debt, it has constructed an elaborate

electronic paper trail of financial transactions with its wholly-owned

subsidiary.

The ownership of patents and intellectual property used

by Stelco would normally be considered part of equity or fixed

transferred-value in a similar manner as ownership of the

machinery, tools and land. For USS to argue now that some of Stelco's

assets or fixed transferred-value belong to it outside the bankruptcy

protection of its wholly-owned foreign

subsidiary and cannot be sold opens a can of worms. Would USS then be

able to choose certain machinery, equipment or tools as not part of the

CCAA bankruptcy and assets to be sold

because it considers them special and originally supplied from the U.S.

owner?

Yet USS argues that its interest in Stelco is the

ownership of debt originating through loans from the parent company to

its subsidiary for which it has concocted an elaborate scheme. But in a

further exercise of monopoly hubris and right, USS

wants to give itself the right to pick and choose what fixed assets are

to be allowed to be sold under bankruptcy protection

as part of the built up equity. If a new owner cannot use the advanced

science and technology to make high-grade steel, this would further

cripple any attempt to restructure the

company.

The USS demand for control of patents and other

intellectual property and its refusal to negotiate the issue with USSC,

together with its recent unsuccessful attempt to terminate the

bidding process quickly and begin either a forced sale or piecemeal

liquidation of Stelco indicate that possibly it has lost control of the

CCAA process of its subsidiary and is worried and

panicky that current events are conspiring against it.

Loss of control by the original ownership group is not

uncommon under CCAA. Those forces central in the CCAA process,

especially the institutions supplying funds, the

debtors-in-possession, and others including the top executive managers

at the local level, have their own

interests and agenda. These interests can begin to

clash with those of the previous ownership group and take their own

form and direction in contradiction with the private

interests of the original ownership.

In the 2004-06 Stelco CCAA bankruptcy, the owners of

equity played virtually no role except as victims. Predators within the

process quickly seized control of the direction and assets,

exited CCAA as new owners, and subsequently made a fortune by flipping

Stelco to U.S. Steel merely eighteen months later. In the current Essar

Steel Algoma CCAA, those in control of

the process have excluded the original owners and parent Essar Group as

a potential bidder on the Algoma assets although the situation is still

in flux and the Essar Group may make a

comeback.

Two recent developments indicate that USS may be losing

control of the CCAA process involving its Canadian Stelco subsidiary

and is becoming desperate and more extreme in its

actions and wants the process quickly terminated in its favour.

USSC Production and Revenue Are Improving

USSC had a better than anticipated April and has

reacquired some of its high-value steel customers in the auto sector,

which had been taken by USS and supplied from its U.S. mills.

This is proving worrisome for U.S. Steel, which wants Stelco gone from

the steel producing scene or at least to have itself in control of any

rump production after exiting CCAA. A similar

scenario of better sales and revenue at Essar Steel Algoma appears to

be affecting the CCAA process in that case as well.

USSC revenue for April was just under $100 million, $13

million more than expected. Increased sales and higher average prices

were cited as the reason. In his latest report, the CCAA

monitor Alex Morrison overseeing the bankruptcy process said, "Over the

past several months, Management has been successful in replacing the

direct sales to automotive customers it lost

in Q4 2015 by expanding USSC's geographical customer base, selling

greater volumes to a number of existing USSC customers and selling

automotive product to the (automakers)

indirectly."

In addition to greater sales, the monitor highlighted a

higher average selling price for steel through April. Morrison said

sales and income last year were negatively affected by U.S.

Steel's decision to move production of its highest value steel to its

plants in the United States. As this is turned around and customers

begin to come back to USSC, this puts USSC into

direct competition with USS, which is a new development that would not

please those in control in Pittsburgh.

USSC Concludes Long-term Deal with Cliffs Natural

Resources Inc.

Cliffs Natural Resources Inc. is a USS competitor in

the iron ore pellet business. In early June, USSC in a surprising

announcement said it had concluded a new agreement with Cliffs

for iron ore pellets. Cliffs subsequently said it will be restarting

operations in August at its United Taconite mining facility (UTAC) in

Minnesota, which has been shut down for an

extended period.

Cliffs said the August restart of UTAC was made

possible due to additional business recently contracted with U.S. Steel

Canada to supply the majority of its iron ore pellet

requirements for the third and the fourth quarters of 2016 and beyond.

The new iron ore pellet tonnage ordered by USSC brings Cliffs' sales

volume expectations for the year to a higher

level than anticipated in the Company's previous forecast.

Lourenco Goncalves, Cliffs' CEO said with undisguised

glee, "We are very pleased to announce an increase of our pellet supply

to U.S. Steel Canada, who became a new Cliffs' client

in 2016. U.S. Steel Canada used to be a captive client of its former

parent company U.S. Steel Corporation. We are also very pleased to

announce a higher sales guidance for 2016, thanks

to this new business with U.S. Steel Canada, which came at a higher

tonnage than we had previously anticipated. Most importantly, I am

happy to bring our entire UTAC team back to

work a lot earlier than previously announced last week."[1]

You can almost hear the grinding of teeth in Pittsburgh

from this development. U.S. Steel's own iron ore pellet mine is

partially shut down and in need of sales. Did Pittsburgh order

its mining division not to conclude an agreement with USSC? Is

Pittsburgh hoping instead for liquidation of Stelco or at the very

least bringing Lake Erie Works back under its control?

Either way no agreement with Cliffs would then be necessary as the

supplying of iron ore pellets from its own mining facilities is an

internal transfer of value.

On a related side issue, the Cliffs' agreement with

USSC and another much larger 10-year contract for iron ore pellets

signed with ArcelorMittal are having a big impact on

competition in the sale of iron ore pellets, and also on the Essar

Group and the CCAA process involving Essar Steel Algoma. Essar Group

has almost $2 billion tied up in constructing a

new iron ore pellet mine and refinery in Minnesota south and west

across the border from Essar Steel Algoma. Essar had hoped to conclude

an agreement for pellets with ArcelorMittal but

it opted out because Essar seems incapable of completing the Minnesota

project on time. Essar was planning to supply its own Algoma steel mill

from its new Minnesota mine but this has

been put in doubt under CCAA. This leaves the Essar uncompleted mine

with no customers at this point unless it can close a deal to purchase

the former Stelco and regain control of

Algoma as well.

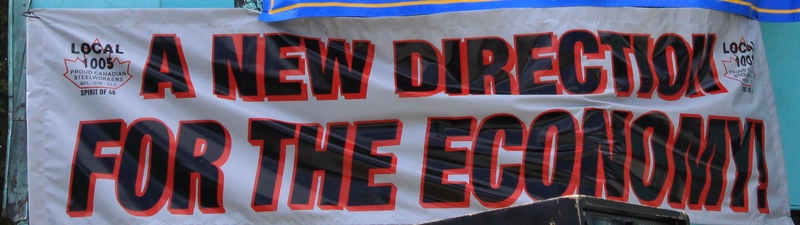

A New Direction Is Needed to Stabilize the Economy and

Provide Security for Canadians

Workers cannot be indifferent to the events at Stelco

and Algoma Steel and not intervene with their own forceful demands. The

present system is not working and needs a radical

change. The working class has to be in the forefront of fighting for a

change in the direction of the economy to stabilize and secure it, and

develop relations of production in conformity

with the economic base and in such a way that equilibrium is

established.

In the basic sectors, a public authority is needed to

exercise control over the direction of the economy and its productive

facilities so that it favours the people and public interests.

Ownership can no longer be considered the deciding factor in control of

the basic sectors. Ownership has to be relegated to just one factor in

the basic economy, which receives due

consideration for its private interest for a return on its social

wealth, but is not in control of the direction of the basic sectors. A

public authority infused with the aim of the people to serve

the public interest and economy, and which recognizes and upholds the

rights of the actual producers must become the deciding and controlling

factor.

The people can readily see all the interrelatedness of

the production process and the need for harmony with the economy's

different parts. This must start from a base in Canada that

the people can control and over which public right has authority and

the power to deprive monopoly right of its power to cause trouble such

as what is happening at both Stelco and

Algoma Steel and elsewhere.

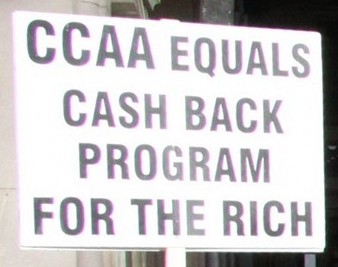

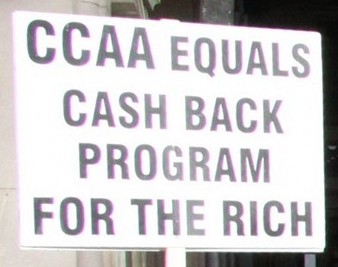

The CCAA process is a tool of monopoly right. The court

must be removed from the restructuring of the basic sectors. A public

authority must be established to control the

restructuring that has the mission to serve the public interest and the

stability and development of the Canadian economy, and which recognizes

and upholds the rights of the active and

retired working class.

The actual producers have to step forward as conscious

participants in seeking a way forward and to ensure and guarantee the

rights of all and that any public authority in control does

not deviate from its social responsibilities.

To read the two press releases from Cliffs

Natural Resources dealing with the agreements with USSC and

ArcelorMittal see below.

For Your Information

Cliffs

Natural Resources

Inc. Announces Earlier Restart of United Taconite

and Increases 2016

Sales Guidance

Press Release -- June 9,

2016

CLEVELAND, June 9, 2016 /PRNewswire/ -- Cliffs Natural

Resources Inc.(NYSE: CLF)announced today that it will be restarting

operations in August at its United Taconite mining

facility (UTAC) in Minnesota. This restart will occur two months

earlier than the anticipated October 2016 start date previously

reported last week following the announcement of the

Company's 10-year supply agreement with a major steel client. The

August restart of UTAC was made possible due to additional business

recently contracted with U.S. Steel Canada to

supply the majority of their iron ore pellet requirements for the third

and the fourth quarters of 2016. The new iron ore pellet tonnage

ordered by U.S. Steel Canada brings Cliffs' sales

volume expectations for the year to a higher level than anticipated in

the Company's previous forecast. Accordingly, Cliffs is revising its

2016 sales volume guidance to 18 million long tons

from its previous guidance of 17.5 million long tons. In addition, 2016

production volume guidance has been increased by 500,000 long tons to

16.5 million long tons.

Lourenco Goncalves, Cliffs' Chairman, President and

Chief Executive Officer, stated: "The vast majority of the steel

companies in North America are currently enjoying stronger order

books, and their demand for high quality iron ore pellets from a

reliable supplier is increasing. With that, Cliffs' business continues

to gain very positive momentum, with the improvement

of the existing business with our long established clients and the

addition of new ones." Mr. Goncalves added: "We are very pleased to

announce an increase of our pellet supply to U.S.

Steel Canada, who became a new Cliffs' client in 2016. U.S. Steel

Canada

used to be a captive client of its former parent company U.S. Steel

Corporation. We are also very pleased to

announce a higher sales guidance for 2016, thanks to this new business

with U.S. Steel Canada, which came at a higher tonnage than we had

previously anticipated." Mr. Goncalves

concluded: "Most importantly, I am happy to bring our entire UTAC team

back to work a lot earlier than previously announced last week." United

Taconite is comprised of an iron ore

mine and a pellet processing plant, and is located in Minnesota. The

operation employs approximately 450 employees.

Cliffs Natural

Resources Inc. and ArcelorMittal USA LLC Enter Into

New Long-term Iron

Ore Supply Agreement through 2026

Press Release -- May 31, 2016

CLEVELAND, May 31, 2016 /PRNewswire/--Cliffs Natural

Resources Inc. (NYSE: CLF) announced today that it has entered into a

new long-term commercial agreement with

ArcelorMittal USA LLC to supply tailor-made iron ore pellets for the

next ten years through 2026. The new agreement will replace two

existing agreements expiring in Dec. 2016 and Jan.

2017 and fill the entirety of ArcelorMittal's pellet purchase

requirements from the previous contracts. The new commercial agreement

includes ArcelorMittal's total purchases of iron ore

pellets from Cliffs up to 10 million long tons and preserves Cliffs'

current position as ArcelorMittal USA's sole outside supplier of

pellets. Accordingly, Cliffs will continue to be the sole

pellet supplier of ArcelorMittal's Indiana Harbor West and Cleveland

Works steelmaking facilities, while maintaining the current level of

pellet supply to ArcelorMittal's Indiana Harbor

East facility. The new contract also establishes a minimum tonnage of

pellets of 7 million long tons, which is higher than the current

minimum level from the two previous contracts

combined.

Lourenco Goncalves, Cliffs' Chairman, President and

Chief Executive Officer, said, "Cliffs is pleased to announce a major

accomplishment within the execution of our strategy, which

is the signature of a new 10-year pellet supply agreement with

ArcelorMittal. We arrived at a mutually beneficial agreement, as both

companies recognize the importance of bringing

sustainable value to our respective businesses." Goncalves added, "The

signing of the new supply agreement confirms what we have always stated

regarding the strength of the business

relationship between Cliffs and ArcelorMittal USA. The new agreement

also removes any remaining uncertainty about Cliffs, and supports our

conviction in the bright future of our

Company, its employees, its shareholders, and all other stakeholders,

including the communities in which we operate."

Pricing for the pellets under the agreement will be

adjusted by the price of steel in the U.S. domestic market, and iron

ore market based and general inflation indices. Based on current

market levels, Cliffs anticipates an improvement in overall United

States Iron Ore realized revenues per ton in 2017, when compared to the

company's current guidance for 2016.

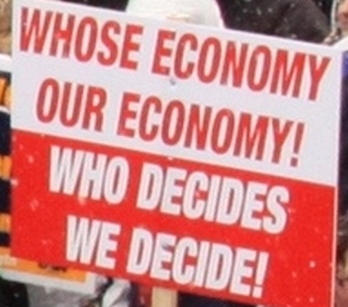

U.S. Steel Argues the Canadian Economy Does

Not Belong to Canadians

U.S. Steel says Canadians have no right to use existing

production technique at the former Stelco mills once the subsidiary is

sold to new ownership. USS wants to deny the science of

producing lightweight steel to competitors who may buy Stelco. This

demand comes even though USS has put the Canadian subsidiary into

bankruptcy protection. A forced sale under the Companies' Creditors

Arrangement Act (CCAA) usually means the company

is either liquidated with all assets sold piecemeal, including patents

such as in the Nortel Networks case, or the

complete operation is transferred to new ownership.

USS wants to pick and choose what Canadian assets are

included in the bankruptcy. This arises because it considers Canada and

the former Stelco as subjects that do not have an

objective independent existence, being or rights. On a broad scale USS

denies even its ownership of Canadian equity in the form of fixed

assets as if they do not exist. This is to avoid

losing them or their equivalent in money through the CCAA. Instead, USS

has concocted a story of ownership of debt in Canada rather than

ownership of anything real and productive with

the exception of intellectual property. Within this scenario, USS hopes

to liquidate Stelco's production capacity as a competitor but still

have the bits and pieces sold to cover the so-called

debts to itself. The disappearance of equity ownership and its

reappearance as debt to itself gives USS a veto in the restructuring as

no new company would want to have $2.2 billion in

payment for the assets fly off to U.S. Steel with nothing left to deal

with legitimate obligations such as pensions, other post-retirement

benefits, creditors such as suppliers, contractors, and

municipal taxes, the provincial debt of $150 million and environmental

liabilities.

Within this denial of ownership, USS wants to pick and

choose what is considered Canadian fixed assets and what is considered

not-Canadian even though existing in Canada and used,

including production technique and science. USS dares to argue this

from a position of monopoly right, even though knowing that science and

technique are inseparable from modern

productive forces. Machines need workers to operate, maintain and

repair them, and workers cannot perform their work without the

technical knowledge and science needed for the

machines to produce effectively.

USS argues from a position of imperialist strength

against what it considers a dominated country and working class. It

would argue in a different way in the U.S. under Chapter 11, the

U.S.-style CCAA type of bankruptcy. The patents and technique would

automatically go to the new owners along with all other fixed assets.

This was the case here also when

Canadian-owned Stelco was last in CCAA from 2004-06 and exited under

new ownership. The new owners seized all the assets from the former

owners of Stelco including the science and

technique of the productive forces.

The fact that this issue of intellectual property is

even argued in the CCAA court and given credibility exposes the

imperialist hubris of U.S. Steel and the submissive and dominated

position of the Canadian authorities and the inability and

unwillingness of the Ontario Superior Court and federal and Ontario

governments

to intervene and handle the matter in the people's favour

and to defend the Canadian economy. A public authority is needed to

take control of the situation with the aim of serving the public

interest and Canadian economy.

The IP issue raises the importance of having an

independent economy under the control of Canadians where research and

development and scientific technique serve the people, and

where foreign imperialists cannot deprive the workers of their right to

continue to use the advanced technique in production. Control of the

economy has been a central issue in this saga of

U.S. imperialist domination of the Canadian steel sector right from the

moment U.S. Steel took over Stelco.

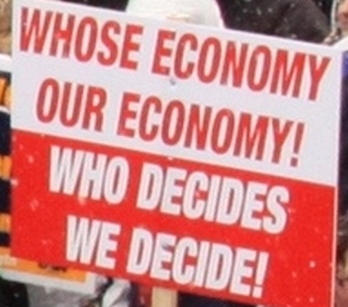

Who controls the economy? Canadians have to step

forward and declare forcefully: we control the economy! It is our

responsibility because the economy and its productive forces

affect everything in our lives. Ownership of the productive forces is a

factor but just one factor under the control of the actual producers

who are Canadians. Without control of their

economy, Canadians do not have control over their lives, future and

individual and collective security and well-being.

U.S. Imperialism in the Ontario Superior Court

U.S. Steel Canada (USSC, the former Stelco) put forward

a motion

requesting a court order under the authority of the CCAA, "establishing

an intellectual property claims process ... to

identify, determine and resolve intellectual property claims" involving

the Canadian subsidiary and the foreign owner U.S. Steel (USS).

Counsel R. P. Streep representing USSC said that the

Court approved Transition Agreement between USS and USSC from last

October included a provision that both parties would

attempt to work out the issue of intellectual property (IP) and

intellectual property rights through discussion and negotiations. If

negotiations failed then a motion would be submitted to the

Court no later than the end of June 2016. USS was part of this

agreement and while discussion has taken place on the issue, USS

refused to provide a "definitive or particularized list of

Intellectual Property (or Intellectual Property Rights) that USSC is

using or has used in the past, that USS claims USSC (or any successor

or assign of any of its assets or business) cannot

continue to use." (Affidavit of William Aziz - the Monitor- Page 6 Para

16).

Streep contends the submitted procedural motion is

meant to find a way to resolve the issue and is necessary for the sale

of USSC, as the bidders need to know what they are buying.

Streep said USS has had eight months since the October Transition

Agreement to participate in negotiations but has so far refused even to

identify what it claims as IP not to be included as

USSC property.

The lawyers for USW, USW Local 1005, the Province,

non-unionized employees and Monitor supported the motion so that the

issue could be given a hearing and resolved. They

contend that USS should clarify the IP it considers not part of the

sales process and have a ruling on the validity of its claims,

otherwise

USS has an advantage over other stakeholders.

The lawyer for the Monitor insisted the motion is a

procedural one meaning the Monitor would be required to review the USS

IP claims and assess them. The lawyer did not want the

court to think that the Monitor's support for the motion prejudiced the

claims of USS, meaning the Monitor supports the contention of USS that

its equity position in the former Stelco is a

debt to itself, which must be paid first when the assets are sold and

it has the monopoly right to do so. The Monitor wants this motion to

clear up the issue of intellectual property

ownership separate from other assets as that would facilitate the sales

process by helping the bidders know how the issue affects their bids.

Lawyer Michael Barrack for USS said the U.S. company

was not trying to involve itself in the sales process today, readily

emphasising the "today." He predicted the claims process

outlined in the motion was doomed to fail, presumably because USS will

ensure its failure by not cooperating. The desire to see the failure of

the sales process is consistent with the

conduct of USS because it does not want a competing steel company to

successfully restructure USSC. Barrack suggested an alternative process

of reciprocal disclosure presumably between

USS and USSC. He seemed to imply that the USSC motion was designed to

poach research and development in advanced high strength steel and new

grades of high grade steel and other

developments that have not reached the commercial level and USS was not

willing to engage in such discussions. He said USSC has no right to and

is not party to USS contractual

agreements and licensing arrangements. Barrack said USS does not know

what USSC has downloaded from certain "How to" books it was given or

what intellectual property it has used

and considers part of its technical base. He insisted USSC should

disclose all its technical knowledge first. He suggested that after

disclosure, USS could then say what it considers belongs

to the parent company alone and what belongs to both. USS wants to know

what USSC will be giving to its bidders in terms of IP information.

USSC has to lead in disclosures Barrack

insisted and then USS will respond.

Lawyer Streep countered that what USS was proposing

would involve USS in the bid process as an overseer and gatekeeper, a

position it should not have. Streep did not acknowledge

that given the court's previous acceptance of U.S. Steel's

transformation of its equity in Stelco into debt, this already makes

USS an overseer and gatekeeper.

The judge passed the USSC motion but with the comment

that "it goes too far," which he did not clarify other than to say he

would make two deletions in his written decision. He

ordered USSC and USS to work together on "language" regarding changes

to the October Draft Order and determine what IP issues cannot be

resolved and have to be brought back to the

court.

Outside the courtroom the steelworkers and their allies

in attendance discussed the proceedings. The court skirted around the

issue, they said. Specifically, USS is worried about losing

Protec as a customer. Protec has traditionally bought large quantities

of steel from USSC until USS took the orders away. Protec demands and

uses high grade steel that is very difficult to

make and Stelco workers are experts in its production. The high value

steel is a big money-maker for whoever produces it. USS appears worried

about losing Protec and other customers to

a revitalized USSC or Stelco. The Canadian mills know exactly what

Protec wants and how to produce the steel the company and others

demand. With Essar in the mix with a bid for

USSC, it would be interested in supplying Protec and others with the

desired high grade steel. The competition from a resurrected USSC is

exactly what U.S. Steel sought to destroy in

Canada. The issue of who controls Stelco and its future direction

constantly raises its head. The CCAA has proven itself as no place to

settle such crucial questions as monopoly right

dominates public right. An alternative public institution is required

that has the authority to deprive monopoly right of its power to

overwhelm the public interest and deprive Canadians of

their rights.

PREVIOUS

ISSUES | HOME

Read The Marxist-Leninist

Daily

Website: www.cpcml.ca

Email: editor@cpcml.ca

|