|

June 2, 2016

CCAA Court Is No Place to

Settle Important Matters for the People and Economy

The Arrogance of Monopoly Right

PDF

CCAA

Court

Is

No

Place

to

Settle Important Matters for the People and Economy

• The

Arrogance of Monopoly Right

• Denial of Workers' Rights in Bankruptcy

Restructuring

• Bankruptcy Protection of U.S. Steel Canada

and Essar Steel Algoma

Is a Public Matter

• The Wily Foxes in Charge of the Henhouse

CCAA Court Is No Place to

Settle Important Matters for the People and Economy

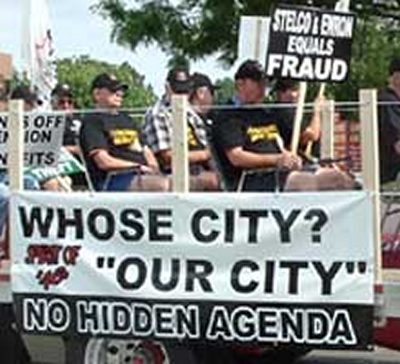

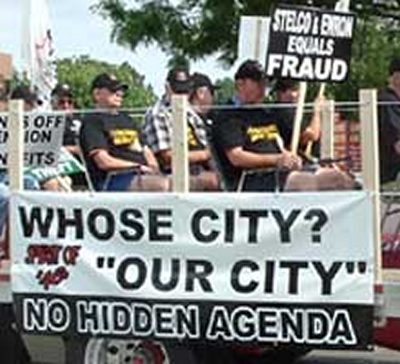

The Arrogance of Monopoly Right

United Steelworkers, USW Local 8782, USW Local 1005 and

the

province of Ontario are appealing a ruling of the Ontario Superior

Court to declare U.S. Steel's equity ownership of

the former Stelco as debt to itself. The ruling under the authority of

the Companies' Creditors Arrangement Act (CCAA)

puts USS in a priority position to be paid upon the forced

sale or liquidation of U.S. Steel Canada, the former Stelco. USS filed

a Responding Factum in the Court of Appeal on May 27, in support of the

original CCAA ruling declaring its equity

in the wholly-owned subsidiary as debt to the parent U.S. corporation.

In the Factum, USS

acknowledges: In the Factum, USS

acknowledges:

"5. USSC is an indirect, wholly-owned subsidiary of

USS. It is an

integrated steel manufacturer and operates from two principal

facilities: Hamilton Works and Lake Erie Works. Prior

to its acquisition by USS, USSC was known as Stelco Inc.

"6. U. S. Steel Canada Limited Partnership (‘Canada

LP') is a

limited liability partnership formed under the laws of Alberta. Canada

LP is an indirect wholly-owned subsidiary

of USS.

"7. 1344973 Alberta ULC (‘ABULC') was an Alberta

corporation. ABULC

was the acquisition vehicle for USS's acquisition of Stelco."

USS purchased Stelco in 2007 with the deal closing on

October 31.

USS paid $1.1 billion for Stelco's "new shares" from a gang of Social

Wealth Controlling Funds (SWCF) including

Tricap Management Limited, Sunrise Partners Limited Partnership,

Appaloosa Management L.P., and Stelco CEO Rodney Mott, who is from the

U.S. and was parachuted in to facilitate the

sell-out to USS. The SWCF gang seized control of Stelco during CCAA.

Under Stelco's 2004-06 CCAA bankruptcy protection, those in control of

the process eliminated the existing equity

shares, essentially without compensation, and replaced them with new

ones owned by themselves.

Only 18 months after Stelco emerged from CCAA, the SWCF

gang

flipped the company selling all the new shares to USS. U.S. Steel

immediately delisted the new Stelco shares from

the Toronto Stock Exchange making the U.S. parent company the sole

direct owner of Stelco. USS also assumed $800 million in Stelco debt

for a total initial investment of $1.9

billion.

Prior to a public

announcement closing the deal, USS says a "loan

agreement" was struck with the newly purchased and reorganized

subsidiary, now called U.S. Steel Canada, to

borrow from the parent company, at least on paper, the amount USS paid

to the SWCF gang, approximately $1.9 billion in cash and assumed debt. Prior to a public

announcement closing the deal, USS says a "loan

agreement" was struck with the newly purchased and reorganized

subsidiary, now called U.S. Steel Canada, to

borrow from the parent company, at least on paper, the amount USS paid

to the SWCF gang, approximately $1.9 billion in cash and assumed debt.

USS writes in the Factum:

"8. Canada LP and USSC, are parties to a loan agreement

dated

October 29, 2007 (the ‘Term Loan'), pursuant to which Canada LP made

advances to USSC [...]

"9. As of the date USSC filed for protection under the

CCAA (the

‘Filing Date'), the total amount outstanding under the Term Loan,

including accrued interest, was

C$1,847,169,934."

The initial paper trail to portray the purchase,

investment and

equity ownership of Stelco as debt to itself was followed with

continuous attacks on production at both Hamilton Works

and Lake Erie Works. The shutdowns and losses mounted year after year

culminating in the idling of the blast furnace in Hamilton in 2010, and

permanent cessation of steelmaking in 2013.

Production for the best customers of high-value steel was transferred

to USS plants in the United States.

In tandem with the crippling of production and mounting

losses, USS

created a further paper trail of further large loans to its Canadian

subsidiary totalling $193,089,318 in 2010. The

paper trail continued using its own wholly-owned financial institution

called Credit Corp.

USS writes in the Factum:

"12. Pursuant to a security agreement dated January 28,

2013, as

amended by agreement dated October 30, 2013 (the ‘Security Agreement'),

USSC granted Credit Corp a

general security interest over all of its personal property .

"13. Subsequent to the grant of security by USSC, USSC

made further advances under the Revolver Loan of US$71,000,000.

"14. On November 12, 2013, Credit Corp, USSC, USS and

two other USS

affiliates entered into a further amendment and restatement of the

Security Agreement providing security to

USS and the two USS affiliates in respect of the provision of

intercompany goods and services on credit by any of them to USSC."

The "secure" provision of goods and services now totals

US$49,533,135, according to USS.

Less than a year after the "Security Agreement," USS

put its

wholly-owned Canadian subsidiary into CCAA bankruptcy protection on

September 16, 2014.

USS writes: USS writes:

"17. USS filed claims in the CCAA proceedings including

unsecured

claims (the ‘Debt Claims', which included amounts owing under the Term

Loan and amounts accrued

under the Revolver Loan prior to the grant of security) for

C$1,847,169,934 and US$120,150,928 and secured claims (the ‘Secured

Claims') in the amount of US$122,471,575."

Under CCAA, the debt claims of USS on its wholly-owned

subsidiary

are superior to most other claims and certainly any equity ownership,

which is generally subordinate to most

claims. The issue of equity ownership of USSC has disappeared into a

deep pit supposedly to be resolved upon exiting CCAA when new ownership

will claim all the assets or bits and

pieces.

The paper trail of debt to itself appears to be

carefully crafted

insurance against a failure of U.S. Steel Canada, which was predictable

given the crippling of production. Some suggest

that the evidence points to something more sinister, a deliberate

wrecking of Stelco as a competitor with minimum financial hardship to

U.S. Steel owners once the payout from the forced

sale of assets is complete. But why go into CCAA to sell the assets?

The major difference in a sale of assets under CCAA bankruptcy

protection and outside CCAA is the dumping of the

pension, post-retirement benefits and other financial obligations, the

$150 million loan to the Ontario government and other loans and

payments to suppliers and contractors. The total on

that front is more than what USS is now demanding as a priority debt to

itself. Of course, this scheme would only work if USS could transform

its equity into debt to itself and the CCAA

authority and federal and Ontario governments bow down to monopoly

right and negate public right.

Many Canadians would say this manoeuvring to serve

narrow private

interests is no way to build an essential sector of the basic economy.

Something has to be done to save the

situation for the good of the Canadian economy, workers, pensioners and

communities. The arrogance of monopoly right has to be curtailed.

Public right to build the nation is paramount.

Monopoly right to wreck the economy and nation must be confronted and

defeated. If defence of the security of the people and their economy is

to mean anything in practice, the state must

act to stop U.S. Steel's wrecking and attack on Canada.

(To be continued

with a further review of the USS Factum. The entire USS Factum is

available here.)

Denial of Workers' Rights in

Bankruptcy Restructuring

Depriving workers and retirees of

their rights in restructuring

should

have no place in modern Canada

Ontario Superior Court Justice Frank Newbould is

overseeing the bankruptcy protection and restructuring of Essar Steel

Algoma under the federal authority of the Companies'

Creditors Arrangement Act (CCAA). Justice Newbould admits publicly

that he has no competence in economic matters and prefers to leave

decisions in the hands of the financial

oligarchy. Soo Today wrote on May 19, "Justice Newbould ruled

that he was poorly equipped to second-guess a decision on financial

viability made by Essar Steel Algoma in

conjunction with 'highly qualified professionals with great experience

in restructuring. Under our corporate law, a court should be loath to

interfere with the good faith exercise of the

business judgment of directors and officers of a corporation,' the

judge said."

The statement belies belief. Does the judge not realize

that he is overseeing the bankruptcy protection of a major corporation

in an

essential sector? Similar "professionals, directors and officers"

put Algoma Steel into such a mess that it has sought bankruptcy

protection under the CCAA not once but three times in the last 25

years! No root problem has been sorted out by these

"highly qualified professionals" yet "under our corporate law," says

the judge, the court system is nonetheless "loath to interfere with the

good faith exercise of the business judgment of

[these] directors and officers."

Newbould's subjective assessment of those in charge is

irrelevant, as is his own admission of incompetence in economic

affairs. The issue with the CCAA court, which renders it

useless to sort out any economic problem, is the violation of the

rights of the workers, salaried employees, retirees and people in the

affected workplaces and communities. This alone

renders the CCAA court invalid and no place to settle matters of such

importance for the people and economy.

A modern economy cannot function without equilibrium in

the social relations between those in control of the productive forces

and the working class. "The good faith exercise of the

business judgment of directors and officers of a corporation" must

begin with the recognition of the rights of all those involved not just

those who own and control the enterprise. The aim

of the public authority overseeing the restructuring of a struggling

company must serve the interests of all those affected not just the

directors and officers of the enterprise or those

presently in control of the bankruptcy process and restructuring.

The same backward view of

non-interference in management rights is thrown at unions that organize

to represent the interests of workers at an enterprise. Workers are

told not "to

interfere with the good faith exercise of the business judgment" of the

professionals in control who represent the private interests of the

owners and directors. Many in control of enterprises

fight against equilibrium such as the present case in Hamilton where

the German imperialists who control MANA refuse to negotiate with

steelworkers and have locked them out for over

three years. Workers are told they should have no rights, no say over

their wages and working conditions and no right to veto decisions of

management that go against the interests of the

workers. The working class finds itself in a constant battle to

organize to defend itself in all situations to uphold its dignity and

affirm its rights and this includes under CCAA. The same backward view of

non-interference in management rights is thrown at unions that organize

to represent the interests of workers at an enterprise. Workers are

told not "to

interfere with the good faith exercise of the business judgment" of the

professionals in control who represent the private interests of the

owners and directors. Many in control of enterprises

fight against equilibrium such as the present case in Hamilton where

the German imperialists who control MANA refuse to negotiate with

steelworkers and have locked them out for over

three years. Workers are told they should have no rights, no say over

their wages and working conditions and no right to veto decisions of

management that go against the interests of the

workers. The working class finds itself in a constant battle to

organize to defend itself in all situations to uphold its dignity and

affirm its rights and this includes under CCAA.

The disequilibrium in relations of production is a

major reason why economic problems and crises keep recurring. No

problem can be sorted out that serves the general public interest

and brings some stability to the economy and society without

equilibrium in the social relation between the working class and those

who own and control social wealth. To deal with these

situations and problems where a large company is in difficulty, a

public authority is necessary, which assumes control and as first

principle recognizes and upholds the rights of all those

involved including importantly the active and retired workers.

The Ontario Superior Court is clearly not such a public

authority and should not be involved in restructuring of companies. An

alternative public authority serving the broad public

interest must be constituted that can bring a climate of equilibrium to

restructuring by upholding as first principle the rights of all those

involved and affected, including importantly the

active and retired working class.

Bankruptcy Protection of U.S. Steel Canada and

Essar Steel Algoma Is a Public Matter

Justices Frank Newbould and Herman J. Wilton-Siegel of

the Ontario Superior Court are respectively in charge of the bankruptcy

restructuring of Essar Steel Algoma and U.S. Steel

Canada (USSC) in the crucial steel sector of the economy. Algoma Steel

employs over two thousand steelworkers and salaried personnel while

USSC still has over a thousand, which is down

substantially since U.S. Steel seized control of Stelco in 2007. The

two companies bear the social and economic responsibility for tens of

thousands of retirees and their dependents, buy

millions of dollars worth of supplies from local companies annually,

and the value steelworkers produce provides enormous public revenue for

the municipal, provincial and federal

governments. Algoma Steel is estimated to affect in one way or another

around 70 per cent of the 80,000 people who live in Sault Ste. Marie.

The fate of Essar Steel

Algoma and USSC currently under bankruptcy protection of the

Companies' Creditors Arrangement Act (CCAA) is not a private matter

for certain

powerful members of the financial oligarchy and court to decide. The

fate of these monopolies is a public matter and should be in the hands

of a competent public authority that upholds as

first principle the rights of those affected and the well-being of the

public interest and Canadian economy. Such a public authority should

recognize and involve those directly affected by

the restructuring and ensure that they and their peers have a say in

the resolution and importantly a veto over any decisions that are taken. The fate of Essar Steel

Algoma and USSC currently under bankruptcy protection of the

Companies' Creditors Arrangement Act (CCAA) is not a private matter

for certain

powerful members of the financial oligarchy and court to decide. The

fate of these monopolies is a public matter and should be in the hands

of a competent public authority that upholds as

first principle the rights of those affected and the well-being of the

public interest and Canadian economy. Such a public authority should

recognize and involve those directly affected by

the restructuring and ensure that they and their peers have a say in

the resolution and importantly a veto over any decisions that are taken.

The CCAA has proven in practice that certain powerful

members of the financial oligarchy and their allies in the big law

firms use the court to serve their narrow private interests

skirting existing laws and social responsibilities for pensions,

benefits and taxes. It must stop! The restructuring of major

corporations is a public matter and concerns the public interest.

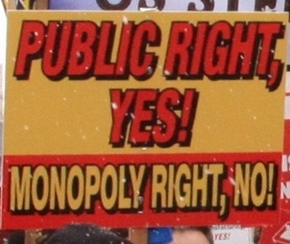

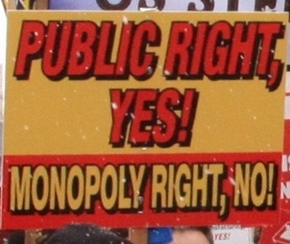

Public right must not be overwhelmed by monopoly right in restructuring

otherwise the process holds no legitimacy, stands in contempt of

society, and will sort out no problem affecting

the economy and common good.

From its practice serving monopoly right, the CCAA

court has lost all legitimacy and should have nothing to do with

restructuring companies in the basic sectors of the economy. A

public authority must be established to deal with corporate

restructuring. As first principle such a public authority must

recognize and give pride of place to those directly affected and

implicated in the operation of the company and their peers, including

the workers, salaried employees, retirees, management, suppliers, and

residents in the surrounding communities. No

one or group should occupy a privileged position with a structured

hierarchy of rights such as now exists within CCAA. The problems should

be sorted out in the public interest and for the

good of the broad common economy, not for the good of some narrow

private interest such as that of U.S. Steel's demand to wreck and

liquidate Stelco's assets and be first in line to seize

whatever they bring in money.

Bankruptcy restructuring is

a public not a private matter. The activities of big companies in the

basic sectors affect the entire economy and the well-being and security

of the people.

The stability and viability of big companies are a concern of all

Canadians, especially those workers and retirees directly affected. The

public process to resolve the recurring problems

confronting companies active in the basic sectors must serve the broad

public interest and common good of the economy and not bend its will to

the narrow private interests of those who

own and control the company. Ownership must be seen as just one factor

in the relations of production at a company that must submit to

equilibrium with all the other factors if problems

are to be resolved and the economy stabilized and rights secured.

Direct experience has shown that no good comes from a process that

deprives those affected of their rights. For many

steelworkers and retirees of Algoma Steel this is the third time in

CCAA and at Stelco the second time. Bankruptcy restructuring is

a public not a private matter. The activities of big companies in the

basic sectors affect the entire economy and the well-being and security

of the people.

The stability and viability of big companies are a concern of all

Canadians, especially those workers and retirees directly affected. The

public process to resolve the recurring problems

confronting companies active in the basic sectors must serve the broad

public interest and common good of the economy and not bend its will to

the narrow private interests of those who

own and control the company. Ownership must be seen as just one factor

in the relations of production at a company that must submit to

equilibrium with all the other factors if problems

are to be resolved and the economy stabilized and rights secured.

Direct experience has shown that no good comes from a process that

deprives those affected of their rights. For many

steelworkers and retirees of Algoma Steel this is the third time in

CCAA and at Stelco the second time.

The Ontario and federal governments must stop the

charade of CCAA restructuring of Algoma Steel, U.S. Steel Canada and

other big companies and constitute a legitimate public

authority to deal with the economic problems in the public interest and

common good.

The Wily Foxes in Charge of the Henhouse

Justice Newbould overseeing the bankruptcy

restructuring of Essar Steel Algoma is quoted as saying he would never

doubt the judgement of the professionals, directors and officers in

control of the process under the Companies' Creditors Arrangement

Act (CCAA). The statement itself throws contempt on the search to

find viable solutions to the economic

problems confronting Algoma Steel. The professionals involved in the

CCAA are in a conflict of interest. For example, the lead lender of the

Algoma Debtor-In-Possession (DIP) is Deutsche

Bank. Under the CCAA process, the DIP lender has enormous power to

manage the outcome to serve its private interests. Large creditors of

Essar Steel Algoma have loudly and publicly

accused Deutsche Bank of manipulating the restructuring and not

allowing a viable outcome given the recent rapid rise of steel market

prices.

The professionals and

officials in control under CCAA can also be the same people

representing the same private interests who put the company into the

current crisis in the first place.

At the very least, these professionals should be harshly judged for not

having found any solutions to the economic problems at Algoma Steel and

Stelco and in the steel sector in general

over the last decades. With constantly recurring crises, it has become

obvious to many Canadians that an alternative to CCAA must be found

that solves problems in the public interest and

common good and does not submit to monopoly right. The professionals and

officials in control under CCAA can also be the same people

representing the same private interests who put the company into the

current crisis in the first place.

At the very least, these professionals should be harshly judged for not

having found any solutions to the economic problems at Algoma Steel and

Stelco and in the steel sector in general

over the last decades. With constantly recurring crises, it has become

obvious to many Canadians that an alternative to CCAA must be found

that solves problems in the public interest and

common good and does not submit to monopoly right.

Steelworkers with knowledge of the Essar Steel Algoma

restructuring process say that rumours are constantly being circulated

to push this or that competing private interest. For

example, rumours were spread that the Essar Group did not have the

financial backing to underwrite the restructuring. This talk is not

made a matter of public knowledge with concrete

evidence so that it can be discussed and verified. Instead, important

issues are simply asserted and spread around to discredit competing

interests such as the Essar bid, which was

subsequently disqualified.

Whether Essar Group is financially sound or not was the

specific issue that Justice Newbould said he was not competent to

judge. After exposing his own ignorance in economic matters

he ordered everyone involved to disqualify themselves as competent in

economic matters as well and just accept without investigation the

assessment of "highly qualified professionals with

great experience in restructuring" and not "interfere with the good

faith exercise of the business judgment of directors and officers of a

corporation." Ah yes Justice Newbould, we should

just let those wily foxes run wild in the henhouse without oversight

and control because we all know, as you have ordered us to know and do,

that their hearts and motives are pure and

their hunger for chicken will not get the best of them.

The atmosphere of rumours and gossip is compounded by

the official secrecy imposed on the participants. Even amongst the

legal participants a hierarchy of privilege exists with

certain people privy to inside knowledge and decision-making while

others are not. This became starkly evident when Algoma Local 2251

United Steelworkers was left out of the loop on the decision to

exclude the Essar Group bid. How can real solutions be found to real

problems in such a backward and suffocating atmosphere?

Not informing representatives from Algoma Local 2251 of

the decision to exclude Essar Group from the next stage of bidding

makes a mockery of the restructuring process. Justice

Newbould further insults the steelworkers by stating that even if they

had been informed they had no right to participate in making the

decision so there is no point to revisit the ruling. This

further exposes the arbitrariness and illegitimacy of the CCAA system

and its incapacity to solve real problems.

Whether or not the Essar Group has the financial

capability to underwrite the restructuring should be made public

knowledge so that it can be investigated and verified. The justice

rejects any public oversight or participation with his view that "he

[is] poorly equipped to second-guess a decision on financial viability

made by Essar Steel Algoma in conjunction with 'highly qualified

professionals with great experience in restructuring.'" Everything is

to remain secret and in the hands of privileged private interests that

stand to gain from the

outcome -- the wily foxes in charge of the henhouse. Little wonder that

this marks the third time in CCAA for Algoma Steel.

The justice dismissed calls

for a review of the decision saying the outcome would be irrelevant as

union representatives have no say or control over the decision.

Regarding this issue,

the Globe and Mail reports that Mike Da Prat, President of

Local 2251 said the union is unlikely to appeal the decision, as the

CCAA court system does not favour unions. Workers

and their allies across Canada are rapidly reaching a similar

conclusion. The CCAA is an arbitrary broken system that is irreparable

because its purpose is to serve the narrow private

interests of the financial oligarchy. This is fundamentally wrong and

damaging to the lives of Canadians and their economy, especially those

directly affected by these CCAA

restructurings. The justice dismissed calls

for a review of the decision saying the outcome would be irrelevant as

union representatives have no say or control over the decision.

Regarding this issue,

the Globe and Mail reports that Mike Da Prat, President of

Local 2251 said the union is unlikely to appeal the decision, as the

CCAA court system does not favour unions. Workers

and their allies across Canada are rapidly reaching a similar

conclusion. The CCAA is an arbitrary broken system that is irreparable

because its purpose is to serve the narrow private

interests of the financial oligarchy. This is fundamentally wrong and

damaging to the lives of Canadians and their economy, especially those

directly affected by these CCAA

restructurings.

The CCAA process clearly exposes it as the open dictate

of finance capital over the people to serve narrow private interests in

opposition to the public interest, economy and common

good. The CCAA is not a place where an arrangement can be found that

considers as fundamental the well-being and security of workers,

retirees and all affected. Rather, the CCAA is a

place of brutal dictate by "professionals," "directors and officers,"

which the justices then rubberstamp with their arcane rulings.

This is unacceptable to Canadians. A public authority

responsible to the people and upholding the public interest must be

constituted to deal with these restructurings of important

monopolies in the basic sectors of the economy.

PREVIOUS

ISSUES | HOME

Read The Marxist-Leninist

Daily

Website: www.cpcml.ca

Email: editor@cpcml.ca

|

USS writes:

USS writes:

The same backward view of

non-interference in management rights is thrown at unions that organize

to represent the interests of workers at an enterprise. Workers are

told not "to

interfere with the good faith exercise of the business judgment" of the

professionals in control who represent the private interests of the

owners and directors. Many in control of enterprises

fight against equilibrium such as the present case in Hamilton where

the German imperialists who control MANA refuse to negotiate with

steelworkers and have locked them out for over

three years. Workers are told they should have no rights, no say over

their wages and working conditions and no right to veto decisions of

management that go against the interests of the

workers. The working class finds itself in a constant battle to

organize to defend itself in all situations to uphold its dignity and

affirm its rights and this includes under CCAA.

The same backward view of

non-interference in management rights is thrown at unions that organize

to represent the interests of workers at an enterprise. Workers are

told not "to

interfere with the good faith exercise of the business judgment" of the

professionals in control who represent the private interests of the

owners and directors. Many in control of enterprises

fight against equilibrium such as the present case in Hamilton where

the German imperialists who control MANA refuse to negotiate with

steelworkers and have locked them out for over

three years. Workers are told they should have no rights, no say over

their wages and working conditions and no right to veto decisions of

management that go against the interests of the

workers. The working class finds itself in a constant battle to

organize to defend itself in all situations to uphold its dignity and

affirm its rights and this includes under CCAA. The fate of Essar Steel

Algoma and USSC currently under bankruptcy protection of the

Companies' Creditors Arrangement Act (CCAA) is not a private matter

for certain

powerful members of the financial oligarchy and court to decide. The

fate of these monopolies is a public matter and should be in the hands

of a competent public authority that upholds as

first principle the rights of those affected and the well-being of the

public interest and Canadian economy. Such a public authority should

recognize and involve those directly affected by

the restructuring and ensure that they and their peers have a say in

the resolution and importantly a veto over any decisions that are taken.

The fate of Essar Steel

Algoma and USSC currently under bankruptcy protection of the

Companies' Creditors Arrangement Act (CCAA) is not a private matter

for certain

powerful members of the financial oligarchy and court to decide. The

fate of these monopolies is a public matter and should be in the hands

of a competent public authority that upholds as

first principle the rights of those affected and the well-being of the

public interest and Canadian economy. Such a public authority should

recognize and involve those directly affected by

the restructuring and ensure that they and their peers have a say in

the resolution and importantly a veto over any decisions that are taken. Bankruptcy restructuring is

a public not a private matter. The activities of big companies in the

basic sectors affect the entire economy and the well-being and security

of the people.

The stability and viability of big companies are a concern of all

Canadians, especially those workers and retirees directly affected. The

public process to resolve the recurring problems

confronting companies active in the basic sectors must serve the broad

public interest and common good of the economy and not bend its will to

the narrow private interests of those who

own and control the company. Ownership must be seen as just one factor

in the relations of production at a company that must submit to

equilibrium with all the other factors if problems

are to be resolved and the economy stabilized and rights secured.

Direct experience has shown that no good comes from a process that

deprives those affected of their rights. For many

steelworkers and retirees of Algoma Steel this is the third time in

CCAA and at Stelco the second time.

Bankruptcy restructuring is

a public not a private matter. The activities of big companies in the

basic sectors affect the entire economy and the well-being and security

of the people.

The stability and viability of big companies are a concern of all

Canadians, especially those workers and retirees directly affected. The

public process to resolve the recurring problems

confronting companies active in the basic sectors must serve the broad

public interest and common good of the economy and not bend its will to

the narrow private interests of those who

own and control the company. Ownership must be seen as just one factor

in the relations of production at a company that must submit to

equilibrium with all the other factors if problems

are to be resolved and the economy stabilized and rights secured.

Direct experience has shown that no good comes from a process that

deprives those affected of their rights. For many

steelworkers and retirees of Algoma Steel this is the third time in

CCAA and at Stelco the second time. The professionals and

officials in control under CCAA can also be the same people

representing the same private interests who put the company into the

current crisis in the first place.

At the very least, these professionals should be harshly judged for not

having found any solutions to the economic problems at Algoma Steel and

Stelco and in the steel sector in general

over the last decades. With constantly recurring crises, it has become

obvious to many Canadians that an alternative to CCAA must be found

that solves problems in the public interest and

common good and does not submit to monopoly right.

The professionals and

officials in control under CCAA can also be the same people

representing the same private interests who put the company into the

current crisis in the first place.

At the very least, these professionals should be harshly judged for not

having found any solutions to the economic problems at Algoma Steel and

Stelco and in the steel sector in general

over the last decades. With constantly recurring crises, it has become

obvious to many Canadians that an alternative to CCAA must be found

that solves problems in the public interest and

common good and does not submit to monopoly right. The justice dismissed calls

for a review of the decision saying the outcome would be irrelevant as

union representatives have no say or control over the decision.

Regarding this issue,

the Globe and Mail reports that Mike Da Prat, President of

Local 2251 said the union is unlikely to appeal the decision, as the

CCAA court system does not favour unions. Workers

and their allies across Canada are rapidly reaching a similar

conclusion. The CCAA is an arbitrary broken system that is irreparable

because its purpose is to serve the narrow private

interests of the financial oligarchy. This is fundamentally wrong and

damaging to the lives of Canadians and their economy, especially those

directly affected by these CCAA

restructurings.

The justice dismissed calls

for a review of the decision saying the outcome would be irrelevant as

union representatives have no say or control over the decision.

Regarding this issue,

the Globe and Mail reports that Mike Da Prat, President of

Local 2251 said the union is unlikely to appeal the decision, as the

CCAA court system does not favour unions. Workers

and their allies across Canada are rapidly reaching a similar

conclusion. The CCAA is an arbitrary broken system that is irreparable

because its purpose is to serve the narrow private

interests of the financial oligarchy. This is fundamentally wrong and

damaging to the lives of Canadians and their economy, especially those

directly affected by these CCAA

restructurings.