|

April 14, 2016

Destructive Economic Impact of

Private Interests

in the Steel Industry

The Steel Industry Is Public Not Private

PDF

Destructive

Economic

Impact

of

Private

Interests in the Steel Industry

• The Steel Industry Is Public Not Private

• U.S. Steel Canada Economic Impact Study

For Your Information

• Report Prepared by the City of Hamilton,

January 2015

Destructive Economic Impact of Private

Interests in the Steel Industry

The Steel Industry Is Public Not Private

The steel sector is basic to the modern Canadian

economy. The social wealth necessary to build and operate a

steel mill can only be mobilized through the collective

authority of the people and resources of the economy. The prices of

production, supply of raw material, the training of the working class,

the provision of the social and material

infrastructure, the relation between supply and demand, and other

crucial features are social and public.

Decisions affecting the steel sector bear heavily on

the entire economy and as such are public. Who decides matters

affecting the steel and other basic sectors is of public concern and

importance, over which the people must have a say and right to decide.

This requires additional public measures beyond the

operation of the companies themselves, especially

in the wholesale market of basic commodities, where public authorities

are required to control prices and exports and imports outside of any

free trade agreements, otherwise no self-reliant

independent stable economy of the basic sectors can be built to serve

Canadian nation-building.

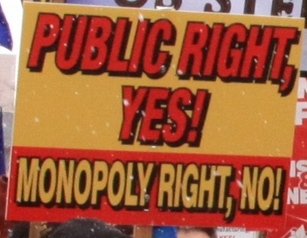

Private social wealth in the basic sectors such as the

steel industry must not interfere with the right of the people to

decide and to have open discussion and authority over their

direction. Private social wealth in the basic sectors such as steel

does not and should not give any ownership group the right to dismiss

and negate the public right to decide on all matters

affecting the direction of the industry.

A public authority, which has the consent and

confidence of the workforce and members of the community, should be

organized to decide on the direction of the basic sectors with the

full and unobstructed conscious participation of the people without

secrecy or hidden agendas of private interests. Private ownership of

social wealth should be viewed as only one factor in

the social relation making up the sector and private owners should

participate in

decision-making as members of the public without special influence or

clout.

Private owners of social wealth in the steel and other

basic sectors should be arms length from the operation and only

participate in decision-making as members of the public if they

reside in Canada. Private owners have a right to an average rate of

return on their invested social wealth, which should be decided openly

and with scientific precision by accountants who

report to the public authority, which regulates payment openly and

aboveboard with complete public scrutiny.

The controversies

surrounding Stelco and Algoma Steel for the past two decades give ample

proof of the necessity for a new direction for the steel sector free

from the interference of

private interests. A new direction under the control of the public must

be instituted for the sake of the economy and nation-building. Private

owners of social wealth have proven time and

again that their narrow private interests conflict with the public and

social nature of the steel sector and do not allow it to flourish.

These problems arise despite the earnest talk of certain

ownership groups of their intention to serve the public good. Talk is

cheap; Canada needs a new direction with a public authority capable of

putting owners of social wealth in their place as

just one factor in the economy. The people witnessed with horror and

contempt the corrupt behaviour of U.S. Steel in signing and then almost

immediately breaking sworn agreements

under the Investment Canada Act

and provincial pension law because the

owners of social wealth considered it expedient in serving their narrow

private agenda and interests. The controversies

surrounding Stelco and Algoma Steel for the past two decades give ample

proof of the necessity for a new direction for the steel sector free

from the interference of

private interests. A new direction under the control of the public must

be instituted for the sake of the economy and nation-building. Private

owners of social wealth have proven time and

again that their narrow private interests conflict with the public and

social nature of the steel sector and do not allow it to flourish.

These problems arise despite the earnest talk of certain

ownership groups of their intention to serve the public good. Talk is

cheap; Canada needs a new direction with a public authority capable of

putting owners of social wealth in their place as

just one factor in the economy. The people witnessed with horror and

contempt the corrupt behaviour of U.S. Steel in signing and then almost

immediately breaking sworn agreements

under the Investment Canada Act

and provincial pension law because the

owners of social wealth considered it expedient in serving their narrow

private agenda and interests.

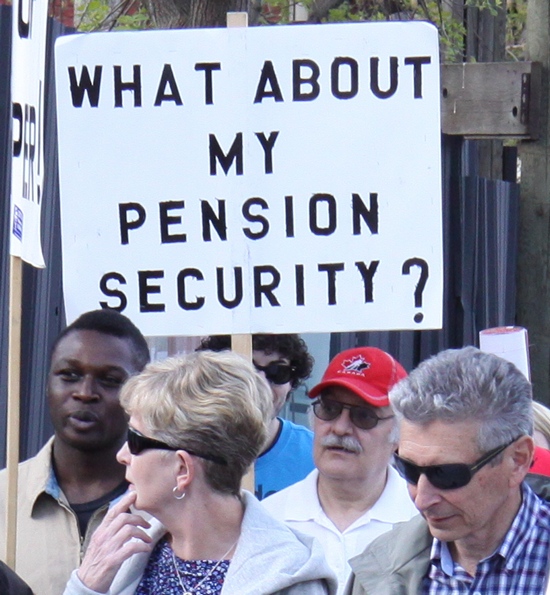

Problems surrounding the meeting of apparent demand

with supply from Canadian mills; problems surrounding the well-being of

the workforce, especially after retirement; problems

dealing with environmental damage and pollution; problems dealing with

market prices and other issues such as imports are social and public in

nature and cannot be resolved with private

interests in command.

The basic sectors of the economy involve immense

amounts of social wealth both from direct investment and from

borrowing. Individuals owning equity in the basic sectors such as

U.S. Steel are most often second or third hand through financial

institutions from all over the world. More often than not, moneylenders

have even greater social wealth tied up in a

monopoly such as the over $3.5 billion debt they own in U.S. Steel. The

disparate owners of social wealth often have conflicting interests

themselves, not to speak of the contention from

owners of social wealth in competing companies. The contention and

sometimes corrupt collusion of owners of social wealth to serve their

particular private interests cause great crises for

the basic sectors, as Canada has experienced not just in steel but in

the energy and other sectors.

What constitutes private ownership is even under

scrutiny and contention. U.S. Steel says it bought Stelco in 2007 but

sometime during its tenure as equity owner it gave up its equity

ownership and secretly turned it into a debt ownership. This conspiracy

began with an eye to putting Stelco into bankruptcy protection and

having U.S. Steel declared the primary owner of

debt in a company where it no longer owns equity. These fraudulent

conspiracies are further proof that ownership of social wealth in the

basic sectors should not mean control but simply a

right to a certain claim on the added-value workers produce but with no

rights to direct the company or authority over its affairs or that of

the sector.

A public authority in which the people have confidence

and can openly and consciously participate in making decisions on the

direction of the company and sector and ensure their

viability and stability must be formed to take control out of the hands

of the owners of social wealth.

The pay-the-rich schemes

most often called bailouts, subsidies, disguised assistance in such

areas as research and development financed through the public treasury

etc. are now

considered "normal" practice by the ruling imperialist elite. This

acceptance of pay-the-rich schemes is an admission that

privately-controlled social wealth is incapable of directing the

economy and particularly the basic sectors in a stable manner that

allows them to claim a rate of return on their investment satisfactory

to themselves without recurring crises. The pay-the-rich schemes

most often called bailouts, subsidies, disguised assistance in such

areas as research and development financed through the public treasury

etc. are now

considered "normal" practice by the ruling imperialist elite. This

acceptance of pay-the-rich schemes is an admission that

privately-controlled social wealth is incapable of directing the

economy and particularly the basic sectors in a stable manner that

allows them to claim a rate of return on their investment satisfactory

to themselves without recurring crises.

Pay-the-rich schemes including

public-private-partnerships are an admission that the owners of social

wealth are incapable of running the socialized economy without public

funds and

direct government intervention. This admission and the concrete

evidence of the recurring crises in the overall economy and in

particular sectors, the permanent unemployment of over a

million workers and deteriorating social conditions are more than

enough to prove that a new direction for the economy is necessary

beginning with public control over the basic sectors and

the people's conscious participation in the running and decision-making

of those sectors.

A new direction should begin with the establishment of

a public authority to direct the affairs of the former Stelco, Algoma

Steel and Wabush Mines, all of which are presently under

the fraudulent bankruptcy protection of the Companies' Creditors

Arrangement Act. A public authority with government backing

would

immediately cancel U.S. Steel's fraudulent claim on

Stelco's assets and begin to look for investment either public or

private to refurbish the mills and mines of the three enterprises,

resolve all outstanding issues with the steelworkers, miners

and salaried employees by respecting their rights and previous

collective agreements and pension laws, and begin to address in a

serious manner the environmental issues and the

strengthening of a steel sector that can meet the economy's apparent

demand for steel in a self-reliant manner.

U.S. Steel Canada Economic Impact Study

The excerpts from the

Hamilton report found below

underscore the fact that the steel sector is a public industry. Stelco

is not a mom and pop store with limited ramifications for the

community. The City report deals mainly with social issues but does

touch on the interconnections with other sectors of the economy such as

the number of companies left with unpaid bills

because Stelco is in bankruptcy protection. The excerpts from the

Hamilton report found below

underscore the fact that the steel sector is a public industry. Stelco

is not a mom and pop store with limited ramifications for the

community. The City report deals mainly with social issues but does

touch on the interconnections with other sectors of the economy such as

the number of companies left with unpaid bills

because Stelco is in bankruptcy protection.

In Sault Ste. Marie, the

Algoma Steel complex has an even greater influence in the lives and

economy of the people. Reports say that around 70 per cent of the

population of the

community depends either directly for livelihoods or indirectly in some

way on the steelworks.

Decisions taken regarding the steel and mining sectors

are not private matters; they affect the public in a major way.

Decision-making should not be seen as private, which is the

narrow corrupt viewpoint of certain individuals who control great

social wealth. The interrelated economy cannot be left in the hands of

the owners of social wealth and the monopolies they

control. Decisions in these sectors affect entire cities, regions and

the country. Those decisions need to be in the hands of the public

upholding the right of the people to decide in the public

interest in opposition to the narrow private interests of owners of

social wealth.

Members of the Hamilton City Council Steel Committee

say that U.S. Steel executives have treated them with disdain refusing

to meet with them to discuss the serious problems

surrounding the steel sector. This attitude towards city officials

reflects an absence of concern for the well-being of the people and

their community. The owners of social wealth consider

their narrow private interests as more important. The concern and

attention of U.S. Steel executives, especially those in Pittsburgh, are

centred on their empire-building and private social

wealth. Canadians and their nation-building are viewed as obstacles to

their empire-building.

Active organized resistance to empire-building is

necessary in today's Canada, as control from the global owners of

social wealth interferes with nation-building and the building of a

self-reliant stable diverse economy. Private social wealth should not

confer any special rights on its owners. Owners of social wealth have a

right to a certain rate of return on their

investment but no right to control the economy or political affairs, or

to interfere in the people's right to direct their economy and

nation-building.

For Your

Information

Report Prepared by the City of Hamilton,

January 2015 (Excerpts, Not Necessarily in Order)

The Hamilton Works location sits on a total of 813

acres of land, a large land holding, but relatively small in size when

compared to Lake Erie Works, which is over 8 times larger at

6,600 acres.

USSC employed 2,337 people as of July 31, 2014.

The 2007 acquisition of

Stelco Inc. by USS required the involvement and ultimate approval of

the federal government due to the nature of the acquisition of a

Canadian company by a

foreign company. As part of USS' application to the federal government

for approval of the acquisition, USS made the following commitments,

which were used to build the case for

approval of the sale. The 2007 acquisition of

Stelco Inc. by USS required the involvement and ultimate approval of

the federal government due to the nature of the acquisition of a

Canadian company by a

foreign company. As part of USS' application to the federal government

for approval of the acquisition, USS made the following commitments,

which were used to build the case for

approval of the sale.

- Make $200 million in capital investments in USSC.

- Maintain 3,105 workers at Hamilton Works and Lake

Erie Works.

- Produce [4.5 million tons of steel] annually. [On

October 29, 2007 the Minister approved the transaction, subject to 31

binding undertakings from U.S. Steel regarding the operation

of Stelco, which included that, over three years, it would increase the

annual level of production at the former Stelco facilities by at least

10 percent and that it would maintain an average

aggregate employment level of not fewer than 3,105 employees on a

full-time equivalent basis.]

- Guarantee the pension funding obligations of Stelco

Inc. Make $31 million voluntary contribution to the USSC pension funds.

The years immediately following the acquisition of

Stelco Inc. (now USSC) by USS saw a significant decrease in steel

production and a failure of USSC to meet or even approach the

investment, production and employment commitments made to win approval

of the acquisition from the federal government. These commitment

defaults prompted a legal response by the

federal government and ultimately resulted in an undisclosed agreement

between USS, USSC and the federal government that included additional

operational and investment commitments,

as outlined below:

- Operate Hamilton Works and Lake Erie Works until at

least December 2015.

- Make at least $50 million in additional capital

investments to maintain Canadian facilities by December 2015 (above the

previous $200 million commitment).

- Contribute $3 million to community and educational

programs in Hamilton and Nanticoke.

While the second round of commitments were likely

intended to build upon those initial operational, investment and

employment commitments with the objective of increasing the

economic activity at USSC, the past few years since the 2011

Commitments were disclosed has witnessed a continued decline in

economic activity from USSC.

Despite the involvement of

both the provincial and federal government in the early stages of the

acquisition of USSC to facilitate a viable business environment for

USSC through

approvals and financial assistance, and the commitments made by USS

concerning USSC's operations, USSC is currently in a much weaker

position than was likely envisioned by all major

stakeholders in the initial weeks of the acquisition. As of December

2014, the commitments made by USS in both 2007 and 2011, relating to

USSC are far from being realized, and have

been replaced by the reality as outlined in the points below: Despite the involvement of

both the provincial and federal government in the early stages of the

acquisition of USSC to facilitate a viable business environment for

USSC through

approvals and financial assistance, and the commitments made by USS

concerning USSC's operations, USSC is currently in a much weaker

position than was likely envisioned by all major

stakeholders in the initial weeks of the acquisition. As of December

2014, the commitments made by USS in both 2007 and 2011, relating to

USSC are far from being realized, and have

been replaced by the reality as outlined in the points below:

- Significantly less current employees at U.S. Steel

Canada than was projected in 2007.

- An accelerating trend of decreasing capacity at U.S.

Steel Canada.

- Significant uncertainty about the future of U.S.

Steel Canada's operations expressed by workers, pensioners, and

resident stakeholders.

- Concern about the long-term viability of the various

U.S. Steel Canada pension plans after December 2015.

The four pension plans provide USSC pensioners with

over $231 million in total pension income annually.

Hamilton Bargaining Plan (Local 1005) members represent

over 65% of the total 14,338 USSC pension plan members (as of December

31, 2013), and have the lowest annual average

pensions ($16,355). [The total number of people reliant on the pensions

such as spouses, increases the total to well over 20,000.] The absence

of a Cost of Living Adjustment (COLA) has a

significant financial impact on USSC pensioners. The projected impact

of not having a 2% COLA for an individual over 25 years is a loss of

$100,000, and the estimated loss of income for

the 7,050 Hamilton pensioners over 25 years is almost $700 million.

Over 7,000 USSC pensioners

from all four USSC pension plans reside in the City of Hamilton,

representing over 60% of the identified USSC pensioners. Over 7,000 USSC pensioners

from all four USSC pension plans reside in the City of Hamilton,

representing over 60% of the identified USSC pensioners.

If the distribution of the 11,699 identified pensioners

is representative of the total population of USSC pensioners, then the

City of Hamilton could be the city of residence for over

8,600 pensioners.

Approximately 1.4% (1 in 72) of Hamilton's total

population are known USSC pensioners.

Approximately 6.3% (1 in 16) of Hamilton's population

of 60+ years old are known USSC pensioners.

Over 70% of USSC pensioners with Hamilton addresses are

associated with a detached single family home. Those 5,043 USSC

pensioners represent 4% of all single detached homes in

Hamilton (1 in 25 homes).

The properties associated with known USSC pensioners

make sizeable cumulative [property tax] contributions by ward, ranging

from almost $400 thousand in Ward 14 to over $4.3

million in Ward 8.

The dwellings associated with known USSC pensioners in

Hamilton provide the City with approximately $24 million in property

tax annually. [Of note, is the fact that Stelco

pensioners in Hamilton continue to pay their property taxes while U.S.

Steel refuses to do so and has won a CCAA court order enforcing its

demand. Also, the $24 million cumulative

property tax paid by steelworker retirees living in Hamilton is

considerably greater than the property tax paid by USSC when it was

paying the tax. Also, U.S. Steel says that no equity

profit has been made in Ontario since 2009. This means the company has

not paid any corporate income tax although owners of U.S. Steel debt

have claimed interest profit and dividends

have continued to be paid to U.S. Steel shareholders.]

Approximately 2% of the total population of Hamilton

Wards 5, 6 and 10 are current USSC pensioners.

The USSC pensioner population represents a large and

significant segment in each Hamilton ward.

Impact on City of Hamilton Revenues

The annual total tax contributions from USSC have been

steadily decreasing since 2000, having decreased over 70% from the

$22.56 million paid in 2000 to just under $6 million

forecasted for 2014. [Since the report was released, the CCAA court has

granted leave for USSC to suspend payments of municipal taxes.]

USSC's tax contributions represented over 3% of total

tax revenues in 2000, but is under 1% in 2014.

The USSC tax contributions from recent years (prior to

2014) have recently been successfully appealed by USSC, necessitating a

large tax rebate owing to USSC of over $6

million.

The water related revenues from USSC has decreased as a

percentage of total City of Hamilton water revenues from 3.8% in 2008

to a forecasted 1.3% in 2014.

A worst case scenario for the City of Hamilton as it

relates to USSC property tax and water revenues would be a further

reduction of approximately $3.9M annually, reducing the

current annual revenues from approximately $6.6M (forecasted for 2014)

to approximately $2.7M annually in a future year.

[If the wrecking of Stelco steel production continues]

it would result in hardships to current employees of USSC who would

suffer job loss and might have difficulty finding similar

work and remuneration.

- It would result in hardships to USSC retirees, who

rely

on USSC to continue to contribute to their underfunded pension plans

and to provide post-retirement benefits.

- It would result in a permanent decrease in retirement

incomes of USSC retirees, and that reduction would have a material

impact on their health, the affordability of their current living

situations and lifestyles.

- It would impact hundreds of companies supplying goods

and services to USSC.

- It would have a significant impact on the City of

Hamilton's annual revenues.

- It might have a significant impact on the City of

Hamilton's program demands.

- It might result in a prolonged asset disposition

process that might leave current USSC lands in the City of Hamilton

unproductive for an extended period of time.

Over the course of their employment at Stelco and USSC,

a component USSC pension plan member's compensation package was the

inclusion in a Defined Benefits pension plan,

which promised post-retirement benefits in the future and varied in

composition between each of the four USSC pension plans. Over the life

of the pension plans, the defined benefits for

each of the four pension plans have been subject to changes based on

the outcome of negotiations between the employee groups and the

employer.

The four pension plans provide USSC retirees with over

$231 million in total pension income annually.

The businesses of a city or community are impacted by

the overall health and strength of the local economy, as cash from

business revenues and employment incomes of local

businesses and employees have the potential to be spent in the city or

community. This section looks at the impacts on all local businesses,

both the known Direct Suppliers of USSC,

whose impact is easier to visualize and quantify, and the other

businesses in Hamilton, who rely on the expenditures of the employees

and retirees of USSC and its local suppliers.

A result of USSC pursuing creditor protection in

September 2014 was that it provided the public with a unique insight

into the company's large and diverse number of creditors at that

time. In the initial CCAA documentation disclosure, USSC provided the

courts with a List of Creditors (Trade Payables), identifying the

names, mailing addresses and total amount owing

as of the date of filing. While this list is still being finalized, and

does not identify all companies in the USSC supply chain over the

course of a full year, it provides quantitative data for a

highly conservative estimate of the financial impact of the possible

failure of USSC.

The List of Creditors described above was analyzed and

the 684 Trades Payables were grouped by country and sorted into

categories based on outstanding balances owed by USSC as

at September 16, 2014.

Approximately 60% of the $78.8 million owed is to

Ontario based companies (529 total).

There are 127 companies with business addresses in the

City of Hamilton, and they are collectively owed a total of $22.3

million (28.3% of the $78.8 million).

There are four Hamilton based companies who are owed

more than $1 million, and an additional 27 companies owed between $100

thousand - $999 thousand.

There are 96 Hamilton based companies who are owed

under $100 thousand, with a majority of these being owed less than $25

thousand.

[Observations on the health and welfare of pensioners]

It is hard for seniors to cope with sudden changes in

their economic status, due to the limits of a fixed income. The "asset

rich-income poor" are considered at most financial risk.

Financial strain causes stress, depression and family pressures.

Reduced retirement income is associated with heart-related death in

both men and women. Single men without a cash margin

are at a greater risk for heart attacks and those men with reduced

retirement income have a higher risk of death. Seniors who are not

accustomed to seeking out services may not be aware

of services available to them. They may also have trouble accessing

those services. Stress can lead to many mental and physical health

issues, the most serious being depression, heart

disease and death.

PREVIOUS

ISSUES | HOME

Read The Marxist-Leninist

Daily

Website: www.cpcml.ca

Email: editor@cpcml.ca

|

The controversies

surrounding Stelco and Algoma Steel for the past two decades give ample

proof of the necessity for a new direction for the steel sector free

from the interference of

private interests. A new direction under the control of the public must

be instituted for the sake of the economy and nation-building. Private

owners of social wealth have proven time and

again that their narrow private interests conflict with the public and

social nature of the steel sector and do not allow it to flourish.

These problems arise despite the earnest talk of certain

ownership groups of their intention to serve the public good. Talk is

cheap; Canada needs a new direction with a public authority capable of

putting owners of social wealth in their place as

just one factor in the economy. The people witnessed with horror and

contempt the corrupt behaviour of U.S. Steel in signing and then almost

immediately breaking sworn agreements

under the

The controversies

surrounding Stelco and Algoma Steel for the past two decades give ample

proof of the necessity for a new direction for the steel sector free

from the interference of

private interests. A new direction under the control of the public must

be instituted for the sake of the economy and nation-building. Private

owners of social wealth have proven time and

again that their narrow private interests conflict with the public and

social nature of the steel sector and do not allow it to flourish.

These problems arise despite the earnest talk of certain

ownership groups of their intention to serve the public good. Talk is

cheap; Canada needs a new direction with a public authority capable of

putting owners of social wealth in their place as

just one factor in the economy. The people witnessed with horror and

contempt the corrupt behaviour of U.S. Steel in signing and then almost

immediately breaking sworn agreements

under the