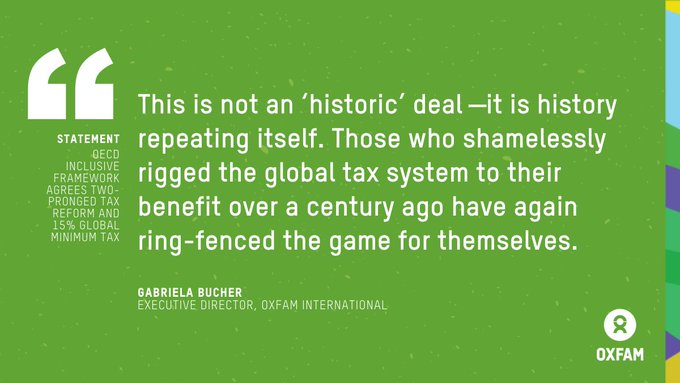

OECD Tax Deal Is a Mockery of Fairness -- OxfamIn response to the OECD's tax deal announced October 8, Oxfam's Tax Policy Lead Susana Ruiz said: "Today's tax deal was meant to end tax havens for good. Instead it was written by them."

"Calling this deal 'historic' is hypocritical and does not hold up to even the most minor scrutiny. The tax devil is in the details, including a complex web of exemptions that could let big offenders like Amazon off the hook. At the last minute a colossal 10-year grace period was slapped onto the global corporate tax of 15 per cent, and additional loopholes leave it with practically no teeth. "This deal is an unacceptable injustice. It needs a complete overhaul. The OECD and the G20 must bring fairness and ambition back to the table and deliver a tax plan that won't leave the rest of the world to pick up their crumbs and scraps." Oxfam NotesOne hundred and forty countries have been negotiating the two-pillar tax framework under the OECD-G20 umbrella. The first "pillar" aims to make the world's largest corporations pay more taxes in the country where they earn profits. Based on current proposals, Oxfam estimates that it will affect only 69 multinationals and would only apply on "super profits" above 10 per cent. Loopholes could let the likes of Amazon and "onshore" secrecy jurisdictions like the City of London off the hook. Extractives and regulated financial services are excluded from the deal. New analysis by Oxfam estimates that 52 developing countries would receive around 0.025 per cent of their collective GDP in additional annual tax revenue from the "Pillar One" proposal endorsed today. The second "pillar" seeks a global minimum corporate tax rate. The OECD tax plan dropped "at least" from a proposed minimum global corporate tax rate of "at least 15 per cent" and further delayed its full implementation from the previously planned five years to 10 years. The 15 per cent rate is well below the UN Financial Accountability, Transparency and Integrity (FACTI) Panel recommendation made earlier this year, which called for a 20 to 30 per cent global corporate tax on profits. The Independent Commission for the Reform of International Corporate Taxation (ICRICT) has called for a 25 per cent global minimum tax to be applied. A 25 per cent global minimum corporate tax rate would raise nearly $17 billion more for the world's 38 poorest countries (for which data is available) than a 15 per cent rate. These countries are home to 38.6 per cent of the world's population. Developing countries are more heavily reliant on corporate tax. In 2018, African countries raised 19 per cent of their overall revenue from corporate tax, compared to just 10 per cent for OECD nations.

This article was published in Article Link: Website: www.cpcml.ca Email: editor@cpcml.ca |

In a press

release, Oxfam points out: "This deal is a

shameful and dangerous capitulation to the low-tax

model of nations like Ireland. It is a mockery of

fairness that robs pandemic-ravaged developing

countries of badly needed revenue for hospitals

and teachers and better jobs. The world is

experiencing the largest increase in poverty in

decades and a massive explosion in inequality but

this deal will do little or nothing to halt

either. Instead, it is already being seen by some

wealthy nations as an excuse to cut domestic

corporate tax rates, risking a new race to the

bottom.

In a press

release, Oxfam points out: "This deal is a

shameful and dangerous capitulation to the low-tax

model of nations like Ireland. It is a mockery of

fairness that robs pandemic-ravaged developing

countries of badly needed revenue for hospitals

and teachers and better jobs. The world is

experiencing the largest increase in poverty in

decades and a massive explosion in inequality but

this deal will do little or nothing to halt

either. Instead, it is already being seen by some

wealthy nations as an excuse to cut domestic

corporate tax rates, risking a new race to the

bottom.