Lost in the White House Hall of Mirrors

Starting last autumn, throughout the full court press of agitations against the Victor Yanukovich government in Kyiv, the White House and State Department were putting it about among EU governments that they need not worry about losing access to Russian natural gas because... the US could supply more than enough natural gas to replace Russian gas deliveries. This claim was transparently fraudulent at the time.[1]

It seems to defy credulity that such a transparently false claim could have been repeated so widely and for such a long period. It was already well-known in western Europe that the scale on which gas may be extracted from shale by hydraulic fracturing is orders of magnitude less than conventional methods applied across entire fields of raw material. The average production lifetime of shale gas wells in relatively well-endowed geological conditions such as western and southern Texas is less than seven years, compared to the decades-long productivity of conventional gas wells in the same regions. In recent years, there were a number of incidents in various parts of western Europe of low-level mini- earthquakes taking place after "fracking" nearby.

Such disconnection between scientific fact and reality itself hints at major interimperialist and intermonopoly contradictions roiling between companies in the EU and the U.S. After his recent meeting with EU leaders, Obama issued a remarkable statement concerning the Transatlantic Trade and Investment Partnership (TTIP).

Well aware that the TTIP is being secretly negotiated behind closed doors by the major private multinational companies, and playing on EU fears of Russian gas loss after the U.S.-orchestrated Ukraine coup of February 22, the U.S. President claimed these circumstances would make it easier for the United States to export gas to Europe and help the latter reduce its dependency on Russian energy. "Once we have a trade agreement in place," he opined, "export licenses for projects for liquefied natural gas destined to Europe would be much easier, something that is obviously relevant in today's geopolitical environment." In other current statements, referring to the recent boom in unconventional U.S. shale gas, Obama and Kerry have both stated the U.S. could more than replace all Russian gas to the EU. This is an outright lie based on physical realities.[2]

A second even more challenging problem emerges from the U.S. "offer" of gas to the EU to replace Russian gas. Fulfilling this promise entails creation of massive, costly infrastructure in the form of new Liquified Natural Gas terminals that can handle the huge LNG supertankers to bring it to similar huge LNG terminal harbors in the EU. Owing to various U.S. laws governing export of domestic energy and supply factors, however, there exist no operating LNG liquefaction terminals in the U.S.[3]

The third problem is that, even if new port capacity were installed on a scale that could satisfy EU gas needs to replace Russian supplies, domestic natural-gas prices would be pushed higher, cutting short the mini-manufacturing boom fueled by abundant, cheap shale gas. The ultimate cost to EU consumers of U.S. LNG would have to be far greater than current Russian gas pipelined over NordStream (under the Baltic Sea, direct to Germany) or through Ukraine to customers in southern and southeastern Europe.

The fourth problem is that the specialized LNG supertankers do not exist to supply the EU market. All this takes years, including environmental approvals, construction time, perhaps seven years on average in best conditions.

Conclusion

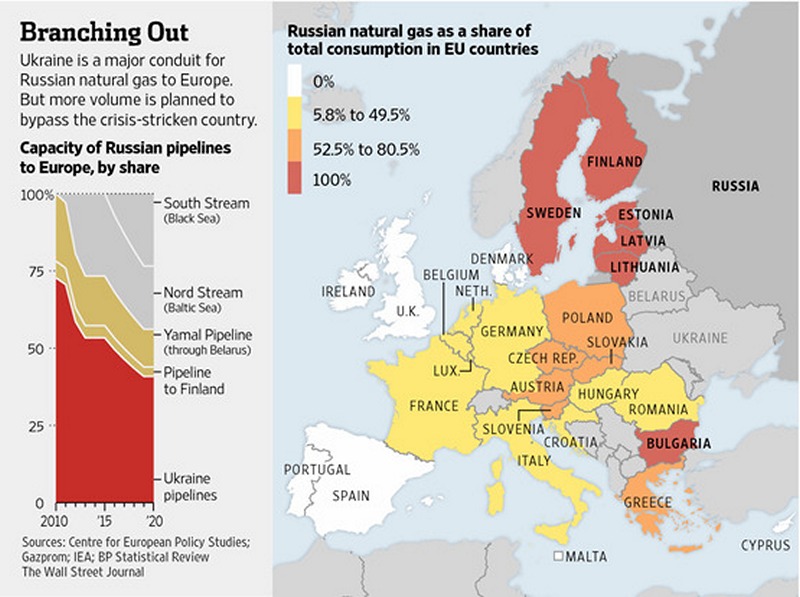

Today, the EU receives some 30 per cent of its gas, the fastest-growing energy source there, from Russia. In 2007, Russia's Gazprom supplied 14 per cent for France, 27 per cent for Italy, 36 per cent for Germany, with Finland and the Baltic states receiving as much as 100 per cent of gas imports from Russia.

Clearly the EU has no realistic alternative to Russian gas. Germany, the largest economy, has decided to phase out nuclear power in the same moment that its "alternative energy" sources -- wind and solar power -- are an economic and political disaster with consumer electricity costs exploding even though alternatives are a tiny share of the total market.[4]

The chimera of shutting Russian gas off and turning U.S. gas on instead is economically and energetically incoherent. It is the perfect fantasy of an economic order in which there is no longer any other god but Monopoly, and maximum is its profit. The overwhelming social and political reality pushing its way under the door, meanwhile, is rapidly increasing anarchy coupled with increasingly uncontrolled violence from the powers-that-be of the kind that usurped power this February in Kyiv.

Notes

1. The "shale gas revolution" in the USA has failed. The dramatic rise in U.S. natural gas production from "fracking" or forcing gas out of shale rock formations is being abandoned by the largest energy companies like Shell and BP as uneconomical. Shell has just announced a huge reduction of its exposure to U.S. shale gas development. Shell is selling its leases on some 700,000 acres of shale gas lands in the major shale gas areas of Texas, Pennsylvania, Colorado and Kansas and says it may have to get rid of more to stop its shale gas losses. Shell's CEO, Ben van Beurden stated, "Financial performance there is frankly not acceptable.... some of our exploration bets have simply not worked out."

2. A useful summary of the shale gas illusion comes from a recent analysis of the actual results of several years of shale gas extraction in the USA by veteran energy analyst David Hughes. He notes, "Shale gas production has grown explosively to account for nearly 40 percent of U.S. natural gas production. Nevertheless, production has been on a plateau since December 2011; eighty percent of shale gas production comes from five plays, several of which are in decline. The very high decline rates of shale gas wells require continuous inputs of capital-estimated at $42 billion per year to drill more than 7,000 wells-in order to maintain production. In comparison, the value of shale gas produced in 2012 was just $32.5 billion."

3. The only such terminal now under construction is the Sabine Pass LNG receiving terminal in Cameron Parish, Louisiana, owned by Cheniere Energy. John Deutsch, former CIA head, sits on the board. The problem with the Sabine Pass LNG terminal is that most of the gas has been pre-contracted to Korean, Indian and other Asian LNG customers; there is nothing left for the EU.

4. According to a report filed by Natalia Zinets over the Reuters news wires during Friday April 11, reality has been no impediment whatsoever to fantasy-spinning by the EU in cahoots with Kyiv's interim Energy minister, Yuri Prodan, in Kyiv about current and future EU-wide gas prospects:

"Ukraine said on Friday it would turn to Europe for gas and won a promise of help from Brussels after Russia warned it could cut supplies over Kiev's refusal to pay Moscow's 'political, uneconomic price' for supplies.

"Presenting a united front a day after President Vladimir Putin wrote to the European Union warning that its supplies could be disrupted if Ukraine failed to cover its bills, European officials said they had little to fear and would help Ukraine pay.

"With Russia increasing the pressure on Ukraine's faltering economy, Ukrainian Energy Minister Yuri Prodan told parliament the EU would stand in solidarity with Kiev if Russia reduced supplies, making sure Moscow could not increase flows through alternative pipelines to bypass its neighbour.

"'Ukraine cannot pay such a political, uneconomic price, so now we are negotiating with the European Union about reverse deliveries into Ukraine,' Prodan said.

"'We will make gas purchases from reverse flows urgently. On the conditions offered by European gas companies. We plan that they will be Germany's RWE and a French gas company' [later identified as GDF Suez]."

(TML Weekly No. 16, April 26, 2014)