|

Economic Analysis Trans Mountain Pipeline BuyoutExcerpts from Gordon Laxer's report "Billion Dollar Buyout," released June 3. The excerpts focus on the economic aspect of the buyout. For the full text of Laxer's report click here. [...] In the summer of 2018, Trudeau's government

invoked the

"national interest" to justify buying the Trans Mountain oil

pipeline system -- including a 65-year-old pipeline -- from

Texas-based Kinder Morgan. Ottawa's aim was to expand the

pipeline to send major volumes of Alberta bitumen to BC's

coastal shores for export. [...] Ottawa bought the pipeline while the United States,

Mexico and

Canada were negotiating a replacement deal for the North American

Free Trade Agreement (NAFTA). The Canada United States Mexico

Canada Agreement (CUSMA) includes a chapter on state-owned

enterprises [crown corporations in Canada], an energy side

letter, and exemptions for the Trans Mountain Corporation, the

pipeline company now owned by the government. [...] [...] This report argues that the state-owned enterprises exemption and the energy side letter simultaneously reinforce a business-as-usual approach and protect the extraordinary measures (and extreme cost) the Canadian government has taken to continue exporting bitumen. [...] In August 2018, Canada bought Kinder Morgan Canada's

Trans

Mountain pipeline system for $4.4 billion. Although construction

for the expansion was barely underway when the federal government

finalized the sale, the purchase included the plan, existing

permits and approval for the expansion. The federal government

has long provided subsidies to the oil and natural gas industry,

but nationalizing a pipeline is unprecedented in Canada. Since

the Trans Mountain Corporation (the name given to encompass all

parts listed above) is now state-owned, it will be subject to the

CUSMA exemptions Canada negotiated for the company. [...] Ottawa bought Kinder Morgan Canada's pipeline system,

which

included the Trans Mountain pipeline, its expansion project, the

Puget Sound pipeline and related facilities. The existing 1,150

km pipeline is 65 years-old and runs from Edmonton to Burnaby. It

carries crude oil and refined petroleum products. The 111 km

Puget Sound line branches off Trans Mountain's mainline at

Abbotsford, British Columbia to Washington State. This spur line

carries oil to four refineries in Washington state and has a

capacity of 240,000 barrels a day. The expansion project will

almost triple the mainline capacity from 300,000 barrels of oil a

day to 890,000. It will swell the capacities of the Edmonton,

Burnaby and Westridge terminals in Canada and the Sumas terminal

in Washington state. [...] [...] In December 2017, Kinder Morgan Canada (KMC) said it was

suspending construction on the Trans Mountain expansion in order

to focus on the permitting process. In March 2018, KMC met with

the federal government several times to discuss government

guarantees and a government indemnity -- referred to by KMC as

"the backstop" -- to allow the project to proceed. At the end of

March, Finance Minister Bill Morneau requested advice on "options

for the Government's participation in the Trans Mountain project"

from the Canada Development Investment Corporation (CDEV), the

government body that eventually came to own the Trans Mountain

Corporation. [...] On April 8, 2018, KMC officially announced suspension of all "non-essential" spending unless it got an agreement to "allow the project to proceed" by the end of May. KMC retained TD Securities to advise on any "potential transactions," a clear indication the corporation planned a sale. On April 30, KMC repeated that the financial backstop was inadequate and proposed a purchase price of $6.5 billion. On May 23, 2018, KMC rejected Ottawa's offer of $3.85 billion and asked for $4.5 billion (before tax deductions). This includes $3 billion for the existing line, $1.4 billion for the rights to pipeline expansion. The government agreed to the price that day and it concurred on the condition it had six weeks to find another buyer. Judging the pipeline too financially risky, no private sector offer came. The expansion held additional risks, including determined opposition from Indigenous nations, environmental protestors and the BC government. In contrast, the existing pipeline itself holds little political risk, but significant safety risks since it is an aging line carrying a carbon-intensive fuel. The government's financial advisor, Greenhill & Co, prepared a financial analysis of the original proposal of $3.85 billion (which is not publicly available). It is unclear how the government had time to analyze the higher price with only "several hours" to review it. TD Securities advised KMC that the sale price was fair for the corporation's shareholders. TD was one of several big banks that provided a $5.5 billion loan primarily for the expansion. The loan was cancelled after the government stepped in to buy the pipeline system. Shareholders at both Kinder Morgan Inc (KMI) and Kinder

Morgan

Canada welcomed the sale. They had little to lose. Ottawa could

either buy the pipeline itself or let the expansion fail. Instead

of calling Kinder Morgan's bluff of pulling out without a buyer,

the Trudeau government caved and bought the Canadian subsidiary

for a high price. After financially supporting the pipeline at

taxpayers' expense, the federal government plans to re-privatize

it. [...] Kinder Morgan Shareholders Had Little to LoseKinder Morgan Canada had spent $1.1 billion on

the pipeline expansion project before the sale. Due to an

unprecedented approval by the National Energy Board (NEB),

shippers (i.e. oil corporations) contributed around $210-220

million. Long-term contracts with shippers meant that if the

expansion was cancelled, oil companies would bear 80 per cent of

the costs. Of the remaining $900 million that Kinder Morgan

Canada spent, the corporation was exposed to 20 per cent, or

about $200 million. [...] Canadian Loans to Trans Mountain

In September 2018, a month after the government purchase, the Trans Mountain Corporation (now a federal crown corporation) had access to $6.5 billion in loans from the federal government's Canada Account managed by Export Development Canada (EDC). EDC provides billions of dollars every year to support fossil fuel companies. The Canada Account is used for transactions involving "risks in excess of that which [the EDC] would normally undertake." The loans came from the consolidated revenue fund -- directly from taxpayers. There are three separate loans, each with an interest rate of 4.7 per cent: (i) a loan for $5 billion used to buy Trans Mountain Pipeline Entities and to cover the pipeline system's operating costs; (ii) a loan of $500 million in the case of a spill (as mandated by the NEB); and (iii) a loan for $1 billion dollars for ongoing costs related to the expansion in its first year. Propping Up a Bad InvestmentThe Trudeau government justified the purchase, saying it was a "good investment" and that the government did not want to subsidize Kinder Morgan. Ironically, the government will provide even more subsidies as the new owner because the pipeline expansion was never commercially viable. Moreover, the project's promise of unlocking higher prices for heavy oil is not supported by available evidence. Mythical Prices in Asian Markets

[...] In its $23 million ad campaign, the Alberta

government

said

the Trans Mountain expansion would unlock higher prices for heavy

oil in new Asian markets. [...] The oil's final destination will depend on market

demand.

Nowhere in its NEB application did Kinder Morgan say it would

guarantee that Asia would be a final destination. In fact,

available evidence suggests that prices in Asia would be lower

than the U.S. Moreover, most of the diluted bitumen Alberta

currently exports is protected from the "price discount" -- the

lower price that heavy oil from the oil sands receives relative

to lighter, higher quality oil from parts of the United

States. [...] [...] Intervenors in the NEB's engagement process for the Trans Mountain expansion -- which took place between April 2014 and February 2016 -- outlined concerns about Kinder Morgan's ability to finance the project. Ignoring this evidence, the NEB ruled in May 2016 that the expansion was in the public interest. After the federal Cabinet approved the expansion, the parent corporation KMI failed to find a joint venture partner for it. As many companies do when under duress, KMI restructured to protect its assets. In 2017, the corporation "hived off" its Canadian assets in a new subsidiary called Kinder Morgan Canada. KMI owns 70 per cent of Kinder Morgan Canada. The other 30 per cent is traded on the Toronto Stock Exchange. In May 2017, its initial public offering -- the first time a private corporation offers shares to the public -- produced $1.75 billion in capital. All of it was sent to repay the parent corporation in Texas. Shortly after, in July 2017, the parent corporation said that the subsidiary would be "self-funding," effectively relieving itself of financial responsibility for Kinder Morgan Canada and its expansion. The cost of the Trans Mountain pipeline expansion

continues to

climb. The federal government has not released an updated

estimate or an upper limit on its spending. In fact, the federal

government has been alarmingly opaque about the entire project.

The construction cost was last estimated by KMC in March 2017 at

$7.4 billion. The question is not whether costs will exceed $7.4

billion, but by how much. Before the federal court quashed the

expansion, TD Securities estimated in May 2018 costs to be $9.3

billion, assuming a one-year delay and an in-service date of

December 31, 2021. The Parliamentary Budget Officer used

the $9.3 billion figure as their base scenario and indicated a

likely further delay in construction. Economist Robyn Allan

estimated the cost for the pipeline expansion to be over $10

billion. [...] During the 2012 NEB hearing when the expansion was initially considered, Kinder Morgan said that the expansion could not proceed if rates of return were outside the 12 to 15 per cent range. Assuming a 12 per cent discount rate to reflect the lowest hurdle rate of return Kinder Morgan would have accepted, the Trans Mountain expansion is worth only $300 million, even if it is completed by December 2021. This is a fraction of what the government paid for the project. A one-year delay at this discount rate would lower the expansion's value to minus $350 million. Therefore, the project will most likely have a negative rate of return. It is unfathomable that a government would make such a significant investment that is practically guaranteed to lose money. Tolls paid by the oil producer shippers are the pipeline's only direct source of revenue. The expansion is not financially viable without higher tolls from the existing system. In January 2019, the Trans Mountain Pipeline Unlimited Liability Corporation (a subsidiary of the Trans Mountain Corporation) applied to the NEB to approve the toll agreement it negotiated with shippers for the existing pipeline. The NEB approved the toll application in March 2019. Economist Robyn Allan calculated there will be an annual shortfall of about $673 million a year from the proposed toll agreement. Allan argues this constitutes a subsidy because the toll agreement does not cover the full cost of the line and taxpayers will have to cover the additional costs since the Trans Mountain is a state-owned enterprise. Taxpayers will have to provide a $2 billion dollar subsidy over three years for the existing pipeline to cover the shortfall -- mounting to $3.4 billion over five years if the government still owns the pipeline. If, after consultations with Indigenous nations, the government approves new construction, the Trans Mountain Corporation must provide a new capital cost budget to its shippers that signed 15- and 20-year contracts on the expansion. Because delays raised costs, they will be reflected in the new budget. If costs are above $6.8 billion -- which they most certainly are since the most recent budget to which shippers last agreed was $7.4 billion -- shippers can terminate their agreements and the expansion could fail. If so, the shippers would bear 80 per cent of the expansion's costs to date and the federal government would only pay 20 per cent, saving a substantial amount of money. But it would be a major defeat for the Trudeau government. Alternatively, the shippers could ask for even higher toll subsidies than they already receive. They are likely to do so. Shippers have contested toll rises as little as 10 cents a barrel on this expansion. In short, Ottawa bought a pipeline that was not commercially viable. The government has been losing money right from the start. Since the government purchased Trans Mountain, it has operated at a loss. For the first four months of ownership the loss is $58 million with an anticipated loss for 2019 of $175 million. The government is subsidizing the original line by $2 billion between 2019 and 2021. Prime Minister Trudeau admitted in an interview that the government wanted to buy the pipeline "not to make a profit" but to reach markets beyond the United States. However, the evidence to support this claim about accessing new markets is very weak, fundamentally challenging the logic on which the government's decision to purchase the project is based. As costs rise, taxpayers continue to foot the bill. There is no limit to how much the expansion will ultimately cost. State-Owned Enterprises and the CUSMACUSMA Chapter 22 lays down neo-liberal

strictures

on "state-owned enterprises" (SOEs). These restrictions will

limit Canada's ability to take effective climate action through

Crown Corporations to compete with for-profit corporations in

building things like electric buses and cars. [...] [...] CUSMA's Chapter 22 will restrict "state-owned enterprises" from competing with private, for-profit companies. ... Chapter 22 includes penalties for non-compliance when governments pursue "the public interest as defined by the federal Parliament," as political economist Duncan Cameron puts it. Special Exemption

Since [the Trans Mountain Corporation] is now a

subsidiary

of

the Canada Development Investment Corporation, it falls under the

state-owned enterprises chapter in the not-yet-ratified CUSMA.

Ottawa negotiated an exemption for the corporation to provide

policy flexibility mainly to subsidize its new acquisition. [...] [...] In the CUSMA, Canada received similar exemptions for the Bridge Authorities, the Canadian Commercial Corporation, the Canadian Dairy Commission, the Canada Mortgage and Housing Corporation and Canada Housing Trusts, and the Trans Mountain Corporation. The United States only has an exemption for the Federal Financing Bank. The CUSMA exemption for the Trans Mountain Corporation makes it even easier for Ottawa to use its unlimited finances to subsidize the pipeline expansion. The exemption states that even though assistance to the corporation may adversely affect the interests of another country in supplying pipeline operation services, "Canada may provide non-commercial assistance in circumstances that jeopardize" the corporation's viability. It means the United States could not retaliate even if Canada's subsidy hurt a competing U.S. pipeline proposal. The NEB's approved subsidized tolls for the existing Trans Mountain line would be allowed under this exemption. However, since the CUSMA has not yet been ratified and NAFTA remains in force, the NEB's subsidized tolls violate NAFTA's rules about state-owned enterprises. Ottawa has supported Indigenous ownership shares in the pipeline. This is perhaps a strategic decision since Indigenous opposition to the project has created significant risk. Since May 2018, or perhaps even before, when the federal government stated it would buy the Trans Mountain line, it had Indigenous ownership in mind. Ottawa added a clause in the CUSMA exemption to allow the Trans Mountain Corporation to "accord more favourable treatment to aboriginal persons and organizations in the purchase of a good or service." Five Indigenous groups are vying to buy an ownership stake in the pipeline project and at least one group has met with Finance Minister Bill Morneau. Minister Morneau said there is no project until

consultations

with Indigenous communities have been completed and added that

the pipeline involves great risk and immense capital. It must be

"de-risked" before a deal on Indigenous ownership is struck, he

said. To make a sound investment, Trans Mountain Corporation CEO

Ian Anderson advised potential owners to await completion of the

pipeline expansion. [...] Carbon Energy Exports

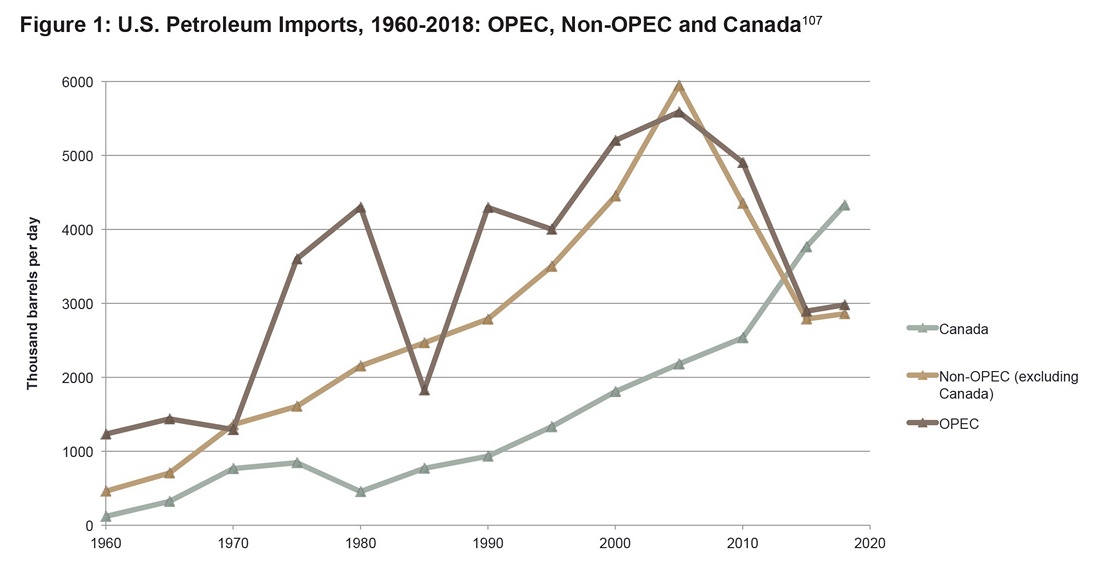

[...] For the next year or two, NAFTA's energy chapter will remain in force. It includes the energy proportionality clause that requires NAFTA countries to make available for export the same proportion of oil, natural gas and electricity to the other NAFTA countries as it has in the past three years. Given the concentration and continentalization of the oil and gas corporations and pipelines, this makes "available for export" virtually the same as obliged to export. The rule has never been invoked, but hovers like a spectre over Canada's oil and natural gas exports to the U.S. and limits the energy and environmental options Ottawa would consider. From the start, Mexico got an exemption from NAFTA's energy proportionality rule. It meant Mexico was not obliged to export its oil and natural gas to the United States. Until 2015, with a few exceptions, the United States did not allow oil exports. In effect, the proportionality clause only really applied to Canada, guaranteeing the United States first access to the majority of Canada's oil and natural gas. The shale oil and natural gas revolution and horizontal drilling in the United States has rapidly altered the picture, lifting the country out of great fuel import-dependence. Domestic natural gas production bottomed out in 2005 and [subsequently with widespread hydraulic fracturing] the United States became a net exporter in 2018. Domestic oil output also rose sharply after 2008 and greatly reduced U.S. net oil imports. The surge in U.S. production of both carbon fuels led President Donald Trump to boast that the United States is now an energy superpower. The shift weakened Washington's resolve to retain NAFTA's energy proportionality rule. That being said, U.S. demand for Canadian oil has only risen over time, and in 2014, oil imports from Canada overtook those from OPEC (the Organization of Petroleum Exporting Countries). However, Trump's government also had sovereignty concerns over committing a share of U.S. energy for export under the proportionality rule, another reason Washington did not insist on keeping the provision. Since Washington wants to end oil dependency on the

Middle

East and Venezuela, most future U.S. oil imports are likely to

come from Canada via cross-border pipelines. Since no Canadian

government or major political party has advocated Canadian energy

independence since the early 1980s, Washington may feel secure

about Canada as a supplier even without the proportionality rule.

The extensive cross-border pipeline network reinforces Canadian

oil exports even in proportionality's absence. The American

Petroleum Institute -- Big Oil's major advocacy organization in

the United States -- did not object to proportionality's end. [...] [...] Besides, the Alberta government and the Canadian

Association

of Petroleum Producers (CAPP), the main initiators of the energy

proportionality rule when it was inserted into the 1989

Canada-U.S. Free Trade Agreement, no longer pushed for it. |